Gift to Family members – 3 awesome tips to save income tax legally

Most of the people in India try to save income tax by investing the money in their spouse, children and parents name. We are going to explore this topic more deeper and help you understand the exact rules applicable and how you can save more tax legally, by gifting money to your family members.

Majority of people, just transfer the money to their family member account and invest that money, thinking that they will not be paying tax on that amount and it’s a smart way of gifting the money and avoid paying the tax. But that’s not correct. I have already written in detail about what is gift tax and certain exemptions when one don’t have to pay any tax on gifts received.

What most of the people do in real life is that, they just transfer the money to their family member bank account and invest that money in their name, assuming that by default it will help them in saving tax, because they have gifted away that money and because their family member has income below exemption limit, they also don’t have to pay any tax. However, it’s not that simple.

Now, let’s understand the tax implications of various people involved when a gift is given and what is the right way to save tax by gifting money.

Let’s take an example – where husband earns Rs 10 lacs per annum, gifts Rs. 1 lakh out of that to his wife, who is a homemaker. Wife, then invests this Rs 1 lac in a Bank FD at the rate of say 10% interest per annum and earns Rs 10,000 as income.

This transaction has three parts and the tax implications as follows

- Tax Implication on GIVER (husband) for the amount gifted

- Tax Implication on receiver (Wife) for the amount received

- Tax Implication on the income earned, when the gifted money is invested.

Tax Implication on GIVER (husband) for the amount gifted

Let’s first talk about the tax implication for the person giving the gift.

The person, who gives the gift can never claim any income tax deduction or exemption from his/her income. Most of the people confuse the entire gifting implication and assume that the money which they have gifted to somebody will be reduced from their total taxable income and they have to pay tax only on the balance income. But that is not correct.

In the above example, the husband earns Rs 10 lacs per annum and should ideally pay tax on that full amount after deducting any income tax exemption they get from various sections like 80C and others.

How most of the people think?

Now husband can argue that the Rs. 1 lac which was gifted to his wife should be reduced from his total taxable income and he should be paying taxes only on Rs. 9 lacs. But this is simply not allowed!

Because – if this is allowed, then everyone will gift all their salary or business income to wife or parents and no one will pay tax at all, because they don’t have any income now as the entire income is gifted. That does not make any logical sense.

So in the above example, husband has to pay tax on his income of Rs 10 lacs subject to all the benefits as available to him under various sections of the IT act and let’s say that his total tax after all tax deductions (80C) comes to Rs. 75000/- and his post-tax income is Rs. 9.25 lacs. He can gift whatever he wants out of this post-tax income.

Tax Implication on Reciever (Wife) for the amount received

Now let’s take the tax implication for wife, who got the money in our example. Will she pay income tax on this gift received or not?

The answer is NO

Because this is a gift from her husband, who comes under the specified list of relatives who are exempt under the income tax act from gift tax liability. If she had got this 1 lacs from her friend or some random person, who is unrelated to her. In that case, this 1 lac would be considered her income for the year and taxed in her hands, but here she will not pay any tax on this 1 lac.

Below is the list of relations from whom if one gets any gift, they don’t need to pay any tax.

- Your spouse

- Your brother or sister

- Brother or sister of your spouse

- Brother or sister of either of your parents

- Any of your lineal ascendants or descendants

- Any lineal ascendant or descendant of your spouse

- Spouse of the persons referred in above points

So the point is that, if one gets a gift from close family members, like spouse, parents, siblings etc, the receiver does not pay any income tax on the money received.

Tax Implication on the income earned, when the gifted money is invested

Now the tricky part comes in.

What happens when the gifted money is invested in products like FD’s or shares? Let’s say that the wife invests this Rs. 1 lacs in a bank FD and earns an interest @10% annually, ie Rs 10,000.

Now who will pay the tax on this interest of Rs 10,000?

Husband or Wife?

I know most of the people will think that its wife, because once she gets the gift, now its her money and she is 100% owner of that money and any income generated from that should also be her own income and she should pay the income tax on that amount. So here in this case, if wife does not have any other income apart from this Rs 10,000 , then her total income for the year will be Rs 10,000 only and as its lower than the exemption limit, so she will not be paying any tax and won’t be required to file any income tax returns.

