Minimum Balance in Credit Card – How does it work ?

A lot of people have no idea on how their credit card works and what is the exact interest applications. Credit cards are in the market mainly to make money from customers by charging them huge interest because they overuse their credit limit or just fall for the minimum balance option and get into a debt trap. Let’s first understand a few concepts like billing cycle and grace period to start with

How Billing Cycle in Credit Card works?

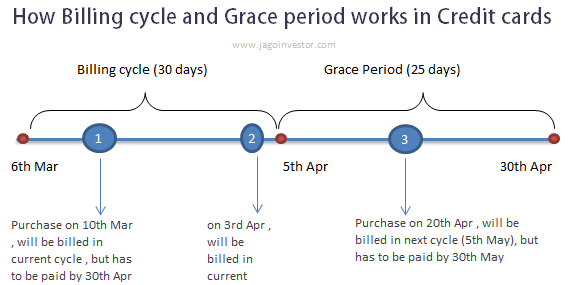

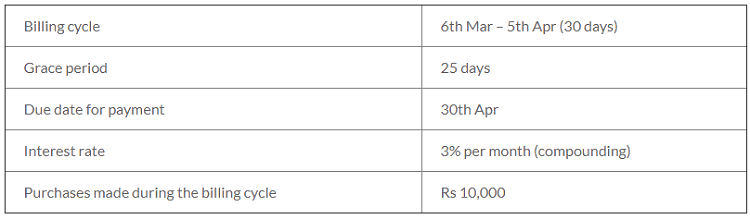

The billing cycle is the duration for which you are liable to pay the due amount. e.g. from the period 6th Mar- 5th Apr. It means that your bill gets generated on the 5th of every month. This bill includes all the transactions done in the last 30 days. If you buy something on 7th Mar, that transaction will appear on the bill generated on 5th Apr and if you buy something on 4th Apr, still it appears on the bill generated on 5th Apr.

What is the meaning of the Grace period?

A grace period is a number of days up to when you have the liberty to pay off your last bill. For example, if the grace period is of 25 days, in that case, you will enjoy no interest for the next 25 days from the recent billing date. In our example, as the billing happens on the 5th of every month. You can pay off the bill till the 30th of that month, but after that you start paying the interest if you don’t pay the bill in full.

A maximum number of days without interest?

So now based on this info, what is the maximum number of days for which you can enjoy interest-free credit?? The answer is the maximum 55 days! It’s because your billing cycle length is 30 days and grace period is 25 days, so if you purchase anything on the first day of your billing cycle, in this example say 6th Mar, then it will actually appear on your bill of 5th Apr (30 days are gone) and you still get 25 days to pay off this loan, so total 30+25 days = 55 days of interest free credit. However, if you buy anything near the end of your billing cycle, like 4th Apr, then that will appear on the 5th Apr and you can pay off that in the next 25 days, so in this case total 26 days of interest-free credit.

Now this means that if you have any large purchase or any big-ticket size purchase to be made, it’s always better to make sure you do it exactly at the start of the billing cycle to get maximum out of your credit card.

The myth of Minimum Balance

Do you know that you start paying interest on your balance outstanding even if you have Rs 1 in outstanding? Yes, if you don’t pay off your full balance by the end of the grace period, you will be charged with the interest from that point of time. Even if you pay off the minimum balance, still you pay the interest on the rest of the outstanding balance. A lot of people live in this myth that just because they have paid the minimum balance, they will not pay the interest and can pay off the rest of the balance next time without any interest. This is totally wrong!

Paying the minimum balance is just going to make sure that you are not charged any penalty for late fees. That’s the reason “minimum balance” is there. The worst part of this whole minimum balance thing is that once you have any outstanding balance in your credit card, the concept of the grace period is lost. You keep on paying the interest on your outstanding balance at the end of your billing cycle. The grace period concept will only return once the 100% dues are cleared.

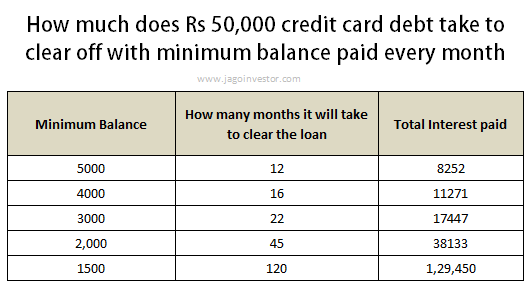

This is one big reason why the credit card outstanding balance ballons to such a big amount once a person starts paying the only minimum balance. Let’s understand this with a picture.

Minimum balance is to make sure you don’t pay full?

Minimum balance is a trick, pure trick to make sure you pay less and get into a debt trap. Credit card companies know very well, that if they do not give any option to pay the minimum balance, people will have no other option than to think “let’s pay off my bill in full”. But they know that if they put an option saying “minimum balance”, most of the people will then think – “Ok! this month let me pay this small amount and next month I will settle the full amount.” Sadly this is the first step for most people to get into the debt trap, and this cycle never ends. As this strategy is a lifeline of credit card companies, they make sure they take full advantage of this.

