A readers tell me : ” I invested 4 lacs in Sectoral Funds and now its down by almost 45% in one year. Now I need the money for my Sister Education in next 1 month, Should I withdraw it or wait for 1 month ? Manish , please advice ..”

I asked “But why did you invest in Sectoral Funds or even Equity” ?

Reader : “Because I am a High risk Taker, that’s why”

I call it breach of trust with your common sense. My hands were literally itching to slap this idiot when I heard this. We have to re look “Risk Taking” all together again . I have already talked about Risk here at How much risk you should take and Understanding your Risk Appetite .

[ad#big-banner]What are the two elements on Risk Taking?

In our country most of the people are willing to take risk. They will say that they are risk takers , they have high Risk appetite , they love challenge, and all kind of nonsense. But they forget to consider their “Ability to take risk”. Its not important enough whether you are willing to take risk or not , your situation should also allow you to take risk. Ignoring your “Ability to take risk” can lead to situation like above example.

So mostly there are two components of taking risk .

- Willingness to Take Risk : This depends on our inherent nature, our attitude towards life, finance domain , Knowledge of financial products etc. Our whole upbringing will contribute towards this, because our willingness to take risk will depend on our inherent self , who we are from inside . So you can either be extra cautious by nature and may not be willing to take risks or you can be a big risk taker who is willing to sell his pants and bet money on anything. This is answer to “Can you take risk ?”

- Ability to Take Risk : This is the next Important part in Risk taking. Does your situation allow you to take risk or not ? It has nothing to do with your willingness to take risk , you can be very much a risk taker and dieing to bet on the next multibagger or invest in that 100% return a year mutual fund , but you have to consider a worst case at the end. You have to visualize the worst case as if it has happened after you take that risky decision . This is answer to “Shall you take the risk ? “

Let us have a close look at definition of RISK .

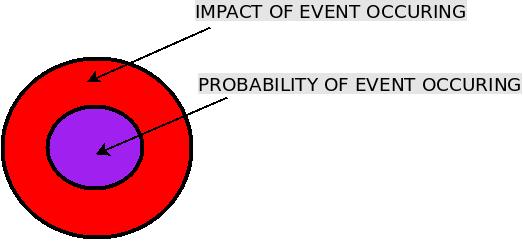

Boom !! .. So Risk is composed of two parts . Probability of Event occurring should be the secondary thing one should look at and Impact of event occurring should be primary. See the picture below to understand it visually .

Probability of Event occurring : Most of the people unconsciously think about this. It happens a lot in case of Life Insurance , a general argument is that the probability is very less for them to die and hence they take the risk of not taking adequate risk cover through Term Insurance because they loose money if they don’t die , idiots! (See this post to understand the reason) . Same case with buying a mutual fund which has no credit to itself apart from a 100%return in last 1 yr even though its 8 yrs old fund and have a return of 8.7% since inception. The probability of these mutual funds giving return may be high, but in-case they fail, the impact it can have on your investments can be fatal , especially if you have not considered its impact on your short term goals. So the person in the example above never thought of the impact on his short term goal of Sister Education . He only considered that chances of event happening, which was low (mutual funds going in losses) and if he is a risk taker or not , but he never considered how it will impact his goal. Even though the chances of something bad happening is low and he is personally fine with it mentally by taking risk, the right decision was to better not take that risk because the goal associated with it was very important and the impact is severe overall .

Impact of Event occurring : This is the primary thing one should look at and then take a decision. Until an event happens its very tough to imagine it, that’s the reason you should literally close your eyes and try to visualise a situation and try to feel about it . So if you want to avoid a Term Insurance just because you never get your money back and you want to settle down with a money back policy (Like Jeevan Tarang from LIC) which gives you 10% of the insurance cover you actually require for a premium you can really afford, try to visualise a situation that you died and now your family needs the money after you are gone . Visualise how are they managing , Visualise how your dependents are already emotionally terrified and how they will fulfill their financial goals without you ?

Does it mean we should not take Risk ?

I am not against taking Risk . I love risk taking personally (but my ability to take risk is limited) . We are only talking about taking calculated risk here and being aware of what is the outcome of what we do. Risk comes from not knowing what you are doing. So take calculated risk. Know what can be the impact of taking a decision and be ready to face it when it happens. if you are not happy with the impact, don’t do it . “Not taking a risk” is another very severe risk people do. “Not taking a risk in your life if you are ok with the impact” is equally bad . So not taking risk can also have a drastic impact in your life . Below is a nice video i found for you to get motivated to take Calculated risk .

Conclusion

Recently I came to know that one friend of mine met with an accident while crossing road in Bangalore. He used to cross roads in hurry, because waiting wastes time and meeting with a small accident was not a high probability event ever. Though he was a probability genius , he forgot the impact part of this event . He is safe after this accident but impact could be much worse. Mathematics can never win infront of logic .

Finally at the end I would like to summarize this article in short. We take all sort of decisions in life regarding money , relationship , marriage , health and all of those decision have two parts, First is our willingness and how we feel about it and second is the impact its going to have in our life. This post is to build your FPQ (Financial Planning Quotient , I coined this term 😉 ) and that’s the most important thing. Taking a decision is last thing , understanding what you are doing is of utmost importance . So now their are some questions unanswered , which i will leave to you if its applicable to you .

- If you have a Endowment policy , its totally safe and secure , but have you thought of its impact in our life when they mature at the end ?

- If you are avoiding Health Insurance of your elder parents because of high Insurance premium , Do you also understand that the Probability of them getting some health problem is very high and the Impact is pretty severe . So when it actually happens you will wonder why you were foolish earlier.

- Is the travel Insurance of around Rs 110 worth when you go for air travel within India from one city to another or for that matter from one country to another (charges are not Rs 110 in this case) ?

- So if a mutual fund has given 150% return in last 1 yrs, has it happened without taking any risk? and are you ready to face the other side of coin ?