Budget 2015 : 16 things which every investor should be aware about

When budget speech was over, the first thing I did, was that I created a poll asking people, if you are happy or disappointed with the overall budget. I was sure that most of the people will vote for “Disappointed” and that’s exactly what happened. Around 192 people voted for it and around 65% people said they were disappointed.

While, I agree that the budget didn’t offer too many benefits to common man, as they had expected, but the budget 2015 has a lot of things to offer and it’s worthwhile to look at things a little deeper. So what I am going to do is list down all the major changes for you below and explain them

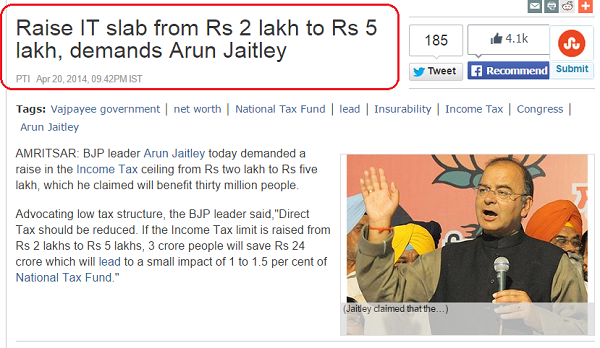

1. No changes in Tax Exemption Limit or 80C limit

One of the big blow for most of the people in India was that there were no changes in the income tax exemption limits and 80C limit. At the moment, there is no income tax to be paid if taxable income is upto Rs 2.5 lacs in a year. Most of the salaried class people were expecting some relief in this area and were expecting that the limit should be changed.

However, they were disappointed heavily, when there was no change. Mr. Arun Jaitley himself had demanded raising the limits from 2 lacs to 5 lacs sometime in 2014 when BJP was not in power, but now when he is finance minister himself, he didn’t do what he “expected” from others.

2. Health Insurance limit increased from Rs 15,000 to Rs 25,000 per year

A big change in this budget was increase in health insurance exemption limit from Rs 15,000 per year to Rs 25,000 per year. In the same manner, for senior citizens – its raised from Rs 20,000 to Rs 30,000. This is really a good move because health insurance premiums can go up to Rs 25,000 per year in case one is paying the premium for self, spouse and children. This will encourage more and more people to buy health insurance.

So if you are paying yours and senior citizen parents health insurance premium, you can avail a maximum of Rs 55,000 under sec 80D. It’s a good time to head over to this website and leave your details if you are interesting in buying health insurance.

One more announcement was made that those senior citizens who are above 80 years in age, and are not covered by any health insurance, they can avail a deduction of Rs 30,000 towards expenditure on medical treatment.

3. No tax on Interest under Sukanya samriddhi account

When few months back Sukanya Samriddhi account was launched, that time the interest was taxable and investors complained how PPF is better than this scheme, but Arun Jaitley clarified that there won’t be any income tax on the interest part also, which makes this scheme better compared to its earliar version. However its still debatable if its good or bad compared to other alternatives like PPF or mutual funds in a long run.

4. Transport Allowance Limit increased from Rs 800 to Rs. 1600 per month

Another good thing about budget was that the transport allowance was raised from Rs 800 to Rs 1,600 per month. Transport allowance is not taxable at all.means now out of your overall income, total Rs 19,200 will be deducted

That means whatever income you earn, Rs 19,200 will be deducted on the name of transport allowance (Rs 1600 X 12) and you need to pay tax only on the balance amount, subject to other exemptions and benefits. While it’s doubled from Rs 800 to Rs 1,600, still Its not very high amount, especially for big cities where the transportation expenses are very high.

5. TDS introduced for Recurring Deposits Interest

You might not have heard this in the budget speech, but now the TDS will be cut even for the recurring deposits. Till now for so many years, TDS was deducted only in case of fixed deposit, and not in case of recurring deposits. But now this has changed. While it’s not a big issue, but anyways you need to pay the tax on recurring deposit interest earned, even if TDS is not deducted. An amendment will happen in the definition of “Term/Time Deposit” under sec 194A and recurring deposits will come under TDS.

6. Service Tax Rate Increased from 12.36% to 14%

This was a big blow for common man. The service tax rate was increased to 14% from earliar rate of 12.36%. That means whichever services you avail, you will be paying the additional 1.64% in service tax. In case of restaurants, you will be paying 0.656% more every time (restaurants are required to charge service tax only on 40% part of the bill) . So if your restaurant bill was Rs 1,000, you earlier paid Rs 49.4 as service tax, but now you will pay Rs 56 , which is Rs 6.6 more.

