Let us say you have 1 Lac rupees and you want to invest for the term of 1 to 1.5 years that can earn a decent interest rate. You thought of investing in fixed deposit in a bank for 1.5 year @ 6% per annum. Just after one month, bank increased it’s FD interest rate by 0.5% and again after 6 months interest rate is increased by 1%. But you cannot avail this benefit since your FD carries fixed interest till 1.5 years. Is there any investment instrument that could work to handle this situation? Of course YES, Mutual fund industry does offer floating rate debt mutual funds to invest in.

Basic Definitions you should know

- Coupon rate: The stated interest rate on a bond or other debt security when it’s issued.

- Benchmark rate: A rate used as a yardstick for measuring or setting other interest rates.

- Expense ratio: A measure of what it costs an investment company to operate a mutual fund.

What are Floating Rate Mutual funds?

These are the Debt mutual funds which invests about 75% to 100% in securities which pay a floating rate interest (bank loans, bonds and other debt securities) while the rest is in fixed income securities. See List of best Debt Oriented Mutual funds

There are two kinds of floating rate funds– long term and short term. The portfolio of the short-term fund plan is normally skewed towards short-term maturities with higher liquidity and the portfolio of the long-term plan is skewed towards longer-term maturities. However, even the longer-term funds are positioned more on the lines of short-term funds and are not very aggressive in nature.

Floating Rate securities vs Traditional bonds

As you may know, that most bonds have fixed interest rates which are set when they are first issued, either by a government or a corporation. That rate of interest doesn’t change for the life of the bond. A floating rate security on the other hand, has a variable interest rate. That means it’s interest rate will go up and down, or “float” to reflect changes in current market rates.

Depending on the particular floating rate security, the interest rate may change daily, monthly, quarterly, annually, or at another specified interval. The rate is generally changed to keep it in line with a particular interest rate benchmark, which is often called the “Reference Rate.” Among the benchmarks used to set the interest rate on floating rate securities are the MIBOR (Mumbai Interbank Offered Rate). Hence, each time the benchmark rate fluctuates; the coupon rate is adjusted accordingly.

Note

The MIBOR rate is the weighted average of call money business transactions done by 29 institutions, including banks, primary dealers and financial institutions. This rate is calculated and disclosed by FIMMDA-NSE. [ Ignore If you dont understand ]

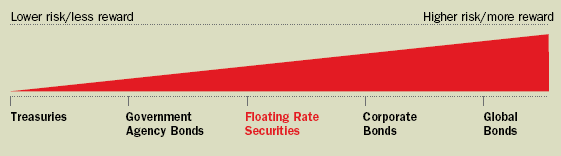

Credit Quality and Risk/Return spectrum

Credit quality is the measurement of a bond issuer’s ability to repay the debt it undertakes. Investment into AAA and equivalent rated instruments, call money market and government securities are the safest and most liquid instruments, while below AAA and equivalent rated instruments reflect downgraded quality and lower liquidity. However, their lower quality results in better returns, albeit at a higher risk.

Example analysis

Let us compare the floating rate, fixed rate debt fund and liquid funds over the years to understand the performance.

| HDFC Floating rate Income fund long term plan (G) | HDFC Floating rate Income fund Short term (G) | HDFC High interest (G) | HDFC Liquid fund (G) | |

| Category | Debt: Floating Rate Long-term | Debt: Floating rate short term | Debt: Medium-term | Debt: Ultra Short-term |

| 1 month | 0.35 | 0.35 | -0.65 | 0.3 |

| 3 month | 1.20 | 1.06 | -0.4 | 0.95 |

| 1 year | 7.68 | 5.0 | 5.53 | 4.68 |

| 3 year | 8.58 | — | 8.2 | 7.17 |

| 5 year | 7.48 | — | 5.98 | 6.77 |

| Expense ratio | 0.25 | 0.75 | 2.25 | 0.5 |

| Exit load | 3% within 18 months | Nil | 0.5% within 6 months | Nil |

Why, When & How

Why to opt for floating rate funds

- The primary advantage of these funds is that, they are less volatile than other types of debt funds. In case of fixed rate bonds, when interest rates in the economy change, the price of the bond adjusts to make up for the fixed coupon of the bond.

- Looking at the performance table over different time frames, floating rate funds have delivered outstanding performance over the years and more importantly, with considerable consistency.

- A look at the performance table also reveals a better consistency in delivering higher returns when compared to other type of funds.

- Credit quality of floating rate funds’ category is more or less similar to liquid funds and ultra short-term funds. Average maturity does not play a very important role in case of floating rate funds as they invest in instruments, that have a variable coupon rate.

When to opt for floating rate funds

- Floating rate funds make better choice when interest rates are set to rise.

- Floating rate fund can be considered to establish emergency fund. In the above case of HDFC Floating rate Income Long term plan (G), one can slowly build up emergency fund and once 18 months are over, you can redeem any time.

- If investment period is 1 to 2 years and liquidity is a concern, then one can look at floating rate funds over fixed rate debt funds. Now banks are coming up with recurring deposits with quarterly revision of floating rates. Always look for alternatives as per your investment period, returns, risk and liquidity.

How to select floating rate funds

- Long term floating rate funds are better than short term considering performance, less expense ratio.

- Select a fund which has proved its performance over a period. (This shows the effectiveness of the fund house in mobilizing the assets under management).

- Select the fund which invests significant % of asset in companies/securities with highest credit rating.

- Select the fund with low expense ratio.

Floating rate funds in India

The primary reason for their lack luster presence in the mutual fund industry has been investor ignorance of the nature of floating rate funds. There is a shortage of sufficient long-term floating rate instruments. Due to this, fund managers divert certain portion towards fixed interest securities. In the present situation of Indian economy money market and higher inflation situation, interest rates are set to rise in near future. Always consider floating rate funds over liquid/ultra short term/debt funds.

List of Top Floating Rate Mutual Fund

Long Term

Short Term

<a href=”http://answers.polldaddy.com/poll/2791648/”>For the First 10 yrs of Career, Which one is better ? Renting or Buying a house</a><span style=”font-size:9px;”><a href=”http://answers.polldaddy.com”>trends</a></span><br />

This is a guest post from Srinivas Girigowda who is one of the best contributors on this blog :), Kudos to him. Check out his finance blog Here