No more sending ITR-V by post after income tax filing – Verification with aadhar card introduced

POSTED BY ON April 19, 2015 COMMENTS (156)

There is a good news to taxpayers. CBDT recently announced that taxpayers who filed their income tax returns online will no longer have to send the ITR-V paper acknowledgement by post to CPC Bangalore, if they have aadhar card which can be used for verification purpose.

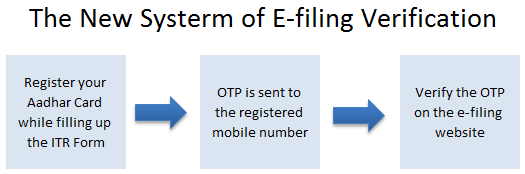

Instead of manual verification, a new Electronic Verification Code has been introduced to verify the e-returns. For that one will have to mention their aadhar card number in ITR form, and tax-payer will get an OTP number on their mobile for verification, which needs to be completed on the website of tax filing.

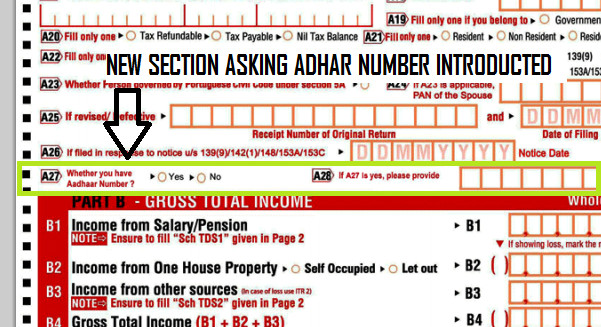

Below is a snapshot of the new ITR form where aadhar card number is asked in case you have it.

Issues with the old system

Earlier the process was like this. Once you e-filed your tax returns, you then had to send the acknowledgement copy within 120 days to CPC Bangalore. Only those who had signatures could do verification online, but it was very rare, hence millions of tax-payers had to take the pain of manually sending the form.

However, the old system was not robust and a big number of people used to get messages that their acknowledgement has not reached tax department and other manual errors used to happen.

With the introduction of this new system, things will be simplified and even faster. Now the process will be as simple as filing the tax returns online and they will get a one time password for verification purpose on the registered mobile number, which has to be used for verification on the website of tax department. That would complete the process of verification.

But I don’t have Aadhaar Card ?

Don’t worry. You can always send the physical documents ITV-V to CPC, Bangalore like you did earlier. You can do that even if you have aadhar card. This new system of verification is just an alternative way for those who have aadhar card.

What do you think about this new system?

Write us your opinion on this in our comment section.

Hi,

I have a query.

I e-verified my ITR using Aadhar OTP. the status shows that EVC accepted and it is successfully e-verified. Now, my doubt is that since I am due for a refund, do I have to still send ITR V/acknowledgement copy to CPC bengaluru? Because my ITR still not processed. Also, on the acknowledgement it is written in bold letter n red ink that DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC BENGALURU. Please help! What should I do?

to be on safer side, why dont you send it !

i have return form with wrong assesssment year.what to do now? should i have to again e file my return for right assessment year?or there is some other method?

Hi Inder

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

i have forgot to fill the column DESIGNATION OF AO (ward/circle) in itr -1 (sahaj) . other things are correct. itr 5 has been gfnerated and e verification has also been done . will i face any problem .

Hi arun

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

I had successfully e-verified via netbanking and did not send the acknowledgment to CPC Bangalore. I received SMS in Jan 2016 that ITR return is still not submitted.

Does it mean i should still send ITRV to CPC ? but why then there is the process of e-verify.

Hi Balu

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Thanks Manish. I raised the query already to CPC and they asked me to ignore the S:S as it is wrongly sent from the system. I inquired here in the forum just to know if its common problem,

ok , I am not aware of this actually 🙂

Balu, how did you raise the query? I have sent ITRV’s twice and still it shows not received.

