Days Past Due (DPD) section – What is the meaning in CIBIL Report ?

You might have seen a section in your Cibil Report which says DPD (Days Past Due). While Loan Status and Credit Score matter a lot when it comes to getting a loan approved or rejected, a big myth among people is that a clear report (without SETTLED or WRITTEN OFF status) and a credit score above 750/800 are the only two things that they need to get a loan.

at

That’s not true. While a clean report and a good score are definitely primary level requirements for getting a loan approved, there are finer details which a bank looks at, before deciding if they want to give you a loan or not; and Days Past Due or DPD is one of those important metrics. Lets understand this then …

What is Days Past Due (DPD) on a CIBIL report ?

Days Past due or DPD means, that for any given month, how many months worth of payment is unpaid. And this information is for each account . Which means that if you have 3 different loans going on, then you will have DPD information for each of those accounts. For each account you can see Days past due information for each month for the last 3 years , i.e., 36 months.

You might already be aware that your cibil report contains the past 36 months of your credit information. Each and every month, your lender who is a member of CIBIL, will update the CIBIL with the latest information like Did you pay on time or not? How much outstanding loan do you have at that moment? How many months worth of loan is remaining and other micro details are shared on monthly basis by banks and lender to CIBIL. So each month, a new month’s data is added and the oldest month (36th month) is removed from the cibil report and this way a sliding window of 36 months data is available on your cibil report at any given point of time.

Example – Date 06-12 and DPD value is 90

If DPD value is 90 for a date say 06-12, it means in June 2012, the payment is due for last 90 days, which means 3 months dues! So you can now understand the the DPD in the last month (May 2012) would be 60 and for Apr 2012 would be 30.

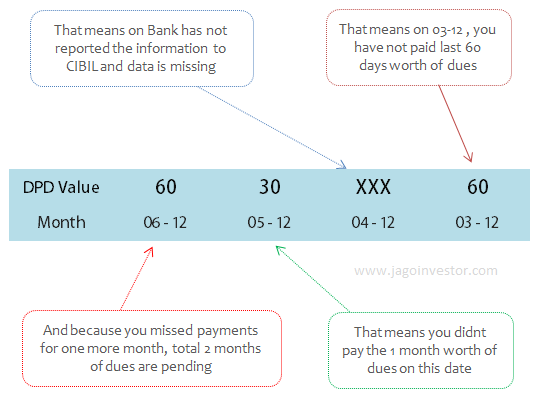

When you default on any payment or do not make the full payment, this DPD value will start getting a number and it will be a negative thing. So if there is a cheque bounced from your side and the loan not paid on time, you can expect one entry of DPD for the latest month with value 30 – which says one month of dues are not paid. If you clear it on time before the next cycle comes, it will help you to improve your bad credit score and the DPD value for next month again will be normal, but if you do not make the payment and keep those dues , then the DPD value for the next month will increase to 60, which implies that from 2 months you have not paid the dues. See the graphic below to understand more examples of DPD

What does XXX means as DPD Value ?

There are certain values which can appear in DPD section and each of them has some meaning, however the safest values are 000 and XXX . If you have the value as 000, it means the dues are totally clear on that date and nothing is outstanding. And if the DPD value is XXX, then it simply means that bank has failed to report the data for that month to bank, and it does not impact you at all . At times instead of 000, the value can be STD which means that the dues are for less than 90 days . While any other number other than 000 is a negative thing, but make sure it does not go above 90 days , because then its super negative.

At times, some lenders also report DPD values in a different way, as per asset classification norms set by RBI. In that case, the values which appear under Days Past Due section are STD , SUB , DBT or LSS which denotes good to bad , where STD is good and LSS is the worst one. Here is what each of them denotes

| STD (Standard) | Payments are being made within 90 days. Note that any delay of more than 90 days is seen as Non Performing Assets (NPA) by banks |

| SUB (Sub – Standard) | An Account which has remained NPA for upto 12 months |

| DBT (Doubt ful) | The Account which has remained Sub Standard Account for a period of 12 months |

| LSS (Loss) | An account where loss has been identified and remains uncollectible |

Can DPD values be changed ?

There have been cases that lenders have rejected loan applications based on DPD information even though the credit report was clean and the score was quite good. And the common worry at the time is “Can’t I change my DPD information somehow?” and the answer is NO . You can’t change DPD information like you can change SETTLED or WRITTEN OFF status by taking some action. All you need to do is wait for some time and as time passes, new month information will get added to your report and old data will keep getting phased out. So if you have some bad DPD data before 12 months, then it will go out in next 24 months, and if you have some DPD data 2.5 years old, it will go out in 6 months period.

