“Don’t judge a person by their Sunday appearance” applies to Mutual funds also. Best Mutual funds are the best over most the time frame and Worst mutual funds are the worst performers in most of the time frame.

What I mean by this is that the best performers return wise in 5 yrs, 3 yr and 1 yr are almost at the top and worst performers are always in the bottom for 5 yr, 3 yr and 1 yr time frame. Let us look at the Chart of mutual funds performance

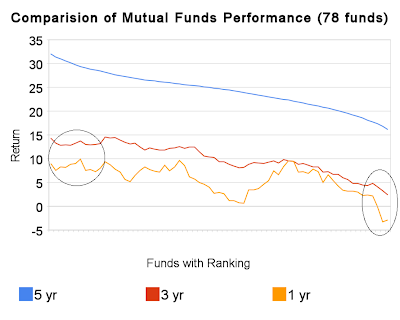

I compiled a list of 78 top mutual funds on the basis of 5 yrs Return and plotted a graph of returns for 5 yrs, 3 yrs and 1 yrs for them accordingly. To smooth out the data, I took a 10 period moving average (i.e. I took an average of Top 10, then an average of 1-11, then 2-12…) Just want to see what is the pattern of Mutual funds list. Have a look below:

If you look at the chart above, you will see that the Best performers (Top 10) were in the best performers list for 3 yrs and 1 yr time frame also. And at the same time, the worst performers in 5 yrs time frame were the worst performers in 3 yrs and 1 yr time frame, whereas the opposite was not true… See this video post on how to choose a good mutual fund for yourself?

Here are the Learning’s and conclusions:

Do not judge a mutual fund by it’s short-term Performance like 1 yr

There were many mutual funds who gave top returns in 1 yr time frame (See the orange line, see all the top positions) but not all of them were the best in 5 yrs time frame. The same thing happened with 3 yrs time frame: there were 2-3 mutual funds at the top in 3 yrs time frame but they were not best in 5 yrs time frame. See why SIP works well in long-term

Short-term performance does not give enough indication of Long-term

This is common sense, just like meeting a person for few hrs or days cannot tell us about his/her nature or behaviour, the same way a mutual fund cannot give a good indication of its long-term perspective from short-term performance.

In the above chart you can see that if I gave you just one year performance chart and it was sorted by returns, you could never tell which amongst the top would also be at top in 5 yrs time frame.

Bad performance in short-term should not be taken too seriously.

This is kind of same thing which I said above, but let’s see it with a different perspective. Short-term performance should not be the only reason for selling your mutual fund or Shares. We generally take our decisions based on short term performance, that is true for Life also.

We need patience and give time to our investments to show its true colors. Good investments happen by giving time to your investments and Early Investing, not just by choosing one.

Comments please, your 4-5 kind words will help me know if you liked it 🙂