Best Credit Card In India – Review of top 6 cards

Most of the people who apply for a credit card in India, do not pay much attention at the time of taking the card, but later get frustrated by the card itself for various reasons high bad customer service, hidden charges, and several other factors. The obvious question then is, which is the best credit card in India? We did a survey on credit cards and tried to do a review of credit cards based on participants experiences. We will see how these cards rate in 6 important parameters. There were 654 participants who took the survey, hence you can safely assume that the collective responses will give a near reality results.

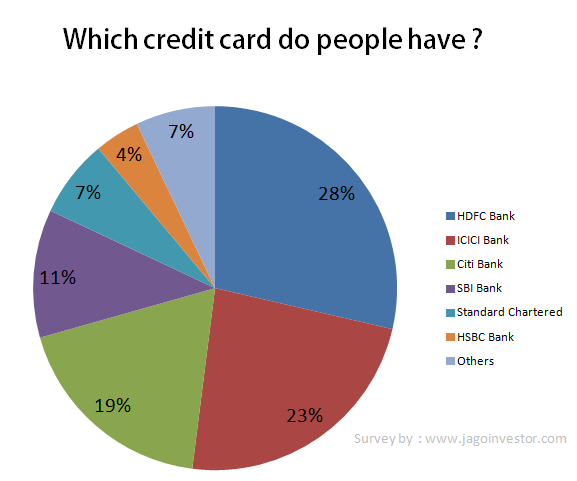

If you see the chart above you will know that the 6 top credit cards in India are –

- HDFC Bank Credit Card

- ICICI Bank Credit Card

- CitiBank Credit Card

- SBI Bank Credit Card

- Standard Chartered Credit Card

- HSBC Credit Card

6 factors to look at before you apply for Credit Card In India

Let’s see those 6 parameters which you should look at before you apply for a credit card in India. At the end of this article, we will see the detailed results of the credit card survey and find out how different credit cards performed on each parameter so that if some particular parameter is more important for you, you can just pick a card based on that parameter.

1. The interest rate charged on credit cards

The first parameter to look at while choosing a credit card can be the interest rate charged by the credit card company. It can range from 1.99% on the cheapest credit card to as high as 3.5% per month on the most expensive credit card. For most of the people who pay their bills on time, this parameter will not matter much, but you never know when you might get into a debt trap kind of situation where you start using your credit card to the maximum limit and pay the interest per month, at that point of time this factor will really matter. Note that interest rate charged is mentioned on a per month basis, but a small difference of 1% can be very big, considering it on a yearly basis.

For example, a 1.99% monthly interest rate actually means 27% Yearly and 3.5% monthly means 51% yearly CAGR.

51% yearly CAGR ! … means your Rs 1 lac of credit card debt can actually increase to 7.9 lacs in just 5 yrs if you don’t do something about it and obviously you will run around to improve your CIBIL score later!

2. Annual Fees & Other charges

A lot of credit cards charge yearly fees and renewal fees (at the time of renewal). Now a lot of people hold a Free credit card for lifetime, but that’s just bunch of people who were given the credit card on a telemarketing call, mostly because they are working in some big company and chances are higher that their usage of credit card will be much higher than an average customer, hence the free credit card.

But, a lot of people apply for the credit card themselves and for them, there are yearly charges (annual fees) and another kind of charges which is applicable to everyone. For example, the penalty charges if you don’t pay your dues any due date. There are tons of customers who do not pay their dues on last time and just pay the minimum payment. If this happens a lot with you, then there is a great chance that you also live with the myth of minimum payments on credit cards. So apart from annual charges, there can be charges like

- Charges when you pay your credit card bill by cash in any bank branch

- If you make a demand draft from your credit card

- If you request for a duplicate statement

- And many other credit card charges .. the list is not a small one 🙂

Note that if your credit card is FREE as of now, it might carry annual charges when it expires and you apply for renewal – and credit card company says – “Sir, we gave it 100% free only till the card is valid, now its renewed! “

3. Rewards and Offers on Credit Card

There are a lot of advantages of using a credit card in the form of benefits and reward points. For example – You get PAYBACK points which you can use to redeem at various places like www.bookmyshow.com, and book movie tickets by redeeming those points. You also get cashback benefits if you use the card at selected HPCL petrol pumps and you don’t pay the fuel surcharge too.

