How will Budget 2011 affect you ?

How much will you benefit with this budget ? There are some direct and indirect effects on a common man due to this budget which we will look in this article point by point . There has been not a major changes on exemption limits, but there are some changes which aim to simplify the whole process of Income tax.

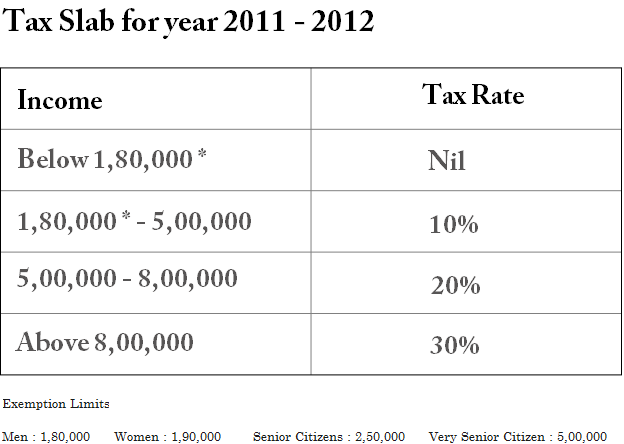

Tax Exemption limit raised

Earlier the limit of exemption was Rs 1,60,000. It has been raised from 1,60,000 to 1,80,000 . Which means roughly Rs 2,000 saving for individuals. For women, the exemption limit is at the same 1,90,000 .

Senior citizen definition and limits

Senior citizen definition is changed. Now any one above age 60 yrs will considered as senior citizen, earlier this was 65 yrs . This is a good move as more and more people will be able to enjoy the benefits of senior citizens. The exemption limit for senior citizens was also raised to 2,50,000 from previous limit of 2,40,000 .

No Tax Return filing if income less than Rs 5 lac

This has been the best point of this budget , from years small tax payers who were having smaller salaries had to go with the cumbersome process of filing tax returns , But from now on tax payers having income of less than Rs 5,00,000 will not have to file their tax returns, if their TDS is cut by their employer.

But incase one has additional income from other sources like dividends, capital gains , interest from Bank deposits or Income from House and Property etc , in that case they will have to file the tax returns or they will have to notify their employer in advance about these additional source of income so that the employer can take these points in consideration and deduct the extra TDS. In this case employees form 16 will be treated as their tax returns. This change can be a bit of blow for tax return filing service providers, a big relief for small tax payers who are purely salaried.

“CBDT will be issuing a notification, which clarifies about the ‘classes of persons’ exempted from the requirement of furnishing income tax returns. This will be implemented for the year 2011-2012 and will come into effect from June 1, 2011” – said Sudhir Chandra , CBDT chairman .

New category called “Very senior citizen”

There is a new category of senior citizen called “very senior citizen” in this budget. Any one above 80 yrs of age will be under this category and they will not be taxed up to the income Rs 5,00,000 . While this looks a nice addition, the benefits of this move should be very limited, as I wonder how many 80 yrs old will have their personal income more than 5 lacs in our country. But it’s would be a good strategy to gift a big lump sum to very senior citizen and let it be invested on his name and generate income for him.

Infrastructure bonds extended by one more year

We saw the introduction of Infrastructure Bonds last year which can save you additional Rs 20,000 exemption other than sec 80C. In this budget , the this benefit is extended by one more year . Which means that in 2011 – 2012 also you can invest in Infrastructure bonds and save some tax.

Insurance policies other than Term Insurance to get expensive

In this budget, our financial minister has warned all the insurance companies to have a deeper focus on pure risk cover. Service tax net has been widened to insurance policies which have “investment” component, which means ULIP’s , Endowments plans , money back plans and even return of premium term insurance plans will have a higher service tax on the premiums. Earlier there was 1% service tax on the premiums, but now it has been raised to 1.5% . Which means that incase your premium is Rs 50,000 in ULIP , you were paying service tax of Rs 500 earliar, but now it would be Rs 750 , which will be adjusted from the premium itself . So that gives another reason to opt for term insurance now ! .