For those who like to learn through video’s, we have a 40 min course on Credit Report and Scores in detail on our Jagoinvestor Wealth Club, which will explain all the aspects of the subject in a clear manner and great detail

Did you understand the meaning of Days past due or DPD which appears in CIR (Cibil Report) ?

January 25, 2013

January 25, 2013

Hello sir in cibil report 2007 settlement (written off acoount) loan account is with Citi Corp finance..pl advice how to remove it in the cibil pl

Can you share more info please

I had running car loan from sbi bank and my ecs debited from PNB bank but on june 2015 PNB bank show unsufficient balance on my account but there is not any unsufficient bank on that month this leads a one month overdue running from june 2015 onwards on april 2016 month i personally visit PNB bank and asked on month june 2015 my account balanced is sufficient why are you show unsufficient.Then PBN bank say due to wrongly entered data interchange account this will happen .PNB bank gives june 2015 penalty amount t to account on april 2016.But this leds my cibil score drop down to 605 so how can i improve my score and days past due from june 2015 to march 2016.kindly suggest me how can days past due change to zero from june 2015 to march 2016

It will not change to ZERO unless its really ZERO !

what can i do further..

Sadly you cant change it . Let 3 yrs pass and that entry will go away !

Hi, Manish,

ICICI BANK CREDIT CARD INDIVIDUAL

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST –

HIGH CREDIT 50,921 REPAYMENT TENURE –

CURRENT BALANCE 0 EMI AMOUNT –

CASH LIMIT – PAYMENT FREQUENCY –

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT –

DATES

DATE OPENED/DISBURSED 08-09-2005 DATE OF LAST PAYMENT –

DATE CLOSED 22-04-2009 DATE REPORTED AND CERTIFIED 31-01-2011

PAYMENT HISTORY (UP TO 36 MONTHS)

PAYMENT START DATE 01-12-2006 PAYMENT END DATE 01-04-2009

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2009 281 250 222 008

2008 007 007 007 XXX 006 008 006 000 000 000 000 029

2007 000 XXX 000 000 000 000 000 000 000 000 000 000

2006 000

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

If CIBIL Score shows payment history of last 36 months then why is this account showing on my CIBIL report?

All accounts are showing in CIBIL by default !

What actions should I take to increase the CIBIL score and to remove the already closed accounts?

The standard things one has to do is

– First close all the outstanding loans/settled loans by contacting the old companies with whom there is dispute

– Stop taking any loans for time being and start paying their current EMI’s on time

– wait for few months and that should help the CIBIL score/report to get better

Regarding the old credit card dues, should I go for settlements or pay in full or foreclosure.

Pay in Full .

If you pay partially pay it, then your name will be under defaulter section in CIBIL

a loan account was originated on1st may 2010, last paymnt was on 1st august 2011 , the due date felt on 15th sept2011, when will an account get onto 60 DPD bucket ?

Hi Harleen

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hie Manish,,

I really need help for understanding this CIBIL. till now I am having 1 consumer loan with AEON finance and 1 PL with Bajaj Finserv and 1 Consumer loan with bajaj finserve.

1.Consumer loan with bajaj finserve is got cleared without check bounce,

Personal Loan with Bajaj Finserv is going on in which 24 EMI is paid and 3 check got bounce and last check bounce on 07March2015. and now I am paying without fail.

Settled the AEON consumer Loan in march 2016 and total check bounce is 12 and as per statement last bounce check showing on date 09 sept 2014. I paid full amount and got confirmation from AEON that cibil update from there side.

Now i am checking my cibil its showing score of 767 and DPD.

I need help to clear this mess and create healthy CIBIL Score …Please suggest…

The main reason I can see is that you are using too much of credit in your life. Better avoid taking all these small loans and rather save first and buy using cash. Slowly your CIBIL score will get better !

Hi Manish,

I had a education loan in 2010 as per bank I dont need to pay any charges in between till I get a job and later I found they charged me with interest charges every quarter and I was not aware of same when I came to know about this my father closed the acc by paying all amt including int and principal in year 2013 june. Last week I applied for a personal Loan my loan was rejected because of High DPD. please sugest what can be done

So for the time you didnt pay it, you were marked as defaulter . Incase you were not communicated on that, then its a bank mistake and you should take up this matter with them

Hi Manish,

i have been a good follower of this site and you people are doing a fantastic job by educating people like us which is really helping us a lot to understand these complex things. By the way i had a conversation with you long back regarding one of my standard chartered credit card dispute and finally i had to make settlement by paying some amount in Last Nov’2015 and the third party(Shaha Finlease) said they will clear my bad CIBIL.

