4 reasons why you should avoid Health Insurance policies from Banks with cheap premiums !

Do you come across health insurance policies from Bank with surprisingly low premiums and with amazing features and benefits, which makes you feel you should not miss this offer? Today I will give you good enough ideas about those health insurance policies and will help you understand the limitations of those health insurance policies from the bank and why you should avoid them in most of the cases. Let’s start.

Background about Health Insurance policies offered by Banks?

All the health insurance policies offered by banks is mainly a group of health insurance provided to all their banking customers in association with some external general insurance company. What happens, in this case, is that a health insurance company approaches a bank and tells them that they can offer a specialized health cover to all their bank customers with lots of benefits with a small premium. The best part of these policies is that there are no medicals involved, there are fixed premiums for all age group customers, very low premium, etc. On the first look, you will not even believe that something of that kind can exist.

But there is always another side of the situation and now these policies despite looking amazing to have lots of problems and limitations which you should know and then take the decision. Let’s check them one by one

1. Depends on negotiations every year

Health insurance policies provided by banks are actually an outsourced thing. So if you buy it from bank A, then actually its a policy from Insurance company B, the bank is merely an intermediary. As this policy is a group cover, the policy premiums and all the featured are going to be negotiated on a regular interval like each year or twice a year. Now the problem is that if the health insurance company feels that the premiums should be revised (for whatever reason), then banks can’t do anything and the only customer will suffer here because he did his long term health insurance planning with this policy.

The premiums of the policy can rise like anything in the future because the pricing of the product is very flawed in most cases because banks do not have much experience in the health insurance domain.

In absence of the right expertize with most Banks, the pricing could be majorly flawed. Though there are no published figures available, our sources at some Insurance companies say that it is an incessantly “bleeding portfolio”. We believe, any contract, in any field, which is not win-win,does not work in the long term.

2. Chances of association breaking in future

What will a customer do if the association breaks between the bank and insurance company in the future? Health care costs are increasing and its always a good thing to get your self insurance as soon as possible, now if after 5 yrs of running a policy suppose the association breaks, a customer will be left into a situation where he has to again find a suitable policy and who knows if he has developed some illness in between these 4-5 yrs, who will cover that. Here is a real-life experience from Ketan shah on the forum, see how he suffered when something similar happened with him

Dena bank 5 Years back came out with Scheme in tie up with Oriental Insurance for providing mediclaim at highly attractive premium i.e. Rs. 7000 for 5 Lac cover.

We hold various accounts with dena bank and as per their tie up we got ourselves covered (5 Policies) after paying 2 years premium, when the 3 rd year renewal came we were informed that the tie up with Oriental is no more there and the same policy will be transferred to United India Insurance for same Premium..

Now we have paid 2 years premium with United India and the 3rd year Premium we are informed that Dena Bank has increased the Premium 2 -3 fold for policies…

Now trusting Dena bank and paying 5 years of Premium which comes to almost 2 Lacs we are stranded and forced to pay high Premium for my parents and now we are in a fix If we don’t pay and we cant even change the company since parents are 65 +

we were assured that the scheme shall continue since it is bank tie up and therefore we got our previous pvt policy cancelled which had a very High Premium for my Parents (20000 for 5 Lac)

Please advice if we can approach IRDA for the same…

3. Limits on renewable age

Health insurance is a long term financial product and should always be bought with very long term benefits in mind. Having a lifetime renewal option is not just a wish, but kind of must-have feature in your health insurance policy and that’s where these policies from banks fail. They all have a limitation on the renewal age in most of the cases.

Even if the premiums are lower, what will you do sometime in the future when you really need that policy and it shuts the door for you.

4. Pathetic “service” issues

The service provided at the time of claim settlement is really a big parameter. Now if you have bought it from the bank (here bank is the agent), there is no “person” or “company” to help or assist you at the time of claim settlement? Whom do you mail? Who do you talk to? Who will you catch? Who will you blame? The bank due to its size and nature will not entertain you in a proper manner.

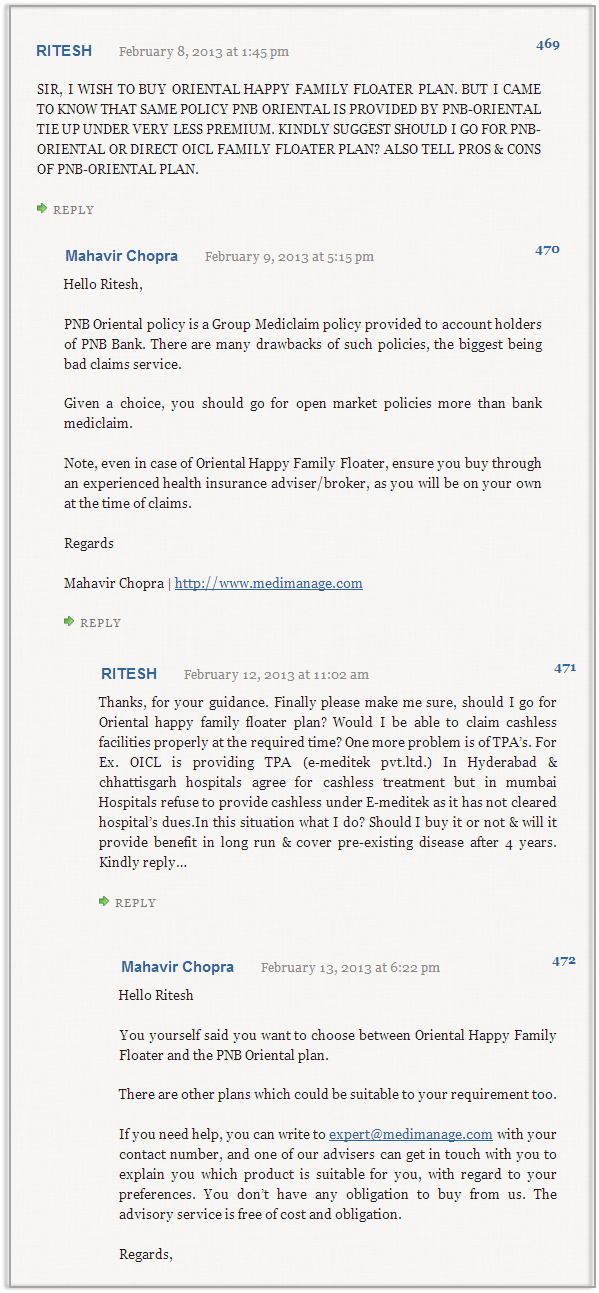

Also being a group policy, it some times gets very complex to understand their limitation and many things will be a complete nightmare for you as a customer. So it’s really a big disadvantage here. I want you to go through the following conversation on service issues which was done by Mahavir Chopra of medimanage and Ritesh sometime back. It will give you some idea about this aspect.

Overall I would say any health insurance from banks which are pure group cover should be just an extra health cover in your life. It should NOT be the primary long term solution for your health insurance needs. Its very important to have a large health cover from a very strong company with great benefits and strong service levels.

What do you feel ?

July 4, 2013

July 4, 2013