Mutual Funds Performance vs Benchmark Performance

How would you judge whether you have scored good marks in an exam? How do you define “good”? If you had a very very easy test and most of the questions were easy, would you call 80/100 a great score? NO. In the same way, if the exam was very very tough and made everyone cry, but you scored 75/100. Would you call it a great score then? Yes! So the point I want to make is there’s always a benchmark in any area to decide if the performance was good or bad. If you have done better than the benchmark, you did well, else you did bad. This is exactly how mutual funds are to be judged. You can’t just say a mutual fund has performed bad or good based on the returns it has given in a time frame.

What is a Benchmark?

Each and every mutual fund has a mandate and rule defined on where will it invest and in what proportion. Like if a mutual fund says that it will invest in all the large-cap companies in India, then its benchmark would be mostly NIFTY because NIFTY is the indicator of the large-cap companies. And the whole point of investing in a large-cap mutual fund is that it should give you better returns then NIFTY because you can always invest in NIFTY and get the returns without any fees or risk. So only if a large-cap equity mutual fund beats NIFTY, you can say that it performed Good. Because if it does not then it has performed badly even after you paid him the fees, what’s the point of paying the fees and getting returns lesser than the Index which gives you some returns anyways.

In the same way a Small Cap Mutual Fund would have CNX MID CAP. One can just buy that Index and get returns from it based on the movement of the stocks in that benchmark. A mutual funds tries to take a call on what stocks to select and when to get rid of them to generate superior results and only if it can beat its benchmark, we can say that the mutual fund performed better than it’s benchmark.

Bad Market Performance in the last few years

So in any mutual fund, there is a benchmark and you can say that the mutual fund performed good or bad in a time frame only if the returns from a mutual fund are better than its benchmark for that particular period. Now based on this very simple rule, let’s see some cases. In the last few years, stock markets have performed badly. This bad performance from markets will obviously affect mutual funds performance too. So if a mutual fund has not given double-digit returns, can we conclude that mutual funds are bad investments? No.

Sandeep asked a question related to this

I was told that HDFC Top 200 is an excellent fund . But I invested around 50,000 in that fund last year and now my fund value is near 46,000 . Is this fund really good ?

This kind of questions come to all the investor’s mind, this happens when you dont know how exactly you should judge a mutual fund’s performance. The only way here to say is HDFC Top 200 did good or bad in the last 1 yrs is to see if its return is more than its benchmark or less than its benchmark and to what extent?

HDFC Top 200 example

If you look at HDFC Top 200 returns in the last 1 yrs from today (27th Apr 2012), its return has been -9.8 %. Now anyone hearing that kind of return will scream – “Oh .. that’s really bad”. But when you look at its benchmark (which is BSE 200), you can see that its benchmark has given around -12.06% So you can clearly see that HDFC Top 200 has outperformed its benchmark by 2.26% which means that it has done a better job.

Note that mutual funds have stocks as the underlying assets in which they invest, so mutual funds performance will depend totally on stock markets performance and in last 5 yrs, its not mutual funds which have performed badly, its actually stock markets, Mutual funds just mimick the portfolio’s in some manner and the real parameter of how good or bad they have done is to see how they have performed compared to the risk-free benchmark they are following.

Now coming back to the same example of HDFC Top 200 , it has given around 22.6% returns CAGR in last 3 yrs , but its benchmark (BSE 200) return was just 16.2% , hence you can say that HDFC Top 200 has done a good job and outperformed its benchmark by 6.2% on yearly basis, that’s really a good number.

Escorts Tax Plan Example

Now lets look at 5 yrs performance of a tax-saving fund called Escorts Tax Plan, The fund has to give -15% return on absolute level in last 5 yrs (1 lac became 85,000) and an agent can say – “Sir – markets were doing badly in the same time, that’s the reason the fund has given bad return’s, in future it would do great” . In this case, all you need to ask is – “Fine, I can understand that market performance affects fund performance but has it performed better than the risk-free benchmark it was following? “

If you look at its benchmark “Nifty”, it has given a 24% positive return in the same period. This means that the fund has performed worse than the index which is totally free, while the fund has not performed even after bring run by professional fund managers. Then what’s the use of that fund.

So now you have a simple rule to judge a mutual fund performance

- If Fund Performance > Benchmark – The fund performance was good

- If Fund Performance < Benchmark – The fund performance was bad

Note that the duration should be good enough like more than 1 yr at least to say anything and the gap between the fund performance and benchmark performance should also be considered. You can say that a fund was bad just because its returns were 8% and the benchmark was 7.8%. that is very much close and does not conclude much.

