5 major changes in life insurance policies from Jan 1, 2014 – How it affects you ?

Some major changes are going to happen in life insurance industry from Jan 1, 2014, especially in traditional policies like Endowment Plans, money-back plans and even ULIP’s. You will surely have a LIC policy or any other private sector traditional plans or might buy them in coming times. Here are 5 major changes which you should be aware about and they will come into effect from Jan 1, 2014.

1. Service Tax introduced in LIC Policy Premium

Till now LIC was not charging the service tax of 3% from the customers and paying it to govt from the pool of money collected itself, but now the service tax will have to be charged separately from policy holders. Which means that if your LIC premium was Rs 50,000 per annum, now it will be 3.09% higher in first year, which is Rs 51,500 and after 1st year, it will be 1.545% as per moneylife article.

While customers see it as additional burden, note that its not the case exactly, Earlier – LIC was paying the service tax from the pool of money collected from investors only, which reduced the bonus amount given back to them. But now because it will not be taken out from the funds, that means the bonus declared each year will go up by that much margin and will come back to investors only. Note that Pvt companies were charging the service tax already, so nothing changes on their side. Only LIC was not charging it separately, which they will have to do from Jan 1, 2014 deadline.

2. Increase in Surrender Value

One of the major changes which has happened, is the change in surrender value for policy holders. The rules of surrender value depends on the premium paying term of the policy. If the premium paying term for policy is less than 10 yrs. Then the policy will acquire the surrender value after paying premium for 2 yrs (earliar it was 3 yrs), however if the premium paying tenure is more than 10 yrs , then the surrender value will be acquired only after paying 3 yrs premium.

In both the cases, the minimum surrender value would be 30% of the premiums paid without excluding the first year premium. Note that earlier, if you used to surrender after paying 3 premiums, you got 30% of premiums paid MINUS first year premium, but now as per new rules, the first year premium will not be deducted. Learn everything about LIC policies working before Oct 1

Another good change is that, from 4th-7th year, the minimum surrender value would be 50% of the premiums paid, and has to reach 90% of premiums paid in last 2 yrs of policy paying tenure.

3. Possible Decrease in Premium on LIC Policies

There is a great possibility that the premiums on LIC policies will come down by some margin, because the mortality rates will now be revised by LIC in calculating the premiums.

Mortality rates are the rates at which the insurance company deducts the fees for insuring you based on your age. LIC had been using old mortality rates till now, but now they will have to use new mortality rates . Just to give you an idea on reduction of premium, when I check the mortality rate for a 40 yrs old person in old table, its 0.001803 . But in new rates its 0.002053 . Which is approx 10% better. Lets not go into detailed calculation at the moment, but your risk premium part should go down by 10% (not the full premium, because only some part of whole premium in traditional policies are risk premium and rest is investment part) .

4. Higher Death Benefit

If the policy holder is above 45 yrs of age, then the Sum Assured has to be more than 10 times the annual premium, and for those who are less than 45 yrs old, it can be minimum 7 times the premiums. Note that for claiming the tax exemptions, your sum assured has to be 10 times the base yearly premium. So when you buy the policy in-case, you need to keep it in mind. BasuNivesh has done a great point by point notes on each aspect of regulation, in-case you want to go into details.

5. Agents’ incentives have now been linked to the premium paying term

Now agents commissions is linked to the premium paying tenure. Earlier a lot of agents used to sell the policies which had higher maturity tenure, but limited premium paying tenure (like 30 yrs policy with 10 yrs premium payment) . Here is the new commission structure taken from Moneylife article

In case of regular premium insurance policies, a policy with a premium paying term (PPT) of five years will not pay more than 15% in the first year. Products with PPT of 12 years or more will have first year commissions up to 35% in case the company has completed 10 years of existence and 40% for the company in business for less than 10 years.

