If asked, “Do you have a lot of knowledge about personal finance?” You would say “Yes, of course!” Now, on the next question, “Is your financial life great?” For most of you it would be “No”. We all know term plans are required, we need to start the SIPs to meet financial goals, we need to cut down on our expenses, etc etc. But, how many of us actually go ahead and implement what we all claim to know! A very small percentage!

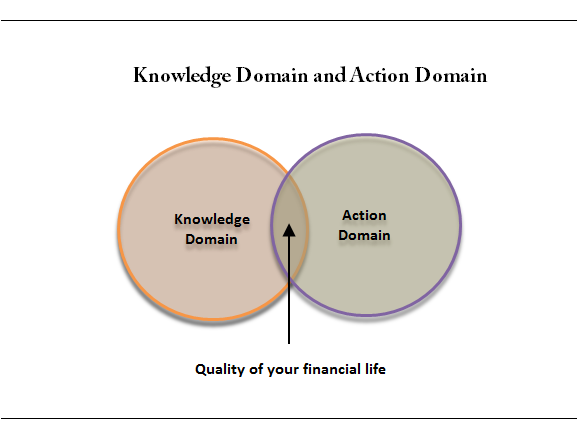

In this article, me and Nandish will talk on how taking actions is the real thing to be done in your financial life and just by accumulating knowledge about personal finance (what most of the readers on this blog do!) does not add up much in our financial lives! . In the video above, we are sharing – how two of our clients have given a new direction to their financial lives. Watch the video above to hear some action-provoking conversations between me and Nandish. There are two domains each person has called ‘Knowledge domain’ and ‘Actions domain’ .

Knowledge Domain

This domain is filled with the knowledge aspects in your life. When you read a blog, magazine, watch a show.. etc…etc, you are increasing your knowledge domain. You knowledge expands and you know more and more things. Your clarity on various subjects increases. This part is very important because it gives you confidence and understanding along with reasoning ability. If you are following a blog from long, your knowledge domain might be very high. But guess what! Your knowledge domain has very less impact on your financial life

Action Domain

Action domain is very simple to understand. All it means is how much action you take after increasing your knowledge domain. The more proactive you are in implementing what you know; it will have direct relation with the quality of your financial life. Increasing your knowledge domain will be of little or no use if you don’t expand your action domain.

In our financial coaching program, we concentrate heavily on taking actions and moving things in our clients’s financial life. We see people have good knowledge, but the one place where they are stuck is “Actions”. Somehow they don’t move forward by implementing what they know. Take yourself, many of you know that you need to take a term plan , you need to start your SIP, you need to start exercising (that includes me as well), but we don’t Act! and that’s where our big knowledge domain is of no use! Start taking actions!

I see so many readers on this blog who keep sharing their actions and how they started their SIP’s after reading an article . How they took the term plan after reading my article on online term plan , how a lot of readers got in action and started exploring options for their health Insurance, after reading one of my recent articles on Health Insurance

Financial Life as a project

One of the biggest reasons why most of the people fail to take actions in their financial life is that they dont look at their financial life at a project which needs a completion in all areas dont take a lot of actions in their financial life .

If you are stuck in your financial life and feel that you need an extra support which helps you be in action, you can register for our paid Financial Coaching program

Conclusion

Which of the two, knowledge and action domain is important? I personally feel that action domain is much more important than knowledge domain, because once you choose to act, you are bound to learn things and find out ways of completing somethings.

Please share what actions you have taken in your financial life? Which domain is bigger in your financial life ? Also let me know how was the video and if you liked the conversation ?

Also wanted to know your opinion on “Financial Action Day”, when we celebrate a week or a month as “Action Month”, when we as a group take massive actions in our financial lives and complete the long pending tasks ! . What do you say ?