Now on my CIBIL report,

# Status shows nothing/blank where as earlier it was WRITTEN OFF in my 2013 cibil report

# Current Balance is 0(zero)

# Date of last payment is 19-12-2008

# Date Closed is blank/nothing

# Date Reported & Certified shows as 27-10-2015

# DPD(Days Past Due) shows

Oct’15 as 000

Nov’15, Dec’15 as blank

and no more cell shows where as this is a recent March’16 report.

My queries are:

1) As per the status i mentioned, does it mean that that dispute is clear in my CIBIL and i am good ? or does it have any other side effects?

2) i received their offer on 16 Nov 2015 and prior to that i never say i will make the payment and finally made the payment on 18 Nov 2015. Then they said it will take 30 to 45 days to update in CIBIL. But here the report shows the last report date was 27-10-2015. So how can it be possible for them to clear my CIBIL before i made any settlement ?

3) i fetched the CIBIL report on 21st Mar 2016 and i was expecting the DPD values should be showing till Feb 2016 but the cell itself shows till Dec 2015 and in that Oct15 is 000 which means “paid on time” i believe but my question is how is it possible as i made the payment on 18 Nov 2015 ?

4) DPD values for Nov’15 and Dec’15 shows blank, what does it mean? where as i know XXX means not reported by bank.

Thanks

Deepak

Hi Manish, I have a score of 782 as of 10/16/2015 and HDFC credit card is where i messed it up. but later i am paying all my well. Can you please let me know if i can apply for a car loan now looking at the data below on my report.

HDFC BANK CREDIT CARD

(MEMBER NAME) (ACCOUNT TYPE) (ACCOUNT NUMBER) (OWNERSHIP)

ACCOUNT DETAILS

CREDIT LIMIT – RATE OF INTEREST –

HIGH CREDIT 51,576 REPAYMENT TENURE –

CURRENT BALANCE 12 EMI AMOUNT –

CASH LIMIT – PAYMENT FREQUENCY –

AMOUNT OVERDUE – ACTUAL PAYMENT AMOUNT –

DATES

DATE CLOSED

DATE OPENED/DISBURSED DATE OF LAST PAYMENT

DATE REPORTED AND CERTIFIED 30-09-2015

PAYMENT START DATE 01-10-2012 PAYMENT END DATE 01-09-2015

PAYMENT HISTORY (UP TO 36 MONTHS)

DD-MM-YYYY DD-MM-YYYY

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2015 000 000 000 000 000 000 000 000 000

2014 000 055 026 025 026 026 025 026 000 026 023 000

2013 000 025 000 000 000 000 000 000 000 000 000 000

2012 000 000 000

COLLATERAL DEFAULT STATUS

VALUE OF COLLATERAL – SUIT FILED/WILFUL DEFAULT –

TYPE OF COLLATERAL – WRITTEN-OFF STATUS –

WRITTEN-OFF AMOUNT(TOTAL) –

WRITTEN-OFF AMOUNT(PRINCIPAL) –

SETTLEMENT AMOUNT –

Hi Karan

One cant comment like that. It all depends on the bank how they look at the report.

Hi Manish,

I have a personnel loan in ge country wide 2005, which was not paid. Now that is showing in my cibil as follows

Opened 19_8_2005

Closed. 07_08_2007

Reported 31_12_2012

Status blank

DPD. 600, 500 etc. From 2005 to 2007 (36 months).

Kindly let me know how to remove these dpd & why reporting in 2012 & dpd shows 2005-2007

Kindly suggest

You cant remove DPD

I am a regular reader of your blog and try to follow all the wonderful tips.

I have recently viewed my CIBIL SCORE and found out this.

I had taken a consumer loan on 31-7-2-13 . I also got a card from Bajaj Finance Ltd for this loan saying it can be used in future for rest of my needs.

The loan was paid in regular instalments and paid in full till 5-4-2014.

On my cibil report the status is account balance : 0 open: no . last payment date 5-4-2014. all entries are 000.

But the Acoount status is : current account .

There are no other adverse remarks in the statement.

Can you help me understand wheather my loan is closed or still considered as open.

I was under the impression that once I have paid all due instalments the loan will close automatically .

Please help me understand the problem as in future I am planning to get a housing loan.

