Monthly Income Plan : A detailed guide on MIP’s

Monthly Income Plans– When you hear it for the first time, you get a feeling that it’s some kind of assured and non-risky product that will deliver you uninterrupted monthly income, but it’s not exactly that way. Do you have a lot of cash which you want to park somewhere with the expectation of better returns than a Fixed Deposit? Are you looking for some kind of instrument that will give you regular income with decent returns with moderate or low risk? If yes, welcome to the world of Monthly Income Plans, which are also known as MIP’s.

What are Monthly Income Plans?

An MIP is nothing, but a debt-oriented mutual fund that gives you income, in the form of dividends – simple as that. As MIPs are debt oriented mutual funds, they invest heavily in debt instruments like debentures, corporate bonds, government securities, etc. It generally has 75-80% of its money in debt and rests in equity and cash. The income you can get from MIP is not limited to the monthly option. You can also choose to receive income quarterly, half-yearly or annually. Just like any other mutual fund, the MIP too comes with two options.

1. MIP with Dividend option: MIP’s with dividend option provides you an income in the form of dividends. There is an option to receive this income monthly, quarterly, half-yearly and yearly. So you have to choose the option at the time of buying the MIP. Note that while the dividend from MIPs is tax-free in the hands of investors, the company has to pay a dividend distribution tax of around 14% on the dividend before it reaches your hand. So your returns reduce by that much.

For example, If a company declares a dividend of Rs 3 per unit, they have to pay 42 paise (14%) as a Dividend Distribution Tax and you will only get the remaining amount in your hand , on which you don’t have to pay any tax. I hope you know, that the NAV of your MIP will come down by Rs 3 after the dividend is declared and given to you. So don’t shout your excitement to all the world when you get dividends, it’s just your own money which you got!

2. MIP with Growth Option: Here, the money is not paid out to you in forms of dividends, instead it keeps growing in the mutual funds. Hence your money is just growing inside the fund itself and you can reap all the benefits at the time of redeeming the funds in the future. In this option, you have nothing to do with dividends. Note that you get the power of compounding in growth options because your returns also earn in the future. Here is an article on the difference between dividend vs growth option in mutual funds to give you a better idea of what I am talking about.

Features of Monthly Income Plans

1. Dividends can be declared only from the profits and not from Capital

Regulations demand that dividends can be paid only from surpluses and not from capital investment. What it actually means is that dividends can be declared from earned income only. If your initial NAV was Rs 10 and after a month the NAV rose to Rs 10.2, The dividend can only be given out of this 0.2 and not from the initial capital value. This makes sure that Company can not show to the world that they are constantly giving income in case they have not done well.

2. No guarantee of Regular Income

The biggest myth about Monthly income plans is that they provide guaranteed monthly income, which is not true (See this question asked by Krishna on our Forum). While the aim of MIPs is to regularly declare dividends, it might happen at times, that they do not declare any dividends because of bad performance. To top that, there is no regulation or oversight on the MIP’s part to declare regular dividends. So take it on the chin, if you don’t get your income once in a while.

3. MIP’s return is influenced by interest rates and stock market

Just because it’s a debt oriented product, It does not mean that they are “safe” . Even MIPs can give a negative return, but in extreme cases. The debt portion is influenced by interest rates. When the interest rate falls, the NAV rises as the price of bond increases. When the interest rate rises, NAV falls. At such times the equity portion of the fund helps to maintain the return. Here is an article on Interest Rates and how they affect Mutual funds.

4. MIPs are prone to mis-selling because of a high commission structure

MIPs offer lucrative commissions to agents as much as 1-1.5% unlike 0.5-.75% in Equity funds. Due to this, it becomes easy to missell MIP’s as they can be labeled as “Safe Funds” and “Monthly Income Plans” which Indians like to hear a lot.

“Look what happened after the abolition of entry load in mutual funds in 2009 . From the last 1 Year, the corpus of MIP schemes have seen a huge inflow all over India. Last year, the total industry AUM was close to Rs. 3700 crore and today it is well over 24500 crore. In this entire period, equity funds AUM have gone down. Now when the intentions itself are not good, needless to say that the outcome will be right. Many investors are not aware that there is an EXIT Load of 1% in almost all MIPs if you were to withdraw before one year & in some cases even 1.5 years.” – says Hemant Beniwal on this Forum post

Taxation of MIP’s

MIP’s are debt funds and hence the taxation is same as debt funds .