There are many other kinds of benefits that many credit cards in India offer and those can be different from one credit card to another. This is one very important factor before you choose a credit card because a big number of people just take credit cards for these benefits and even if you are not looking for these, you might want it in the future at some point in time.

4. Customer Service and Transparency

Once I called my credit card company (which is ICICI Credit card) because I wanted to know if there will be any annual charges on my credit card as the expiry date is over and I wanted to renew the credit card. They gave me a very clear and satisfactory step by step answer which made me feel – “Great” .

There was no renewal charges and no annual charges even after renewal. So I was happy. Now it was not the FREE thing here which made me happy alone, It was the way customer care talked to me and treated me like a human:).

While there are instances when I was not that happy, but overall on average, I would still rate the customer service of my ICICI credit card as “good” . Well, that’s my experience only and others can have a bad or worse experience with the credit card company. Before you apply for a credit card, you need to look at this very critical aspect of customer service and how transparent are they overall.

5. Convenience to pay the bills

Something which you will deal with each month is the payment of your credit card bill. Now almost all the credit card companies allow paying by net-banking, cheque, cash and other ways. But still, some banks can be really torturing and not that supportive. It can be cumbersome at times. There have been instances when people paid by cheque before time and it was not processed on time and the person had to suffer because of that and had to run around to get back those charges reversed.

Here is the example

I got the CIR and there is absolutely no big hiccups except one in ICICI bank credit card (I had lot of issues with this bank and some late payments od 1-7 days in some credit cards in very few months. Never listens customer and pathetic customer care executives) of which the DPD is consistently not (000) good for last 5 months. But hey it wasn’t my fault. I dropped the cheque of overall due (about 12000/-) and they never bothered to inform me that my payment was not credited (god knows what they did with cheque). After 5 months when they made a balloon of charges and the whole amount jumped to 19000/- they called me and threatened me of CIBIL. I was never in the mood to not pay the due hence paid the whole amount 19000/- notified by them. Could this lead to this much low score?? – Link

Not to mention the unfair update on CIBIL report which affects you for years. So it’s a critical factor to look at before you apply for a credit card in India.

6. How easy was it to apply for credit card

Have you gone through a frustrating time applying for credit card, really had to run around to get a credit card even when you were totally eligible to get one. While this criterion is not that big, as its a one-time event still you can consider it before you apply for one. I recently had a hard time opening a saving account for my brother with ICICI bank because they had no way to accommodate people living on rent with friends, however, Kotak bank did it for me, at that point of time, the “ease of opening the account” was really a big thing for me. In the same way ease of applying for a credit card can be one important factor at times.

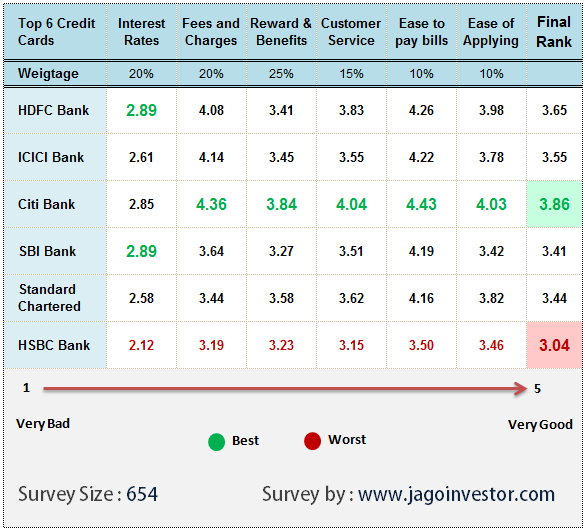

Best & Worst Credit Card in India as per Survey

Below are the results of the survey which we conducted on credit cards. Have a look at it.

