How Inflation affects your investment – compare inflation with the returns of different investment products

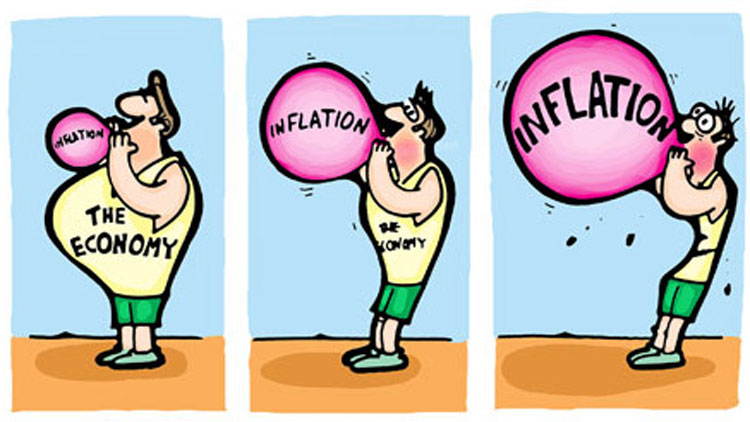

Do you remember the price of a movie ticket or any or your favorite thing few years back? It is the same today also? I don’t think so. It has increased by some numbers. This increase in the price is known as inflation. In this article I’m going to tell you what is inflation and how it can affect your investment.

Inflation :

Inflation is the increase in the rate of prices caused because of devaluation of the currency. Is is also known as the decrease in purchasing power of the currency.

Its a tool to measure the increase in prices. If inflation is 6%, it means on an average the prices have increased by 6%, means anything which had cost of Rs.100 last year will cost 106 this year. (Its a average price and not exclusively for some item)

For example:

Considering inflation at 6%, the value of Rs.100 will go down to Rs.53.86 in 10 yrs and to 29.01 in 20 yrs. In order to keep value of you money same, the absolute return earned must be greater then inflation.

Inflation vs returns on different financial products

Fixed Deposit :

Investing in Fixed Deposits just retains its value, but people feel that they get good returns upto 8.5 or 9.0%.

There is a tax of 3.5% on your FD returns and then if you adjust inflation of 6% after that, you will realize that though your Rs.100 has become 109 in a year, you have to pay 3 or 3.5 tax on that, and then if you have Rs.106 after that, you can purchase the same thing which you could have purchased in Rs.100 a year ago.

Hence, FD don’t give returns in real sense, they just keep your buying power. (considering inflation + tax = return from FD)

Gold investment :

Investing in GOLD is considered the traditional way of investment and also it is consider as the best way to beat inflation. Historically Gold has always outperformed inflation. It has generated 13.66% annualized return since 15 years, which is almost double of the inflation rate.

See the graph given below, in this graph the returns of gold investment since 20 years is given. You can see that how gold prices have moved or increased in last 2o years.

Image source: www.Bemoneyaware.com

Cash in bank :

The worst thing one can do is to keep Cash in Bank account, instead of investing it in any product. The returns generated from this saving can not beat the inflation rate.

For example: Suppose you have some cash in your savings account on which the interest rate applicable is around 4-4.5%, whereas the inflation is around 6%. Here the returns can not even meet inflation rate.

Cash must only be kept to a limit which may fulfill your emergency needs (preferably 3 times of you salary). Any extra amount must be invested.

Mutual fund :

Mutual fund is an investment in stocks so the returns are volatile here but if you consider it as a long term investment product then you will realize that it has given returns way higher and beat the inflation rate by almost double.

So this is the difference between the inflation rate and the returns of different financial or investment products. Now you can compare the returns and choose which product is suitable for you to invest in.

We can help you to improve your portfolio by making a perfect financial planning for you. If you have any doubt or query you can ask us by simply leaving your concern in our comment section.

May 6, 2008

May 6, 2008

Manish,

People just don’t realize how inflation is eating all their savings. We just look at guaranteed returns like 6%, 8% returns etc but fail to think after factoring inflation in most cases we won’t get anything. You have mastered explaining everything in a layman language. Tnq a lot !!

True ! .. Inflation is something which makes all the FD’s and inflation a dud product for yound investors

Manish,

I am a new reader. I have read most of your articles and learnt a lot. Your articles are really awesome. However

a) In most of the articles you have assumed equity growth of 15%. In such a case, NIFTY has to reach 20,000 by 2020. Really will that be the case?

b) Inflation is something related to demand/supply within India. So it might be very high in coming years. But equity as a whole is dependent on the entire world. What if inflation goes up high and market stays in the current range for next 4 to 5 years? This is because last year during recession, prices of basic commodities decreased in USA where in it increased highly in India. In general is there a relation between Indian Sensex and inflation?

c) As per my understanding, all countries are living on lending money. Over past 10 years this was the case and this brought the economy growth everywhere. But now this has maxed out and the growth may not be the way it is in past 10 years. What is your idea on this?