Send it through Speed post or registered post

Hi, I have done aadhar verification at the time of filling the return 2015-16 & not send the copy to bangalore. Now when I am going to open an account, bank ask for ITR V, What should I produce to bank now? Any friend, Please help me. Thanks.

Hi Javed

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

My ITR-V has been already reached bengaluru and status has been changed to ITR-V Received

Now I heard that if we done EVC, the refund will be in 7-10 days.

Is there any chance to Everify again in my case?

Hi sathyaraj

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

everification can be done thru netbanking as well.

I could not link aadhaar card. i efiled my return online.

Subsequently, I opened my SBI a/c via net banking; When I click efile tax option, it takes me directly to efile page where it is mentioned tax return submitted and alongside eVerify link.

When I click I get OTP in my mobile. Once I fill that status changes to eVerified success. So NO NEED to send to bangalore even if NO Aadhar.

Hi Subramanian

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I have invested in LIC after declaring my investments for FY2014-15. I am eligible for refund. Do I need to send the investment proofs with the ITR V by post?

No , you dont need to give investment proofs !

I had the same issue in year 2011-12. But I had to deal with loads of headache to get the money refunded. As I didn’t send the docs.

Dear sir,

Last financial year I had not submitted my savings declaration in my company as a result of which my total tax got deducted, what should I do while submitting my itr to get the refund on my tax. pls help

Hi sachinbhoinallu

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Hi,

I have filed income tax using online java utility. But I have some refunds as well. I want to know if I need to send my investment proofs to IT dept so that they may process my refund. Or how else will they verify if my investment is genuine (if I do not send photocopies of my investment).

Thanks,

Gaurav

Exactly what is on my mind as well. Let’s see if someone comes for our rescue here.

You need not sent any investment proofs to IT department unless they ask for it

You dont need to send any investment proofs !

Hi,

I did e-filing and chose option 4 for verification initially and got ITR- V and after sometime I did e-verify through netbanking. Do I need to post ITR-V to CPE or not required?

If your income is less than 5 lacs and you have verified, then no need to send it view post

I have alredy sent the ITR V by post to CPC some 5 days back. whether E verification can be done now, If yes, how?

Yes it posssible

hi , i have E-verified my return online through Netbanking and also sent ITR-V through post to CPC Bangalore . Will I face any problem by using both online and offline (by post) options .

No

Hello Manish,

I always enjoy reading your informative articles. Considering the fact that government has added considerable changes to IT forms this year, I expect another detailed article from you ! I would like to ask you a question regarding this year’s IT form (I am sorry that it’s not in line with the theme of this article). I work in an MNC and I have few ESSP shares of my company in E-trade. Should I declare this as foreign asset while filing IT return ? Thanks in advance !

Regards,

David

Hi David

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

I had a refund from my itr. My income is under 5 lakh. I had efiled through OTP based verification. I read that whosoever having no refund to claim can go for online filing. Now will I get my refund in this case.

Hi Gaurav

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I have invested in PPF after declaring my investments and closing of Form C for FY2014-15. I am eligible for refund. Do I need to send the investment proofs with the ITR V by post?

YES

Greetings of the day

My CA filed my ITR and also linked my AADHAAR number. I did not get OTP on my registered mobile. So he send my ITR-V by post.

However last year when there was no AADHAAR card link, I got OTP.

What could be the reason for this?

Thanks and regards

Arun

I am not sure on that Arun, it might happen that your CA has changed the mobile number and kept his own !

Thanks Manish

I will confirm from my CA

Arun

Hello Manish,

Does EVC method still valid for the gross total income more than 5 lacs?

I already send the ITR V to bengluru, it’s around 6-7 days and it hasn’t reached yet. Should I go for e-verify still I’ve sent manual ITR V copy?

Yes, as of now .. still one has to follow that !

Its a good step taken by CBDT digitalizing the ITRV acknowledgement. It can even save paper and in turn trees.

Thank you!