However in real life, this is not how it works.

In this case, IT department clearly knows that people will gift the money to their spouse who does not have any income, so that the whole income generated become’s tax-free. To combat this, there is something called as Income Clubbing provisions, which adds the income of one person in other income in certain cases, and that will apply in this case.

So in the above example, this interest income of Rs. 10,000 would not go tax-free and will be clubbed with husband’s income and he has to pay tax based as per the applicable tax slab.

So if, husband earned Rs 10 lacs a year, now this Rs 10,000 will be his additional income making his total yearly income as Rs 10.1 lacs.

But Income earned from the income earned is not clubbed

One interesting point to note is that any further income generated from the income is not clubbed further and that will be 100% income of the person who got the gift.

So in above example, when wife gets Rs 1 lacs as gift, and earns Rs 10,000 as the income, that Rs 10,000 will be clubbed with income of husband, but when this Rs 10,000 is further invested into FD again and earns Rs 1,000 income, this time – it will be wife’s income and not husband.

So now, how you can apply this rule in real life? Here is a tip !

Let’s say you have Rs 10 lacs with you. If you invest this money in your name, you will earn Rs 1 lac as income from it and pay tax on it, but next time again when you invest this 1 lac, you will earn Rs 10,000 and then again have to pay tax on it because it will be your own income.

What is the alternative way ?

What you can do here is that, you can invest Rs. 10 Lakhs in your wife’s name and earn an interest of Rs. 1 lac. This Rs. 1,00,000 will be clubbed in your income for the computation of income tax; which was going to happen anyways. however, when your wife further invests this 1

However, when your wife further invests this 1 lac in another FD and earns Rs. 10,000 (assuming 10% interest) as interest on it, this time it will be considered as her income and will not be clubbed with your income. Assuming husband in 30% tax bracket, it’s a saving of Rs 3,000. Might look small, but its one of the ways to save the tax by Rs 3,000 in a legal way.

The image below shows you the rules and how the tax implication will apply in various cases explained above

3 tricks to save more tax legally by investing in family members name?

Now you are clear about the tax implication on person giving the gift, on person who is taking the gift and on the income generated from the investment done by the gifted money.

Now let’s see some things, which an investor can do to legally save tax in a more smart manner by involving their family members and that too in a 100% legal manner.

Trick #1 – Invest the gifting money into tax-exempt or low-tax instruments

Clubbing provisions will not apply when the gifted money is invested in any investment option which are tax exempt by default. Or one can invest in lower tax options.

For example – rather than a normal FD, if the money is invested in shares of a listed company and sold after 1 yr or an ELSS mutual fund, and sold after 3 yrs lock in period, then in that case the profits which attract on 10% tax as equity taxation after recent budget is only 10% without indexation, that too above Rs 1 lac limit

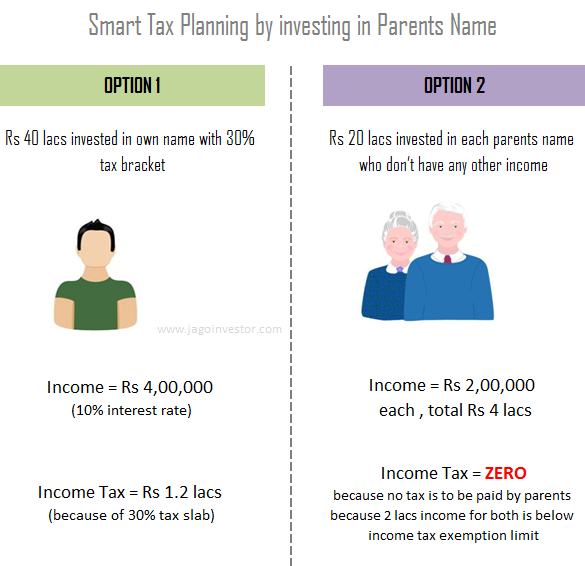

Trick #2 – Invest money in your parents name

You can save taxes by gifting money or by giving loans to your parents or in-laws because clubbing provisions does not apply in these cases. This is because any income generated on the gifted or loaned money to parents is purely parents income and will be taxed in their hands only.