7. Wealth Tax act abolished and replaced with 2% surcharge for super rich

Wealth tax is now abolished. Wealth tax is the tax one used to pay for certain kind of assets worth Rs 30 lacs. The wealth tax didn’t bring a lot of wealth for govt and hence they have simplified the whole thing by removing it. Instead of it, they have introduced a 2% surcharge on the those who earn more than Rs 1 crore a year. This new move will bring in around Rs 9,000 crore in govt kitty!

What I loved about whole removal of wealth tax is that CA students were very happy about this as their syllabus is now simplified :), here is one tweet which confirms that!

8. Tax-free infrastructure bonds worth Rs 20,000 crore to be introduced

Tax-Free Infrastructure bonds are back. Keeping the focus on the infrastructure development, especially for railways and roads, the finance minister announced that the bonds worth Rs 20,000 crores will be introduced. The interest on these bonds will tax-free and the maturity will be after the long term tenure of 10-15 yrs.

9. PAN Mandatory for all Transactions above Rs. 1 Lakh

Now, if there is a transaction of more than Rs 1 lac, it would be mandatory to quote the PAN Card. For example, if you are paying Rs 4 lacs for buying a car, you will have to quote your PAN number for sure. This requirement of furnishing PAN is for both purchase and sale transactions. Finance minister also mentioned that tax authorities are also making provisions to check “splitting of reportable transactions” , which means that if someone tries to split the transactions only for the sole reason of avoidance of mentioning PAN, then it would be detected.

Suppose you want to make a transaction of Rs 4 lacs into gold through your debit card, but if you make 5 payments of Rs 80,000 to avoid mentioning PAN, then there will be some mechanism to detect this and you will have to explain it to tax authorities if there is any enquiry.

The Finance Bill also includes a proposal to amend the Income-tax Act to prohibit acceptance or payment of an advance of `Rs 20,000 or more in cash for purchase of immovable property’.

10. FM to Reduce Corporate tax rate from 30 to 25% over next 4 years.

This is not directly related to common man, but its important to mention it here. Just like salaried people pay tax, even corporates (companies and firms) also pay tax and the rate was 30% till now. That will be reduced to 25% over the next 4 yrs. This is really big thing, because a lot of tax is earned by govt from big and small companies and it was a bold move to reduce the taxation rates for corporates.

11. Choice between EPF and NPS

Now employees will get an option between EPF and NPS, but this option will be available to only those employees whose monthly income is upto a limit, which is not yet shared. However the good part is that employer will still have to contribute their share into EPF, only the employee share will either be invested in NPS or EPF.

Both EPS and NPS are retirement tools by govt and I personally think that over the years, govt should keep only NPS and abolish EPF, so that the whole system is more simplified.

12. Upto 10 Year imprisonment for concealment of Income or Assets abroad

Do you have any property or income abroad ? If Yes – please understand that you need to mention and declare it in your income tax return in India. Otherwise it amounts of black money and as per this budget you can be jailed for upto 10 yrs if found guilty. So if some Indian who has or does not have income of India or not, is getting any income outside India and has any assets outside, they have to file the tax returns for it without fail. If govt finds out that you didnt follow this rule, even your assets in India might be siezed in India.

Not just that, even you will have to pay a penalty of upto 300% . Read this article which explains things in a bit more detail.

13. NPS limit raised from 1 lac to 1.5 lacs

The limit of NPS has been increased from 1 lac per year to 1.5 lacs. NPS is a retirement benefit investment product by govt were you can invest and create your retirement corpus.

14. Pay Rs 12 a year and get 2 lacs accidental insurance

Focusing on poors who do not have any access to insurance products, it was announced that a special scheme with name “Pradhan Mantri Suraksha Bima Yojana” will be launched soon and will be connected to Pradhan Mantri Jan Dhan Yojana . By paying Rs 12/year , one would be eligible for getting accidental cover of Rs 2 lacs.

The exact details on this are yet to come and it would be interesting to read the finer points on this scheme and how it works. Because this scheme will provide 1 lac of insurance for Rs 6 , however in market when you buy any standard accidental insurance, the premium per lac can range from Rs 100 to Rs 500. Lets see more on this when the scheme details come in future.

15. Pay Rs 330/year and get 2 lacs life insurance

Under ‘Pradhan Mantri Jeevan Jyoti Bima Yojana’ one would be entitled to a life insurance of Rs 2 lacs sum assured for a premium of Rs 330/year . This would cover natural and accidental death both and any person under age range of 18-50 will be eligible to buy this policy.

