Should you Invest in IDFC Infrastructure Bonds

From the Budget, infrastructure bonds are also eligible for additional tax exemption upto Rs 20,000 over and above Rs 1 lakh under Section 80C. IFCI Ltd was the first company to issue these infrastructure bonds and they have collected a substantial amount in the last few months. Now, IDFC Ltd has introduced its infrastructure bonds and there are a lot of investors, who are considering these bonds as an option to save additional tax for this year. Rajendran and Prashant have also asked the questions related to Infrastructure bonds some days ago on Jagoinvestor Forum. In this article, I give you brief information on IDFC Infrastructure Bonds.

The maturity period of these bonds is 10 years and the lock-in period is five years. These bonds will be listed on the Bombay Stock Exchange and National Stock Exchange. After completion of five years, you can keep these bonds for additional five years and withdraw money at the time of maturity. In case, if you need to withdraw money before maturity, then you always have an option to sell these bonds on stock exchanges. Thus, these bonds can be traded like stocks on the stock exchanges but only after the lock in period of five years is complete. You would require a demat account and Permanent Account Number (PAN) to invest in these infrastructure bonds. The face value of each bond is Rs 5,000. The minimum application has to be for two bonds and in multiples of one bond thereafter. Hence, the minimum investment required is Rs 10,000. You can invest more than Rs 20,000 in these bonds but the tax-exemption would be only upto Rs 20,000.

Taxation on Infrastructure Bonds

You will get tax exemption benefit up to Rs20,000 when you invest in these bonds. However, the interest gained will be taxable. The interest would be added to your income and taxed at the existing slab rate. this taxation rule will be same even after Direct Taxes Code (DTC) Bill comes into effect. Both, the current Income Tax Law and DTC require you to pay tax on the interest earned.

Infrastructure Bonds in different series

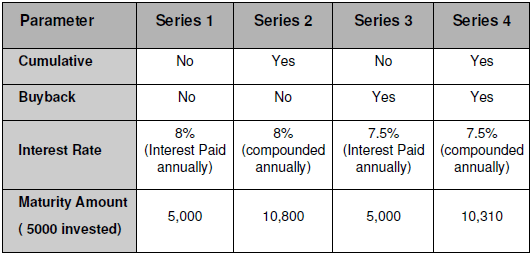

Note that these bonds come in 4 different flavors and they are called as Series 1, 2, 3, 4 . Each of these series is different from each other in some way. There are two main things you should understand , which might be of concern to you.

Interest Cumulative : Series 1 & 3 do not provide cumulative interest. They will pay interest annually. For example, if you invest Rs 10,000, then after completion of 12 months, the interest amount will be paid to you every year and the bonds maturity value would be same as your investment. However, bonds which have cumulative interest will keep accumulating interest. And this interest would be compounded every year. (see CAGR)

Buyback : Series 3 & 4 have buyback option. Buyback option means that you can sell your bond back to issuing company after five years; once the lock in period is complete. In return, you will get back your original invested amount and the interest accumulated for five years. You would notice that interest rates for series 3 & 4 is 7.5%, which is because they have an added advantage of buyback facility. If you don’t want buyback option, you will get 8% interest. People not opting for buy-back options will depend on secondary markets to sell their bonds if they require money urgently before maturity (10 years). Thus, after lock-in period (five years) is complete, they will have to find a buyer in secondary markets else wait till maturity, when they will get the money back from IDFC.

Other features of IDFC Infrastructure Bonds

- NRI’s cant invest in these bonds (Only available to Resident Individuals and HUF’s)

- The bonds don’t attract any TDS

- The bonds are rated LAAA by ICRA, However high rating is not something you should be very excited about. (Link)

- The interest accrued on the bonds will be credited to the respective bank registered with the demat account through ECS on the due date for interest payment

- Interest on the bonds shall be payable on annual or cumulative basis depending on the series selected by the bond holders

- The bonds can be pledged for availing loans after the lock-in period of 5 years

Subscribe to the Bonds in physical form

If you do not have demat account and want to apply for these bonds in physical form , you can still apply for them using these steps (link) , Thanks to Srinidhi for giving this info .

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

- Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

Should you Invest ?

Though, it’s mentioned that the interest rate on these bonds are 8% or 7.5%, the interest earned would reduce further to 5.5%-6% range when you count the tax paid on interest. But if you look at it from a different angle, and count your money saved due to the tax-exemption at the time of investing, in that case the return would turn out to be around 9.5%-10%, but do you think it’s the right way of looking at returns?

What do you think about these bonds ? Are you investing or not and why ?

October 7, 2010

October 7, 2010

Is it better to opt for the buyback offer or wait till maturity for IDFC Long Term Infra Bonds (2011-12)??