Medical , Air-travel and hotels becomes Expensive

Healthcare , Air-travel and expensive hotels is set to become more expensive due to some changes in this budget. The changes are

- Health check-ups done by hospitals with more than 25 beds or those with air conditioning will now be in the service tax net .

- There will be service tax of 5.15% on hotels where the tariff is more than R1,000 a day or they are air-conditioned restaurant that has a licence to serve liquor.

- The service tax on economy class airfare has been increased by R50 to R150 on domestic sectors and by R250 to R750 for international travel.

So you will have to add some more thousands to your bill incase you were planning to go on vacation with your family and it required air travel + hotel stay !

Day to-day basic items to get costlier

There is excise duty of 1% levied on 130 items which includes day-to-day items like tea, coffee, sauces, ketchup, mobile phones , soups and all kinds of food mixes, ready-to-eat packaged foods . This would mean a bit of cost increased on them .

DTC coming in 2012

Financial minister has once again confirmed in his speech that DTC will be implemented from year 2012 . As per this article DTC would affect the NRI definition and it would negatively impact them.

Employer contribution towards NPS goes out of sec 80C

If your employer was contributing towards NPS , his contribution was eligible under 80C , but with this budget while it will still get tax deductions , it would come out of 80C , which means that some space will be left under 80C for people whose employer was contributing in NPS . The person can now invest more in sec 80C because of this .

Comments ?

What you you feel about this budget ? how are you affected ? Do you see as a good budget or as a bad budget ? Download this great ebook by Livemint on Union Budget incase you want to dive deeper .

March 2, 2011

March 2, 2011

whether govt. contribution in NPS for its employee in 2011-12, will be outside 80C or not. pl tell.

that should be outside 80C

Dear Manish,

Is this rule of Examption of tax below 1.8 Lac is effective for this financil year 2011-12 ?

Yes

sorry. i forgot to gve details of exemptions…. LIC prm 35000, med ins prm.8670//

rental rec chgs,17500/= i.e, total around.rs59000/- pl let me know in detail thank you sir

Sir, I am aged 69 yrs, pensioner,hving income by pension rs.1,80,000 and rental inome of rs.65000 PA, and int on Dep rs,75000 totally rs.3,20,000. shall iahve to Py IT and submit retn for Mar,2012.? Pl guide me.

Thanks

Srinivasy

Your income is above the limit , but if you invest in few tax saving instruments your taxable income will be below limit and you might not have to pay tax, but even then the return filing has to be done

Manish

Manish,

I am looking for requirements for NRI in the new DTC.

To claim NRI status earlier one had to stay OUTSIDE india more than 183 days. Does it remain the same?

Thanks

Ashok

Let first DTC come into effect . we cant be sure that its coming 100% . What if there is again a delay ?

May i know about this 10-10-d ? is there any change in this ?

Nothing is changed in 10 10 d for this current year

Hi Manish

can you please see this link and let me know is there any change in the cash back policy(life insurance) for the next financial year

http://taxguru.in/income-tax/direct-tax-code-may-bring-ulip-life-insurance-plan-under-tax-net.html

Raja

After DTC comes in year 2012 , Tax rules will change , only those policies which have premium less than 5% of SA will be eligible for tax deductions at the time of contribution and also at maturity , right now its 20% .

So right now if some one pays 25k premium for SA 1 lac , he will not get tax benefit not his matutiry amount will be tax free as his premium is more than 20% of SA , thats current law .

One DTC comes, it will change to 5% .

I hope you are clear now ?

Manish

Thanks Manish so for the next financial year 2011 -2012 ,there is change in tax policy. If i take the policy now is my maturity amount and cash back every 5 years will not be taxable right(i got that 20% below).

Sorry for the first time i am understanding these things so taking some time to ink in.

