Procedure for EPF Withdrawal on death? (here are 6 documents required)

A lot of EPF accounts are lying unclaimed after the death of an employee. Families have no idea how to claim the EPF money and what is the process?

Today I will share with you how your family will be able to withdraw the EPF account money in case something happens to you.

How to claim EPF money after the death of an employee?

Once a person is dead, the beneficiaries of the dead employee can proceed with the process of withdrawing the EPF money. The first right is of the nominee who was mentioned in the EPF by the account holder. Mostly it’s a father or mother as most of the people are unmarried when they start their careers and they mention one of the parents as a nominee.

Here are the documents one need to submit

[su_table]

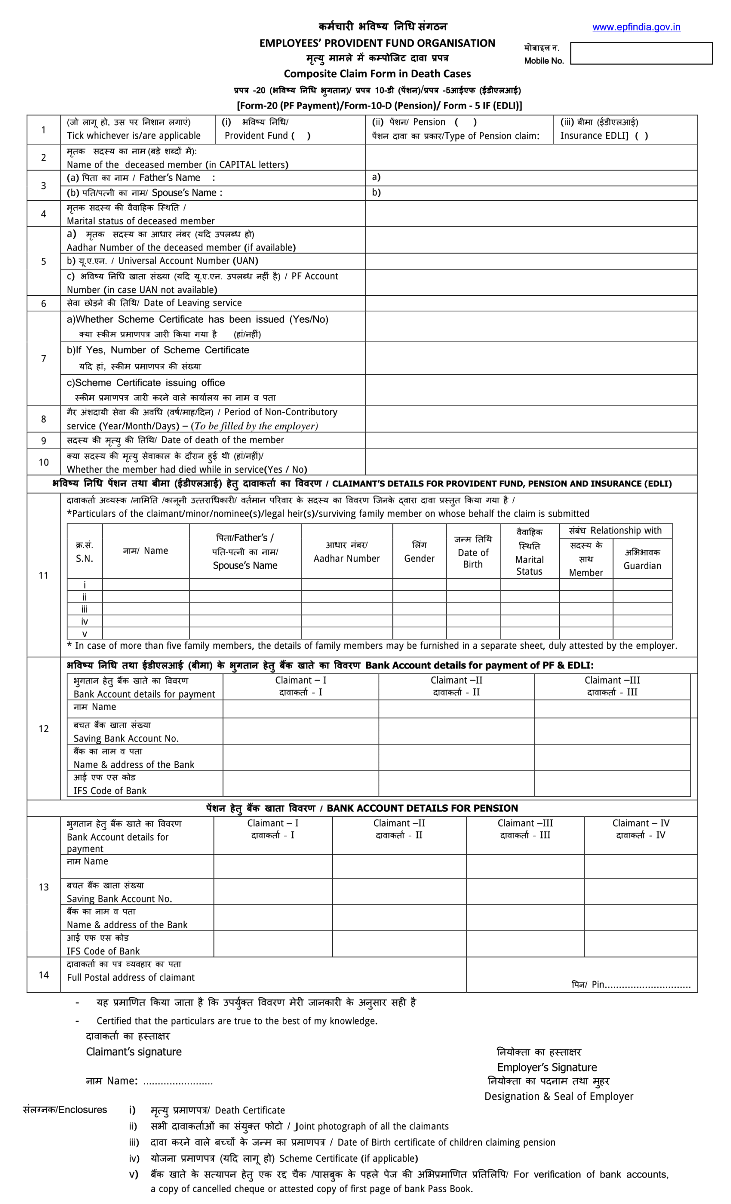

| 1 | EPF Composite Form | The first form is called the Composite form for death cases, which is a single form to be filled to claim EPF, Insurance money and any pension amount. |

| 2 | Death Certificate | You need to provide the death certificate of the EPF account holder who had died. |

| 3 | Birth certificate of children claiming pension | If there are children of the deceased who are claiming the EPF, they need to provide the birth certificate for each of them |

| 4 | Joint photograph of claimants | One has to provide a joint photograph of all the claimants together. This is to make sure that there is no fraud in the name of claimants. |

| 5 | Copy of cancelled cheque or attested copy of the first page of Bank Pass Book | To make sure there is proof of the account where the money is is going, one has to provide a copy of the cancelled cheque or the first page of the bank passbook |

| 6 | EPS Scheme certificate (only if applicable) | This is a certificate which is a document that has all the details of who will get the pension etc after the death of a member. It’s issued by EPFO and this is applicable only when there is a pension part applicable. |

[/su_table]

How does the EPF Composite form look like

Here is a snapshot of how the EPF composite form in death cases looks like. This is the main document that one has to fill if they want to claim the EPF amount.

