Example of mis-leading financial product advertisement

Does False and Misleading Advertisements come under the heading of “Mis-Selling” ? Have you ever saw a financial product advertisement where numbers are tweaked and framed in such a way, that the financial product looks very attractive and not-to-miss deal ?

You see the advertisement and nothing looks wrong to you and you just concentrate on numbers like 15% or 17.45%, as advertised ! . What about mis-selling by big financial institutions who are considered to be too-big-to-fail?

I came across the following advertisement (printed here only partly) in several media including the Company’s website. Even before that, one of our investors, was also flummoxed by the high yield indicated and asked us to explain how it is possible?

Well, a bit of creativity and lot of embellishment seems to have achieved the desired results.

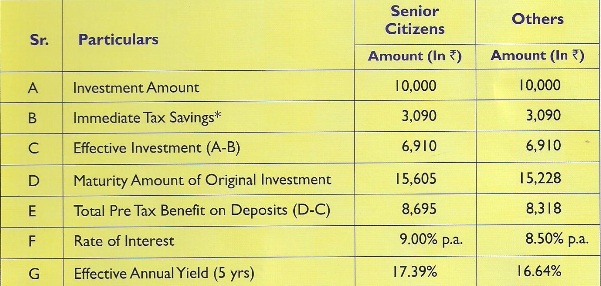

Below is the snap shot of that advertisement which shows the amazing effective yield of the product.

This advertisement in question is about a 5-year deposit from one of the biggest PSU banks in India, which is also eligible for exemption under section 80C of Income tax act. No wonder, tax saving season has just arrived!.

Tax Saving Fixed Deposits, lets you invest a certain amount, on which you will receive tax exemption subject to maximum of Rs.1 Lakh. This would translate to reduction in your tax out go, depending on the tax bracket in which you will fall under – it may be either 10% or 20% or 30% and the cess applicable thereon.

A simple and straightforward situation.

Since it is a bank deposit, it is perceived to be safe. There is an additional layer of safety, because the bank in question may be bracketed under the category of government owned (major share) and it is too-big-to-fail.

What is the problem with this advertisement?

There are so many of these kind of advertisements, enticing you to invest in them because it is the tax planning season. In your interest, if there is little bit of embellishment of the numbers what is wrong with that?

Anyway, you need to be ‘sold’ something, otherwise you will end up paying lot of tax to the same Govt. Instead, just listen to the advertiser and put the moolah where the message belongs to.

At this juncture, let me make it clear the meaning of mis-selling and quote from one of the recent regulations by SEBI Securities Exchange Board of India.

For the purpose of this clause, “mis-selling” means sale of units of a mutual fund scheme by any person, directly or indirectly, by –

a) making a false or misleading statement, or

b) concealing or omitting material facts of the scheme, or

c) concealing the associated risk factors of the scheme, or

d) not taking reasonable care to ensure suitability of the scheme to the buyer.”

If we go by this definition of mis-selling, let us see where does the subject advertisement stands.

1. The advertisement does seem to make a false or misleading statement. While calculating the effective yield at 16.64% or 17.39%, it does not adjust the effective yield for income tax. Even though it says the return is pre-tax, it just stops there.

Why is it important to adjust the return to taxation? Because to arrive at Effective Annual Yield, it has assumed that the investor falls in the category of 30% marginal tax rate and hence he or she is eligible for “B. Immediate Tax Savings” of Rs.3,090/- which is 30% + 3% Cess thereon on Rs.10,000/- deposit.

When such being the case, how the advertisement can conveniently ignore the taxation on the interest income? Interest on bank deposits is taxable as “Income from other sources” either on cash/receipt basis or on accrual basis depending on the method of accounting followed by the investor.

It is a convenient forgetfulness on the part of the advertiser.

2. The advertisement appears to attempt concealing or omitting material fact such as taxability of interest income earned by the investor. It has also not highlighted the tax deduction at source applicability in case the interest income is beyond a certain threshold.

3. The advertisement (in its full form) also has not highlighted the risk factor of possible default or delay in payment of interest in time and the capital. Since bank deposits need no rating, no one bothers about the underlying risks.

4. The advertisement (in its full form) does not highlight the suitability of the scheme to the buyer. It brings in to its fold all investors under the category “Others”.

Therefore, it fails by all the four counts that are applicable for lesser mortals, such as mutual fund manufacturers and advisers. Of course, you can not apply one regulator’s dictum on others in letter; what about the spirit? Just because RBI is the regulators for bank, should bank not follow what is in interest of investors ?

