Update your FATCA declaration online in 2 min, if you are an existing mutual fund investor

Are you an existing mutual fund investor? If YES, then you must have got an email from the fund houses where you have invested to provide some additional information about yourself and about your tax residency related questions in the name of FATCA declaration.

In this article I will quickly guide you about what is this FATCA Compliance and how you can update this information with AMC online in 5 min.

What is FATCA Compliance?

Foreign Account Tax Compliance Act or FATCA was passed in US in the year 2010 to make sure that the financial institutions across the world share some basic information of their US based clients.

A lot of investors from US (US citizen and NRI’s residing in US) were supposed to disclose their investments outside the US, but it didn’t happen the way US govt was expecting.

So finally, US govt passed this FATCA law and signed treaties with various countries across the world. India is one of them. So now various financial institutions based in India are asking all their customers to give a declaration about their tax residency, place of birth and if they are paying taxes in any other countries. I am not going into too much of detail here, because you can read it in detail in this moneylife article here .

The main purpose of this article is just to help you understand, how you can update these FATCA details quickly in 2 min online.

All mutual funds investors are supposed to update their information with AMC’s by the end of Dec 2015.

If an investor fails to update their FATCA declaration, then their additional investments will not be processed in future and any SIP which is currently running will also get stopped. So it’s suggested that you complete the declaration as soon as possible. Note that your existing investments will remain intact and there is no impact on that.

How to update your FATCA related information online?

It’s very simple. All you need to do is visit the following two links and update your information.

- https://www.camsonline.com/FATCA/COL_FATCAMainPage.aspx

- https://www.karvymfs.com/karvy/fatca-kyc.aspx

I have created a short video tutorial on how to update the FATCA information online. Please check it below

Note that a mutual funds is either serviced by CAMS or Karvy (all funds except franklin Templeton, go this link where you can update FATCA for franklin). So these agencies have come up with the links online where one can update all their information.

When you update your information online, an OTP will be generated which will be send to your email/phone which is registered in their records. If you are invested in mutual funds which are services by CAMS (like Birla, ICICI, HDFC etc) , you just need to update the first link (cams one). If you are invested in mutual funds which are serviced by Karvy like Reliance, UTI or Canara Robeco, then you will have to update the karvy link as well.