Thanks

If its not mentioned as “CLOSED” then its not closed in CIBIL . Please ask your bank to update it

Hello,

I had closed SBI Credit card on 29-07-2014, but DPD ( DAYS PAST DUE) shows 000 till Dec 2015. Can someone let me know, what going wrong here. Please be not that, it was clean exit , I have NOC from SBI Cards.

cibil report as below –

DATES

DATE OPENED/DISBURSED 25-02-2012 DATE OF LAST PAYMENT 19-07-2014

DATE CLOSED 29-07-2014 DATE REPORTED AND CERTIFIED 25-12-2015

PAYMENT HISTORY (UP TO 36 MONTHS)

PAYMENT START DATE 01-01-2014 PAYMENT END DATE 01-12-2015

DAYS PAST DUE (No.of Days) or ASSET CLASSIFICATION (STD, SMA, SUB, DBT, LSS)

YEAR

MONTH DEC NOV OCT SEP AUG JUL JUN MAY APR MAR FEB JAN

2015 000 000 000 000 000 000 XXX XXX XXX XXX XXX XXX

2014 XXX XXX XXX XXX XXX 000 000 000 000 000 000 000

Dont worry .. 000 means good . You are clear !

Dear Manish,

There is account which was written off in 2012. The DPD code used after that was XXX and suddenly last year september they changed the code to 900. Due to this my CIBIL score has dropped by 80 points. Can you advise if financial institutes can use 900 after the account is closed as written off.

I have the Same Question…Manish Please Reply on the above query

I am not aware on this .

Written off means your loan is not closed though your dpd stands for XXX.

Hi Manish,

I have a defunct HDFC salary account, which i completely forgot. But the banker has levied a penalty for non-maintenance. When i checked the message to my old mobile number, i was shocked to see that it is -4500. What do i do now? Will it impact my cibil score

It will not impact the CIBIL score. HOwever if you have any work in future with HDFC, then you might first have to pay the balance and then only you can get your work done. I suggest pay it off and close the chapter

Hi Manish,

I recently closed my car loan which had a tenure of 4 years. I have always made the payment on time through ECS and never missed a payment. In spite of this for all the four years my CIBIL report shows a DPD of STD and xxx, for all the months, none of the month shows 000. How is this going to affect my credit rating and if I get this corrected will it improve my scores. My personal loan applications are getting declined due to a low score of 630.

Thanks,

STD or XXX is not worrysome . You need to increase your score now .

i have cibil score is 747……but my previous auto loan was payed delay paymets….dpd is there above 90……then…how to get loan…how many monts i have to wait

Better clear your DPD asap

Recently I applied for Personal Loan which was declined citing reason my 4 months old Auto( Car Loan) record is not good. Surprised by this I purchased Cibil report as on 31.07.2015 and found that lender of Auto loan has reported DPD for 6/2015 as 051 days and 07/2015 as 27 days which are wrong figures.

Because EMI due date for 6/2015 is 30.06.2015 and EMI paid on 04.07.2015.

EMI due date for 07/2015 is 31.07.2015 and EMI paid on 04.08.2015.

That is actual DPD is 04 and 03 days. Is 04 and 03 days are bad?

(However this is also fault of branch as branch has obtained SI and in spite of sufficient balances available in SB on due dates transferred EMI with delay)

After discussing with Manager pending correction of CIBIL report he has issued me a letter certifying actual No of DPD for 6/2015 and 07/2015 as 04 and 03 days.

Will CIBIL show correct DPD for these months if branch informs CIBIL?

Talk to lender first, they need to update the correct numbers to the CIBIL

Hi Manish

Recently i got my CIBIL report from one of the free website. In that report it has mentioned like “DBT” . I took a education loan from Indian bank and i closed that with one time settlement on September 2014. Still am getting rejection of my Personal loan and Credit card application. Please assist me what will be the solution for this?

You mean you didnt pay the full amount and paid less ,right ? In that case, you will not get further loans as you are marked as defaulters

My cir report showing std so cn igt credit card frm banks

MOstly yes , if your report is clean and does not have bad remarks !

Hi Manish, as per ur responses high number of DPD or written off or settled tag on civil report goes in some time but I have a loan which is for the year 2006 ‘settled’ due to which my current score is is 576. I could manage to get one loan on a LED TV to improve score which is being paid o time with STD from last 7 months. How much should I wait to take another updated report with should have improved numbers as I am paying on time?

I think you should wait for atleast 6 months

Recently i get my cir report

My que is in my report dpd is indicate 000 for 4mnth

Aftr tht its shows STD so having std in cir report is good or bad i am confused totally pkz help me in diz

Its totally safe .. no worries !

Thnk u so mch

In diz base of cir report cn iget credit card frm banks

Not clear of your question