How to find out Best Fixed Deposit?

Searching for the best FD?

In this short article, we will see a very useful website which gives you all the information on Fixed Deposits and Banks in India

FD is a tool of saving some part of your income in a fixed account for a fixed time period and earning some interest on that amount. It is a traditional way of saving and we observed our parents taking advantage of Fixed Deposit account for investment purpose since our childhood.

Different banks offer different rate of interest on FD accounts. If you want to invest your income in this traditional tool then you should search for the best bank with best interest rate before investing your money.

Let’s take an example..

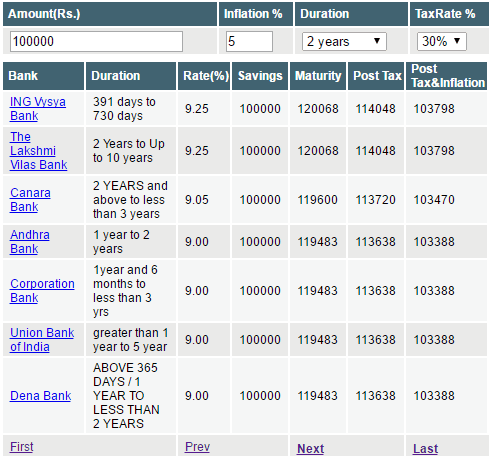

Person ‘A’ says: “I want to invest Rs 1,00,000 in a Fixed Deposit for 2 yrs in a public Sector Bank. I come in 30.9% Tax bracket. Which is the best Bank for me that will provide the maximum return?”

He again says: “I also wan to get all the information on the Bank in India at a single place; Which is the website I should checkout?”

How do you answer this question?

You will find the solution for these questions once you read this complete article. Let’s go for this step by step….

How to find out Best Fixed Deposit?

FD accounts are offered by banks and NBFC’s (Non-Banking Financial Companies). NBFC’s offers higher interest rates to attract more accounts and raise capital.

If you want a safe FD then banks are the best option. If you want to invest in companies then before investing you should search for the company details before investment. You can see the criteria and schemes of top companies here.

Have a look at http://www.way2goals.com/Project2/chooseBank.html. This website gives excellent information on Fixed Deposits based on different parameters given by you.

So if you want to invest Rs 1,00,000 for 2 yrs and 3 months in a Public Sector Bank and you belong to 30.9% Bracket, it will filter out the the list of best Banks that suit your needs and provides best return.

It will also tell you what will be your final profit after paying tax and what will be your gain after factoring in Inflation (based on your expectation of inflation percentage).

See the following screenshot for the above figures. (click to enlarge)

In current time there are two banks which are offering higher interest rates on FD. These banks are ING Vysya Bank and Lakshmi Vilas Bank. The rate of interest they are providing is 9.25%.

- Maturity amount

- Interest Earned

- Interest After Tax

- Gain After Inflation

Currently The information on the website is updated twice a week.

Information about a particular Bank

The interest rate is different for each bank. So if you want to open your FD account in a bank, you should check for the interest rates offered by different banks.

If you go to http://www.way2goals.com/Project2/interestRatesByBank.html#. You can get all the basic information about a particular Bank at one place . It will give you information about

- Website of the Bank

- Contact

- Interest Rates information for Different Tenures

Also checkout this link to learn some basic stuff . Way2Goals Software India Pvt Ltd is the company behind http://www.way2goals.com/ .

Conclusion

This is an excellent tool dedicated to Banking Information especially information on Fixed Deposits. Way2Goals is one stop destination for any information on Banking Sector. There is scope of adding lots of things, but I believe it will come with time as any other thing in Life. Great tool!!

If you come up with tools like these please share it with others here :).

June 23, 2009

June 23, 2009

Thanks for sheare it….it’s great post.

good information……

i don’t have much knowledge on investments. i am reading correspondence above and trying to gather some knowledge.

Thanks for your comment m.chandran

Hi Chauhan,

can you tell me in straight cut(please don’t use any banking terminology) “if i deposit 10 lacs for 6m or 1yr long how much credit do i get for every month”.

regards

Kolan

It would be around 6k .

ohh that’s not even 1% of the money that i deposit, can you suggest me the best way to get 20k per every month from the bank as a 2% with the 10 lac

You will have to deposit 30 lacs in that case

Im Ms Sircar, my age is 52 and i want to invest Rs 5 lakhs such that every year i wanted to receives at least 12-15% returns for the next 5 years. Plz Plan out the investments for me.(mention reasons & assumptions).

12-15% per annum is not possible . The best you can get with confidence is 8% in FD

I would like to know your recommendation-

1) If I have 30 – 40 lakhs where can I invest to get the best returns within 3 years.