Short Term Capital Gains: Any profit before a year would be Short term capital gains and it would be added to your income and taxed at your slab rate. So for investors who are in higher tax slabs it would be wise not to sell their MIP’s (in case they can) before a year, else there will be a good amount of tax on your profits.

Long Term Capital Gains : Any profit you get after 1 yr in MIP would be taxed at 10 per cent without indexation or 20 percent with indexation, whichever is lower.

Short Term and Long term Capital Loss : The best thing about MIP’s over FD’s or Post office schemes is that incase you have any loss in MIP’s , you can set it off against the capital gains in the same year or in next 8 yrs , which makes sure that even losses can be used for tax saving purpose.

Dividends : All the dividends received from the MIP’s would be tax-free in the hands of investors, but note that companies already pay Dividend distribution tax from the MIP’s

Read more on Short term and long term capital gains

MIP’s save money for bad times

Think about ants! They make sure that they save enough food for the rainy season, so that they don’t fast in bad times. In the same way MIPs do not declare all the earned income as dividends, instead they declare a part of earned income as a dividend and save rest for troubled times in future.

This makes sure that when there are bad days in future and MIPs do not see much growth, they can use the money saved, to declare dividends. For instance, in 2008, despite bad markets, 19 funds skipped only up to four monthly dividends.

However, a lot of MIP’s didn’t perform that well and could not save the part of earned income in a proper way. Hence they had to skip all 12 months dividends. Eg., Canara Robeco MIP Mn Div, which skipped all 12 dividends in 2008 and 9 months dividends in the year 2009. See the chart on the right to get more insight into how MIPS missed their dividends. Source: LiveMint

Beware: There is one more option called dividend reinvestment in MIP’s apart from Dividend payout and growth . If the payable dividend is less than Rs 250, then the dividend would be compulsorily reinvested.

Who should Invest in MIP’s ?

1. Investors looking for regular Income

If you are retired/semi-retired or just looking to generate some regular income can look at MIP’s as an option. Note that instead of choosing a monthly option of income, I would rather suggest a quarterly or half-yearly option .

2. Conservative investors looking for better returns

Are you a conservative investor but still looking for better returns than pure debt options like Fixed deposits or Insurance policies? Well, you can’t get 100% safety with MIP’s, but there are very good chances that you would be getting better than FD returns with MIPs.

3. Investors who want to park a big sum of money

A lot of people have questions like “Where to park my lump sum money for medium-term with lower risk ?” If your horizon is very less – like 6 months or a year, MIP’s might not be the best option, but if you want to park it for 2-3 yrs with low risk, MIPs with growth option can be a suitable instrument .

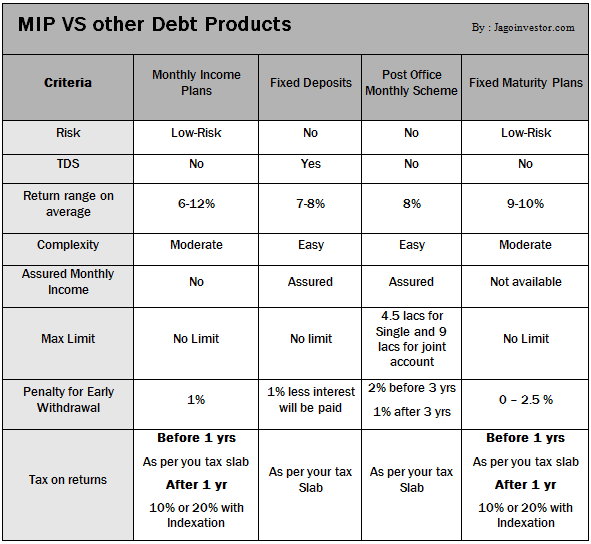

MIP vs Fixed Deposits/ Fixed Maturity Plans/ POIMS

You might get confused between so many debt products and might be wondering how Monthly Income Plans compare to Fixed Deposits (read this post by Deepak Shenoy) , Post Office Monthly Income Scheme or Fixed Maturity Plans (FMP) . There are various parameters on which they all differ . Below is the chart which shows you those differences .