What about Bank Social responsibility ?

What would be the state of mind of the investor, when she sees such a highly enticing advertisement? In the absence of a super-regulator or dialogue between various regulators, different regulators seem to have different yardsticks about mis-selling or mis-representation. But who cares as long as it is a big govt. owned entity?

It used to be the same case when govt was running a mutual fund business from early 1960s till late 1990s. The mutual fund scheme was also guaranteed by the Govt (remember UTI), was eligible for tax exemption and the fund house was considered to be too-big-to-fail in its time, even though such a coinage was not fashionable in that period.

Finally the mutual fund business did collapse under its own weight and thousands of investors lost their hard earned money. Even though the government stepped in to arrest a free fall, the sheen of guarantee was lost. No lesson seems to have been learned from then to now.

What is the actual situation therefore in the present instance?

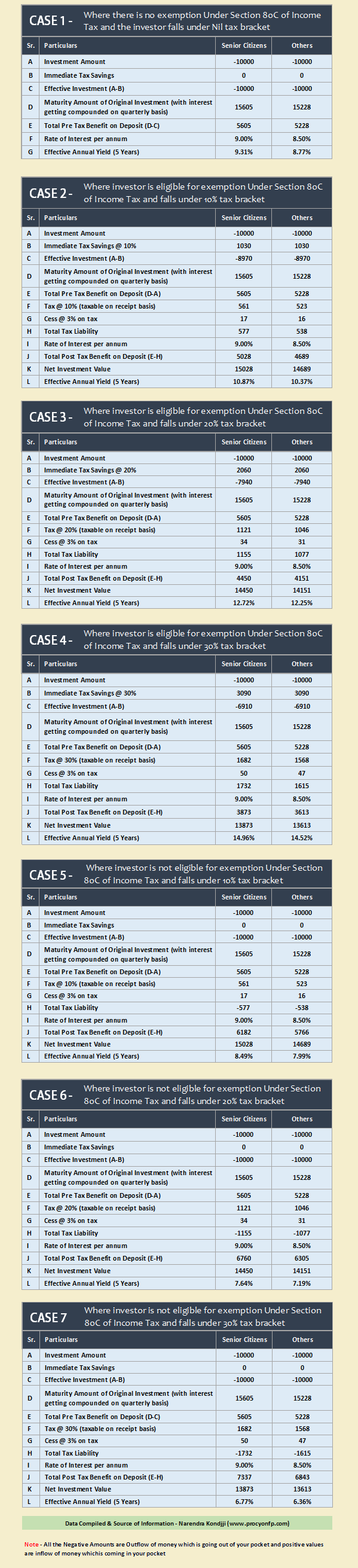

Below are the various possible scenarios:

As you can see the effective annual yield in all the above scenarios is nowhere near the one mentioned in the advertisement the moment you take in to account the taxability of the interest income.

How many of the investors who are already in the marginal tax bracket of 30% would have the limit left to invest in this fixed deposit scheme and also would be able to receive tax exempt interest income?

They will be definitely in minority or possibly no one would meet both the conditions at the same time. What can one say about the tactics of highlighting a scenario applicable in minority cases to all investors?

Misleading or partially true advertisements

Why should you as an investor and we as financial planners be worried about such misleading advertisements? Are we not immune to such misleading illustrations by many of the financial products manufacturers already?

In fact recently the Finance Minister of the country mildly chided one type of financial product manufacturer not to mis-sell the products. He attributed the consistent fall in the market share of such a product to the past sales practices.

Herein lies the crux of the problem that investors are floating in a sea of distrust and when very big names keep publishing such misleading or partially true advertisements, the distrust would keep growing and that is not good for the saver or investor and in turn to the economy.

Already some of the insurance products and mutual funds have become the victims of mis-selling, perceived or otherwise. I am really surprised that such a big institution is indulging in a highly embellished communication of doubtful veracity when there is no need for such gimmicks. I am also worried because I and my family have our banking relationship with this too-big-to-fail entity.

About the Author – The article is written by Narendra N Kondajji, A bangalore based CERTIFIED FINANCIAL PLANNERCM (CFP) . His website is www.procyonfp.com and this article was originally appeared on his blog here

February 18, 2013

February 18, 2013

Manish,

Moneylife if referring this article here:

http://moneylife.in/article/misleading-financial-advertisements/31466.html?utm_source=dlvr.it&utm_medium=twitter

Yea .. I saw that Narendra 🙂

If I want to earn interest income, whether it will be suitable to go for NCD instead of bank F.D. . I heared that I can earn interest ranging from 11% to 15% if I purchase NCD from secondary market. please note liquidity is not an issue for me ? I also want to know that if there is any case in NCD history where issueing company defaulted to repay principal and interest to NCD holders? if some one wants to invest big amount say 50 lakh or more NCD is safe or not?