How Psychology Affects Your Payment Behavior

A recent research study concluded that when a person looks at the amount of “minimum payment”, it can influence how much of his balance he decides to pay off each month. The study looked at how people’s behavior changed when they saw a specific number as “minimum balance” and when they did not see anything as “minimum balance”.

A random sample of 481 Americans was taken and divided into 2 groups . One group saw a mock credit-card statement showing a balance of $1,937, and an annual interest rate of 14%, but they didn’t saw any “minimum payment” option. However one the other hand, the other group also saw that the minimum payment of 2% of the balance was mandatory.

What they found is that people who did not see any minimum payment number desired to pay a higher amount of their balance — significantly more than 2% . Whereas people who were shown the minimum payment number were inclined to pay closer to 2% (meaning they’d be in debt longer)

Example of Ajay paying Minimum Balance

Let us see an example to understand all the concepts and working of credit cards. Let’s take an example of Ajay

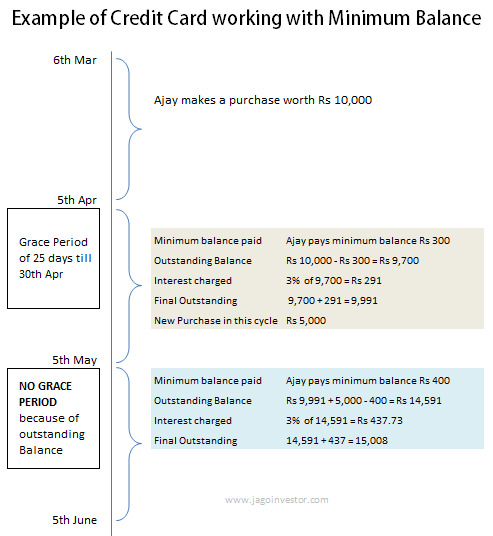

Suppose Ajay pays a minimum balance of Rs 300 and carries forward the outstanding balance for next month and also spends Rs 5,000 more in the next billing cycle.

In this case, as Ajay makes the minimum balance of Rs 300, then his outstanding balance would be Rs 9,700 as on due date (30th Apr). Now his total interest will be charged on this Rs 9,700 and that would be 3% of Rs 9,700 = Rs 291, which will be added to his outstanding amount and his final outstanding amount would be Rs 9,991 (just Rs 9 less than his original outstanding amount). Now as he carried forward an outstanding amount on his credit card, there is no concept of grace period. Now in this billing cycle as he has spent another Rs 5,000. That will be added to his old outstanding and the total would now be Rs 9,991 + 5,000 = Rs 14,991

Now this time, suppose his minimum balance is Rs 400 (just for example), and he pays it, then his outstanding balance will come down by Rs 400 and his final outstanding balance would be Rs 14,991 – 400 = 14,591. Now as there will be no grace period, he will be charged the interest of 3% on his outstanding balance of Rs 14,591, that’s 3% of 14,591 = 437.73 and will be added back to his outstanding, 14571 + 437.73 = 15,008 (approx)

You can see that even after making the minimum balance he is actually having more than his previous outstanding amount because of interest paid. In case he does not pay the minimum balance also, in that case, he will also be charged a heavy penalty for late payment and that will be added back to his credit card debt. You can see how the minimum balance gets one into a debt trap.

Making Minimum payment affects your Credit Score

Do I need to give any other reason why one should stay away from minimum balance whenever possible? Making a minimum payment means not making full payment on time and the more number of times you do it, the worse your credit score gets each time. Read more on Improving your credit score here

Conclusion

Now you know all the terminologies in credit cards and how it works exactly. You also came to know about how minimum payments work and how it gets you into a debt trap. Try to make sure you become more responsible for your credit card payments. What do you think about it ? Give your views about this

May 7, 2012

May 7, 2012

Iam a new user just got my card recently.i didn’t even have an intention to get one but was convinced by the bank when I went there to open an account.the bank never cautioned me about how burdensome it can be if I used it carelessly instead they just went on and on explaining me the benefits.i thought that whenever I swipe I’ll have 50 days time to return the amount just didn’t knew about the billing cycle and grace period.so thanks a lot you saved me from getting honey trapped.;-)

Hey Mohammed

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Hi Manish, this really opened my eyes. I have been paying only the minimum payment due for all three credit cards that i hold. What should I do now? Is it a good idea to pay the total outstanding at once and start fresh? Will it affect positively or negatively settling all the dues at once?

It will affect positively. Paying minimum due for a very long time is very bad for your financial life. Dont do it.

Make sure you pay the full outstanding and from now on keep paying the full every month.

Manish

Thanks Manish for nice insight.

