How is interest on saving bank account is calculated ?

A lot of people do not know interest is calculated on their savings bank account.In this article I will explain all the aspects of interest on a savings bank account. Earlier all the banks had the same interest on their saving bank accounts, which was 4% , so a person had no choice in terms of interest rate, you would have got the same return with any bank. But, RBI has recently de-regulated interest on saving bank account and now banks can decide the interest they want to pay on saving bank. This has had a positive impact for customers, because now due to competition, banks like Kotak Bank and Yes Bank have started offering higher interest rates like 6% or 7% and using that parameter to attract lot of customers.

How is interest on saving bank is Calculated ?

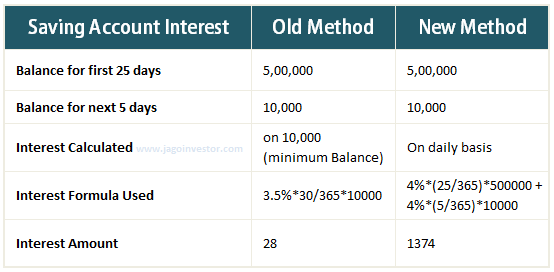

Coming to the main question, the procedure to calculate saving bank interest, we will first see how it was done earlier and then we will see how its done now.

Old Method

Earlier, Banks used to pay 3.5% interest on the minimum balance between 10th and last day of the month. This was not a very customer friendly method because if you kept Rs 5,00,000 in your saving account for the whole month and on 26th, & let’s say you take out 4,90,000. You would have got interest only on Rs 10,000 @3.5% , which is just Rs 28.

New Method

Now a new method is used to calculate the interest on saving bank account which is very fair. From April 1, 2010 , as per the RBI circular on new guidelines on saving bank interest calculation; this is the rule for interest calculation.

“The interest has to be calculated on daily basis for the closing day balance” – It’s that simple. So let’s say the interest rate is 4% , then you will get interest @4% on daily basis for your closing balance and it will get accumulated , but it will be paid back to your account only after 3 or 6 months. While RBI wants all the banks to pay the interest every quarter, each bank has its own criteria , like ICICI Bank pays it twice a year right now in Sept and March.

So now, if you see the same example we discussed above, with the new method of interest calculation, the interest will be 4% on 5 lacs (Rs 1,369) for 25 days (from start of month to 25th) and on 10,000 for next 5 days (Rs 5) (26th – 30th) . So the interest would be total Rs 1,374 . In the old method it was just Rs 28 . Can you see the gigantic difference?

High Interest on Saving bank from some banks

You must have seen some banks are now offering 6-7% of interest rate and they have dual interest rates, like 5.5% below 1 lac and 6% above 6% (in case of Kotak Bank) , which means that you will be getting 5.5% on the amount below 1 lac and only on the difference amount above 1 lac, you will get 6% interest . So if you have a balance of Rs 1,50,000 in your bank (lets say kotak bank) , you will get 5.5% on 1,00,000 and 6% on 50,000 .

You should be more interested in interest below 1 lac

If you see the average amount kept in saving bank account , it should not cross 1 lac for most of the people . While there are people who park their money in saving bank account for some time, but it does not happening with most people. So if some bank is giving higher interest for amounts above 1 lac, that’s a secondary benefit for you, not the basis of selection of bank. Because if you are anyways ready to keep a balance of more than 1 lac, why not just create a short term deposit online,which can be broken anyways or just activate your sweep in account option, so that an amount above a target amount automatically gets converted to FD and earn more money.

Do you now understand how interest on saving bank account is calculated? Will it help you manage your bank money in a better way?

October 8, 2012

October 8, 2012

Just landed from Google and found this post is 6 years old but helpful. Thanks And i appreciate your job

Hey Kumar

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Hi i have one question i have deposit 10 000 in one day .didn’t withdrawal the money for this month.next month frst they ll initiate the 4%interest for one month ?

No , 4% is the yearly interest. You get it calculated on daily basis

hi,

i have 30000 as minimum balance maintaining in my sbi account.few days back i got 380 rupees as interest in my account.as per rate i should paid with 1440 rs per anum but they credites 380 rupees and this is the second time credit.so totally i have got only 760 rs till date,what about reamaining money.

please explain sir,…

Did you calculate on the daily basis ? I am sure the bank must have done the correct calculation ..

Check with them

Manish

Hi,

I have a doubt , i deposit every month 10000 , this is 4th month , i did not get any interest in sbi

when they will credit interest…

i am remaining the same 30000 in my ac…

can u tell when will they credit interest amount ?

Many banks credit it on 6 monthly basis also !