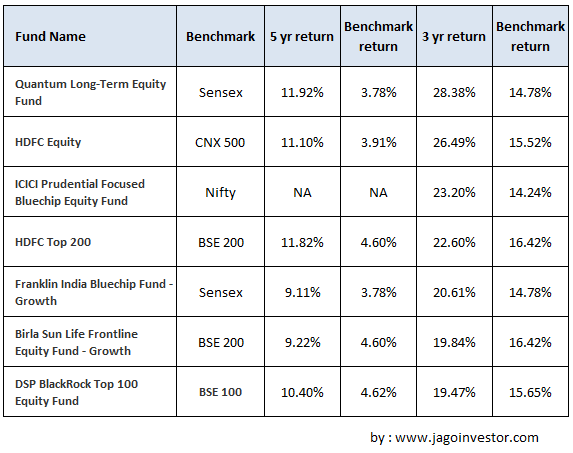

Now a fairly good way of choosing a mutual fund is just based on how it has performed in the last many years compared to its benchmark. So I am putting up some top funds which have done very good compared to its benchmark

Some Top Mutual Funds vs Benchmark Returns

The following are some of the very good potential mutual funds for 2012 and they are really doing good overall. Let’s see their returns overall for 5 yr and 3 yr timeframe along with their benchmark returns. You can see some funds outperformed their benchmarks with huge margins. For example, Quantum Long term equity fund has return 28.38% in 3 yrs compared to just 14.78% from its benchmark which is Sensex. Thats 100% more, really brilliant.

So overall the learning is that if you want to find out some good performing mutual funds, you should be looking if a mutual fund has outperformed its benchmark over several years with a good enough margin or not. If it has consistently done that, you can be clear that fund management is going well.

How often do you look into the benchmark? What else do you think should be looked at while judging mutual funds?

May 2, 2012

May 2, 2012

Hi Manish,

I need to know how does compounding works in mutual fund. I understood the rupee cost average methodology which comes in picture when we use SIP method But compounding in mutual fund is something I couldn’t understand. Since the returns in mutual fund are not fixed how is the money compounded? Like in FD we know the interest rate would be 7.1% and at the end of the year the interest would be added to principal amount in the next year that is the way the money is compounded. Is it that at the year end if a said fund has a return of say 10%, they would buy extra units with that returns and add it to our portfolio? Your reply would be much appreciated.

Thanks in advance

The compoundings does not mean that it happens each month or year. Compounding means the returns also gets returns, thats all ..

So if your 1 lacs becomes 1.1 lacs in 1 month, then any further growth will happen to full 1.1 lacs not just 1 lacs, thats compounding !

Hi manish,

First of all thanks for this forum…. its really educative.

Iwant to invest in

HDFC Balanced fund G 1000 pm

ICICI Pru Balanced Fund G 1500 pm

Mirae Asset Emerging Blue Chip G 2000 pm

Birla SL Frontline Equity Fund G 1500

Total 6000 pm for 5 yrs.

Plllll advice. I am already insured by govt and pension would follow.

Regards

I think its a good choice of funds . .go ahead

In case you are new to this, my team can help you with setting up everything from start to end. Just fill up http://jagoinvestor.dev.diginnovators.site/start-sip

Hi Manish,

I have few questions to you. I have read both your books, now I am reading the 3rd one. Also I have enrolled for 100moneyactions program last week. I am 27 yrs old and have following queries –

1. Out of the total savings how much amount should be invested and in which asset classes.

2. I already have a SIP, now instead of a FD or a recurring deposit, can I make investment in a Mutual Fund and as and when I have some surplus amount, can I make further investment in that same folio or will I have to make another investment in a new fund.

Thanks

I would also like to know that while applying for a new term policy, when giving details of existing insurance policies, I have to provide detils of the policies which are paid up for which I am not paying premium as well? Also last year I applied for a term policy with aviva for which my premium was increased because of some health issues for which i refused the policy and later i purchased a policy from kotak in which all my health report was correct. Now while applying for the new policy, do i need to give details of the aviva policy as well which i refused?

Are they asking for it in their form ? If yes, you have to give it

I am applying for bharti axa online term plan. There is a column of insurance history with other companies, where it is written to provide details of existing life insurance cover with other companies.

Yes, you have to give that info

Hi Vishal

1. You should invest the maximum money you can . There is no minimum like that

2. You can invest in the same Folio , its possible .

Manish, this is a really good article. I have been investing in mutual funds since 2006 and I have always relied on the MF ratings provided by ValueResearch & MoneyControl to decide on which MF to invest. Only now, after 6 yrs of investing in MFs, I’m starting to understand (some of) the science behind the valuation. Thanks for this!

Do you have a similar article on how to evaluate ULIPs? I’m not sure which benchmark can be used as its a mixed investment (insurance + markets). Should I evaluate based on IRR (sum of cash outflows + current value), or is there a better way to evaluate the return?

You cant benchmark ULIP’s as there is no standard format and no clairty on where they invest exactly . I would personally skip them altogether !