Two ways of getting income from an MIP

We will see two different ways of generating monthly/quarterly income through MIP’s Monthly. One is the regular way of choosing a dividend option and the options one is starting a Systematic Withdrawal Plan from MIP after a year of buying it. Let’s look at both and its pros and cons …

1. Choose dividend option

The good point in this option is that you will start getting the income immediately as the company starts declaring the dividends, and you don’t have to take care of taxation issues. However, the bad side is that eventually 14% dividend distribution tax would be paid by the company and the stability of income will depend on how often dividends are declared by the company. If they skip the dividend you will not be getting the income for that month/quarter.

2. Choosing growth option and start SWP (Systematic Withdrawal Plan)

If you use a bit of strategy, you can create a more stable and more tax efficient income by this method. You can choose growth option in MIP and after 1 yr you can start a SWP (systematic withdrawal plan , opposite of SIP) from your MIP to your bank account . What will happen with this option is that you will not have to depend on companies dividend announcement , as it’s your decision to liquidate a fixed part of your MIP’s, sell it and get the money in you bank account . Also as you are doing it after 1 yr, there wont be any exit load and the profits you get out of it would be Long term capital gains , so you only pay 10% on the profits (assuming you don’t want indexation benefits), which is 4% lesser than the dividend distribution tax . If you have a large amount of investments in MIPs, then this option can save some tax for you, but if your investments aren’t significant enough, it’s not worth the hassle .

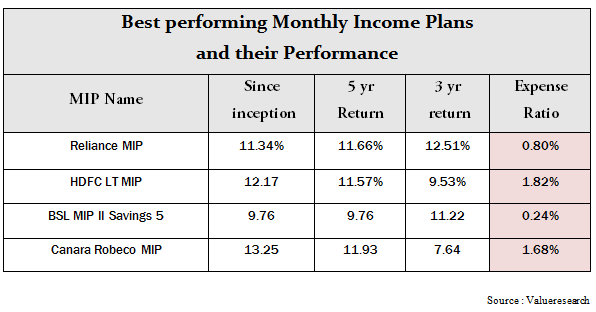

Some best performing MIP’s in Market

One of the readers Sagar asked his query on our forum: “Which is the best Monthly income plan ?“. While there is no guarantee that the MIP which you choose today will keep performing well always, but I have got a list of MIP’s which have done excellent in past and still look good. You can choose any of these if you are disciplined enough . Once you choose them make sure you concentrate on regularly investing in them without looking at their performance every week or month. Just review them in a year or so . watch out for the expense ratio of the MIP’s, lower the better

Conclusion

Conclusion

So the main takeaway from this article for you should be to understand that MIP’s can be good alternative for you if you have been investing a lot in Fixed Deposits and do not mind taking small amount of risk. Another important point was to look at MIP’s are income-generating products with understanding that sometimes the income can go for a toss in between and you have to comfortable with that.

I would love you hear your comments on monthly income plans and do you feel that it can be helpful in your portfolio , share with us !

January 20, 2011

January 20, 2011

I’ve a common question.

Generally from taxation part all debit funds attracts two types of taxation (stcg and ltcg) except arbitrage funds.

What is the point in recommending different types of fund for different persons ? Though the tax is going to be same and knowingly MIP funds or Long Term debt funds are yielding high returns..

Why don’t you recommend same MIP fund or long Term debt fund to all? Why do you ask for investment horizon? Please clarify..

MIP’s have around 80% of debt component and hence suitable for a 2-4 yrs of investment. If its more than 5 yrs, then MIP is generally not the best option

Hi manish,

I have read this article about mutual fund MIP scheme and i’m completely new comer to this field.

I have Fixed deposit of 25 lacs and now a days i cannot able to bear with the very low interest rates from the last few years,

So i’ve been searching for mutual fund may be good option and found your article and i’m completely depend on interest amount from the capital value of my fixed deposit.