Thanks for your comment Rakesh

Hi All,

I want to share my experience. After filing i got my ITR V to mailbox, since i wanted to see alternatives to avoid sending the paper,was surfing and found i can do EVC, mine was a EVC through net banking since i had refund.

Step1) File you returns. (Try to give Aadhar if you have)

Step2) Go to eFile > eVerify Return

Step3) Click on eVerify link

Step4) Choose you option appropriately. Mine was Option2 (If you are not sure google for ‘e-Verification User Manual’)

Option 2: “I do not have an EVC and I would like to generate EVC to e-Verify my return”

Step3)Once i selected Option2, It prompted “EVC Through NetBanking ” ( since i had to get a refund)

Step4) It will show list of banks available for verification with netbanking .

Login to you Bank if its listed and you have Netbanking.

Step5) Every bank has its own link for Tax e-Filing .

Mine was ICICI and navigation was Payments&Transfers > Manage Your Taxes > Income Tax E-filing.

Step6) Once you confirm to agree and Click Submit , you will be redirected to the Income Tax website asking for your Confirmation on the Electronic Verification.

Step7 and Final) Return Successfully Verified ,Download Acknowledgement. ..Awesome.

You will also get a mail with your acknowledgement.

Hurray….Happy Ending

Steps could vary but this is high level journey.

Regards,

Krishna

Thanks Krishna for the Navigation. I filed my IT returns and couldn’t find out where to verify.

I verified using my aadhar linked phone number

Hey Krishna

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Guide me to upload ITR-V form online

Hi Praveen

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/pro

Manish

I had mentioned the aadhar card number but i did not any verification, so i had send the hard copy. Can you tell me why?

Finally the EVC process has been launched. Even those who have already submitted ITRs this year can go for e-verification/Aadhaar based verification. No need to post/speed post the ITRs. Completed the process just now for ITR submitted earlier. 🙂

There are three options to verify return using Aadhaar card, logging using netbanking and ATMs of stipulated banks. Very simple process….!!! Thanks to IT Dept…for taking of the painful leg of the annual ritual….!!!

For those with less than 5Lacs income its even simpler since they get an EVC code sent to their registered email id/mobile number which they have to enter on the efiling website and whoa….they are done!

Hi Nilesh

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Dear Sir I have one query or rather you can say one confusion, if I have saving bank interest is more than 10000 and I want to pay tax through E-pay tax via Income tax site then under what head and which transaction ID have to pay tax and after how many days this will credited in my 26AS, and if take more time and I filled the ITR showing interest and mentioning the challan number and Code in the ITR form, will it seek attention of of IT department as it not credited or updated in 26AS or as E-verification is started it may cross check with my 26AS and may be show mismatch.

Hi Anup

You should choose challan 280 . See this article http://jagoinvestor.dev.diginnovators.site/2015/03/pay-income-tax-online-challan-280.html

But thats for those who have less than 5 lacs income . Right !

Hi Manish,

I filed returns for FY 2014-15 last week. They are still asking to send the signed ITRV hard copy to incometax office even though Aadhar number is entered while filing the return.

Hi Amrutha,

I have done this income tax filing – Verification with aadhar card introduced and that worked successfully also.

After submission of ITR-

Navigate to My Account -> e-Filed Returns/Forms.

There you will find link “Click here to view your returns pending for e-verification”.

By click on this link you can e verify your filed ITR.

Thanks,

Shahenshaha

Will it work for those whose income is more than 5 lacs ?

Yes, the system has not yet started fully !

Remember, that in this country, the voters or the mass people dont have choice in policy-making once their elected representatives (one representative per 16 Lakh voters) reach parliament. Anyone recall how they forced the EPS scheme in 1994-95 through private employee’s throats inspite of everyone knowing that the EPS scheme is “Rob Peter to Pay Paul”?

Even today only max 4 crore tax returns are filed in the country where 86 crore adults live.