If you look at the above chart you will see that the best credit card in India turns out to be Citibank Credit Card and the second best is the HDFC Bank Credit card overall. However, this does not mean that other credit cards are not good at all the parameters. ICICI Bank credit card is very close to all the other cards in several parameters.

While the SBI Bank credit card and HDFC Bank credit card top the list when it comes to interest rates charged (means they have lower interest rates compared to others), but HSBC Bank credit card comes last. HBSC bank credit card has not done well in any parameter as per the survey and has the lowest ranking in all of them.

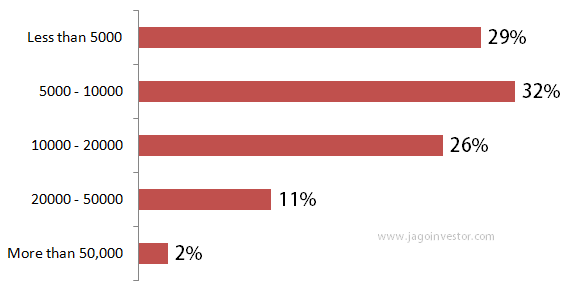

Average Credit Card bill for the last 6 months

86% of people are paying less than Rs 20,000 per month as there credit card bills, that’s last 6 months average. Whereas only 2% of people had more than Rs 50,000 bills per month. I suspect that these people must be using their credit card for various mandatory expenses which are required anyways. Lots of reward points and benefits to them:).

Credit Card Reviews from participants

Ramakrishna says on his Citi IOC Card – I am using credit cards from past 9yrs. If u use the credit card in the right manner, u get the most out of it. And make sure you pay your outstanding amount before the due date. Most of the times, by end of month I am barely left with the liquid and credit cards used to save during that bad times and used to pay the outstanding by the due date. I never ended up paying any interest until now. The best credit card to date to my knowledge is Citi IOC card. I had made use of the rewards and offers at the extreme.

Kriprabha on Axis Gold Card – Very, very bad – due to careless service. 1) Not pointing out auto-debit facility – I missed one annual fee, so from 300/- bill went up to 1000+. 2) Not applying their own rules about marking a lien on my FD Receipt — my card was blocked for weeks and no one seemed to know this requirement, and they kept assuring me the card would be activated soon. As of now, the card is inactive – reason unknown. I am snipping up a card today – want to avoid AMC which they will apply happily! These bankers live and work in air-conditioned comfort which is possible due to high ABQ. I will soon terminate my “relationship” with them. I am a senior, living on savings, so these visits to the bank cost a lot in auto fares.

Raghavendra on HDFC Credit Card – Experience with HDFC Cards has been good. I have never looked at the interest option since I’ve always paid the outstanding amount by the due date. Was charged a penalty a couple of times when I paid the outstanding a couple of days after the due date ( had not even paid the minimum amount by the due date, owing to travel), but the same was reversed after a detailed email to HDFC Cards requesting for the same, in light of good payment track record except for the 2 instances. On the rewards front, HDFC Bank does not have a very good rewards scheme as compared to others. But customer service is excellent. They also have two billing cycles, one of the 25th and the other on the 5th and allow customers to choose any one of them. This is useful for those who already have a card and choose a second to make optimum usage and take advantage of the alternate billing cycles

Atri on HSBC Credit Cards – I am using HSBC gold credit card for more than the last 7 years. I always submitted payments in time and even insured the card purchases. It was as good at their services and also at the part of mine but I do not know why in their review they decided to cancel my card and stop their services to me. I even asked HSBC CUSTOMER representative but they could nor reply satisfactorily. I now feel I should have to get a credit card from the Public Sector Bank only and wasted my time and money. My message to all public is to use Bank Account / Credit Card only of Public Sector Banks like SBI, Canara Bank, Central Bank of India, etc. for a good governance in the nation. Thanks and Regards.