I know it may vary in the range of few 9 to 12% around, At least suggest me the good one when compared with last year , as well as which scheme i can go for ???

Waiting for your reply.

Hi Krishna

We help a lot of people to invest in MIP and generate better returns.. If you want to invest in that, just fill up the form below and my team will call you and help you on that. (no charges)

http://jagoinvestor.dev.diginnovators.site/pro#schedule-call

Thank you relaince deft fund

It’s a good knowledge site

I HAVE 12 LAKHS LUMP AMOUNT IN MY BANK A/C I AM APPLY MONTH INCOME PAYOUT GRANTEE INCOME AMOUNT OR FIXED AMOUNT MINIMUM 10% OR 12 % PAYOUT WHICH SCHEME INVESTMENT

Hi Arvind Khanna

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

Dear Manish

if I have a corpus of 70 lakhs as my life savings & I need a monthly income from it to live my life with family, what would be the safest yet best instrument(s) to park my money in? kindly give me a detailed guide as to how should I go abt it.

Thanks a lot for your valuable advise.

Nishanth

Everything is correct except the taxation part which is 28.84% for DDT and not 14%

Yea , that has changed now .. Will update the article

An excellent article. Quite an eye opener in fact . You have covered almost all important aspects which would come to a layman’s mind.

Thanks for your comment Ali

I HAVE 20 LAKHS LUMP AMOUNT IN MY BANK A/C I AM APPLY MONTH INCOME PAYOUT GRANTEE INCOME AMOUNT OR FIXED AMOUNT MINIMUM 10% OR 12 % PAYOUT WHICH SCHEME INVESTMENT

Hi feroz

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

hi

an investor want to invest 5 lac (expecting cagr of 10-12 % – pls suggest fund category)

and also wants to invest in SIP of 3k from income of above invesment for the tenure of 5 year (pls suggest mode MIP, STP, SWP)

Hi sagar

I can see that you are interested in investing in mutual funds. I want to share that now you can invest in mutual funds with Jagoinvestor as your advisor

We create a FREE online account for you, from where you can invest and redeem online.

Our team will be happy to explain you more on this.

Find more at http://jagoinvestor.dev.diginnovators.site/start-sip

Manish

Hi Manish,

Regards to MIP with growth option and SWP,I have some queries hope you could spare some time to clarify.

SO,considering I will be in the 20% tax bracket,

1.For returns through SWP only after 1 or maybe 2 years is this the best option ?

2.Lump-sum or SIP recommended?

3.if lump-sum, then what would be the ideal minimum amount? Right now I can spare around 50k or should this be more to the tune of 5 lacs?

And lastly, if instead, I am planning for regular (half yearly or quarterly) returns after 3 years would this be the ideal route?

1.. I didnt understand the question

2. There is no one answer, it all depends on market level also . like right now I would have done lumpsum , not SIP

3. 50k is fine if you are first time investor. DOnt invest so big amount that if things go wrong, you never come back after that.

You have asked a lot of A or B kind of things, where its not a clear cut answer.

Manish,

First of all thanks a lot for the reply . Sorry about my query being confusing. I am literally a noob with respect to investing and it was just around 8 months back that I started giving any serious thought to investing my hard earned money (thanks to an article in Jagoinvestor that I stumbled upon).My idea of investment was a couple of LIC plans(from neighborhood auntyji !!) and bank FD’s. I am still learning something new every time I read one of your articles and I have to say you have a very simple and practical way of presenting things. Just wish I had spent the time some years back.

Regarding my previous query , let me try and see if I can make it a bit more clearer ,

Suppose I start an MIP of duration 1 year (growth option) and choose to start an SWP after 1 yr. .Does it matter in which tax bracket I will be when this SWP is running? Any tax related effects on the amount received through SWP?

Thanks,

Jose

Jose,

Considering current taxation structure, it may be a better option to go for SWP in MIP or any debt oriented scheme after 3 years in order to convert the capital gains to long term to get indexation benefit.

Tax bracket matters more for short term capital gains, as they get added to your income and taxed at the marginal rate while Long term capital gains get an indexation benefit that has been a better option historically.