Awaiting for an early reply as I’ve to give consent till 21st Nov.

I have no clue on that

For the infrastructure bonds – is it best to go for buyback option or sell it through stock exchange with STT?

Better go with buyback option.. as the liquidity in stock exchange might not be there !

Thanks Manish for the reply. I have IFCI Option Infrastructure bonds. I see there is some liquidity in the exchange. The volume is 52 on 5th July. From the tax perspective, does it make any difference between selling through the exchange and buyback?

From tax perspective it makes no difference!

Dear sir,

I have also invested in L&T infra bonds on 22/2/2011.

I want to know when the money will be credited to my account from these bonds.

DP ID/ CL ID / Folio #: 383344-10541972

Regards,

Manish Chawla

9136001645

Hi ManishChawla

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi,

I have L&T bonds which are now lock free. I dont see any liquidity to sell these in the market. Is there nay other way to sell these?

Anuj

No, if you dont have to buy them. YOu can only sell them back on maturity

Hi,

I think you are the one who can guide me. Pretty nice details.

I have series 2 bonds which I bought in physical form during November 2010. Can I sell it through my demat account?

Thanks,

Murali

Yes, but you need to first demat it, only then you will be able to sell . Also there has to be a buyer for you to sell.

Manish

how to i sell it after that lock in period of 5 yrs..i bought it in papers and not via demat

If the lock in period is not over, then you can try your luck on secondary market to sell it, but I think you will face issue ! ..

Hi,

I purchased through ICICI direct and i can see these in my Demat Portfolio under FD/Bonds.

It seems there’s some corporate action also recently as i got mail like below:

Demerger IDFCB3 IDFC LTD SR-3 7.5 BD 12NV20 01-Oct-2015 Transfer of Infra Bonds from IDFC to IDFC Bank Ltd.

But i am unable to sell them using ICICI demat as it says stock not traded in the exchange. Last traded price shows as 31sth March 2015.

How can i get rid of these bonds 🙂 ?

Thanks

I know this is an old article – though article mentions selling bonds in secondary market after 5 year lock-in, the tax treatment in such cases is not clear. The gains from selling in secondary market can’t be called interest – so, will this be treated as capital gains?

Yes .. thats the advantage of these bonds 🙂

I Have invested in it .20k for taxbenefit.

Fahad

Accha .. which tax bracket are you in ? You will benefit max if you are in 30% , if you are in 10% then it does not make sense

manish

Okk i got some stuff.Dtc applies from april 2012 meaning the year from april 1 2011 to 31st march 2012.Tax calculation will be done in accordance to DTC.

Hence investment in this bond after 31st march 2011 will be considered in accordance to DTC hence it will be EET model but ths year EET is not applicable and as mentioned in article investment for this year will or need to be considered in accordance to EEE model as investment was done before DTC came into existence.Thats the reason there are some articles saying not to invest in mediclaim according to tax constraint for next financial year.

Anyways doubt is clear and as said before ill invest elsewhere and giving the bond a miss.

Sohil

NO , its EET at the moment , the interest is taxable when you get it in hand , so its decided that its EET , nothing becuase of DTC here

Manish

Please reconfirm it manish(with some CA >i am also planning to check the same with my ca as i visit him coming month) agree its on EET basis but as mentioned by the CA in this article ,DTc is progressively applied and investment made in instrument before DTC sets are bound to continue on EEE line.

I was asking because on of my friend is keen to go for the bond anyhow.

Last night i was searching income tax site to get reference where it mentions 80ccf only gets EET but i wasnt able to find any such reference.

Sohil

You dont need to find much on this , its EET only at the moment and will be for the whole tenure , as menioned in DTC

Manish

Sohil

the rule with DTC is that , if a product will continue to get the same benefits as before the DTC for its full tenure , so if some thing is EET when you take it , it will continue to be in EET mode for that part . Which means Infra bonds are EET before DTC and hence if will continue to be so

Manish

Can you get me the link where it states infra bonds are EET instrument.

I was searching for same.

One link which i found out in support of the article is

http://www.incometaxindia.gov.in/archive/BreakingNews_RevisedDiscussionPaper_06152010.pdf

see page 6 and 7.Though only point missing is the section and instrument name.

A dig on the bond calculation by newspaper saying if same goes the calculation than sbi 9% return fd gives more than 19% return

Sorry for the pdf link but onsite the table is not there which is there in this pdf

Sohil

Thanks for the link . It would be of help to others

Again a problem.Now another article by a reputed CA have pointed out that investment in this year should be made as per DTC comes from next year so EET model wont apply and EEE mode of taxation will be applied and one should go with the bond.

http://www.dnaindia.com/money/column_new-infrastructure-bonds-window-may-not-open-again-after-march-31_1499116

Again i am totally confused.