Its obvious that big returns can come only with big risk .. read more about NCD here http://jagoinvestor.dev.diginnovators.site/2011/10/ncd-non-convertible-debentures.html

Sir,thanks for quick response, I want to know if there is any reputed company of indian history whose NCD (not private placement) are listed and company defaulted to repay principal and interest to NCD holders. If yes,plz give name some of them .

I am not sure of any cases at the moment

[…] http://jagoinvestor.dev.diginnovators.site/2013/02/misleading-advertisements-financial-products.html […]

Bank FDs are most widely used product. Its simple and considered safe. Peoples who are not financially aware dont have much option to invest their money other than FD. If a big PSU bank pollutes FD too then god help us.

I have never seen a single bank in India who cares or understand their social responsibility. I think if they remain honest atleast on some investing options like FD (as its used by almost everyone) that will be good for us.

Thansk for sharing your views on this topic 🙂

With Budget to be announced next week

do you think the tax slabs would be relaxed for individuals

http://in.reuters.com/subjects/india-budget-2013

You can only guess , I am personally not worrying or speculating about it, because I have no control over it !

Couple of years ago, I walked into the bank to make tax saver FD but alas ended up buying ULIP. I regret the decision even today. Thought I was helping BM but he switched job next month. Almost 3 years now, my ULIP is yet to be breakeven into positive territory. In such a mess, somehow I bargained to get a locker allotment from the bank. I rue even today that tax saver FDs could have made online by the banks as is the case today.

Krish

Thanks for sharing your experience 🙂 .. lots of learnings in your sharing !

Hi Manish,

I have read your first book and organized my portfolio as per your financial guidance.

I am a regular reader of your blogs. I am following your website for last one year.

I bought two term insurances one for me and one for my wife, started SIPs in 3-4 good MFs, surrendered my ULIP and started investing regularly in stock market with calculated risk. I took all these ‘ACTIONS’ after reading your first book.

I told about your website to my friends who were planning to buy some insurance and after reading your posts they understood the real fundamentals of insurance and purchased the best one.

Thanks a lot and keep up the good work.

Nidhish

Good to hear that Nidhish ! … glad to know I was able to bring difference in few lives .

I am yet to read the article completely but half-way through it , i felt that this is not the language which Manish usually uses and started thinking why Manish has written such a complex article(compared to his previous articles). AT the end my questions were answered and this was a guest post by Narendra N Kondajji.

Narendra – With due respect this was just a mere point to highlight the difference in writing style which i observed after reading it partially.Nothing personal. Or you could blame Manish for spoiling most of the readers with his way of writing over the years 🙂

Sethu,

No offences felt – different folks different strokes. Otherwise, it will be very boring place indeed.

I will take it as compliment 🙂

[…] relationship with this too-big-to-fail entity. Links and credits for this insightful article:How investors are fooled by misleading advertisements – Example Never blindly believe anything.Always cross check.if something is too good to be true then probably […]

What in case, if an investor has done investment when he was in 10% or no tax bracket and at the time the FD matures he belongs to 30% or highest tax bracket?

How will the calculations go and what will be the effective return?

Pankaj,

The answer is not straight forward one. The benefit and the burden, both accrue depending on the tax treatment you give for the interest income. If you are declaring the interest income every year, you will have one set of answers and if you are declaring the interest income on receipt basis (that is after 5 years), you will have another calculation. Our simulation for the later case gives a XIRR of 8.7%, in case of others and 9.11% in case of Sr Citizens.

Pankaj

Are those 7 illustrations not helping you to find out how its done ? You can see the procedure and do it yourself !

Manish,

The 7 examples above has 2 catagories and its sub categories as follows:

1. Investor who is eligible for exemption

1. Invested at 0% Tax libility and matures at 0% Tax libility

2. Invested at 10% Tax libility and matures at 10% Tax libility

3. Invested at 20% Tax libility and matures at 20% Tax libility

4. Invested at 30% Tax libility and matures at 30% Tax libility

2. Investor who is not eligible for exemption

1. Invested at 0% Tax libility and matures at 10% Tax libility

2. Invested at 0% Tax libility and matures at 20% Tax libility

3. Invested at 0% Tax libility and matures at 30% Tax libility

However, in my question i was expecting answer for:

1. Investor who is eligible for exemption

1. Invested at 10% Tax libility and matures at 30% Tax libility

Since tax treatment may differs at the time of investment and maturity as the lockin period is 5 Yrs, which is good amount of time.