Let’s see an example.

Assume that you have Rs 40 lacs in your hand which you want to invest and your father and mother are both senior citizen and have no income from any source. Now what you can do is, gift Rs 20 lacs to each parent and let it get invested in a bank FD at an interest rate of 10% (just an assumption)

Now both of them will get 2 lacs as the interest income individually and this is their only income in a year and will be below the exemption limit (Rs 3 lacs for senior citizens) . So there won’t be any income tax to be paid by them.

This way you have invested Rs 40 lacs in family name itself with ZERO income tax.

On the other hand if this 40 lacs was invested in FD on a main bread-winner name who is into 30% bracket, he would have paid 30% income tax on 4 lacs of interest, which is Rs 1.2 lacs. This whole 1.2 lacs is saved.

Even if parents are having additional source of income, it’s still beneficial to gift the money to them as it would lower the income tax outgo, because of the lower slab rates and applicable exemption limit.

You can apply the same logic and invest in property in parents name and let the income come to them and enjoy the tax-free income subject to exemption limits.

Trick #3 – Invest money on Major Children Name

In the same way, even the money gifted to major children (above 18 yrs) will not be clubbed in your hand. So in case you have children who are 18 years or older who are either studying or earning at a lower tax slab than you, then gifting your surplus money and investing in their name will neither attract gift tax nor clubbing of income will apply.

Income earned out of investments made by your major Children out of the gifts given by you will be taxed in their hands only.

This is really a great thing because if you are going to pay for some upcoming children education goal or marriage goal, then instead of investing the money in your name and funding the goal later, why not just gift the money to the child and invest it in their name itself. When the goal arrives, the money can then be used, but for years there will be no tax liability (or lower tax) and you will save a good amount of income tax.

You may even consider giving interest-free loans to your children as it is lawful and can help you save you more taxes. However when the children are minor then clubbing provision will attract except in cases where the income is earned by the child due to his or her skill or talent.

Plan your Income Tax with help of a CA

There are lots of ways one can save income tax by restructuring their investments in family members name. Generally people do not have much time to plan all this and for years they pay higher income tax and never optimize it. If you really want to work on this. I suggest hire a good CA for his consultancy services. This can be your family CA or some friend if you want or some external person whom you can trust.

Let me know what new ideas are coming to your mind right now after reading this article? What are your views on this? Please share it on comments section.

|

This article is guest post by Rishabh Parakh, a Chartered Accountant by Profession & Founder Director of Money Plant Consulting, which provides services related to income tax filing, scrutiny cases and various other CA related services with operations in Pune, Mumbai and expanding to other regions. |

February 12, 2015

February 12, 2015

thanks for the article, I understand the gifting tax saving method.

I would like to know the gifting ways/process/specifics, could you please share?

(eg., how to gift or what is the way to gift?)

Just tranfer the money to another account if its small amount like less than 50 lacs

Gift money to spouse, as interest is taxable in doner acount, can be returned to doner after maurity of FD

Good point

Hello sir,

My father sold a property which was in the name of my grandfather and father,as my grandfather is no more, while amount was credited to my father account.my question is that whether the income earned from capital gain can be gifted to spouse and children..If the whole amount is gifted will my father be liable to pay tax??

Gifts can be given only out of “income after tax”.. you cant gift an amount and save your self to pay from it!

Manish

Now Long term capital gain is taxed at 10%, Please update trick 1 part of the article.

I have some queries.

1. Father in law invested mony on my wifes name : It might be mature in this year,

2. I transffered mony to wifes a/c for RD deduction. Since 3 years, (RD is 12 months)

3. All Matured RD’s invested in FD

4. On some RD/Seving interest bank deducted TDS but not filed any IT Return

5. Filled form 15 G for tax exception

6. If I would like to file retrun for F.Y. 2016-17 what is the procedure, how shall I fille IT?

Hi Girish S

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

Hi Manish

I read you valuable article. Thanks for your guidance.