Now i mean in financial year 2010-2011

Raja

DTC will be applicabel from 2012-2013 only , We have one more year to go . After 2012 , new rules will apply , Having premium below 5% is best option . DTC will take new shape again as we have one more year to go .

Manish

Thanks Maneesh, I really appreciate your help.

This is the best place to understand budget in simple words to the extent we needed,thanks again…

Raja

Great 🙂 . Keep reading 🙂

manish

Hi

I am looking to take a cash back policy. One of my friend told that in the latest budget the amount i received (for every 5 years) is taxable. is that true?

I read that there is change of tax from 1 to 1.5% for initial premium. but is there any changes of tax on the amount i am going to receive . is it taxable or not?

Raja Sekhar

Its not taxable as per current law .

Manish

Hi Manish, Can you tell us in detail about DTC provisions. It would help in financial planning starting this year. there r several diff. versions in the net. pls publish a reliable one.

thanks

Anand

hi Anand, almost each and every provision of income tax laws has been changed in DTC, which will be applicable from f.yr. 2012-13.

Are you salaried person, businessman, professional, etc. please specify?

Anand has asked this question to manish, but liberty from manish, i am answering to anand. hope manish dont mind.

Rajiv

You are a great help ! , Please answer questions whereever you feel . For readers Manish is the person who will for sure Look at the comments ,so they write my name 🙂

Manish

you didnt cover Home loans in this post, HL less than 15 lacs have a 1% discount from now. Is it for existing loans or just for new loans??

interest subvention (discount) of 1% is no doubt is boost for housing dreams of middle class. but it comes with a conditon that the cost of house should not exceed 25 lac rupees. this provision will be applicable for the new loans only. so this year also you can expect home loan interest of 8.5% or near thereto for small borroweres.

No tax return filling for below 5 lacs indivuduals is a good move. However budget 2011 on the whole is a lacklusture performance. if you ask me it was done without any clear mandate in mind.

SS

Hmm .. you can say that there was no mandate , you have not looked at the overall budget . We have just mentioned about personal finance related changes in this article

Manish

Well.. there’s nothing innovative in rest of the budget either, leave alone the personal finance.

Manish,

I put the same wine in new bottle. I am keen to invest around 2 lakh in FD for 10 years. Currently Canara bank is giving 10.5 % rate of interest for senior citizens.

Point 1. – I want to make sure i get this high rate of interst at the same time NO TDS is deducted.

Point 2. – I should be one of the joint account holder. I am 35 years old and have taxable income.

Now with the New as per the new tax law. My father would be considered as senior citizen. He is getting a pension of 2.55 lakh per year.

My Doubt is

Can my dad submit 15H Form?

Should he first invest 1 lakh in 80 C,so that his taxable income reduces to 1.55 lakhs and there by he will not have to pay any tax?

How should i prove the bank that my dad will be investing 1 lakh in 80C?

Please let me know what would be the best solution?

DEAR AMIT, IF YOUR FATHER IS A SENIOR CITIZEN THEN HIS INCOME IS EXEMPT UPTO 2,40,000 FOR F.YR. 2010-2011 AND 2,50.000 FOR F.YR. 2011-2012.

IF HE HAS INVESTED RS. ONE LAKH UNDER SEC. 80C, THEN HIS INCOME IS EXEMPT UPTO 3,40,000 OR 3,50,000 FOR RESPECTIVE YEARS.

A SENIOR CITIZEN CAN SUBMIT FORM 15H IF THE TAX LIABILITY ON TAXABLE INCOME INCLUDING INCOME FOR WHICH 15H IS BEING SUBMITTED IS NIL. ASSUMING YOU HAVE GIVEN FIGURES OF PENSION OF RS. 2,55,000 AND FDR INTEREST FOR NEXT YEARS I.E. F.YR. STARTING FROM 1/4/2011.