I need your expert advice if there is such interest/penalty also for Credit Limit reduction?

Below is my present situation:

I rented a car in US using my HDFC credit card. The rental agency have blocked 1184 USD as authorization.

But HDFC have made my credit limit from 1,30,000 to 0 in this month’s billing cycle. Also the total amount due they showed is 81,973 INR while minimum amount due is 4100 INR. I did not had any other expenses for this billing cycle so its all due to car rental.

Still will I have to bare heavy charges if I pay just minimum due amount, where the amount has been blocked as credit limit?

I will pay with other card when I return the car so it should bring up my blocked credit to original but what about the interest/penalty?

Please suggest the right way to do it to avoid interest/penalty in this case.

Thanks!

Unless you pay the total dues, you will incur the penalty , there is no other rule to this.

Thank you Manish ?

If there is an outstanding of 10000 on ICICI credit card what will be the minimum due amount? how is minimum due calculated what % of outstanding will be the min due

Its generally 5% ..

Hello Sir,

This 3% interest is charged on monthly basis?

And also what if i pay the total outstanding (14591 INR) on 10th day of bill,even then we have to pay the 3%?

Avinash

Yes its charged monthly. You need to pay your bills on the outstanding bill date otherwise you need to pay the fine. THe bill date anyways takes care of the grace period

Manish

Nice article very informative. Thanks

Thanks for your comment Sourabh

sir i am using hdfc credit card this month bill is generated there is of minimum due amount of 200 my bill is 9736 how much i need to pay this month.

Hello Manish

Thank you very much for the detailed insight of the tricks of these guys!!

Regards

Diana

Thanks for your comment Diana

How do we pay credit card bill , is it automatically cut from saving account or th bank guy comes at our house to collect the payment ?

You will have to manually pay it each month by logging into your bank/card portal via netbanking or through cheque. For some banks like ICICI , I know that you can setup a automatic payment each month.

Manish

Hello sir, My name is Amol. Due to some personal issue’s I couldn’t pay the EMI’s ( Home loan, credit card, education loan) time to time since 2 years. I was shocked to see my cibil score as 394. I’m not getting any credit card/loan from bank. How would I Improve my score? Will I able to transfer my home loan to another bank on this cibil 394 score? Help strongly needed.

You need to first clear off all your loans ! .. only then your score will improve !

Let’s assume I have paid my insurance for 100,000 using my CCard. I have a minimum payable of 5000 or 100000.

I opt for 5000 and the next month’s bill comes to 105000 again. Now I don’t have 105000 with me. I have only 30000 with me.

A) Can I pay 30000 during the in-between period (The billing cycle). Or I MUST pay 105000 in full and settle all my dues in one shot? Will I be penalized if I pay 30000 during the billing cycle and the minimum balance at the end of thebilling cycle?

Please help me. This is my real situation with SBI cc. They are charging 5% per month.

Once you pay partial amount, you start paying interest on the full amount, hence its better to always pay the full amount

Manish

Thank u … thank uniform heart , for your good advice … I & everyone using credit card needs to know this ,..

Thanks for your comment Rajan

Hi Manish,

Say my due date is the 1st Jan and due amount is Rs 1000. If for some reason I miss the payment and realize this on 15th Jan. Next statement date being 13th Jan. I have spend another Rs 1000 till 15th Jan. So my total dues is Rs 2000 + late fees + interest + S.T., say Rs 3000. If I pay the entire amount of Rs 3000 on 15th Jan, will any purchases after 15th Jan attract interest. Or will I lose the grace period till the end of next billing cycle i.e. 13 Feb.

Regards

Deepak

You will have to pay interest till the time you make payment. I mean once you clear all payment , you will enjoy the credit free only after that , not before !

What is the interest rate if i take loan against SBI RD account.

Brilliant explanation!

Thanks for your comment PBI

Thanks for clear explanation.

many many thanks to you. awesome explanation

Thanks for your comment badboy

I was thinking of paying only the minimum amount on my credit card statement, but this article helped me a lot.

Thank you very much.

Glad to know that Karthik ..

Hi Manish

am a new user of cerdit card i have more questions but when i see this msg am cleared now thanks

thank you

by mistake this time the bill due dated 11/01/2016 Amounting

Rs 25,875.45 has been paid by me on 11/01/2016 to the extent

of Rs. 25,500.00.

The Short payment Rs. 375.45 has cost me interest of Rs.

2101.51 is not justified .

Subsequently, I have paid Rs. 3,754.50 advance payment

on 11/02/2016, i.e. 10 times of short payment of the said

bill, I have no intention to delay your payment.

and bank interest charge dt 23.12.15 to 23.01.16, how can possible interest charges all amount

kindly suggest any body how can proceed this matter

Thank you and Regards

first see what is the reply given by the credit card company

When does grace period return? From the day I pay 100% dues or next cycle?

Next cycle