The good part of this scheme is that one would be able to buy a lower sum assured of Rs 2 lacs because for people in lower income range, even a sum of Rs 2 lacs ifs good enough and it would really help them in life, but the premium of Rs 330 is not very cheap, because that turns out of be Rs 165 per 1 lac of life insurance. However in market when you shop for any pure term plan , the premiums are very much in same range. For example when a 30 yr old person buys a 1 crore term plan, he/she pays around Rs 8,000 a year, thats Rs 80 for every 1 lac of sum assured.

Anyways, its a good scheme which can benefit poors. The details are yet to come and we are not sure of the fine prints as of now.

16. Gold Bonds to be launched other measures

A special kind of gold bonds will be launched very soon, which will be alternative of buying the physical gold in market. So if you want to invest in physical gold “only” for the prices appreciation, then you can instead buy these bonds whose prices will move as per market price only. This is really good because there were almost no option to invest in pure gold other than physical gold. And the good part is that this will be from govt :).

Another good thing announced was that there would be Gold Scheme’s where one can deposit their physical gold which are in forms of bricks and coins (anything other than jewelry) and earn interest on it. While this is not very much beneficial for a common man, as they mostly have their gold in jewelry format only. So big institutions, temples, and other charitable trusts would benefit from this scheme.

Apart from this, new gold coins will be minted which will be having India ashoka chakra on it, so it will be “Indian gold coins” which didn’t exist till now and one had to buy foreign gold coins.

So overall – How was the Budget ?

The only question, a common man is asking is “How was the budget ?” . I personally think it was a balanced budget overall. For a salaried person, they might not find too many things in this budget and budget surely disappointed them and then there are some things which are good also. Lets not get into debate of “good” or “bad” because one person opinion might be wrong for someone else. Its a personal judgement overall

So you tell me, how was the budget for “you” and how do you feel about it ? What are good and bad things you find in this budget ?

March 2, 2015

March 2, 2015

Dear Manish,

I have 1 query regarding TDS on prior period expense.

In one of our client I got one bill of professional fees that belongs to previous year. While considering the same in books whether I would need to deduct TDS under 194J? Or is there any amendment regarding it?

Hi Nidhi

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

For claiming deduction of Rs 5000/ under preventive maintenance expenditure do i have to collect receipt and preserve it. Please reply to my mail id [email protected]

Yes

hi manish,

could you please explain atal pension yojana vs new pension scheme ?

i am 37 year old & my institute is suggesting me to opt for atal pension scheme by paying 942 rupees per month for next 22 years. and expected to get rs 5000/- pm from my 60th birthday till death. later an amount of 8.5 lakhs will be given to nominee. this is what i was told…

what you feel? is it good returns? no bank people know this properly !!!!!

and if i join atal pension yojana, can i join NPS again later?///

please write APY vs NPS.

regards

KIRAN

I am still evaluating it and also writing article about it . Will publish it asap

Hi Manish,

What is your opinion about “Atal Pension Yojana”. Do you think this scheme can be useful for housewives and even for working professionals ? The benefits under this scheme looks promising.

You will get some time to have a article on “Atal Pension Yojana” ?

All the articles on this site are very informative. Thank you very much for educating us regarding all the financial matters.

Thanks and Regards,

Amit

I am writing on it . Will publish soon

Hello Manish,

Did you analyze NPS vs APY (Atal Pension Yojana)? Could you please give a comparative study on this.

Regards,

Praveen

Praveen I will be writing on tht

Does the new limit of 25000 for 80D include 5000 for medical checkups for self and family like last year?

Yes

Hi Manish,

Suppose I invest 1.5 lakh in ppf.

And 50k in NPS.

Will I get 2 lakh exemption 80c +80ccd 1(b)????

Thanks

Dr.shivaji singh

Yes

Hi manish,

Now that , there is a option between NPS and EPF , which one should one go for? I have heard NPS has compulsory annuity, so is it beneficial ?

If possible can you write a post on this .

I would still suggest EPF

hello,

i had taken up a matter with the banking ombudsman in regards to a rude behavior by a SBI staff. but they simply rejected the complaint stating section 8(2) of Ombudsman act 2006 but forward a feedback of this complaint to the AGM of SBI.

is this a correct way of approach by the banking ombudsman..should i go for a appeal on this..section 8(2) still states unfair practice by the bank where rude behavior falls in it..

What is that section 8(2) ? Did you first complain to bank regarding this and waited for 30 days before complaining to ombudsman ?

Dear Manish,

Pl. clarify whether Transport allowance itself is increased from Rs. 800 to Rs. 1600 PM or IT exemption limit on transport allowance is increased.

Regards,

the exemption is increased . Its your employer who can decide if they want to give transport allowance of 1600 or not

Hi Manish

I work from home, from Hyderabad, for a London based company and my monthly salary gets credited in a local bank in London. I then transfer it to my Indian NRE account and have been doing this since Jan 2011.

From your point 12, I take it I have to pay my taxes in India as I receive my income in UK (i.e. foreign income).

I have not been paying any taxes in India at all since my salary was TDS in UK.

Based on your article do I need to pay my taxes/file-returns since 2011 onwards? along with any fines?

Please shed some light in this matter as there are quite a few of us working in this manner and it would be good to know if we need to clear any old taxes before March 31st.

Many Thanks

Aditya

Hi Aditya

I think this is would need a more expert opinion from a CA . I am not qualified enough to comment on this . If you have a CA then please ask him, or else I can connect you to our CA , who will charge you for this .

Manish

ok totally noob question…how do i invest in NPS? do i need a demat account or something?

No Neha

You dont need demat , follow this article http://www.business-standard.com/article/pf/how-to-open-new-pension-system-account-113070300129_1.html

The transport allowance should have been hiked to at least Rs.60,000 per year. The reason is very simple. Too many cars on the road in some cities. It would have encouraged car owners to think of using public transport for such cities. Right now, there is no incentive for a car owner to switch over to public transport. It takes over 45 minutes to travel a distance of 5 kms in peak hours in Mumbai, and Mumbai has no roads left as they cannot be expanded further.

Hi Mahesh

I am not sure how will increasing the Transport allowance will help in shifting to public transport ?

NPS ,EPF both r worst retirement products.The government of india it seems wants to create products to get cheap funding for its excesses .How can a debt product be good for long term investment.Beats me.LIC is another one.Collectively they have looted the average Indian.Hope sites like jaago invester,freefincal etc wake up Indians from their financial illiteracy.

Hey Deep

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Thanks a lot Sir for sharing this informative post with us. I just wanted to know is there any changes in income tax slab for 2015-2016.

No Change

Hi Manish,

Thanks for the nice article.

I have 1 question about recurring deposit.

I have a recurring deposit of 3000 per month of 3 years in 8.75%. I have already paid of 14 instalment. The maturity value is 123769 which consists 15769 as interest.

Will this be fall under tds? Plz reply.

Yes, you will pay TDS on that !

Hi Manish,

Thanks for summarising budget.

I feel budget was more inclined towards modi’s slogan of “Make in India” with more focus towards Corporates and Infrastructure, as these are some of the prominent factors for growth of any country.

On Individual Front:

It was more like govt. is acting like an financial consultant and it’s evident in this budget :

Long Term Savings:

1) Increase in health insurance limit – will increase penetration for health insurance

2) Tax free returns on Sukanya samriddhi account : attract people to save long term for their child.

3) Choice between EPF and NPS

4) Limit of NPS raised from 1.00Lacs to 1.5Lacs

Insurance :

1) 2 lacs accidental insurance @ Rs.12 P.A

2) 2 lacs life insurance @ Rs.330/P.A

Other Savings:

Gold Bonds

Even though things were pretty decent, but i somewhere feel that tax burden is shifted from corporates to individuals through decrease in Corporate Taxes by 5% and increasing Service Tax by 1.64%.

For common man there was not much in the budget, but will definitely get benefited indirectly in long term.

I appreciate efforts of govt. for the steps taken towards controlling black money and bringing them back to India, by introducing strict rules.

1) 10yrs jail

2) 300% Penalty

3) Seizure of Indian Asset.

As per me in overall budget was ok, with more focus on countries growth which is need of hour.

Hi Chandrashekar Iyer

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

[…] was reading the article in Jagoinvestor.com where Manish has included a really interesting fact about this wealth tax removal. I am attaching […]

Hello Manish, I was working for an Indian employer and moved to Canada (Intra Co. transfer) from the same employer. However I’m paying tax to the local Govt. and need to file a return in both countries. In this case, do I need to mention my income while filing Tax return in India (per Point # 12)? Please assist.

Hi Priyanshu

No , you dont need to mention your out of india income . You just show your indian income . thats all

Hi Manish,

Thanks for the detailed article. I have a question on wealth tax removal. A person X having second house and not given for rent whole financial year. According to the FY14-15, person X have to pay 1% wealth tax if the house is not given for rent more than 300 days. But in this FY15-16 period, wealth tax is abolished. So with this statement, person X saved 1% wealth tax?

Thanks,

Rajesh.

There are two issues here.

Income and wealth tax.

If one has two houses and stays in one, the other is deemed to be let out and income tax is to be paid on deemed income as per some rules.

Wealth tax is on the wealth possessed by a person and there are a different set of rules for this.

When wealth tax is taken out, the second one goes out and the first one remains.

Trust this clarifies.

Yes