You can also download the EPF Composite form for death cases here.

Share this information with your Family

As you can see, that the process of claiming EPF is lengthily and painful, you should make sure that you make it easy for your family members to claim back the EPF money. Hence please do the following things

- Keeping all of your important information in one place which is safe and accessible to your family

- Please update the nominee of your EPF to someone whom you really want it to go

- If you have a WILL, mention the beneficiary who should get the EPF money

I hope you get a clear idea about the EPF claiming process now. If you have any query please reply in the comment section.

April 2, 2018

April 2, 2018

My uncle is passed away in covid and he has 3 minor girls and mother he was working in a private bank they are asking each and everyones account

Yes, they will ask the bank account for all legal heirs .. In this case minor girls and mother are legal heirs

My father passed away and i wanted to withdraw the PF and pension amount with my Mom as Nominee.

How do approach this as the organisation for which my father worked in has been closed.

Please help me.

Submit following documents

– EPF Form 20 : https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form20.pdf

– Death certificate of the account holder

– In case the nominee is a minor, then a guardianship certificate from the court

– Copy of blank/cancelled cheque

Additional Documents in case Nominee is not registered or anyone is claiming money other than the nominee

– Succession certificate or letters of administration along with an attested copy of probate of will issued by a competent court.

to get succession certificate should be get the valuation of the amount from the PF office and submit to the court

My sister gave my name as nominee for PF account,

But in pf portal in claim option showing aadhaar suspended now she is no more pls help me out of this

This is something I have not heard before!

If there is three claiment for pension whether need to submit three form for penson

No, it has to be just one.. Once you get the money, it has to be divided

My bro is passed away but he hasn’t link his adhar no. With mobile no. And I asked to the epfo office but they are saying he have to do biometric or KYC bt he is no more now.. Then what is the another option for the same.. Please answer me I was trying to solve this since 3 months bt didn’t get any answer for this. Plz help me out.

Hi Sonali

Its not a normal withdrawal, but a handover process because the person is no more now. Ask them what all documents is needed by them so that you can get all the money in your account.

Manish

Dear members,

Need information on how to correct nomination name details after the person is deceased

My father gave my mother name as nominee for PF account,

But the middle name given in my mother’s name is wrong .PFoffice has declined our offer claim without giving any info

You need to make an affidavit for the name and then reach out to EPFO

this is a very useful article for me, thanks for sharing, I am searching that info from several days.

Hey TUHIN PATRA

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Manish

Good Article…Keep continue its very helpful

Thanks for your comment Irshad Ahemad .. Please keep sharing your views like this..

Manish

Sir you have written a lot of work keep helping people like this even further.

Thanks for your comment Aasif Ali .. Please keep sharing your views like this..

Manish

I and ex wife living sepeartly by giving talak in2015.Now l am living another woman in relationship base. I want to delete the name of my Ex wife from Nomination form. Can i do and how?

You just need to change the nomination in your EPF by filling up a form. Search about it

Thank you for the excellent info.

Do you have similar info for PPF ?

Thanks Murli Padbidri

read this article

http://jagoinvestor.dev.diginnovators.site/2016/09/withdraw-ppf-from-any-branch.html

Excellent information Sir, as always. Thank you very much for sharing.

Thanks for your comment Sanket .. Please keep sharing your views like this..

Manish

yes this is usefull, do you have aby info about what is the procedure for EFP when anyone changes the company. does he have to create new EPF account?

Hi Ravi Kumar

Submit your UAN and KYC to your new employer, further process will be done online. Or you can also submit Form 13 through your new employer or old employer (preferred)

Nice info..one request ..pls share detail information on how to withdraw PF with latest documents (Aadhar, Non-aadhar )…

Hi Sreenivas

Thanks for your comment

Read this article to know the process of withdrawing PF

http://jagoinvestor.dev.diginnovators.site/2016/09/withdraw-ppf-from-any-branch.html