Sohil

Nothing is there to be confused about , it talks about nothing different that what you know right now . So interest is taxable at the end , as its the rule at the time of taking . If you are in 30% bracket, I would suggest you can go ahead , but does not make a lot of sense if you are 10% or 20% , better pay tax and enjoy the the liquidity for next 5 yrs , use your 20k in a better way and you can make some more money

Manish

But does it mean whether tax which was getting accrued every year and which needed to pay at maturity wont apply and this will be treated as EEE model.

Also DTC applies from april 2012 so next financial year if any bond comes wont the same be under EEE application as that too came into existence before DTC date?

Just asking as a financial advice type.As i have already decided not to go with the bond.

Sohil

The Bonds come with two options , interest payout and accumulation , depends on which one you are choosing , if you choose “Payout” , then you get interest every year and pay tax on the interest every year , If you choose “acuumulation” , then all the interest is accumulated and you get it after 5 yrs and then you pay tax on whole interest that year .

Its EET , and will be EET only. Forget DTC

Manish

Paying a tax of 4,120 @ 20.6% or 6,180 @ 30.9% means that a tax-payer remains with 15,880 or 13,820 in his/her pocket. You need to earn approx. 25.94% (4120/15880) on 15,880 or approx. 44.72% (6180/13820) to reach to your original 20,000. Consider it:

Your Savings A/C. earning 3.5% will take approx. 7.4 years (for 20.6% tax bracket people) & 12.8 years (for 30.9% tax bracket people) to reach this figure. FDs @ 7% will take approx. 3.7 years & 6.4 years respectively. Equities @ avg. 15% will take 1.73 years & 2.98 years respectively. The list goes on & it leaves me wondering why the hell we are thinking so much in investing 20K to save tax, which is exclusive to only these Infra Bonds. So in 20.6% or 30.9% tax bracket I would surely go for it.

Found this link about the IDFC bonds. – a general review –

http://www.dnaindia.com/money/report_idfc-infrastructure-bonds-face-tough-run-again_1495911

Still trying to get my head around all the calculations!

Thanks, Manish, for the article, and to all the others too for all the insights.

This is a most enlightening site.

Sudha

If you dont understand it , thats ok . Ask here what are your questions ?

Manish

Thanks, Manish. Appreciate. But, on second thoughts, think I have some better uses for whatever monies to be invested. So, have decided to give these a miss now.

Sudha

thats a great thing , Infact its a good move ,better use that 20k in next 5 yrs , rather than lock it for tax saving of 4k (assuiming you are in 20% bracket)

Manish

Instead of going into the Rs and paise calculation do see if you can buy this.

1 Does every one need asset allocation in Debt? Yes.

2 Which are the best debt instruments ? EPF and PPF but there are limits to how much one can invest.

3 If asset allocation necessitates some more investment in debt what are the avenues available which also give tax benefit beyond the 80C limit? Infra bonds.

4 Is investment risk free.? No investment, which gives you some return, is risk free. The return is compensation for the risk taken. Even if you keep money at home, it has the risk of being stolen besides the silent thief i.e Inflation”

5 So if one wants some more tax deduction beyond the 80C limit infra bonds are the best option.

I absolutely agree with you here.. People should not lose their sleeps over this.. People should cultivate money saving habits, cut on their discretionary expenses as much as possible, do their investment planning & tax planning right from the beginning of the financial year as its as important as earning money etc. etc… the list is endless so stopping here.. & No Offence to you Manish.. 🙂

Shiv

Yea .. agree with your point that they should plan for taxes from advance of the year .. good point for you . Keep adding valuable comments 🙂

Manish

Hey Manish.. Sir I’m also a very big supporter of “Building the Nation by Paying Taxes” but I favour Tax Saving & am strictly against Tax Evasion. Basically its only the Govt. which makes these provisions & its completely legal. Moreover, “A Tax Rupee Saved is a Tax Rupee Earned!!” & gives more pleasure than a Rupee earned.. 🙂

Shiv

You are getting me wrong here . I am also against tax evasion . All I am saying is not investing money just for the sake of tax saving and better pay the tax to the govt . Many people are there who are so mad about tax saving that they compromise on the returns , liquidity and their comfort .

People who need 20-30k in next 2-3 yrs are also investing money in Infra bonds and other tax saving funds . Tax saving is secondary thing , first one has to see his liquidity and other comforts . One can NOT save in tax saving funds , save the lock in period and can use that money in better way

Manish

I agree with you that a person should first save tax u/s. 80C & then in order to save further tax u/s. 80CCF, he/she should invest in these bonds. Whether a person should invest in FDs or ELSS or NSCs or save tax through any other way u/s. 80C depends on his/her “Risk Profile”, “Asset Allocation” or personal preferences.

