You might have seen a section in your Cibil Report which says DPD (Days Past Due). While Loan Status and Credit Score matter a lot when it comes to getting a loan approved or rejected, a big myth among people is that a clear report (without SETTLED or WRITTEN OFF status) and a credit score above 750/800 are the only two things that they need to get a loan.

at

That’s not true. While a clean report and a good score are definitely primary level requirements for getting a loan approved, there are finer details which a bank looks at, before deciding if they want to give you a loan or not; and Days Past Due or DPD is one of those important metrics. Lets understand this then …

What is Days Past Due (DPD) on a CIBIL report ?

Days Past due or DPD means, that for any given month, how many months worth of payment is unpaid. And this information is for each account . Which means that if you have 3 different loans going on, then you will have DPD information for each of those accounts. For each account you can see Days past due information for each month for the last 3 years , i.e., 36 months.

You might already be aware that your cibil report contains the past 36 months of your credit information. Each and every month, your lender who is a member of CIBIL, will update the CIBIL with the latest information like Did you pay on time or not? How much outstanding loan do you have at that moment? How many months worth of loan is remaining and other micro details are shared on monthly basis by banks and lender to CIBIL. So each month, a new month’s data is added and the oldest month (36th month) is removed from the cibil report and this way a sliding window of 36 months data is available on your cibil report at any given point of time.

Example – Date 06-12 and DPD value is 90

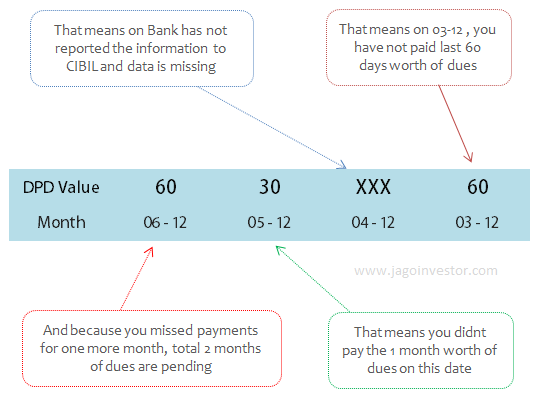

If DPD value is 90 for a date say 06-12, it means in June 2012, the payment is due for last 90 days, which means 3 months dues! So you can now understand the the DPD in the last month (May 2012) would be 60 and for Apr 2012 would be 30.

When you default on any payment or do not make the full payment, this DPD value will start getting a number and it will be a negative thing. So if there is a cheque bounced from your side and the loan not paid on time, you can expect one entry of DPD for the latest month with value 30 – which says one month of dues are not paid. If you clear it on time before the next cycle comes, it will help you to improve your bad credit score and the DPD value for next month again will be normal, but if you do not make the payment and keep those dues , then the DPD value for the next month will increase to 60, which implies that from 2 months you have not paid the dues. See the graphic below to understand more examples of DPD

What does XXX means as DPD Value ?

There are certain values which can appear in DPD section and each of them has some meaning, however the safest values are 000 and XXX . If you have the value as 000, it means the dues are totally clear on that date and nothing is outstanding. And if the DPD value is XXX, then it simply means that bank has failed to report the data for that month to bank, and it does not impact you at all . At times instead of 000, the value can be STD which means that the dues are for less than 90 days . While any other number other than 000 is a negative thing, but make sure it does not go above 90 days , because then its super negative.

At times, some lenders also report DPD values in a different way, as per asset classification norms set by RBI. In that case, the values which appear under Days Past Due section are STD , SUB , DBT or LSS which denotes good to bad , where STD is good and LSS is the worst one. Here is what each of them denotes

| STD (Standard) | Payments are being made within 90 days. Note that any delay of more than 90 days is seen as Non Performing Assets (NPA) by banks |

| SUB (Sub – Standard) | An Account which has remained NPA for upto 12 months |

| DBT (Doubt ful) | The Account which has remained Sub Standard Account for a period of 12 months |

| LSS (Loss) | An account where loss has been identified and remains uncollectible |

Can DPD values be changed ?

There have been cases that lenders have rejected loan applications based on DPD information even though the credit report was clean and the score was quite good. And the common worry at the time is “Can’t I change my DPD information somehow?” and the answer is NO . You can’t change DPD information like you can change SETTLED or WRITTEN OFF status by taking some action. All you need to do is wait for some time and as time passes, new month information will get added to your report and old data will keep getting phased out. So if you have some bad DPD data before 12 months, then it will go out in next 24 months, and if you have some DPD data 2.5 years old, it will go out in 6 months period.

For those who like to learn through video’s, we have a 40 min course on Credit Report and Scores in detail on our Jagoinvestor Wealth Club, which will explain all the aspects of the subject in a clear manner and great detail

Did you understand the meaning of Days past due or DPD which appears in CIR (Cibil Report) ?