You have to pay tax on this long term capital gains at 20% post indexation.

Thanks a lot Avinash.

Yes it will matter, Any income you great from MIP SWP will be treated as your income for that year, so depending on your slab your tax will be calculated!

sir, my name is sapan shah from ahmedabad , my age 31 years old, i have good amount of sip monthly 6000/- large cap fund, 4000/- mid cap fund. and 2000/- small cap fund, and 2000/- birla manufacturing equity…. also i built approxi 8lakh portfolio in stock , like idfc bank, l&t fh, infosys, atul auto, tech mahindra, sbi, cairn india, hindalco, nmdc ,etc and continuously buying good stock for long term. also i have contingency fund, i want to know that can i average the good company like tech mahindra, idfc bank, l&t fh, m&m, hindalco, sbi monthly 20/30 shares of each company like sip. is it advisable or not. or can i buy other good stock…pls give me suggestion…thank you

We dont give any stock recommendation, hence wont be able to answer this !

Hi…

I am one of the NRI, last 10yrs I was in Gulf countries and now I am planning to settle in India, Now I want to invest some amounts and I need to get a monthly income, kindly suggest a good scheme in a good garneted way with no risk options

You can go for MIP in mutual funds. If you are interested, you should go for our financial planning service so that we can help you on this – http://www.jagoinvestor.com/services/financial-planning

Hi Manish, I am earning 25000 per month. I want to invest some money. I’m really confused between SIP’s, MIP’s and LIC plan. Could you please guide me where should I invest, I can invest upto 5000 per month.

As a young person, you should not look anything beyond mutual funds . It will create good wealth for you over long term

Note that we also help our readers in starting mutual funds – http://www.jagoinvestor.com/start-sip

Hi. my question is i am a 42 yr old woman having one daughter.i want to invest 1000 per month for my daughter for 15 yrs. Suggest me the best investment solution.

We suggest equity mutual funds ..

Hello Manish,

Thank you for the clear explanation. I have an investment question:

I want to invest about 2-4 cr. I want to diversify the investment. I am looking for these options in my investment:

1) Monthly or Quarterly income or combination of both via dividends. (I am aware they are not guaranteed)

2) I want to be able to use 50% or more of this monthly income via dividends to re-invest in similar or other investment schemes so money can grow as my expenses are low and I have other source of income as well.

The above 2 terms are a must so please advice accordingly. Appreciate the time and help.

Hi Rahul

You can use MIP’s in mutual funds for this . If you have a bit of risk appetite, I would suggest to use an equity fund and use its dividends as there wont be any DDT on that.

Let me know if you want our support to do the investments ?

Manish

this month i am retiring from psu job . can u suggest me preferable option for quaterly return against fixed deposit. informaion provided by y are of immense help for me. big thanks for this.

While it looks like a great option. FD will give you very low post tax return . YOu can look at debt mutual funds with dividend on quarterly basis

Dear Manish,

Really fantastic, the way you are explaining is simple and easy to understand by a common man. Thanks for your service.

I am an engineer at the age of 49.I want to invest some money which could earn min 75000.00 per month ( as per my current liability).Also pls advise expected mount require to fetch the above income.

Presently working in abroad and shortly I m going to settle in India. Then I have to only depend on the above income.

Your valuable advise may help me to plan my investment.

Hi Ganesan

I suggest you look at our professional advice on this , because a lot of things needs to be done.

Check out this link – http://jagoinvestor.dev.diginnovators.site/services/financial-planning

Manish

First of all. Many thanks for such an informative article. My father has recently retired and wants to invest some part in Senior Citizen Scheme, Monthly Income scheme of Post office and MIP so that he gets a regular income on quarterly basis. He has 2 SIPs running in Diversified MFs which he plans to continue. Is this approach correct? How should he invest in MIP Plan? Lump sum or in regular intervals considering current market scenario? He is getting a 10% interest in Fixed Deposit scheme in his Office’s co-operative bank (State Transport Co-operative Bank, Pune) which is reliable. Is this option better than MIP? Thanks in advance for your help.

I suggest that MIP option is taken. Its a good idea to generate regular income

Thanks Manish

very informtive article.