No developed or developing nation asks a taxpayer to provide all bank account numbers and IFSC codes on a tax return. What is the need? What is the guarantee that the information shared will not be used against the taxpayer or misused by the tax agency? This year return forms first asked for bank accounts and balances, then FM displayed from foreign that he cares more for his people hence the bank balance columns was dropped from return but the bank account information is left intact. What they wish to do with collecting passport number, pan number, aadhaar number, bank account numbers, IFSC Codes, foreign bank account numbers, date of opening of foreign bank accounts? And mind you the foreign assets declaration is not required for foreigners working in India. Just because a developed nation US asks for foreign assets we also start asking? Are we ready to compare with US with respect to everything? US does not give back Social Security to our professionals so India stopped PF withdrawals of foreign nationals working in India till they attain age 58. And we Indians contribute 8.33% of 15000 to EPS, but the foreigners pay 8.33% of their entire Indian salary to the EPS.

Hi Bunker

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Same here. I filed the ITR just now and have been asked to send the physically signed copy of ITR to CPC, Bangalore. Looks like the online system is not ready yet. Some other forms are also not available online like ITR2 and are going to be made available. That’s the reason the last date to submit ITR has been changed to 31st August 2015 for this year. May be the OTP functionality will get activated little later this year and those who submit online returns later will get benefit of the same and would not have to send signed copy by post/speed post.

Early bugs like me and others would end up suffering with one more year of inconvenience…. 🙂

Thanks for your comment Nilesh

And I thought I am the only one facing this issue. I had even raised ticket and called up the Helpdesk of E-Filing portal. As per them, even when I have provided my Aadhar card, I still have to send the physical copy of ITR-V. I guess the Media had exaggerated an unconfirmed news and raised false hopes in Tax Payer’s mind!

Hi PD

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I was able to e-verify using adhaar card OTP. I e-filed my returns on 14/7/2015 ,but had not yet sent the ITR-V to CPC. Today I read this article and thought of giving a try fo re-verify. I logged on to incometaxfiling site. It prompted me for adhaar no. I entered it and my aadhar no. was linked to my pan no.. Then i was redirected to dashboard->my pending actions. Here i saw a link(e-verify) besides my ITRV . on clicking on this link it prompted for a OTP sent on my mobile no. After entering the OTP e-verification was succesful. Instantly i was provided with a link to download acknowledgment pdf. Also I received a acknowledgement pdf on my emailid.

Yes same here. I filed my IT returns today but could not find any option of verifying the return using Aadhar. Surprisingly though there is a field in the form to mention your Aadhar number, if you have one that is. I’m not sure what purpose that will serve.

I guess this year we have to stick to the old routine of mailing in the ITR-V. Hopefully by next year, the new system of authentication will be up & running.

Ok , I think by next year it would be more clear !

Hi Manish

Today i have e-filed income tax return for FY-14-15 but still we have to send the ITR-V form to CPC bangalore. Government has not implemented the new system yet. I have checked with call center people, as per them i have to follow the old procedure only. May be in future, Govt will implement new system where you don’t have to send the Form to CPC f you have ADHAAR card but for now, follow the same procedure.

Regards,

Vibhor Mangla

Hi vibhor

Thanks for sharing that !

I am vising USA .I understand after filling Aadhar number in ITR1 this assesment year

i will get OTP in my mobile phone. I cannot use this OTP and fill for verification since i

am in US upto Nov2. I want to know what happens if i dont use this OTP ,whether i can file online? Ofcourse i can wait till Aug 15 th or so file and send verification form itrv

after returning to India. Or is there alternative. Why not IT authorities send OTP to my mail id instead of Mobile Number. Alas they have not thought about this alternative easy verification of Aadhar

I am not aware of this .

Ashish,

Regarding changing mobile number online for AADHAR Card you need to have your previous mobile number active. If in case that is not active then one cannot update details online.

“..and they will get a one time password for verification purpose on the registered mobile number, which has to be used for verification on the website of tax department”.