2) Also after retirement, where should we invest our indemnity so we can get regular monthly income which is safe as well. Or is it advisable to put in FD and get monthly interest?

FD is the safest option, but with lowest return . You can try out a mix of debt fund and MIP, which can give better returns . Let me know if you need help on this

The best fixed deposits in terms of returns are from public sector banks, especially the banks that are not so popular like DCB, Andhra Bank & PNB. These banks offer high interest rates compared to ICICI, SBI, Axis & HDFC.

The compilation over here http://www.coziie.com/fixed-deposits/banks-paying-high-interest-rates-india fixed deposits lists all the fixed deposits that offer high interest rates in India

Thanks for sharing that link !

I’ve been looking for high return Fixed Deposits in general category and populated the information over here: http://coziie.com/fixed-deposits/banks-paying-high-interest-rates-india.

One thing I noticed is, all the popular banks(SBI, ICICI, HDFC, Axis) pay less for the fixed deposits compared to less popular banks like Andhra Bank, DCB.

So if we want maximum returns on our fixed deposits, then we have to open accounts with small banks. But how easy is to operate with these banks? Are they providing good customer service? These are all the questions one needs to ask before opening a fixed deposit. At least to me, high interest rate is not the only criteria!

yes , lot of small banks give good service , Just that their network is small does not mean that they will give bad returns.

Dear manish

my father has fixed deposit in sbi bank which has a maturity date 5-12-2013.Till now my father didnot claimed the money.Does the bank give interest after the maturity date?

sorry the maturity date is 5-12-2008

No they wont. They should not give it ! . Why do you expect them to give you interest after maturity ? Its your responsibility to tell them whats next step !

Dear Manish,

from the date I come across to locate your site, I am very much keen to review the various questions put forward for your comments and your very informative response to them. God Bless you doing such humanitarian job for our Indian Community in particular. Hats up for you.

My question is that on one of your site I read the following article:

Quote

In case of a joint FD in either or survivor mode if any of the owners passes away, then the survivor gets the FD only on maturity. He or she can’t make a premature withdrawal.”???

Circular from RBI stating the same(reported shown by the respective Bank)

This was a surprise for us, but the manager also showed us the circular from RBI stating the same.

Unquote:

I shall appreciate if you can assist me to get copy of the circular, and authentication of it, or email contact details from we can aquire that.

Thanks and best regards.

Ramkish Jeth

I wont be able to get you the physical copy ,but thats the rule !

http://www.way2goals.com is a nice website.. tnx for the info..

Thanks Chetan 🙂

Hi Manish chauhan,

I have some around 8 to 10lacs with me,I want to know for a long term basis in which scheme I should put it into,I am already paying 1.10 lakhs every year for insurance,so I dont want to go for any more insurance.shall I go for PPF as there I do not have to pay any tax or shall I go for FD in a public sector bank like SBI,but after reading the above posts I dont think it would be idea for a 15 year tenure.I am also not a kind of guy to invest in mutual funds and share markets as it has its own risk.

If you are aware about sahara india ,there is a scheme called U-golden where if you are paying once 16000 ,after 15years you would be getting 1lakh 4 thousand,I dont think if you will invest any other things will give you this much return.

Please suggest me ASAP as I am spending my money some way or other 🙂 so my purse is going blank.

Thanks in advance

There are some issues .

You first need to understand why you dont want to go with mutual funds . You should read 3rd chapter of my book Jagoinvestor. Next thing is do you know much returns does that SAHARA product generate for you ?

Manish,

Sahara gives Bond paper which clearly mentions that,if we are paying 16k once ,after 15 years it will be 1lakh 4k.its a fixed deposit only.but can we believe the credentials of sahara thats the question

2nd thing ,regarding mutual fund you have to be in update and check the status in every month and everytime,even though I am available in internet all the time but I am no good in finance section as i was never interested to that part.thats y not interested for mutual fund or share market.but do you mean to say mutual fund will give me the maximum return.

Thanks.

Krish

What is the name of that scheme ? Because it turns out to be 13%+ which is not possible logically, there is some catch for sure !

Hi manish,

it is sahara U golden scheme..awaiting for ur reply…anyothers in forum please reply with ur expertise

Online I can read that it gives 5 times return in 15 yrs , not sure it shoudl give you 80k after 15 yrs of 104k , better start a thread on our forum http://jagoinvestor.dev.diginnovators.site/forum/

ca u plz start with appropriate content,obviously u will get more reply than my post

Dear Sir,

I have Rs.100000,I want to FD.I don’t know about FD,So can you sugest me?

You can open the FD at same bank where your account is there !

how to calculate fixed deposits rats based on the time.

how to benefited investor with fixed deposits.

