Do you know which bank in india has the highest fixed deposits interest rates ? But before that, let me ask you – Do you know what is the interest rate of your Fixed Deposit ? If it was opened a few years back, all you would have got is around 6-8% depending on the bank and tenure. But today its a different scene! . Fixed deposits interest rates are high these days and you can observe one of the other bank announcing fixed deposits interest rates revised each month and in range of 9-10% . I will show you a snapshot of various banks Fixed deposit interest rates with varying tenures.

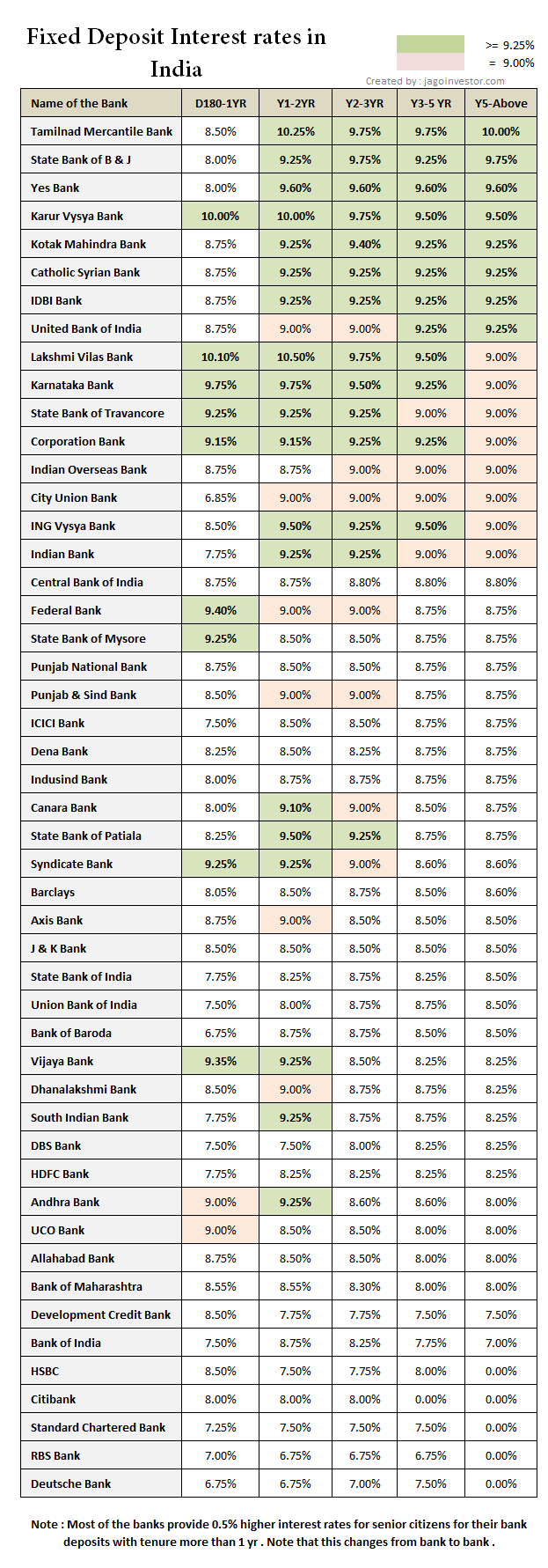

For simplicity purpose, I have not included tenures of less than 6 months . See the graph below . Green color represents interest rates higher than or equal to 9.25% . Pink represents exact 9% . The banks mentioned in the table below are Tamilnad Mercantile Bank, State Bank of Bikaner and Jaipur, Yes Bank, Karur Vysya Bank, Kotak Mahindra Bank, Catholic Syrian Bank, IDBI Bank, United Bank of India, Lakshmi Vilas Bank, Karnataka Bank, State Bank of Travancore, Corporation Bank, Indian Overseas Bank, City Union Bank, ING Vysya Bank, Indian Bank, Central Bank of India, Federal Bank, State Bank of Mysore, Punjab National Bank, Punjab & Sind Bank, ICICI Bank, Dena Bank, Indusind Bank, Canara Bank, State Bank of Patiala, Syndicate Bank, Barclays, Axis Bank, J & K Bank, State Bank of India (SBI), Union Bank of India, Bank of Baroda, Vijaya Bank, Dhanalakshmi Bank, South Indian Bank, DBS Bank, HDFC Bank, Andhra Bank, UCO Bank, Allahabad Bank, Bank of Maharashtra, Development Credit Bank, Bank of India, HSBC, Citibank , tandard Chartered Bank , RBS Bank and Deutsche Bank . Look at the table below for the indicative interest rates for different tenures.

Note that a lot of banks offer high interest rates for special tenures like 500 days, or 555 days or 1000 days, but they have some restrictions which people dont know – some of them are

- Some banks have provision, if rates increased in future, you can not apply for extention at higher rate of interest, instead you have to close that account and apply for new one.

- Automatic renew not possible.

- Upon maturity, you will not be able to get overdue interest.

- Sometimes, you cannot premature close the deposit. however, these conditions vary from bank-to-bank.

Thanks to Lokesh for this information

High level Observations

There are some patterns we can see in area of fixed deposits . here they are

- Fixed deposits with high interest rates for almost all the tenures are not the heavyweight banks, but the new generation banks, they are Tamil Nad Mercantile Bank, Karur Vyasa Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank and others

- Most of the banks provide 0.5% higher interest rates for senior citizens if the tenure is more than 1 yr . But if tenure if lower than 1 yr, the interest rates are same for senior citizens also . This is widely true , but some banks like Axis bank , SBI bank , ICICI Bank and HDFC Banks gives 1% higher interest to senior citizens.

- Most of the foreign banks like Citibank, RBS , Standard Chartered has low-interest rates in range 6-7.5% . This is unattractive during these times when other banks are giving higher rates .

Low and Medium risk appetite investors can cheer

For investors how find themselves not too comfortable with equity and for those who want to park their money for few years without taking any risk and earning some good return in range of 9-10% , Fixed deposits are very good options.

The only point is if you are in high tax bracket, most of the returns will go in tax, but for investors who are in lower tax bracket of 10% or below the permissible limits , they can look for these options without much thought . These fixed deposits were for the year 2011 , but for most part of 2012 also these bank fixed deposits interest rates will be applicable .