If one filed their income tax returns online with the help of tax professional, he(tax professional) submit the return through his terminal using his email id. And just give the printout, which will be sent to income tax department through post by taxpayer.

So my query is, if taxpayer give password to professional, is it not a security risk? because time to time it is possible taxpayers can change tax professional.

Atanu

You can always change the email/phone in the accounts .. later

As if PAN and Aadhar were not enough, now employees get a UAN to manage their EPF accounts (if maintained with the EPF organisation)! http://webcache.googleusercontent.com/search?q=cache:www.epfindia.com/UAN_Services.html

Thanks for your comment Paddu

Good initiative by Income Tax department to make Return making Hassle free earlier we have to send signed ITR-V to bangalore for acknowledgement only then your return filling was completed, sometimes there was issue your ITR-V not reached there and you have to keep track of whether it reached there or you have to send it again . Now filling with Aadhaar make you sure that your Return is fillied and no more need to send ITR-V find more at http://www.aadharcard.info/

Accountability in respect of its citizen for a developing country is apreciable. But, it should not target only to the people who earn legally, I mean, at govt employment sector or semi Govt. The nation accomodate crores of its citizen who earn without any accountability anywhere. They cheat the Nation by employing tax experts to make maths of thier earning, I dont want to name them all as it’s aware to everyone, including the political power centres.

Still I affirm there should be accountability, one must pay tax as per rule for their earning. Govt must be particular to impose the project (Adhar) transparently and with responsibility. Employing people from any sector for the job is irresponsible. Adhar should be implemented by responsible Govt. agency for all the citizen of the nation, then introduce it to other tools for monitoring and detecting defaulters.

Hi Sajeev Sadanandan

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I guess its a welcome step from government to link Aadhar Card to Pan card.

Is this available only for ITR-1 or for other ITR’s too? Anyhow I’m wary of using this (at least for those on whose name gas connection is registered) as I don’t want to let go of gas subsidy after paying 20-30% as income tax!

Its availabe for everyone who sends the acknowledgement

Hi admin, I tried to file online ITR, but on the first page where we select Assesmemt Year, i cant find 2016-17. Available option is 2015-16 only. I want to file returm for income untill march 2015. Will the link available in future or i am missing something

Income until March 2015 comes in A.Y. 2015-16

I am not sure on that. Better talk to the customer care directly on your issue

Its true that – Income until March 2015 comes in A.Y. 2015-16!

It was income for 2014-15 (April 14 to May 15) which would be assessed in 2015-16! 🙂

What to do if my ex employer do not provide form 16A ? how to file I.Tax return without form 16A?

If you have salary slips, even that is fine !

Ex-employer should provide form 16. Form 16A is for income other than salary, e.g. bank interests, etc.

Let us welcome the initiative taken to simplify the process of sending back the signed copy of ITR. Connecting it to Adhar card is a good step and a driving force to create a huge data base of the people of India. There are many details in Adhar card which you will not find in other Govt documents.

Glad to know that

We Indians have created a habit of critcising every steps of Government,rather than welcoming new initiative.

I dont have mobile number updated in Adhaar, how can I get OTP?

I cannot update mobile number since I’m staying in UK now.

Hi Malatesh,

Check Adhar App if it can be helpful.

Also for prople supporting PAN, Adhar is used because there is biometric verification. Though Adhar is not a proof of nationality it is the proof of Identity indeed.

You need that anyways .. update it in your aadhar card. How ? I am not sure !

If this works fine for me, it will be first time I am getting benefit out of Aadhar card (other than gas subsidy). When I purchased a car, Aadhar card was not accepted at RTO, Kerala as address proof. In Passport office, they will not accept Aadhar card alone as address proof. You will need to give additional proof. If government agencies itself has no faith in Aadhar card, why wasting so much money and people’s time for this?

Hey Kishore

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Hi Manish,

Good to know this info!

Could you pls write a notes about Mutual funds SIP for new investors like me ?