Hi Manish,

Thanks for the useful insights on the topic.

Can you please tell me how do I get this data of the Benchmark performance and MF performance.?

There are various websites from where you can get it like moneycontrol.com or valueresearchonline.com .

How 3yr return is more than the 5yr return in both Fund performance and in Benchmark. I mean to say in the Image Quantam has 5yr return as 11.92% and 3yr return as 28.38 also benchmark is 3.78 % , 14.78% respectively .

Is it that the market didn’t perform well in the last 5year and it performed well in last 3yr . Now what about 5-3=2 . So in between this 2yr how did the market performed.???

Why cant it happen . It can happen that in last 3 yrs performance was good , but overall 5 yrs was not that great !

I think its wrong…

“”In the same way a Small Cap Mutual Fund would have CNX MID CAP.””

instead of CNX MID CAP it would be CNX Smallcap .

CNX Smallcap Index is designed to reflect the behaviour and performance of the small capitalised segment of the financial market . Manish SIR Kindly reply .

Dear Manish,

I am investing n HDFC top 200(G) and HDFC equity(G)in SIP since 18 months. now I want to discontinue any one of them and invest the same in ICICI pru focussed blue chip. what is your opinion

hdfc TOP 200

Hi Manish,

Article says, “example of HDFC Top 200 , it has given around 22.6% returns CAGR in 3 years” but on http://www.moncontrol.com (good source says) it is merely 8% and in last 2 years it is -1.3%?

How 22.6% number you came to?

Regards,

Krishna

Its 2.26% , not 22.6!

Hi Manish,

Is there typo in the article then? I am referring to following para:

“Now coming back to the same example of HDFC Top 200 , it has given around 22.6% returns CAGR in last 3 yrs , but its benchmark (BSE 200) return was just 16.2% , hence you can say that HDFC Top 200 has done a good job and outperformed its benchmark by 6.2% on yearly basis, thats really a good number.”

Regards,

Krishna

Actually no , you are right about that 22.6% number, but now the point is that the numbers are true as on that date when the article was written and is mentioned in the article (27th Apr 2012)

Dear Manish,

You see, Manish: I have purchased ICICI pru focussed Bluechip in 2008 for Rs.20,000/- at NAV Rs.10.23. Now the value of Rs.20,000/-(allocated units 1955.990) fund has grown up to Rs.31,800/-NAV as on 30.6.2012 was 16.26. So what is the return of Rs.20,000/- to me? 100 x 11000/20000 x 4 = 13.75%. Here, 4 years is the period of investment. 11000 is the value by which investment has grown up. Thus, I say that I have got [email protected]%. Do you agree with rational and method?

Use XIRR formula and excel to arrive at the exact return. Assuming the purchase date is 1-jun-2008, the return is 12.03%

You should use XIRR method . Look at this http://jagoinvestor.dev.diginnovators.site/2009/08/what-is-irr-and-xirr-and-how-to.html

Dear Manish,

I am glad you have brought in this sensitive and very much critical point of view for those who know not how to satisfy themselves about their investment as a whole. The Benchmark is common and reference point on the basis of which whatever we do has to be weighed.

But for a common man what matters is the absolute return and not relative return with reference to NIFTY or BSE index. When MF and Stock returns are reported by various Newspapers / Bulletins / websites, are these returns wrf to Index or are these absolute wrf to NAV of X date to NAV of Y date?

Secondly, of these two methods, there is another method which I use for my simplicity. I take the purchase value as base and NAV value as variable and calculate percentage difference and say that this is return I have gathered. This calculation is like Bankers’ interest calculator. I find it more rational and satisfying to me because I have my own benchmark i.e investment value with which I must compare my returns. what do you think?

Can you explain with example your method ?

Dear all,

What is your opinion about Reliance Growth , I am invested since last two years but its performance is not so good as compare to other funds like IDFC Premier equity, HDFC Top 200, DSP Black Rock Top 100.

Should switch to some other fund fund Like HDFC Equity or ICICI Pru focused bluechip

Regards

Pradeep

Reliance growth is a mid cap fund , you cant compare it with HDFC Equity , over last few years Reliance Growth has not been in limelight 🙂

Hi Manish,

I am new to financial planning . I am extremely impressed by some of the articles in this site jagoinvestor. Some of them have been extremely useful to us. Thanks for ths same.Also appreciate the prompt response in your site.

I am new to Mutual funds and am looking forward to investing in them. Is there any beginner’s guide on how to read mutual funds performance and how to choose what to invest on. Also is SIP better or one shot investment is good. I am also not familiar with termniologies like small cap,medium cap etc.