Thanks for your comment Girish S

recently my spouse declared that she have total saved amount of @ 200000 ,she saved this money from every month expenditures which I gave her,I am salary person, pl help me how to deal with this cash available with her.

Nothing special to be done here. Just ask her to deposit in her bank account saying that its saved over the years. No issue will be there !

Hi,

My mother has been saving her money from many years wich she received from gifts and that amount is below the exemption limit and now she has deposited it in her own account.Will that money be clubbed in her husband’s income or not?

No I dont think so .. It will be treated as her income only .

Can we take a loan from family member at a certain interest rate and duration for repaying the existing home loan from bank and still claim IT exemption under Sec 24 for the interest paid to the relative ?

If its a HOME LOAN , then YES , Else no

Hi Manish,

Request you to help me with below scenario.

I transferred INR 9 lakh to my mother, and she did a fixed deposit. I am clear with the fact that gifted amount and interest earned on FD are exempt from income tax.

While filing my mother’s IT Return, where should I mention Rs. 9 lakh? Should it be mentioned in

“Exempt income only for reporting purpose” under “Taxed Paid And Verification” Tab of income tax return?

I want to file my mother’s income tax return due to high value transaction, and balance in bank account, so that there won’t be any notices from IT department in future.

Thank you very much!

Regards,

Raj

Hi Nagaraj

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

My mother and me are JOINT owners(equal share of 20+20 lakhs each)of a flat, purchased in 2011(single, common saledeed).Now we are selling a vacant site.in which we both, along with 2 other brothers are having 1/4 share each.Each of the 4 sellers will get a Capital Gain of 30 lakhs from this sale .To get exemption from Capital Gains Tax, (1) I want to give my mother 20Lakhs,and get HER share of property in the flat, transfered to my name,— HOW should I go about this—By way of gift deed/ Release deed or a regular saledeed. (2) The remaining 10 Lakhs I want to put in REC cap.Gain Bondsfor a peroid of 3 yrs. Is it ok?

Hi Manish,

Need your clarification on my understanding:

One thing is clear that gifting doesn’t lower your taxes currently, it just helps lower taxes which would be generated out of investment you make with that money. E.g. if you investing in FD, better invest on spouse or parents name so tax arising is tax free in case of parents, and income generated out of this interest is tax free in case of spouse.

But if I just invest in instruments which are tax-exempt e.g. stocks/MFs/PPF, how does this gifting help lower my tax further?

In that case it WONT !

Thanks Manish.

Firstly, investing 10L ro 40L in a tax-unfriendly instrument like FD is not an awesome idea in first place from a financial adviser’s point of view. There are much better safer investment options like liquid funds for better tax handling and returns.

Secondly, on 10L of investment, tax savings is Rs. 3000 which is 0.3%, that is too after 2 years of maturity of 2 FDs. And if you take current scenario of 7.5% return on FD, tax savings after gifting and all is Rs. 1680. I think it’s peanuts in terms of savings on tax when you are dealing in tens of lakhs of investment. Scale it down to 2L or 5L and you will be spending more on your CA than tax you would save :).

Thirdly, money received back from parents in case of their death is tax free, but interest will be taxable again.

Overall I believe gifting isn’t great way to lower your taxes, neither it deserves going through amount of complexities it involves as you can see. It again helps only in case of FDs kind of instruments which are not great way to invest in anyway.

So keep it simple, spend more energy in efficient ways to invest your money rather focusing on nitty-gritty of going through gifting process. This is the reason saving tax through gifting isn’t popular.

I understand that at times the gifting is not the best thing . I just wanted to share the RULES and nothing else here 🙂

Thanks for sharing those examples and workings . It makes sense !

Hi Manish,

Trick #2 – Invest money in your parents name

I would like to further understand how this works. Let’s say my parents earned 2 Lacs interest out of my gifted money. How can I claim the principal+interest back at the end of the tenure? Assuming my parents don’t need the money, can they simply gift it back to me again? Won’t this raise flags with the IT dept or are such things usually ignored?

From what I understand and what my CA had told me. Gifting money from Major child -> Parents or Parents -> Major children will not be taxed and also the clubbing will not apply. It will surely raise the flag if you do give and back game many times or in a short period itself, like if you give it in 2015 and take it back in 2016 . Then it clearly looks like gaming the system.