Thank you.

Regards,

Suresh D

Hi Suresh D

Read http://jagoinvestor.dev.diginnovators.site/2008/04/all-about-sip-systematic-investment.html

What if the aadhar number is there but no mobile number is registered to aadhar?

Hi Avadhut

You will not get any sms because mobile number is missing

Bosses,

Good information.

Aadhar Card with ITR. Good move.

I would like to share that, for any property deals, ( selling / buying / renting) in registrar office, aadhar card is must. Without the same, papers will not be registered. Recently, i have take home on rent for Rs. 35,000.00 per month and my land lord opted for Rent agreement to be registered in Registrar office. Both of us have given our aadhar number. Tomarrow if the landlord doesn’t show the Rental Income in his ITR, he can be questioned on the basis of Rent agreemnt which was registered with Aadhar.

I THINK THE TAX DEPARTMENT HAS TAKEN A GOOD DECISION ABOUT NOT SENDING ITR-V THROUGH POST. IT WOULD BE VERY COST-EFFECTIVE. NOW ONE JUST HAS TO DO VERIFICATION WITH THE HELP OF OTP SENT ON ONE’S MOBILE NUMBER. THAT’S IT. THE IT DEPARTMENT DESERVES OUR KUDOS !

Hey Mukesh Adlakha

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Adding Adhar number to eliminate sending by post is good idea. One will have to write down OTP somewhere because it is used only once a year hence easy to forget.

I think OTP will be generated when you actually go for verification online. Not when you submit it !

Hi,

I have already filled ITR but i haven’t yet send it to CPC Bangalore. So can i fill again and verify using Adhar Card?

Thanks in advance,

I had the same question, filing of online ITR is done without adhaar card, am in the process of sending signed copy. if this can work retroactively, I would use that instead

Hi Prabhakar

I guess you dont do it . Send it this time because anyways its not yet active (assumption)

Thanks.

why aadhar, and why not PAN card, which every taxpayer has to have. there could be system to register the mobile no. by the PAN holders. Even the people who are KYC compliant in a bank or MF or Demat, there mobile no.s could have been fetched from the records. How many Aadhar card holders have their mobile no.s registered during enrollment? Hardly 20℅

Not sure on that

This is good. But us everyone mentioned PAN should be key to track it. Mobile Number is not a good option as I see many people are changing their mobile numbers more often nowadays due to change in place, lose of phone etc..

You can change your mobile number online in Aadhar .. I will write on that seperately !

This is very good decision

To all who do not understand why Aadhar is used, it is because it has an updated residential address and mobile number. PAN card may not have updated address, you cant see that in the card. God knows what address is stored in IT Dept website. For example, I stay in Kolkata and I applied for PAN card when I was in Bangalore. Hence, the address is old and I never cared for updating it.

Even Aadhar may have an old address. Over that, it is not guaranteed that mobile number is eternal that you always link it with Aadhar. So, how come Aadhar is superior to PAN?

It is expected that when your mobile number or address gets changed, you request the UID authorities to update the details in the Aaadhar card, to generate an updated Aadhar card.

Else, the point of having an Aadhar card as proof of identity and address becomes totally futile! 🙂

And after I shifted house, I have updated my address in the online UID portal and I have already received an updated e-Aadhar card and a confirmation too. 🙂

Thanks for this piece of information.

If you expect someone to update information for Aadhar, then why not he/she will get it done for PAN? That’s my point. Use PAN instead.

is there a way to update PAN address online like aadhar has? guess thats the only difference.

I dont think there is any way for that !

Hi Arjun

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Yes I feel that it is a good move

First I did not get the purpose of sending acknowledgement in the first place ?

Secondly I really dont understand why aadhar card. There has to be some ulterior motive . Aadhar during the last goverments time had faced a lot of flak and criticized and now they want it in your ITR form .

I am also clueless on this .