Thanks

Sowmya

You can read some old articles on mutual funds here : http://jagoinvestor.dev.diginnovators.site/archives and also ask your questions on forum : http://jagoinvestor.dev.diginnovators.site/forum

Hi all,

I think i have made a mistake by investing in ICICI prulife lifestage RP. I have paid 3yrs premium of 30000Rs every year and i have an outstanding due of 30000Rs for next month ( 4th Yr) currently my fund value is 70000Rs (90k invested till now) the fund is currently 60% equity and 40% debt.. I raised a call with ICICI prulife they informed i will get 96% of the fund value after 5yrs its 100%.. Please advice if i need to continue to invest or shall i make it to debt fundor shall i break and come of this fund with 96% and invest the money elsewhere.

dear manish,

my financial advisor is suggesting investment in sip as follows

DSP Black rock top 100 equity (Rs 2000)

HDFC Midcap opportunity fund (Rs 2000)

ICICI dynamic fund (Rs 1000)

need ur advice…..shud i go with this?

regards…

I do not know the background hence I can not comment , the financial advisor might have suggested it as per your situation and requirements .

Kindly suggest your views on below mentioned funds; As I want to invest with equity oriented plans, I have shorted out some fund. I want to choose any 2-3 out of 9 funds.

ICICI Prudential dynamic plan

ICICI prudential discovery fund

ICICI prudential FMCG fund

SBI magnum sector umbrella – Emerging business fund

HDFC midcap opportunities fund

DSP blackrock microcap fund

DSP blackrock natural resources and new energy fund

Goldman sachs gold exchange traded scheme

Birla sunlife 95 fund

Sir, I have long term horizon for above mentioned funds

Jatin

You should choose just 3-4 funds maximum . from where have you listed these down ? And on what basis ?

Sir,

I want to invest only in 2-3 funds from above. I have found out funds as i think person should invest in emerging fields thats why i have sorted out SBI emerging business MF, DSP micro cap MF, DSP nat. resources and new energy fund. I just want to start with 500 rs SIP.I have already started HDFC Top 200 G. In debt portion, I am investing in bank FD and PPF.

I think you are just complicating things .. if its 500 per month , i think you should just look at a balanced fund like HDFC Prudence . thats all

I just wanted to invest in small/micro cap companies that why I have selected above ones.

Hi Manish

I am doing a SIP of Rs. 5000 into Reliance Diversified Power sector fund for more than 3 years now. Initially it was doing good, but of late I see the fund value less than the invested value. Please suggest me which is the good option – to continue the SIP or to invest in some other fund. (My investment horizon is 5 years)

Thanks

Its a sectoral funds , i would say see its benchmark performance

Thanks Manish. Fund is doing better than the BSE Power index.

Then its doing good i would way !

Hi Manish,

I do follow your posts when ever i find time. You bring in some of the basics which we tend to forget due to xyz reasons.

In this article, i would define performance in two ways – a.before i select to invest b.after i invest.

Before invest – I would consider your way/kind of percentile calculation(termed as benchmarking – which might differ by few small number considering some comments raised by followers on dividents) to choose it.

After investing – I would rather look at the percentage of return i get. I will not be happy stating that my funds are doing better than its benchmarks, when both are in negative.

Venugopal

In that case I would say you still have not got the point that if a fund has given a negative return, still it can be a great performance . Beating the benchmark shows that the fund has done what it was bought for . Truely speaking if you look in deep, you buy a mutual fund to beat its benchmark , nothing else .. else you can just buy an index fund .

Manish

My Son Rohan is now 2 yrs old….

ask it on http://jagoinvestor.dev.diginnovators.site/forum

Myself Jagdeep Frm- Thane(Maharashtra) Age- 31 yrs

A.I.- Upto 3 Lac Son- 2 Yrs ……..

I want to Invest Rs 7000 PM…. in mutual fund through SIP…..

for long term…

Goals -1- Child Education- 30 to 40 Lac ( 15 to 18 yrs)

2- New Home Down Paymnt – 10 to 12 Lac ( 5 yrs )

3- Retirement Planning – Yet not decided ( Confused )

Invested Amt-

1-Term Plan – 60 lac Prem.6K (Aviva-i-life) Since 2012

2-Mediclaim Floater -2Lac Pem.5K ( AppoloMunich) Since2010

3-Jeevan Saral – SA- 2.5Lac Prem. 12 K ( LIC ) Since 2012

4-ULIP-Group Unit Link Plan- Prem.12 K (Bajaj Allainze) Since 2011

5-New Bima Kiran- SA-1 Lac Prem. 1 K ( LIC ) Since 2002

6- RD – IN Co-Oprative Bank- Prem – 2 K ( FOR 2 YRS ) – 2012

## HDFC TOP 200 – 1000 PM Sonce 2011

## ICICI FOCUSED BLUECHIP- 1000 PM Since 2011….

Shall I Get my goals with this Investment…plz sugest if your ans is no …

plz make my portfolio better….

Regards,

ROHAN

(M)- 09819496501