You dont need to calculate the rates , its already given to you by banks

how to set fd rates. in the banks

can you ask your question in different way ?

Dear sir / madam ,

I am looking for the FD for 10 years with 11.5 % on cumulative . if any one knows pls rewrite to me thanks

Girish

FD rates change every month or so ,.. please ask this question on our forum

manish

hi,

i am businessman and in my early 50s. i want to decrease work load as i am getting old. i have about 30-50 lac. saving here and there/gold/cash with me which i want to invest for long term i dont mind investing it for 5-10 years so that i can get regular income which take some of work load off. i was considering FDs but as people in comments of this post are saying for longer term FDs are not so effective can you please advise me where i should invest for regular income plus where my actual money is safe too.

I dont have much knowledge of Mutual Funds/stock exchange as i always considered them having big market risk of losing all initial investment i maybe wrong.

I would really appreciate reply. Plus this site is very very helpful.

Rajveer

You can look at Monthly income plans of mutual funds : http://jagoinvestor.dev.diginnovators.site/2011/01/monthly-income-plans.html

My suggestion is it is not a good idea to put all your money in one basket.

Jagoinvestor has some very good articles on asset allocation.

Unlike in US and western countries where the money up to 1 lakh dollars is insured, your money saved in DICGC insured Indian Banks is insured only upto one lakh of rupees per bank per account . Keeping in mind the the risk involved, it may be worthwhile to open accounts in your name, your spouse’s name to increase the risk coverage. It will increase your paper work, but I think it is worth the extra work.

Please read the article below.

http://www.way2goals.com/FinEdu.html

There are other banks which are giving better interest rates than Axis bank. Look at best fixed deposits http://www.way2goals.com/Project2/chooseBank.html . For e.g. instead of Axis bank if you put in Laxmi Vilas Bank or Karnataka bank for 1 year Fd, you will make app. more than Rs. 20000.

Most people tend to ignore the impact of inflation on their projected expenses. Two expenses which have surpassed inflation are medical and educational expenses. Please look at the link below to see how you need to save for your children’s education.

I think your post tax returns in FD after adjusting for Taxes and more importantly for inflation will be close to zero.

You may wish to read this article, which says in the past 5 years that average post tax returns on Fixed Deposits are 7.5% vs nearly 17% if one invests in SIP (Systematic investment plan).

http://www.livemint.com/2011/07/19204540/Meet-the-SIPers-join-them-now.html?atype=tp

You may wish to consider spreading your investments across different asset classes such as Fixed Income(FD , Bonds) , Gold, Equity Mutual Funds, Real Estate etc.

http://www.way2goals.com/AssetAllocation.html

This is my opinion, but, you should understand various financial products before making any investment/savings.

Happy saving/investing.. All the best!

Anand

thanks for your inputs 🙂

Manish

Hello I would want to keep Rs. 40 lakhs in a Fixed Deposit with AXIS Bank. My idea is to get a solid yearly interest to cover the educational expenses of my children. I am an NRI hence I will have to pay tax (I dont mind, I am looking for a safe investment at this point of time). Can you please suggest me which scheme of FD (time) I should invest this money so that I can get a yearly benefit close to 3 lakhs. I would need at least US$ 6000 per year to run the school expenses of my children and would want to use the capital to support their education. Any help would really be appreciated. Many thanks. regards, Somnath.

Somnath

Considering that you dont have any other income source in India , all you need is 8% interest rate yearly from FD , that would give 3.2 lacs as income , you can pay max 20k as tax and be left with 3 lacs per year . So you can choose Axis bank or any other bank . Any tenure more than 3 yrs should be good

Manish

I guess another factor to consider with FD is Penalty on Pre-mature withdrawl. There are times when you might need your funds immediately. Usually Banks do not inform about pre-mature withdrawl penalty openly.

In case your FD is kind of emergency fund then we should look at this factor as well. you can find this data at http://www.ratekhoj.com easily

Ashish

thanks for the link . I will have a look at it !

Manish

As of Dec 8th 2010, Syndicate bank, karnataka bank, Tamilnadu Mecantile bank are giving 8.50% for FD of 3 years and above. As interest rates are subject to change frequently, please visit http://www.way2goals.com/Project2/chooseBank.html for the latest FD rates. FD rates are available on SMS also.

FDAll 3 years

sent to 92200 92200

will return the best fixed Deposits for 3 years across Public sector, Private and Foreign Banks…

For seniors rates type Fdallsnr and send it to 92200 92200

sir

i have 100000 rs. please help me how i fixed with high rate with respected bank for 3 to 9 years as per your desisation

Please put into insurance sector. It covers your life as well as you get better than FD. It is unit linked insurance. Now it is auto balancing also.