Some more data out of credit card survey

- Only 10% of people had 4 or more credit cards

- Around 42% of people had exactly 1 credit card with them

- The average number of credit cards held by one person was 2.03

Other Credit Cards

Note that this survey is focusing on top 6 credit cards and their comparison with each other only, which came out as the result of the survey, but there are several other banks credit cards in market which can be considered, but due to small amount of feedback in the survey, it was not sufficient to conclude anything about them nor do any kind of review about these credit cards. Here is the list of those other credit cards

- Axis Bank Credit Card

- Amex Credit Card

- Kotak Credit Card

- Bank of India Credit Card

- Indian-Bank Credit Card

- Bank of Baroda Credit Card

- IndusInd Credit Card

- RBS Credit Card

- Syndicate Credit Card

- Andhra Credit Card

- Canara Credit Card

- Corporation Credit Card

- PNB Credit Card

- ABN Credit Card

Did this article help you in choosing the best credit card in India? Is there any other parameter to look at before you will apply for a credit card? Do you think this survey helped you in choosing a good credit card in India?

July 30, 2012

July 30, 2012

IRRESPONSIBLE SERVICE OF CITIBANK: I have applied for CITI Bank Cashback Credit Card in the month of August, 2016. After that they have made various call to me from different office of different cities and collected by documents & Photographs 3 times, all time assuring that my card will reach me within 7 days. Till date their 7 days are not being ended resulting no card receive.

Thanks for sharing that Apurba Manna

Dear Manishji, I am a retired person and my monthly income is around Rs.20000/ all from Fixed Deposits. I have Bank accounts in S.B.I. and Union Bank, please suggest me which Credit Card will be suitable for me.

There is no suitablility question here.. You can just apply for any basic credit card.

Manish

I am working in a IT company and before submitting the documents I use to get call from sales person 5 times a day and after submitting the documents there is no response on the application status now its been more than 15 days, After calling customer care they said I have to wait more 7 days, This is so incontinent, Any clarification before I cancel my application.

I dont have any solution for this, other than waiting . Why dont you check with the local branch regarding this. I am sure you have some kind of acknowledgement with you !

I can’t say how many years I have reaped the benefits of Citibank credit card. I have always paid my dues in time, never been charged extra, and I got many full tanks of gas free as I use IOC card. Overall the best, and it was never hacked, I could change stages and simply change address phone over OTP, and its very customer friendly. I don’t even have a citibank office in my state, but I still am lucky to retain my account, I would never choose another. I had also free platinum credit card from HDFC, was hacked over 5 times in last 7 years, and now I believe it is an internal issue as the last card I never used it online, but just before festive season there will be a huge bill amount hidden among other purchases, if you are smart you will stay away from HDFC as the thief is definately in the bank. My credit score is above the roof since all my purchases are online and I always paid on time. So overall choose citi if it is available ! I never had to ask anyone for help so far as I have this great blessing ! Use it wisely and stay within your means, never purchase anything you cannot pay within one billing cycle at max don’t go beyond 3 months emi, and Always pay your bill before due date.

Hey Ruben

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Very Helpful Article Manish. Good to learn about credit card. Now i got bit clear picture. One small question as per the survey on which point of view HDFC is in top than Citi and ICICI like customer service or service charge discounts or etc..,

I want credit card but my cibil score is 602. I have a 2 Wheeler track, personal loan track. Hou to get credit card Pls send your valuable suggestions .

You can open a FD and take a secured credit card against that

OK sir, Hou to develop cibil score.

Citi bank card is worst. they looted everyone after their fake promises.

Thanks for your comment rahul

Very helpful. Thank you for your service to fellow humans.

Thanks for your comment Anil

I’ve recently started working in India, my monthly salary comes to round about 8.4 lakh inr minus bonuses. Including bonuses say about 9 lakh. What credit card would be best for the Indian scenario? I have AE Platinum already, however I’d like to have a CC specifically tailored for India.

I use a ICICI Credit card (RUBYX) and it works for me

HI MANISH,

I AM A CENTRAL GOVT EMP DRAWING A NET SALARY OF 70000/- PM. MY MONTHLY SHOPPING/PURCHASES WOULD BE AROUND RS. 15000/- AND FUEL BILLS AROUND RS. 2500/-. I AM PAYING ELCT BILLS AROUND RS.3000/- AND MOBILE BILLS AROUND RS.1000/- PM BY SBI NET BANKING. NO FREQUENT TRAVELLING EXP.