HIS INCOME WILL BE COMPUTED AS FOLLOWS (ASSUMING HE WILL BE 60 YEARS OR ABOVE NEXT YEAR)

PENSION INCOME 2,55,000

FDR INTEREST 20,000

SAVING BANK INTT 2,500 (ASSUMED)

————–

TOTAL 2,75,500

EXEMPT INCOME 2,50,000

————

TAXABLE 25,500

IN ORDER TO BE ELIGIBLE TO SUBMIT FORM 15H , HE SHOULD INVEST ATLEAST 25,500 UNDER SEC 80C. ONLY THEN HIS TAX LIABILITY WILL BE NIL NEXT YEAR,

HOPE YOUR QUERY IS SOLVED

Rajiv sir…..

Wonderful……………………… Crystal clear…. Thank lot.

WOMEN SHOULD NOT LOOSE HEART, THINKING THAT THEIR EXEMPTION LIMIT HAS NOT BEEN INCREASED. FM HAS DONE THIS THING KEEPING IN MIND THE PROVISIONS OF DTC. IN DTC, EXEMPTION LIMIT WILL BE SAME BOTH FOR MEN AND WOMEN.

BUT CONSIDERING THE NUMBER OF WOMEN IN PARLIAMENT, FM WILL BE UNDER LOT OF PRESSURE TO PROVIDE EXTRA EXEMPTION LIMIT TO WOMEN. AND THEY DESERVE IT. THEY WORK MORE THAN MEN, BOTH AT HOME AND OFFICE. CHEERS!

GOVT. IS SOMETIMES VERY HARSH. TAX SHOULD BE ON PERKS AND LUXURY ITEMS, I MEAN THOSE THINGS WHICH GIVE US ENJOYMENT. BUT SERVICE TAX ON MEDICAL SERVICES IS LIKE TAX ON DISEASES. IT SEEMS THAT GOVT IS SAYING “YOU CATCH A DISEASE, WE WILL TAX YOU. FINANCE MINISTER SHOULD ABOLISH IT.

EVEN SCOPE OF SERVICE TAX ON LEGAL SERVICES HAS BEEN ENLARGED. JUSRICE HAS BECOME EXPESIVE NOW. THIS GOVT HAS NO SOCIAL RESPONIBILITY.

BUT IN THIS BUDGET , ONE THING FOR SURE HAS BEEN IGNORED. WHICH IS PRACTICE OF BLACK MONEY. FM HAS TALKED A LOT ABOUT MONEY. BUT THERE IS NO CLEAR INTENT OF GOVT. ON CURBING BLACK MONEY OR BRING BLACK MONEY FROM ABROAD TO INDIA. SOME INCOME TAX PROVISONS HAVE BEEN CHANGED, BUT THESE PROVISIONS WILL HELP HASAN ALI KIND OF PEOPLE ONLY. I AM A CHARTERED ACCOUNTANT IN PRACTICE AND I BELIEVE THAT NO INDIAN GOVT WILL DO ANYTHING TO BRING BLACK MONEY BACK TO INDIA. CHOR CHOR MOSARE BHAI.

AS FAR AS EFFECT ON DTC ON LIFE INSURANCE IS CONCERNED, I THINK, THE PROVISION OF MINIMUM SUM ASSURED SHOULD BE 20 TIMES OF ANNUAL PREMIUM, HAS BEEN MADE KEEPING IN VIEW THE LONG TERM BENEFIT OF PEOPLE. SO FAR COMPANIES WERE SELLING INSURANCE PRODUCTS JUST LIKE SAVING ITEMS. PEOPLE WERE BUYING THEM THINKING THEM AS TAX SAVING INSTRUMENTS AND NOT INSURANCE INSTRUMENTS. GOVT. WANTS INSURANCE PRODUCTS SHOULD REMAIN JUST INSURANCE PRODUCTS. ONLY THOSE CAN UNDERSTAND THE TRUE BENEFIT OF INSURANCE WHO HAVE LOST THEIR DEAR ONES AND GOT DEATH CLAIMS.LIFE INSURANCE CAN NOT BRING BACK ONE WHO HAS DIED. BUT IT CAN CERTAINLY KEEP THE LIVES OF FAMILY ON TRACK.