I have prepared excel sheet to handle this information and found that in case if you want most out of this post tax you should belong to below category.

1. Investor who is eligible for exemption

1. Invested at 30% Tax libility and matures at 30% Tax libility

Which is a huge diffence and might be banks are showing these figures.

In case you want, i can share you the sheet.

I might be wrong in preparing the sheet and you tax expert can provide better idea on the same. Also, declairing interest on yearly basis as posted by Narendra are not considered here.

Pankaj,

Obviously there are few other scenarios that are not part of the illustration.

The case you are interested in which is :

“1. Investor who is eligible for exemption

1. Invested at 30% Tax libility and matures at 30% Tax liability”

is already covered under Case 4 I suppose.

Also, the effective annual yield is highest in this case which also matches your analysis. So I am with you till now.

The numbers bank is showing has been presented ‘as-is’ as a snapshot at the beginning of the article. Later, I am trying to illustrate how the actual effective annual yield could be different than what bank is showing depending on the tax applicability/liability of the individual.

I have already posted numbers 8.7%, in case of others and 9.11% in case of Sr Citizens. This is for the case where the investor is at 10% tax bracket when invests first and moves on to 30% tax bracket when the FD matures.

Again there could be differences in the yield because of the way interest income is recognised – accrual basis or receipt basis. This is individual choice and tax officer may expect consistent behaviour from the filer.

But crux of the article was not about taxation of individual investor which the investor and his/her accountant can handle but about intentional miss-out on behalf of the bank the information about the applicability of taxation on the interest income. I have used few plausible cases to illustrate this point but there could be many more cases based on the individual circumstances.

Good article. Couple of points of correction:

The Effective Annual yield they have provided is actually after tax. Though their definition of effective annual yield is wrong and does not take into account the effect of compound interest.

Lets take the Senior citizens example. Assuming the investor is in the 30.90% tax bracket, they will get a benefit of INR 3,090 for an INR 10,000 investment, hence the effective investment is INR 6,910.

The maturity amount given of INR 15,605 is also correct hence the pre-tax profit is INR 8,695. Here comes the part they have not spelt out.

The corresponding post-tax amount is INR 8,695 * 69.1% = INR 6,008.

This corresponds to a return on your effective investment of 86.95% (INR 6,008/INR 6,910).

However, this is over a five year period, and hence on an “effective annual yield” basis you make 86.95%/5 = 17.39%

The above calculation is on the basis of simple interest. Fact is, you receive the entire sum at the end of five years and simply dividing the number by 5 ignores the impact of compound interest.

Hardik,

You are right in fact. This is even worse form of mis-representation because nowhere the definition of effective annual yield excludes the effect of compounding. I think they have discovered a new (unexplained in their advertisement) definition of effective annual yield.

However, this point does not take away the tax liability on the interest income and the standard model of calculating effective annual yield as explained in the cases above stands valid. Thanks for pointing out this clever trick.

Hardik,

I have also added comments about your input in my original blogpost as well.

These days, normal man is fooled from each and every department. Stay alert and never fall for any promises…. There are no ways to earn more than 10% from Debt Instruments (Post Tax, for people who fall under Tax Bracket).

Always take a second opinion and don’t be fooloed by numbers.

I have a coleague, who, even on insisting went for Bank FD’s and he even don’t know that it is taxable. Bank sold to him for tax saving and he bought, only to regret later.

Let us not learn from our own mistakes, but learn from others mistakes…. (it’s not costly).

Thanks for sharing your friends incident 🙂

This is SBI. They are indulging into malpractices – may be because of pressure by private banks. Seems SBI is going LIC way!!

I wish this article can reach to the people who have blind faith in LIC and SBI. Alas!! they have no internet connection.

Thanks for sharing your views !

Hi, Nice and informative. But I have doubt. For the case 3 (where my current slab is), tax will be on interest i,e for Rs.5228 (15228-10000) but not on Rs.8318 (15228-6910). Am I right? I think I found this calculation is correct http://basunivesh.com/2013/02/11/sbi-tax-saving-deposit-why-effective-yield-is-so-high/

Dhiraj,

Manish has updated the corrected numbers. It was my bad and not Manish’s. Thanks for pointing out the error.

Dhiraj,

Manish has corrected the numbers. The error was my bad, not Manish’s. Thanks for the feedback.