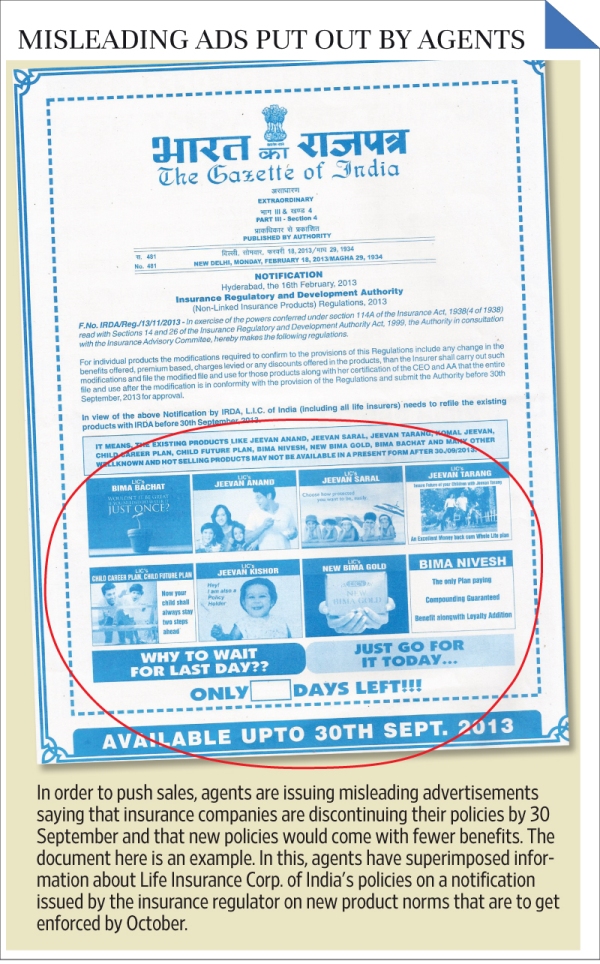

The funny aspect is that a lot of LIC agents tried to mislead many new investors by projecting date Jan 1, as the deadline when a lot of LIC products will stop giving good features using the official notification. LiveMint has even captured it in this image.

What should you do ?

The insurers have to refile all their products to IRDA and already lots of products have been approved and many are still waiting for approvals. So if you have a insurance policy, then you will get the communication from your insurer about any changes if any. Right now, for sure the traditional plans have got better, compared to their past avatars.

If you are adamant on buying endowment plan, better wait for some time and let things get more clear. Let me know about your thoughts on this change ?

September 30, 2013

September 30, 2013

Sir,

I invested single premium of Rs 160000/- in Reliance Life Insurane with market linked plan named Automatic Investment plan during 2008. This year 2016 I fore closed and got a Total refund of only Rs 185000/-. the Ins company deducted Rs 1854/- under sec 194DA. My tax slab is 30%. Sum assured Rs 2 Lakhs.. Kindly workout the balance to be paid? I have not availed any tax benefit while investing. Also reply whether it comes under Long term capital gain tax?

Hi Sivakumar, we will be happy to answer a query related to product. This query you asked requires a calculation and dedicated time. We do not have that much bandwidth .

Can I reduce the tenure of Jeevan Saral Policy. I started that in 2009 and the agent cheated by making the tenure as 35 years. Can I reduce the premium payment term to 20 years?

I dont think there is any option to reduce the term as such !

I am paying Rs.4798/- per month towards “LIC new retire and enjoy policy”.

Premium paying term is 22 years (started from Aug-2013). Sum assured is Rs.16,50,000/-

Now another 3 months are left to complete 3 years (Rs.4,798*36=1,72,728 Rs). I will stop paying premium after 3 years.

What will be my surrender value if I surrender after 3 years or till what period if I wait so that i can get maximum of premium paid? Please compare to your article above point no 2.

Whatever the surrender amount i receive, where i can invest the same to recover 1,72,728 – surrender amount.

Hi HARSHAVARDHANA

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

hi manish,

would like to surrender (3 years premium already paid) endowment lic policy which i bought of term X 20 yrs . premium of 25K/year. want to take a good one single policy with term insurance and invest the rest.

please advise shall i stick to it , convert to paid up or surrender ? according to the new regulations coming up

Yes, you should surrender it now .. and better take a term plan.

Dear manish i have taken new jeevan anand lic policy last year this year i paid around 73844 my actual premium is 72529 so the service tax is around 1315rs my question is will i get rebate on 1315 rs?

Regards,

Mohit

NO MOHIT THERE IS NO TAX REBATE ON SERVICE TAX……TAX IS REBATE IS ONLY ON PREIMUM WHICH YoU paid……

Why ? Do you get service tax back when we eat in restaurant ? Then why here ?

Its important to know the updates and the changes our government is making in life insurance polices, because it directly affects the insurers, and which policies they have bought or will buy.I have bought Tata AIA Life’s Insurance Fortune Guarantee offers Guaranteed Maturity Benefit that varies from 138% to 159% of Total Premiums Paid and Tax benefits u/s 80C & 10(10D) of the Income-Tax Act, 1961.

Hi Nishtha

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I taken policy for two.lakh, I paid.a.premium of ₹ 15000 for one year.15 years back.can I get my.money back.

Hi SATHISCHANDRA

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

Hi,

i am taking a LIC New jeven anand plan in April 2015. i am paid monthly RS 5000.Maturity Amount is 11 Lakes (21 years). Now i am decide to reduce my Maturity amount and Monthly premium.

Kindly Pls guide me How to Reduce my Monthly premium and Maturity amount.

Thanks

Gobinath

Hi Gobinath

The best answer you can get only from the agent you invested through or just contact the company. The thing is your case is a bit personalised and other than company, no one can give accurate information

Manish

Mr.gopinath

Greetings!

By taking a policy ,you enter in to a contract with insuance company and you cannot either decrease or increase your premium amount or the term of the policy. What you can alter is your mode of payment that too only from lower frequency to higher frequency. That is you can change your mode of premium from mly to qly/hly/yly, qly to hly/yly, hly to yearly. You are allowed to change the nominee. As for as i know only these changes are allowed.