Coming to your point that people should pay taxes first & then invest the money somewhere else. I dont know what all investment options you suggest people to invest here in & how much returns are there in your mind. Personally I wont do this, especially if i fall in 30.9% or 20.6% tax bracket. I think EPF is the best Tax Saving “Fixed Income” product available to a person in India (limited to Salaried Class only) followed by PPF, Senior Citizens Savings Scheme (limited to Senior Citizens only), NSCs & so on. Sorry if i missed something here. As far as investment in Equity or Real Estate or for that matter Gold is concerned the returns are surely greater than the fixed income options but they do come with their own things attached to them like risk, volatility, illiquidity, impurity, high investments and so on & so forth. Everybody knows how much uncomfortable Indian people are in equity markets. One cannot invest Rs. 20,000/- (or Rs. 1,20,000/-) in any Real Estate investment at least in India as Real Estate MFs (REITs) are still to become operative here. Then comes Gold. History shows Gold investment barely beats Inflation & is a hedge against it. Though, in the long term, an investment in Silver always outperforms Gold investment by quite a huge margin. Its only in the last few years that the Gold (or Silver) has beaten every other investment, thanks to a prolonged slowdown in U.S. So here I want to say if I’m making 12%-14% safe returns by investing an additional Rs. 20,000/- in these bonds & saving tax u/s. 80CCF exclusively reserved for these bonds then I whould surely go for it. Rest, obviously, depends on the person who want to invest & personal opinions, as these were only my opinions… 🙂

Shiv

Thanks for putting your views . My only point is that one can also think of paying the tax and not saving it .

Manish

Hi Manish

Manish people invest in Fixed Deposits which give 5%-8% interest for 2, 3 or 5 years and after which they need to pay tax also on the interest or TDS gets deducted automatically. These Bonds have a lock-in period of 5 years after which you can either redeem them back to IDFC or sell them on the stock exchange. If I invest 20,000/- & save 30.9% tax at one go, it comes out to 6.18% per annum (30.9%/5), without any other thing being considered in the calculation. If I fall in 20.6% tax bracket, it works out to 4.12% and 2.06% in the 10% tax bracket. When I consider the return of 8% interest also, the yield goes higher. So I dont find any reason for me not to invest in these bonds for tax saving. Though as a pure investment, I do believe there are better products available like MF/SIPs & SBI kind of bonds which SBI brought in October 2010 giving 9.5%/9.25% interest and got oversubscribed 17-18 times on the first day itself.

(Note: The calculation are done to make it as simple as possible.)

Thanks & Regards

Shiv Kukreja

Shiv

Ok , got it .. However for a person who has still not completed exhausted 80C , but still wants to invest in these bonds , it does not make sense , a tax saving FD would be a simple choice . What do you say !

Another point is “not investing for tax saving” can also be a wise choice ! , this 20k extra tax deductions has made people so much that they are not considering what all they can do by not investing the money , paying tax and then utilizing this 20k in some other way in next 5 yrs !

Manish

Hi

I’m an Independent Financial Advisor based in South Delhi. Currently IDFC Infra Bonds are up for subscription and closing on February 4th. I think Infra Bonds are a good investment option as they offer tax deduction u/s 80CCF on an investment of Rs. 20,000 over and above Rs. 1 lakh deduction u/s. 80C. The tenure of the bonds is actually 10 years but after 5 years of lock-in period you can either redeem the bonds back to IDFC, which is called a buyback facility, or sell these bonds on stock exchanges. The bonds carry a coupon rate of 8%.

Shiv

I am not very much convinced with the statement “I think Infra Bonds are a good investment option as they offer tax deduction” . WHY ?

Manish

Sir , I don’t understand how the yield calculation for different tax slabs has been done for the different options of this Bond . Please can you show the working in detail .

Jignesh

Which return are you talking about ? 7.5% is what company is offereing .

Manish

thanks for this useful info and fruitful discussion.

In my opinion if u r in 10% tax slab, then PF is better option as now the interst on it 9.5% and the return is also not taxable. If compounded this 9.5% then tt will be more than the effective return gained by infra bond.

Yes

Agreed with you 🙂

Manish

@Gaurav,

Just be aware that the 9.5% on EPF is only for this year as a surplus was “discovered”. There is no saying that the interest will stay the same and not revert to 8.5% from next year. Read the article http://www.caclubindia.com/forum/epfo-interest-rate-9-5-for-2010-2011-104575.asp