That is corrected !

Hi Manish,

I was recently reading a article in ET Wealth dt Feb 4th 2013. Title”7 ways to earn Tax free income”. I found the option 2 more feasible which says ” Invest through a Non- working Spouse”.

So what if I Gift the money to my Wife and She invests in such FD. Wouldn’t the Interest be tax free? The Article says through the picture shown that the Interest is Tax free.

May be I am missing something. Can you please clarify on this part?

Thanks

Sundesh

the interest will not be tax free, but the assumption here is that the total income she will earn out of the FD interest will not cross the tax limits and hence there will be no tax anyways. If you make a FD of Rs 10 lacs, the interest will be close to 90k per year, now this will be total income of wife so no tax as its below the limits of 2 lacs right now . If she was earning and suppose her income anyways was 3 lacs, then her total taxable income was 1 lac (3-2) and now with this additional 90k , her taxable income would be 1.9 lacs.

but, I guess this is wrong anyways . The husband cant gift money like this to spouse to earn the tax free income , tax clubbing rules will apply in these cases and the income will be treated as husband income.

The same question was asked in this week’s The Hindu Business Line’s Investment World.

http://www.thehindubusinessline.com/features/investment-world/personal-finance/tax-talk/article4422374.ece

If you see the answer it says – “Clubbing provisions will apply” 🙂

Yes Manish you are right. Here the income earned from gift money will be treated as income of husband. This tax saving concept will work only when money will be invested in wife’s name in tax saving instruments where profit/interest income is tax free like stocks, tax free bonds, equity & balanced mutual funds and debt funds & MIP; because the clubbing happens only at the first level of income. If this money is reinvested and earns an income, it will be treated as your wife’s, not yours. “The income from the reinvested income does not attract the clubbing provision”.

Hello Kanchan and Manish,

i am a nri n invest a considerable part of my salary as FD, MF (debt, liquid and equity) in my father’s, mother’s and wife’s name. The interest from such income is usually less than 1.5 Lacs per annum. Does all this income be taxable and will clubbed as mine. Will the interest accrue on their FDs will be treated as income from investments in India?

Would appreciate your help on this matter.

Rgds

Mayank

Hi Mayank,

Clubbing of income is applicable for NRI’s also. In your case; income earned on investment made by you in your family member’s name in India will be clubbed with your income and taxable in your hands. Any income received/accrued in India will be consider as income earned in India.

Correct ! 🙂

This is something wonderful to read on Sunday morning. Very informative post. Detailed and Analyzed one.

One morething I want to ask is,

If we are considering the effective yeild then why we are not considering the time value of money. ? I think, we should analyze the cashflow at discounted value.

Mihir,

In IRR or XIRR formula time value is already taken in to account. Effective yield was calculated by the Bank taking in to account the tax benefits (exemption) along with time value factor which is nothing other than interest rate. I have done the effective yield calculations taking in to account the tax burden (on interest income).

Regards,

Narendra

Good article. Our conclusion is

Don’t Compare apples with oranges. Use the same metric for comparison which can be interest rate p.a (8.50%, 8.75%)or Yield.

Effective annual yield/Annual Yield is high because it has been compounded for 5 years, then divided equally by 5 years. If you put it in a fixed deposit with a bank at 8.50% for 5 years and calculate the same way will get the same effect. So please keep the distinction between yields and interest rates always in your mind, and don’t confuse one with the other.

It’s your money, you need to safeguard it. You can blame others but somewhere you need to take responsibility and learn from your mistakes As we know fool and his money are soon parted

Is Tax saving deposit right investment option for you? Consider Risk,Liquidity and Tax.

Risk: It is safe (as backed by banks)

Liquidity: there is a lock-in period of 5 years, Deposits cannot be withdrawn prematurely,Deposits cannot be pledged to secure loan or as security

Tax : One saves tax on investing but interest earned on FD is taxable.

We have discussed it in detail in our article Tax Saving Deposits,Yields and Ads of SBI,UCO

Thanks for sharing your views and link to your article 🙂

Thanks for allowing my link.

Thanks to you for I am avid reader of jagoinvestor and have learnt a lot from you!

I am glad to hear that 🙂

May be they are talking about 5 year tax free FD

Yes they are talking of Tax saving Deposit Scheme Advertisement of State Bank of India

UCO Tax Saver Deposit Scheme Advertisement has worse ad. They don’t even mention the interest rate!

Yes they are , however tax saving FD does not save you tax on the interest earned !