TERM INSURANCE IS BEST INSURANCE. EVEN MANY HIGHLY EDUCATED PESONS CONSIDER IT AS USELESS, BECOSE THERE IS NO MATURITY BENEFIT. BUT I TELL THEM THAT NO BODY IS BORN WITH A GUARANTEE CARD FROM GOD SAYING THAT “YOU WILLNEVER DIE”. PREMIUM FOR TERM INSURANCE WILL BE COVERED BOTH UNDER DTC AND CURRENT INCOME TAX ACT.

Rajiv

Thanks for your four comments on this article ,It really adds value ! . Keep sharing your knowledge !

manish

DEAR ALL,

BUDGET IS A BALANCING ACT. JUST LIKE A BALANCE SHEET, BOTH SIDES OF BUDGET (REVENUE AND EXPENDITURE ) SHOULD TALLY. FINANCE MINISTER HAS THIS BUDGET IS A NETURAL ONE I.E. NO EXTRA REVENUE WILL ACCRUE TO GOVT. AS FAR AS SERVICE TAX ON MEDICAL SERVICES IS CONCERNED, THIS PROVISION WILL NOT BE THERE WHEN BUDGET IS PASSED. BECOSE MILLIONS OF PEOPLE ARE AFFECTED. AN EMOTIONAL APPEAL HAS BEEN MADE TO FM. UNLIKE PREVIOUS FM MR. CHIDEMREM, MR. PRANAV MUKHERJEE IS LISTENS TO OTHERS.

Rajiv

thanks for your point 🙂 . You gave a new perspective 🙂 , Balancing act !

Manish

Hi Manish,

Not a great budget.

Service tax on Insurance premium. Does that mean I continue to pay same premium for endowment plan and Service tax adjusted within OR additional Service tax?

Health care cost is going to increase which is not good for common man.

Cheers

Atul

Atul

You will not have to pay the additional premium , but it will go from the insurer pocket and eventually will be adjusted from your wealth only , so less IRR for you , but it would be small number 🙂

Manish

Manish,

I have a query on IT return.On IT return need not be filed for the person under 5 lakh annual income is the 5 lakh total annual income or the taxable income?.

Krishna

Krishna

It has to be taxable income i suppose . But not sure !

Manish

You are mistaken. The limit of Rs 5 laksh is the taxable income and not total income in an year. moreoever, all persons whose income exceeds the prescribed exemption ,is to submit the IT return invariably

Short and crisp summary Manish. Such a relief to see this article after all the media hoopla. Can’t believe all newspapers dedicated 20 pages to this budget. To me, it was almost a non-event. The only good thing was there were no populist proposals and hence the excitement in the markets.

Similary, I’m sure that next year’s budget would make media wet their pants in excitement. While DTC’s first draft was quite a regime shift, it has already lost a lot of steam since its first draft.

Smart Singh

Yea .. not major things for a common man in a way , but still something to look at . Next year when DTC comes it would mean 1 month of no-vacation in Media , the news overload about DTC will be more bigger than DTC itself !

Manish

This budget neither revised to include/delete tax saving instruments under 80C, 80CCC etc., nor upper/lower limits. Looks to me that FM would continue to focus on levying additional tax for private players promotional products which attracts tax savings such as ULIPs and High value Home Loans. The additional service tax on ULIP in the current budget is one such sample. It may not be the great news for middle & higher income families.

ULIPs are pushed by private players these days that EEE would continue for the old policies even after DTC comes on board. Clarity needs to emerge on this issue. If true, ULIPs would be agreesively pushed this year (1 month) and next year like never before. Else it would be end of ULIPs after DTC. Undoubtedly the private insurance business is at stake. Certainly not a good news for its employees.

Krish

Not a lot of changes in 80C as it would eventually go away soon and replaced with DTC

Manish