Phani

a) 15% will not come by just buying and holding , Nifty at 20000 in 2020 may not happen . 15% return will be because its an assumption that you will make sure portfolio rebalancing is happening and you keep churning portfolio atleast in 1-2 yr to make sure you throw out junk and buy new funds which are better . A person who just buying equity and sits idle assuming that he will get 15% will be fool . Its not going to happen . Also better thing would be to assume 12-13% instead of 15% . 15% is on aggresive side .

b) I would say inflation and Index are correlated but both of them are dependent on another third thing which is how economy is moving .

c) Yes , the growth in next set of 15-20 yrs will be very different from last 15-20 yrs , in immediate term like 10-15% i see good growth because still india is on its way to become a developed nation and we have so much to grow .

Manish

Manish

Hi Manish,

Even though one keep on churning his/ her portfolio once/twice in a year, it is very difficult to say that the returns are in the range on 12- 15% (CAGR for long term, 5-10 or even 15 years).

Preservation of capital is very important, locking up money in stocks in not a good idea. We all know, what happened during 1929’s stock market crash (it took more than 30 years for DOW JONES to come back to 1929 level), also Japan’s stock market is down by almost 50% from its life high for many years. Even in India all the good stocks BHEL/SBI/DLF all are down (-30 to -60%).

My point is that in the event of uncertain returns, its better to preserve capital. I chose PPF (max limit 1 lakh ) for both me and my wife, EPF , 15% VPF, 10 gram gold every 6 months, EMI for my home loan and remaining amount i invest in stock market…and when i get 15-20% return i book my profit. No matter how high the potential of that stock.

My assumption is that when one says there is 12-15% CAGR return for long term, it will be same if i wait for 1 year or 2 year. Market will always give opportunity hence first get rid of your loan and at the same time think to generate corpus for retirement.

I still believe stock market is gamble and hence i prefer to deal in derivatives rather than equity.

Thanks,

Rahul

You prefer derivatives than equity ? What are you saying !

Derivatives are more volatile than normal stocks , its a bigger gamble in that case ? IS it not !

Manish

Yes Manish! It may sound strange to you but i prefer derivative over equity, I will tell you why –

1. I believe, 12-15% return over a long period of time (long period= more than 5-7 year) is a myth.

2. I have captured sensex data for past 17 years from Yahoo finance and calcuated yearly returns, and ranked them. for normalization i have excluded worst 3 and best 3 years (replacing it with 0% return). at the same time i have calculated the value of FD (@8.75% for similar period, assume that one is investing in tax free product like PPF/EPF). My observations are as bleow-

a) Rs. 100 invested will give you Rs 307.05 over 17 years

b) Rs 100 in FD product with tax free return on interest will give you Rs 382.71

Hence i believe the risk taken is not worth, because you never know when you require money and the position of market at that time.

History in capital market across world has shown it, the stagnation in market may remain for years (japan, dow jones during 1929’s crash)

3. Preservation of capital is very important. Even if one gets minimum 4% return consistently without any risk.

4. I agree that return should beat inflation and some people made huge money in stock market, but the only point which i dont like is the advice you give to people in this forum to invest in financial market (Stocks/Mutual funds) to meet their long term goal and it will fetch 12-15% return over time.

5. One should get into stock market only if they get rid of their loans (as it is a committed outflow of cash), prepare for retirement (preservation of capital).

6. Any earning person mostly require money for following reason at regular inteval (marriage/ house /Car / child’s education/ child’s marriage/ retirement). and hence stick to guaranted fixed return product. Cost of loan in India is much higher and i think one should close it and plan retirement at the same time.

7. Considering the liquidity driven indian stock market and the role of FII, i will prefer to stay away from stocks.

8. I started my career in derivatives and hence have good understanding of its movement and trade only in Nifty/SBI/RIL/LT contracts. And don’t put more than 15k for any expiry. As of now i got good return more than 20%. Even if i lose some of the money i keep it limited to 15k and also i dont average (in case if i am making loss, i simply close the position)

I would love to know your thoughs on this.

Rahul

Hi Rahul

It would be interesting to see how you came to conclusion that

a) Rs. 100 invested will give you Rs 307.05 over 17 years

b) Rs 100 in FD product with tax free return on interest will give you Rs 382.71

Especially the point A ?