SBI and many other branches pay intrest nowdays 3-4 times a year…I guess 6 months havae been reduced to 3- 4 months not sure…But pretty sure that it’s not 6 months nowdays

It can be 3 months also, not 6 months always !

Dear Mr Manish,

I am about to develop my land into building via builder, the builder agreed to pay 40 lacs into my account as per joint venture agreement. If I’ll be keeping the same amount as main balance in my sbi account how much I’ll be getting interest from Bank and how to pay income tax on the same. Kindly explain the same in simple words.

Hi bijay

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

How is end of day calculated? What if I use the money all day, and transfer it to the bank at 3.30 PM everyday and withdraw it back at 9.30 AM every morning. Will I earn 6% interest on my money?

Not sure, but it would be END OF DAY , which is 12:00 at night !

Hi Manish,

If I keep 1 lakh amount for six months continuously and then at the 6th month if the interest calculated (2000RS). Then this interest amount will be considered as principle for the next half year interest calculation?

Only if its credited in your account. If its not, then it will be not !

Hi Manish,

If a company pay salary after deducting income tax to his employee.And If employee keeps salary to his saving account then will employee have to pay tax on it?

Not again … but any interest which he earns , on that amount he has to 🙂

If i have to pay my emi 2000 for a year then how much money i have to deposit which is use for my emi and my principle remain the same

Hi Khushboo

I am not clear on what is your question. Please repeat it with more clarity

Manish

HI Khushboo.. You need to keep Rs. 6,08,333 @ 4%. Then you will get interest of Rs. 2,000 per month. Formula is Interest*365*100/ ( (No. of days)* (Rate of interest) ).

what will be interest for 3 month on these transactions –

SerialNo Transaction Date Particular Narration Debit Credit Balance

12 03-Apr-2016 Transaction INTEREST 0.00 11.36 1164.00

13 31-Mar-2016 Cash WithDrawal SMS Charge 10.00 0.00 1143.00

14 03-May-2016 Cash Deposit ORC-MARCH-2016 0.00 576.00 1730.00

15 13-May-2016 Cash WithDrawal CSWD 1000.00 0.00 730.00

16 13-May-2016 Cash Deposit SPOT 0.00 360.00 1090.00

17 18-May-2016 Cash Deposit CSHD 0.00 900.00 1990.00

18 23-May-2016 Cash WithDrawal CSWD 500.00 0.00 1490.00

19 27-May-2016 Cash Deposit CSHD 0.00 414.00 1904.00

20 27-May-2016 Cash Deposit INCENTIVE-APL-2016 0.00 1532.00 3436.00

21 06-Jun-2016 Cash Deposit CSHD 0.00 700.00 4136.00

22 08-Jun-2016 Cash Deposit CSHD 0.00 650.00 4786.00

23 18-Jun-2016 Cash Deposit INCENTIVE-MAY-2016 0.00 760.00 5546.00

24 21-Jun-2016 Cash Deposit CSHD 0.00 220.00 5766.00

hi Manish if I am having 10000/- in my acc and I draw 2000 one day& 4000 another day.2000 etc.,, before 25th of the month .then how the interest can be caluculated on daily basis

Just use the same method . Each day see the balance at the end of the day and calculate 4% interest on that. Keep adding that each day for 30 days .

Thank you Manish

If I deposits 7lakh in my saving account then what interest I ll get after a month and will be my deposited amount is tax free

It will be 4% annum calculated per day , Hence 30*700000*4%/365 = Rs 2301

Upto Rs 10,000 per year is exempted from tax if its coming from saving bank account interest !

Thank you

How can I get amount on 25th day of month

Example

In my account balance have like this

5th of month – 50000

10th – 60000

20th – 15000

25th – 200000

Now how can I calculate interst.

Thats explained in the article, Calculate the interest for each day balance and add it up !

i deposited 3 lac on 15/04/2016 and withdrew on 26/05/2016 but did not receive any interest from the bank, why.

Its credited on quarterly basis . it will come later in ur accout

You did not get interest because you did not submit your 3 lac within the 10th of the month….. Had you submitted the money within the 10th.. Your intetest would have been calculated . This is rules of banking .

If I want to deposit 10,000 in fixed deposit for a year. How much interest would I get??

Around 7-8%

Thank you very much…I was looking for this info

Glad to know that Bende ..

yeah , this information is useful to me. thanks a lot. . .

Thank You for this valuable information.

HI,

TELL ME PLS HOW MUCH AMOUNT IS TAX FREE IN SAVING ACCOUNT

Interest of upto 10k per year

I want to deposit 1 lac rs. Per year regular 5yrs. For 10-15 yrs how much get rs after 10-15 yrs plz suggest me

Close to 40 lacs