S.koteeswaran

Retd insurance

Dear Manish,

Would you please tell me what will be the rate of service tax from 01.06.2015 on LIC premiums (1st year and on subsequent premiums) on both Endowment and pure term policies.

sir i have a policy from Lic namely New Jiwan Anand (815) for 2 Lacs for 20 years and yearly premium of Rs.11601. I understand the service tax but what i want to know that there is a addition of Rs.200 under the coloum Annual Acc Premium. can u explain it pleas.

Not sure of that

i am completed 3 years but this year only 2 police is done it so any tink happen with my agence

Talk to company on that !

Hi Manish,

I want to invest 1 lakh ruppes, where should i invest, Plz Guide.

What is your risk taking ability and for what goal you want to invest ?

Hi Manish,

I want to invest money to save tax, also for my future use like for higher education of my child. I don’t want my money to get invested at higher risk. Small risk I can take. I want to invest 1 lakh per year.

Then you can invest Rs 1 lac in debt mutual funds. Let me know if you wan to invest through us ?

Sir,

I have a policy Jevan saral last 2 two year’s every 3 moths I pay but present becoz of some fancial problem I am not able to pay every three months so that can i want to ask can I change my payment monthly to yearly or if not so can I change my Jevan saral policy to another lic policy suggest me plzz…thx

I think you can do that . talk to the LIC office !

Dear mahesh

I hopethat you have taken a policy for a sum assured of 2 lakhs. In that case rs.200 may be charged as an accident rider premium. With this rider in case of accidental risk you may get additional 2 lakhs as risk benefit. This has nothing to do with service tax. Service tax is charged in addition to the premium + rider premium+servic tax.

Koteeswaran

dear sir,

i have buy online term insurance plane from max life insurance . company send me policy related document to me by post.but all the document related to term insurance policy not signed by any authority on behalf of max life only stamp seal use every where, my query is that

any hand written sign shout be on the policy related documents or not

only stamp seal are legal or not

Stamp is good enough !

Hi Manish,

Thanks for Nice article.

i took Aviva term insurance, after medical tests i got mail saying0 “you policy benefits at revised terms of 100% extra mortality rate on basic death benefit”

and they doubled my premium.

As medical reports all the tests are normal, reason they were quoting is overweight. please let me know. is the premium will be doubled in that case? i heard it will be just 10~15% extra.. please provide me basic details and charges as IRDA norms.

Yes can range from 20-100% . It all depends on company underwriting terms !

Thanks, for quick reply, they put 110% and all medical reports are fine, i checked with other insurance executives are saying its about 15~50% max,.

In this case(like overweight), what are rules and regulations about this clause from IRDA. Companies are just telling its internal guidelines(not revealing to customers) and they were increased to 110%, tomorrow thwy can 200~300% as well. there will be some regulations/restrictions from IRDA, is there anything like that?

I dont think so .. How a company wants to price the premiums is totally dependent on them and not IRDA . Also once they fix the premiums for you , it does not CHANGE later !

Manish

Dear Manish,

Nice article.

I have started monthly premium of 20k in jeevan anand for 15 years just four months back. All new rules will be applicable in my case. My agent told me that I can expect 7.5 % plus something tax free from this policy. Now after reading all posts above I am very frustrated about return . Pls advice what can I do at this stage.?

Did you calculate things yourself ? Yes your returns are not going to be really great . But I thinks its a good idea to find out how much IRR you can expect . Its easy to calculate in Excel sheet .

At this stage you cant do much as the policy will acquire any value only after 3 yrs of payment and by then more damage will happen if you keep paying . I would have just let my 4 months money go .. and restart my financial life

Manish

Hi ,

I have taken New Bheema Gold Plan four years back….Can this be possible to chagne the plan to another plan…?

There is nothing like “change” of plan .. you can sell it and buy another !

I read many comments. All are talking about returns, inflation etc. The main objective of a life insurance policy is insurance cover. LIC is paying crores of rupees as death claim every year and it keeps on increasing . I think Insurance cover has not been taken into accounts by most of us.

Yes, the main thing an insurance policy should do is INSURE people , but most of the policies are mainly investment policies

Manish

I have a LIC policy which i would like to discontinue as i am now applying for foreign nationality, so i can not hold this policy. How should i go about this to surrender and get the value as i invested in it for 10 years. Please help me with your expertise.

Just apply for Surrendering of the policy

I have taken ULIP plan(smart steps plus child plan) from MAX Life in 2008 july with annualy 25000 premium. for a sum assured 450000 for 18 year. But now, my fund value is around 132000/-. But till now I paid 144000/-. I feel it is not performing well. Do I need to continue investing in this or do i need to surrender this ULIP policy? As I know ULIP pays only after 5 year of investment.. like 10/15 year in long term…..

Please comments….

This is same for various ULIP’s . I think if you do not understand products, then better get out of this ULIP