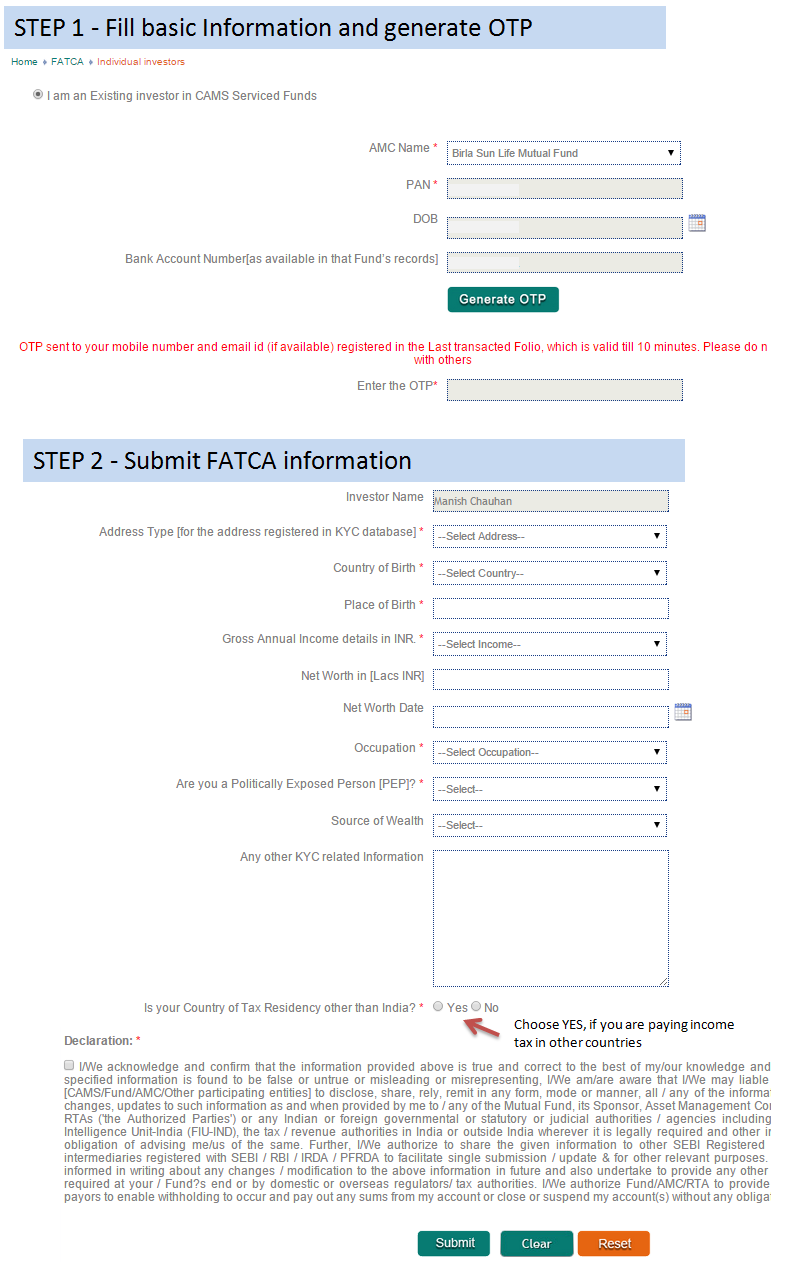

Below is the snapshot explaining how you can update the CAMS link

In the same manner, you can update the Karvy link with your FATCA information. The OTP will be generated in that case also and all the information is same. You need to update the karvy link, only if you have invested in any mutual fund serviced by them in past.

In anycase, my suggestion is to try to update both the links. There is no harm anyways

FATCA Impact on US & Canada NRI’s ?

So what is the impact of this FATCA declaration on those NRI’s who are based in US and Canada. Let me be very brief and to the point here. Only 3-4 AMC’s in India are going to except fresh investments from US & Canada based NRI’s. Few of them are UTI, L&T and Sundaram mutual funds. so if you are a NRI based in US and Canada, now you will not be able to invest in mutual funds from HDFC, ICICI, Birla, Reliance and many others.

However any existing investments can be continued (SIP wont be continued, but the current worth in those funds will be as it is) . One can redeem them whenever they wish to.

NRI’s based in other countries can invest in any fund house they want.

Incase you have any question on this FATCA declaration, feel free to ask your queries in comments section

November 13, 2015

November 13, 2015

How to change email id in FATCA?

You need to do that change in KYC now

I’m ex telecom employee holding some ESOP shares with sharekhan and saw the message to update FATCA details. Do i need to update as I dont have SIP or Mutual funds. below links are specific to functions where as I have have any investments except ESOP

https://www.camsonline.com/FATCA/COL_FATCAMainPage.aspx

https://www.karvymfs.com/karvy/fatca-kyc.aspx

Please clarify

Hi Raj

If you have not got any intimation regarding the same it’s not required.

Hi Manish,

Does FATCA applicable to Foreign Citizens of Indian Orginin?

In other words if I am a citizen of another country, would FATCA still applied to me.

Thanks,

Anand

Yes definately. Its actually for you guys only 🙂

Thanks for your reply Manish.

I still don’t agree as to why Indian Government needs my Foreign Account / Income Tax details when I don’t even Live, Work or Earn any money in India or Pay Income Tax India.

Regards,

Anand

Not applicable to you in that case. Only if you are having any bank account or investing in mutual funds in India , then you need to declare .. else not .

I do have NRE and savings account in India. So it means that I still have to complete the FATCA. Correct?

I can neither add as a new customer. I am at loss to know why you have sent the communition to me.

Is this declaration required for corporate accounts too as I was asked to submit it during one net banking session.

Yes

Hi,

I am having sharekhan trading account and recently they started asking for FATCA details. I am with my husband for past 1 year in USA and he gives me pocketmoney to spend. out of which, i transferred some amount to my india bank account and purchased the shares online. ( my total shares value is less than the taxation limits and profit is just Rs.11k so far)

Now, I want to know whether submitting FATCA will prevent me from doing the trading OR it is just an information to be provided? what are the implications of providing this info? Please clarify.

Its just the information asked. No restrictions will happen due to that

Dear Manish,

I started SIP in HDFC/SBI/ICICI/IDFC and UTI funds while I was in India. Now my status in NRI (US/Canada based). Please suggest, what should I do to legally invested in SBI/UTI mutual funds (as I learnt that they are accepting US/Canada investors). My SIPs are still continuing in these fund houses.

I understand that I can be invested in UTI and SBI as both are accepting US/Canada investors.

What should I do with HDFC/ICICI/IDFC? Can I just stop new SIPs and hold the existing investment? I am asking this because some say I need to redeem all. And others say I can keep the existing investment but I cannot make new contribution to them.

Please suggest. If you have better plan for US/Canada investors, please help.

Regards,

Raju

You can just stop your SIP in those funds and restart fresh in some where you want to do . You dont need to redeem them

I am having AXIS TRIPLE ADVANTAGE FUND GROWTH in Axis Mutual Fund, I have updated my KYC with Axis Bank, whether I want to know again I want to update my KYC with the Karvy authority.

No , you dont need to again do it with Karvy if you have done it for mutual funds !

Bank says I have to give FATCA to them.but in online my pan number is not registered with them

There are FATCA changes for all things like bank, demat, mutual funds .. . so why dont you give it to them . Whats the problem ?