KINDLY ADV ME WHICH CREDIT CARD IS SUITABLE FOR ME WITH NIL ANNUAL FEE AND LESS CHARGES.

Check for ICICI Rubyx credit card !

Hdfc dinar premium card is perfect for u

LTF

Hi my name is Tejas and working in US MNC company, My monthly gross salary is 56 K & on hand salary is 40 K salary and salary account in Axis bank.

I have applied two time for credit card in axis bank and rejected both time. They are saying that your score is low but i am not getting what is exactly that mean.

Can you suggest me some other bank for credit card.

They mean CIBIL score !

Sir plz apply sbi credit card in behalf of fixed deposit and use the card 9 month carefully than apply any bank credit card so approved

Hi dear I m a defence personel my monthly gross salary is 37k and net salary is 18k and have axis bank credit card. I have applied for credit card three times with HdFC and two times in Standard charted bank.both of them rejected my app. I want to know which bank can give me credit card with these details.I wanna have one more credit card.plz reply

Hi vikas for defence person you can apply with SBI cards 90% card will get approved try once

Did you check your CIBIL report ?

is there any option so that i can get my cibil score free of cost

No

Sir what is the reason rejected card cibil score ya any other reason plz confirm

I spend more on flight tickets and hotel booking.Is there any card which gives me rewards or points for any airline flight ticket and hotel bookings??? Thanks in advance

There are specific credit cards which are launched in association with flight companies like Jet

Go for Citi Premier Miles credit card if you are a frequent flyer. It charges annual fees of Rs 3000 but offers below benefits which are totally worth it:

1. Welcome bonus of 10,000 AirMiles and 3,000 AirMiles on every renewal

2. Free Air Accident Insurance of Rs 1 crore and lost card liability of upto Rs 2 lacks

3. 10 AirMiles on every Rs 100 spent on partner airlines and travel booking websites like MMT

4. AirMiles never expire and can be redeemed at anytime on citibank website (which is very good as you have an option to pay balance in cash in case of insufficient points) or travel booking websites (like Yatra, Goibibo, Indigo).

5. 4 AirMiles on Rs 100 on all other spends as well.

6. 1 AirMile = Rs 0.45

7. Other benefits includes Offers in Dining, Airport Lounge Access, etc.

Very nice article! Well articulated with precise data.

Thanks for your comment Pavan

Which are some best credit cards if someone is earning 1.1L per months? He already has American Express Gold card and is now looking for another card. Annual fees must be 0. Some citibank signature card or something?

Hi Anit

you can go to http://jagoinvestor.dev.diginnovators.site/solutions/apply-credit-card and apply for it

Which is better credit card: American Express Gold Card or SBI Signature Card?

Please compare them online.

Hi, my take home salary is 29k per month, what is the max credit limit i might get on Citi Bank Credit card?

You will get twice your salary credit limit for Citi bank credit card.

Not more than your monthly salary

Hi,

I need a credit card which has limit of Rs 60,000 for spending in a month. My salary is Rs. 33000 pm. Which credit card can I look to apply for? Can I get such credit limit instantly?

I dont think you will get it instantly . But you can atleast check few of them.

You can apply for a credit card here – http://jagoinvestor.dev.diginnovators.site/solutions/apply-credit-card

Hdfc dinar club apply

Check with Citibank (Rewards), you will definitely get the amount you mentioned(even more).

Fantastic article..thanks a ton!

Glad to know that Hollini ..

Hi, I am planning to move to Australia and I need to pay around $5000 through credit card. not all together but in 1 year. which will be best credit card for me ?

I think no credit card will give you so high credit limit from the start itself, as its 3 lacs ! ..

Hey you can try appying AMEX gold card,this card has no limit(unlimited credit) and easy to use overseas.

AMEX Gold is not a credit card but a charge card – which means the amount needs be settled in full in every billing cycle.

Apply credit card behalf of fixed deposit so choose our limit against fd amount