Please explain to me or send me the excel you worked on ?

Manish

I dont know how to attch excel here, but i have pasted the data, you can copy it in excel and let me know

Return* = Return on Rs 100(top3, bottom3 returns are replaced by 0%)

Year Close Return Return * Return on Rs 100 FD (@ 8.75%)

7/1/1997 4300.86 100.00 100.00

1/1/1998 3694.62 -14.1% -14.1% 85.90 108.75

1/4/1999 3122.04 -15.5% -15.5% 72.59 118.27

1/3/2000 5375.11 72.2% 0% 72.59 128.61

1/2/2001 4018.88 -25.2% 0% 72.59 139.87

1/2/2002 3269.16 -18.7% -18.7% 59.05 152.11

1/2/2003 3365.06 2.9% 2.9% 60.78 165.42

1/2/2004 6026.59 79.1% 0% 60.78 179.89

1/3/2005 6679.2 10.8% 10.8% 67.36 195.63

1/2/2006 9390.14 40.6% 40.6% 94.70 212.75

1/2/2007 13942.24 48.5% 48.5% 140.62 231.36

1/2/2008 20465.3 46.8% 46.8% 206.40 251.61

1/2/2009 9958.22 -51.3% 0% 206.40 273.62

1/4/2010 17558.73 76.3% 0% 206.40 297.56

1/3/2011 20561.05 17.1% 17.1% 241.70 323.60

1/2/2012 15517.92 -24.5% 0% 241.70 351.92

1/2/2013 19714.24 27.0% 27.0% 307.05 382.71

Can you send me the excel on manish at jagoinvestor.com

Sure Manish, I will send it to you by EOD.

ok

[…] much will be average Inflation figure in coming […]

[…] will also tell you what will be your final profit after paying tax and what will be your gain after factoring in Inflation (based on your expectation of inflation percentage) […]

[…] child in today value. now you can jump to next step , but before that make sure you understand the effect of inflation on our Money . Here is another good article on […]

@saurabh

Well .. Gold is too much hyped these days .. Not that I suspect its return potential for next decade . But I feel that Gold can deliver good returns for next couple of years , but over 10 yrs of time frame Its return would not be more than 10% CAGR (fingers crossed) .

But anyways .. The thing I can think of is to do a SIP on your own (invest per month on a fixed date) in Gold ETF’s . Another alternative would be to divide your investment in Gold ETF’s and Gold Mutual funds .

What ever you do , just remember these points

1. Gold can not beat Equity in long term (If it does , c0nsider it as a once in a cenury thing) .

2. Historically (100+ yrs) GOLD returns have matched the Inflation rate … So do you want to second guess that for next 10 yrs ? sure you can and you should if you have confidence and appropriate reason , Do you ?

3. Do not put more than 10% (max) in GOLD as an investment . GOLD is a hedging mechanism generally .

Tell me !! .

Manish

Hi Manish Ji,

I wanted to invest in gold for approx 10 yrs. so cna u please suggest that wht should be the strategy for such an investment for 28 yrs old.

Thanx.

[…] 10% per year now a days . You require 60 lacs after 12 yrs For Higher Education of your Children . Understand Inflation . Robert (quiet) : Hmm.. That’s something I didn’t think about . So I will need 60 lacs […]

@Gurdial

Yes , definately .. Real estate returns are second highest in long run after equity . So it makes sense in long run .

Silver has been a better performer than GOLD in recent years , it can be an alternative to GOLD as investment .

Manish

Would you consider Real estate(excluding residential flats) as an inflation proof asset?.

Secondly, how about Silver as an hedge against inflation?. For last couple of years Silver has caught the fancy of many investor.

@divakar39

For a person in his 40's , I would say Balanced Funds would be a nice thing , provided he needs to make close to 11-12% return in 10 yrs time frame , If his return needs to be close to 14-15% , Equity Funds would be better , but then he/she needs to take some risk on that .

Mixing PPF + Equity Diversified Funds would also give the same effect as Balanced funds .

Manish

dear manish,to beat inflation for a person aged 40 years who started invcesting recently what is the option? whether he should go for equity diversified mfs or balanced funds. please suggest.

@NKanani

Only in recent years , Gold has given so exceptional returns that people started seeing it as an investment option . However , the long term performance of gold has been limited to provide a kind of return which beats inflation and that would continue happening , for short term , no one can say anyuting .. but if you are planning to buy it today and keep it for long term like 15-20 yrs .. It has no match with SIP in mutual funds ..

Manish

Hi Manish,

Do you think Gold, since it has 'always' outperformed inflation, is the safest investment option? How do you compare Gold to SIP MF?