But I might have to check this with my CA once. Let me check

Manish

Hi Anjan

I just checked it, CA says that legally there is no issue . I mean YES, you can do it . But still there might be enquiry and if questions asked, you should be able to courageous enough to handle the queries and answer why you did it and be firm that its within the legal framework. The tax department can not make you pay any tax based on this, but has authority to raise queries.

As I had said, if you do it once in a while , you can expect no eyebrows raised, but it you make it a regular affair, then it can raise an alarm.

Manish

Thanks a lot Manish for taking the time to clarify this. Once in a while is fine with me 🙂

Glad to know that Anjan ..

Hi. Need your advise on the following 2 scenario

I gift my wife 1lakh. She invests in shares and earns 10k. I know the gain of 10k shall be clubbed with my income. Now 2 following scenario-

1. She invests all the amount balance in the account i.e. 110000 in the shared again and earns 10k. Which income on the above is clubbed and which is not? Is it direct weighted average calculation?

2. . She invests all the amount balance in the account i.e. 110000 in the shared again and loses 5k. Then how to calculate clubbed income? How tAx shall be treated?

Please advice.

Thanks a lot.

Sorry. Please read 5k as 15k in 2nd scenario.

Only the returns on the returns part will be treated her own. Means if she invests 1.1 lacs and she earns 10% , it would be 11k income, but 1k income has come out of the 10k return, so 1k will be her own , but 10k again will be clubbed into husband income

Manish

I sould like consultation for planning and documentation of gift. Property in in indian being gifted by relative .

Thanks for your comment Parul

Hi,

In the example mentioned for Trick#2, when an amount greater than 50k (say 3L) is gifted to each parent in a year, is the amount not taxable from receiver side? Please clarify

Thanks

No

Hi,

Needed your expert advise.

1. Suppose I gift money (post taxation) to my Mother who is 73 yrs old, and if she deposits in an FD, the interest earnings I guess will not be taxable if its within her non taxable limit which is around 3lakhs.

2. When I transfer the money to my Mother, shld I have to follow any legalities like make a gift deed/get it registered etc. to ensure that in future, the earnings plus principle can be claimed by myself only

3. In the FD, to again avoid taxation, is it better if I be a nominee or a joint account holder

Your advice would be very helpful,

Regards,

Umesh

1. Thats correct

2. No

3. FD taxation cant be avoided.

Dear Sir,

I am having NRE FD currently which will mature in Nov-2016.It was started when I was having NRI Status. I have converted my NRE Account to Saving Account in Jun-2016 as I have permanently shifted to India.

1. WilI have to pay tax on NRE FD when it gets mature in Nov-2016. If Yes what is a way to save tax on this maturing FD?

2. Bank said I can submit Form 15G for above FD. Can I submit Form 15G to save FD Tax?(My Indian income for current year lies between 5-10L/A)

3. Do I need to report Interest Earning on above FD while filling Tax return for next financial year ?

Thanks,

Yogesh

Hi Yogesh

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

i have gifted 1 laks to my mother who is below 60 years and have no other income. my father is in 30% slab. so income earned from gifted 1 laks is added in my fathers income or mothers income.

No , it will be mothers income and hence no tax !

Hi Manish,

I am giving 10k per month to my parents. They dont have earning resources and my father age is above 60.

Just want to know can i take tax benefit out of it. If yes, please let me know the section name.

I want to give 73000 rs every moth to my parents if my preants invest it in to fd or rd it is club with my income or their income

please clarify

It will not be clubbed in your income !

I am in 30 %bracket after tax cutting salary credited my account can i transfer every month 73000 rs to my father ac directly through neft then he can either do rd or td on his name interest earn by him club with my income is there is rule min amount tranfer to father any tax issues for me ?

The income earned by interest on the FD from your father will not be clubbed in your income. You can do that

sir,

thanks for information

I have to do any paper work for transfer money to my father .

can I transfer to his bank account directly

sachin

JUst transfer directly online. Thts all !

No you cant

Just that your parents dont have to pay income tax on that amount