I wish to submit FATCA form for HUF entity, I understand that this comes under NON -INDIVIDUAL category . In the form for non-individual part no 1 i.e. Entity details is fine. but part 2 FATCA & CRS Declaration and part 3. UBO details for Passive NFE are confusing. I request you to explain how to fill up these two part.

Hi bharat

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

IS it mandatory for existing resident indian investor to submit FATCA for continue of SIP

Yes

I need to update my KYC details as i am living in usa.

I have invested in HDFC, Reliance and IDFC. I am USA NRI. Updating as shown above will that updated info flow to all 3 fund houses ?????

Yes, it will !

Hi Manish,

I haven’t applied for FATCA till now, and as per the given guideline video tutorial of updating the fatca information online it has to be updated before 31st Dec 2015. So If I am willing to update that now can you please suggest me the process for the same.

You can still do that !

Hi Manish

Though I have read the whole article – but a bit confused. I have a simple NRO/NRE accounts with banks in India and I am an NRI. I have no investments in a MF. Do I have to fill FATCA? Reason asking is that I have received conflicting advice from banks in India – with one saying that I have to and the other downright advising that it doesn’t apply to me.

It may help to add that I am Australia based and not USA.

No , in that case you dont have to

Thanks Manish for your advice. Now any tips how can I put my case forward to the bank that they should not be asking me (and people like me with similar profile) to comply with FATCA – I am wary of the standard reply that this is “our standard policy…”

I am not talking about Mutual funds FATCA . If you have not invested in mutual funsd, then you dont need to do that for MF, for rest other products, you still might have to do that!

HI SIR

WE ARE NOT UPDATE FATCA ON BOTH CAMS & KARVY. TO PLEASE SUGGEST ME ,CAN I AM DONE TO NEW APPLICATION FOR PURCHASE…IN FUTURE NO ISSUE FOR REDEEM OR SWITCH,TRANSFER

Hi LAXMAN

I am not clear on what is your question. Please repeat it with more clarity

Manish

I AM EMPLOYED IN IT COMPANY IN INDIA AND I AM POSTED ABROAD FOR PROJECT ASSIGNMENTS FOR MORE THAN 182 DAYS IN A YEAR AND COME BACK IN INDIA AND FOR ANOTHER PROJECT ASSIGNMENTS I AM POSTED ABROAD . I PAY TAX ON THE SALARY RECIEVED IN THAT COUNTRY .I AM MAINTAINING MY SALARY ACCOUNT IN INDIA WHERE MY SALARY IS CREDITED WHEN I AM POSTED IN MY COMPANY IN INDIA AND I AM FILING MY INCOME TAX RETURN IN INDIA AS NRI. PLS GUIDE WHAT IS MY TAX.RESIDENCY STATUS FOR SUBMITTING FATCA FOR UPDATING MY KYC IN BANK ACCOUNT IN INDIA. REGARDS

In that case you should call yourself NRI only !

Hi Manish,I enjoyed your informative video tutorial on FATCA compliance for which i have a unique query and will appreciate your response by E mail at [email protected]

I was in USA for 23 years,now in India retired with India address.I am RETIRED and receive pension fromUS government every month AFTER deduction of 30% tax from the money.Thus I am retired,BUT receive retirement money in my account after paying TAX every month. What should be my response to the last question-TAX country? when I am Indian citizen,Indian resident,receiving retirement/pension every month from USA on which I pay tax to US treasury every month and invest form the money this received after tax. Regards Arun Mehta Pune

You are indian citizen !

Yes.While I was permanent US resident from 1976 to 2003 but always Indian citizen,I surrendered my US greencard. Add the info provided above and you have the above query revised. Thanks Arun

Dear Manish,

I have invested in Reliance MF but that time they did not ask for FATCA declaration. Now that i want to invest in other mutual funds i have done the FATCA declaration through Karvy. How will it confirm that the FATCA declaration is done?

By logining into other MF sites then also they are telling me to do FATCA Declaration..Suggest

You dont worry on that. If you do further investment and if your fatca is not done yet, the AMC will ask you for that!

Hi Manish,

I have recently started investing in ELSS through SIP(before one month). I have filled the FATCA declaration form while starting the SIP. I am expected to travel to US in next 10 -20 days from my organization (onsite opportunity from company) and would be in US for long term. Would I have any issues regarding FATCA?

Hi Manish,

I am in a fix one bank advisor told me that all the mutual fund maturity amount is taxable whereas another told me that all the maturity amount from ELSS is non taxable and also the equity based mutual fund after 1 year is also non taxable amount.

Which one is correct…

Equity mutual funds are not taxable after a year. ELSS is also an equity fund !

Any views on what IRS is planning with this information ? Will it impact my tax payable amount ?

No idea on that