Assume PoorGuy hasn’t done online ITR so far. EvilGuy came to know that PoorGuy’s PAN is ABCDE1234F. EvilGuy could just use this info. + a use-and-throw mobile no., etc. to file a forged return, leading to scrutiny of PoorGuy’s income/accounts and possibly harassment by tax officials, etc.

May be recently creating an account for online ITR has more checks, I don’t know. But when I did that in 2006 or 7 anybody could just create an online ITR account.

Hey Paddu

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Is there any benefit at all to the taxpayers…who are paying their taxes.

What is the benefit that i derive from paying the taxes (30% brackets)…

I can’t send my children to Govt. Schools, I can’t go to govt. hospitals (unless i have a death wish), …. the Bloody roads are clanky……

any benefit i derive from paying my taxes….

Please don’t get me wrong I want to see my country prosper in the form of better infrastructure…it is just that i don’t see it coming to me in any form that i would use.

Hi Asi

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Looks to be a good move, as long as the process becomes neat, clean and fast.

As for people talking about subsidy on LPG through Aadhar, I have updated my Aadhar and bank details in LPG system about 3 months back and as soon as I booked the first cylinder I got the subsidy credited twice in my account. When check I was told that 1st credit is against the cylinder I booked and 2nd is the advance subsidy for next cylinder and this advance will continue. When I booked the next cylinder, subsidy again got credited to my account in 2 days. This way I am actually having a surplus subsidy on cylinder at any time. This is a great initiative and I fully support.

Hi Ashish

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I didn’t get the advanced subsidy and when I was running around my distributor to get the gas connection transferred from my dead dad’s name to mom’s name I could hear many consumers bad-mouthing the govt. as they didn’t receive any subsidy.

I don’t think the red-tapism in LPG works with the subsidy system. And yeah I think the subsidy will cease some time in future when you link Aadhar to ITR.

Hi Manish

The registered mobile number is the mobile umber registered with AADHAR card or the one registered with TAX website.

-Navneet

I think its Aadhar card

The one which is registered with aadhar !

This is a welcome move by cbdt. But instead of linking aadhar they could link pan and mobile for the same.

I don’t understand, while before elections this same people were speaking loudly against the whole system of aadhar. And now they are preaching for aadhar itself, which has no proper guidelines regarding keeping of records and utilisation of centralised database.

Thanks Dipen Shah

I agree with Karthik. They started with caste census and now they want aadhar card. Now itself we are paying the full amount on LPG and after sometime the subsidy gets credited to the bank. Once this becomes a habit, people will be accustomed to paying the full amount and expecting the subsidy in bank. Then they will stop subsidy and people will continue to pay the full amount ! They already have our PAN why do they need Aadhar when the SC has repeatedly told that Aadhar is not compulsory. Anyway , good thing that this is not made mandatory in the form. I am going to send it by post. Anyway they know how much tax I pay through PAN and Banks have my Aadhar and PAN no.

Agree to your points San

But here Aadhar is not compulsory. Its an alternative . Supreme court judgement says that one cant use “just aadhar” . One can still file it physically.

Hi Manish,

This is definitely an awesome step taken by IT department. I think gradually we are observing the importance of having Aadhaar card. Automation is a must need in our daily life and our system is upgrading day by day. Hope to see more such reforms which will also make our income tax rules even more simpler in coming days. 🙂

Hi Santanu

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

India Post was earning Rs. 5 for every ITR V which was sent, now that income will be lost!

How many will send by normal post ? I don’t think many will send as we will not be sure whether it will be sent or not. Most people will send by speedpost which is around Rs.40

yes you are correct.

I agree….most of the time I used Speedpost for ITR V

Hi Vignesh E

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

think about printing and paper saving. its a Go Green initiative

instead of Aadhar, they would have used PAN an dMobile number for verification. It is clear tell tell that Govt will not give subsidy to Tax payers for LPG and other stuffs. Worst hit would be middle class.

they should rationalize before they clean up. then i can agree on this part.

Hi Karthikraja K

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish