Mistake in your Medical report while taking Term Plan – Real Life Experience

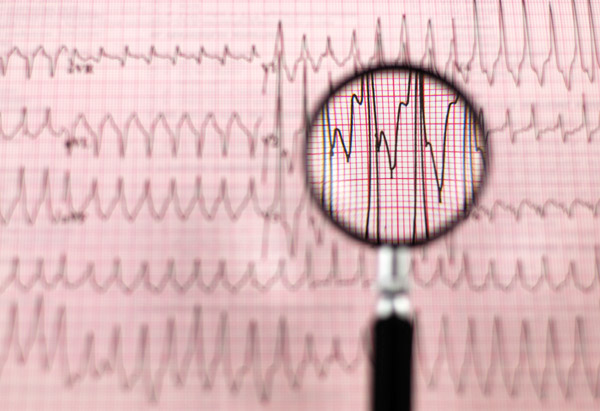

What happens when your hospital goofs up and your term plan premium goes up because of that mistake? When you take a term plan, the insurance company either asks you to take up medical test in some hospital or a doctor comes to your home and does the checkup. Things mostly go well and at times some kind of health issue comes up, and you say

“Ahh … you say, I didn’t know there was this issue, Thank God! a medical test was done.”

Then the insurance company increases the premium because there was some issue in your medical report. You pay the increased premium, feeling secure now that things are black and white. But, what if the medical report was wrong because of some mistake the hospital made? What if there was a TYPING Error? Yes! It happens and we have a real life experience today.

Nitin shared his experience on our Question and Answer forum while buying his term plan from HDFC and Aviva. Below are his experiences

Experience while buying HDFC Click2Protect

After some analysis I found below 2 plans suitable for my term insurance needs: [list style=”check”]

- HDFC Click2Protect

- AVIVA i-Life

After considering some factors, I had chosen HDFC Click2Protect and applied for it. My medical test has been performed in 4-5 days. Few days later I got notification from HDFC that my proposal is postponed because of ‘elevated level in my blood sugar’. It was a shocking news for me because I am a healthy person and never had any problem (touch wood). I called hospital people (where my medical check-up was conducted) and after request they informed me that my sugar level count is 173 (normally it should be between 70-100). I still not believed that and went for medical check-up again by myself and found sugar level count is 72(which is normal).

Then I decided to go for AVIVA i-life plan and applied for the policy. Fortunately/Unfortunately, my medical examination was scheduled at same hospital, where it was conducted before for HDFC. This time I carried my medical report (which I had done by myself) and asked hospital about the reason for differences in both reports. According to their report my count was 173 & according to my report count was 75. They checked again and found that it was a TYPING MISTAKE, actual count was 73 but they wrote it 173 by mistake.

Now, because of this mistake HDFC postponed my application & also my insurance records gets affected. Hospital GM apologies for the mistake and sent clarification note to HDFC about the mistake. Currently, my AVIVA application is under processing.

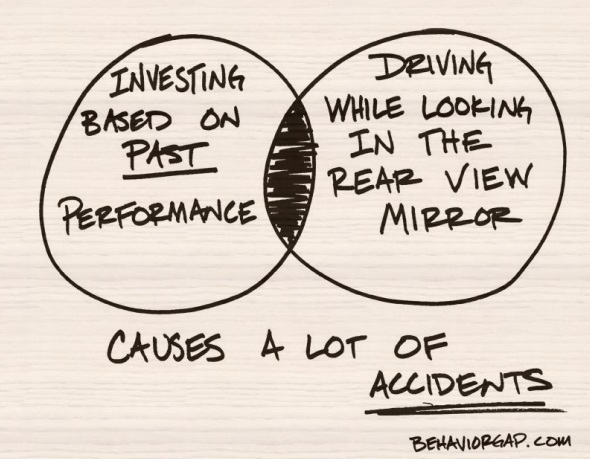

Lesson Learnt & Message DON’t trust on any medical report if it looks surprised for you. Please double check it with multiple doctors or Hospital if you think it is not correct and challenge it.

After this incident, he went for Aviva Term plan and the same kind of issue happened this time also. Below is the experience.

Experience while buying Aviva Term Plan

My medical examination for AVIVA ilife plan happened in same hospital (where I had for HDFC C2P plan). After few days, I got information from AVIVA that they have raised my premium by 50% because of ‘Increased liver enzymes’ in my body and waiting for the balance payment to issue a policy. It’s again a shocking news for me, since I didn’t expect it this time. But the good thing is that AVIVA has shared my medical report with me. I checked with 2-3 doctors about my report and according to them this increase in liver enzymes is possible for those people who drink alcohol or having fever in last 1 months.

But for my case, I don’t take alcohol nor having any fever in last months, so doctor suspect that this time also report may be not correct. So again, I went for a medical test (only for Liver part this time) by myself and found that my liver report is NORMAL (as expected). I informed AVIVA about the same and also shared my Normal medical report. After 2-3 days, finally got mail today that they have issued my policy without any extra premium. Hmmmmm……buying a online term insurance looks like winning a war for me.

Important Points Regarding Medical Tests

- Make sure you do minimum 12 hours of Fast before the medical tests

- After doing the medical tests, check if you can get the medical test copies or at least the results

- For any point you are concerned about, better take a second opinion from another clinic

- If possible, go for medical tests once again at your own cost to double check if you suspect anything

Did you double check your medical reports which you did for your term plan or health insurance plan? If not, its time to just have a second look and check if you are fine with it.

March 18, 2013

March 18, 2013

sir, i applied for lic e term plan. for it i had my medical test at ludhiana hospital recommended by lic. but this is not a well reputed hospital. during medical test, the hospital said me that there was a heart related issue in my health. on this basis lic increased my premium . there after i went to a well reputed hospital for heart related test. and surprisingly my medical reports shows me 100% fit. so what should do i now.

I think you should do health checkup at your own cost and first verify if you really have any health issue or not .

This is what LIC did with me as well. Independently verified. Letting insurance companies decide and limit health checkup hospitals, is itself a scam. Hospitals will almost always conduct test’s in favour of the insurance company.

Thanks for your comment Jatin

Sir

I bought a term plan of HDFC of 50 lac for 30 yrs throgh its office representative…they did my medical but report was not shared with me in my insurance policy copy..when I asked the representative …he told me …hdfc wont share it.

Can u plz help me out…is it true hdfc wont share?

But religare n max bupa share it with customer. ..as my friend got it

as all companies regulated by IRDA …how can it be possible. .

Kindly guide me.

Hi satya

Its not true . THey will share it if you want it . Talk to HDFC directly !

Its available for their term plan in policy details online.

Hi

Am 40 and applied for Aviva I Life online term plan for 50L by paying premium of 7965, Now after the medical reports they have increased my premium to 16k almost 100% because of diabetic condition I have declared the same in the proposal form.

They have shared me the medical report everything is normal as per the medical report reference range except for diabetic which was showing as fair control. Is this can be the reason for 100% increase of premium.

I do have another offline term plan from aviva for 50L which was done on 2011 which was issued at normal rates cos that time I did not have diabetic

In your opinion can I go ahead with the Aviva I Life by paying extra 100% premium?

I think you should remain with the old term plan only !

I have applied for HDFC 1 cr term plan , premium told was 17000 which is now rate up to 30,000. I have diabetes which was declared in the form. Pl advise

Pradeep Varyani

Yea so what is the question ? go ahead

I too had gone for the same HDFC Standard Life Click2Protect Plus policy and the insurer have now asked for a 100% raise in the premium on the same medical issues (Elevated Blood Sugar and Elevated Liver Enzymes).

I want to cancel the premium and have asked for a refund. The insurer has responded that they shall deduct the medical test results (which I am okay with). However they say that the medical reports cannot be shared as it is against some IRDA guidelines.

My question is since the insurer shall deduct the money from me, shouldn’t they also share the reports with me? How do I a lay my hands on the medical reports (which I suspect may not be correct)

Arijit

I am not very sure on this . Ask them for the exact IRDA guidelines on this and threaten them for complain with IRDA and Insurance ombudsman

Manish

Thanks Manish,

I too was planning on the same lines…shall keep you posted in the travails that I face.

Rgds

Arijit

Sure !

Hi Manish,

I am 30yrs old and going for a Birla Sun Life term plan of 50L for 30 yrs, the premium is 9000/- is this the right premium or BSL are charging me more. pl advice. and thanks to all your above advices many of my queries got resolved. 🙂

I guess for a 30 yr old its very high premium . In Aviva or HDFC you will get 1 crore for 10-11k .. You can take our professional assistance in buying HDFC one, if you want – http://www.jagoinvestor.com/services/life-insurance

I have a term insurance since 1 year …Should inform the company if I develop any disease like diabetes hypertension heart issues or cancer related conditions in the subsequent years…or there are any further medical tests at certain age milestones like 40years or 50 years which can result in premium increase..my initial medical test is normal

No you dont have to inform them for anything which happens in future .

Hi Manish,

I am looking for a term insurance of 50 lacs cover or more. Currently I am covered by a corporate term plan as well as a money back policy from reputed insurance company. But I am looking for more cover.

I am 30 Yrs male. I am a moderate social drinker and sometimes smoke also.

Every year I go for routine checkups as it comes free with my health insurance policy.

Few months back my reports showed Fatty liver and slightly increased levels of SGPT and SGOT in the Kidney function tests with slight elevation in Triglycerides as well.

I just wanted to know that, is there a possibility that my proposal might get rejected by the insurance company?

I am of the view that as a customer we should disclose all the facts in the proposal form, so in case of any mishap the family members dont have to struggle a lot. But I also fear that will my honesty result in me being denied a policy? Please help !

It might get denied, but thats teh worst case . In best case, your premium will rise.

Regarding honesty point, I think you have no option . You can surely hide that info , but then your claim will be rejected .

Dear Manish

You are doing wonderful service to the society at large by operating this blog and sharing information. Like many others, my eyes started to open after hitting your blog.

There is an uncanny coincidence seeing the way premiums are hiked by companies. Despite not having any complaints till date, I too, was at the receiving end last month when Edelweiss Tokio asked 35% higher premium due to “elevated blood sugar and liver enzymes”. After protracted follow up, they shared those reports. I have asked for a re-test, on which they are yet to respond.

I have strong reason to believe that an unholy nexus is operating between underwriters and hospitals.

If they do not cooperate, I plan to make public the name of the hospital and the company under intimation to them, for starters.

What would you advise, Manish?

I think you should wait on this and get checks done from your end once. I don’t think of nexus existence, but may be some human error !

Yes, I have already decided to test myself independently.

Hi,

I am planning to take a Medical insurance and a Term plan

– Non Smoker

– Non Alcoholic

– No previous elements

– Recently did a medical checkup(routine) in Apollo Delhi. Which was good/clear.

Which would be the best Policy for me.

Thanks,

Prem Pratick Kumar

Aviva or HDFC

Dear Manish,

I recently applied for HDFC LIFE click 2 protect term plan policy.

A company representative came to my place and we filled all the required information in the online form. Later on , I was told that the proposal have been Declined . This came as surprise to me as I have Recently been issued a term plan from other insurer & that also with all medicals done with no increase in premium . Since that time I am regularly fallowing up with that person to know the reason of decline but have received no reply so far.please clear below two queries:

1. Can a company decline the proposal in initial stage wherein we have just paid the First premium & the documents collection/medicals have not even initiated ?

2. In the case of decline , is it not mandatory for the insurer to clear the REASON OF PROPOSAL DECLINE ? if it is mandatory but they are not clearing the things , then what are the options available with customer ?

Regards,

vivek

How much was your insurance before ? Because you cant take unlimited amount . If company felt that you are hitting your limit, they can decline it .

I have recently got a mail from agent saying that reason of proposal decline is medical history provided in the proposal form by me.

but without medicals , how can they decline & make a spot in my insurance profile wherein no insurer have declined me till now ?

Vivek

It varies from one company to another, your one detail can be looked as “negative” by one company and “not negative” by another !

Need help

What if I am 34 yr old with High BP. Can I get term insurance? If yes which one? Does it make sense to go for it.

In the past HDFC has rejected my application hence I did not apply again and feel worried abt dependent family (Wife n kid).

Pls reply ..thanks

Yes, you need to take it, but because of your medical situation, its really tough to get it . Check with some offline plans and may be you get it .

Hi Manish

I’m 37 years old and have take the Aviva Life Shield Platinum term plan for 50 Lacs through offline two years back. Initially(when I took the policy) I paid the premium for Rs.10500 and went for medical tests as per aviva’s network hospital and the report was all normal, except for diabetes which was at margin say 100(normal as per the report was 90 to 100). And Aviva issued me the same same policy for less premium for Rs. 8800 after just filling one form(i thing might be due to margin diabetes)by my agent. My questions to you is

1. Why the premium amount is reduced from 10.5 k to 8.8k

2.Now am diabetic after 2 yrs of issuing the policy(its not too high but it is 140(fasting) will the claim be rejected in case of unforseen conditions due to this

3.Do I need to inform the insurace company about this

Please answer my questions

thanks

Satish

I suspect that your agent removed the info about your diabetis from the form , it might be the case . Can you check with Aviva on this ,if they have this info .

vigilance is the KEY in todays world

Hi Manish,

Earlier I had ICICI PruLife’s Elite Policy (proposed via an employee there) for which I had a normal medical test report, as per their scheduled hospital. Later, I opted for i-Protect policy as (same employee mentioned ealier) told me that since no agent comission involved; premium is less with same benefits. I didnot go for medical test this time, since he said he will attach same medical report from old policy (this was almost 1+yr old).

Now, it is 2 yrs I am paying for i-Protect. Recently I had written to their customer care to confirm if all my policy related documents (incl. medical) were accepted and fine. As I want to avoid any unexpected circumstances later. They replied that everything is fine.

Does this look good? Since I will be 31 after few months, I want avoid later heavy premiums and ensure that my Term plan is in good shape.

Please suggest!

Yes, if they replied in agreement then it should be fine

In 2012, I had to get two tests done , one for ICICI Pru, the other for Kotak Life, both which are term plans. In the ECG report from ICICI Pru, I was informed that I had a RBBB (Right bundle branch block) and that my heartbeat was not 100% normal. Surprisingly, the report from Kotak did not mention about the RBBB. I immediately pointed this out to ICICI Pru, and ensured my annual premium was not hiked due to the ECG mistake. My doctor later said that RBBB is not an abnormality and that many people lead healthy lives, irrespective of LBBB or RBBB.

Thanks for mentioning it , however note that each company may look at a parameter differently .

Hi Manish,

I am 30 Yrs old and I have mild High BP, should I disclose it while applying for the online Term insurance.

Please advise.

Thanks in advance!!

Vicky , obviously .. any reason why you should not disclose 🙂

To me, it looks like it’s all done intentionally by the hospital. Maybe they get some percentage of increased premium from the insurance company? Who knows, any shit can happen in India. The person’s experience in OP is making me believe this.

It would be good if people share the name of the hospitals so that we can avoid them.

The person who shared the experience has not named the hospital

Can we sue the hospitals giving us wrong reports ?

YEs, you can and you should 🙂

HI Manish

I have took term plan from icici i care about 1 cr plus accidental 50 lacs. i m 25 yr old. and they dont asked for medical test for same so is it ok??? no medical test for such a cover ,and wont face any problem with claim,if situation occured.

Yes, its fine