NEFT and RTGS – A detailed Guide

Lets try to understand what is NEFT and RTGS and what is the difference between them. NEFT and RTGS are two main mechanisms to transfer money from one bank to another bank in India. Transferring money between two accounts in same bank is pretty straight forword and its a internal matter of the bank, it does not have to deal with other banks and their protocols, however when one bank wants to send the money to another bank in India, there is a defined mechanism it has to be done and hence NEFT and RTGS comes into picture. Both these systems are maintained by Reserve Bank of India. Lets understand both of these

NEFT – National Electronic Fund Transfer

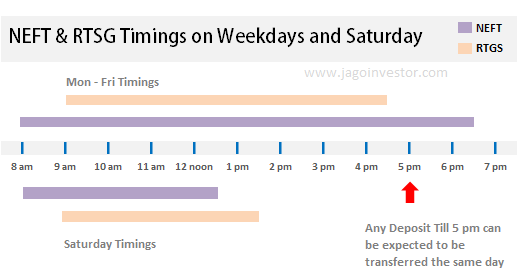

NEFT full form is National Electronic Fund Transfer, and its a system of transfer between two banks on net settlement basis. Which means that each individual transfer from one account to another account is not settled or processed at that same moment, its done in batches . A lot of transactions are settled in one go in each batches. Presently, NEFT services are available from 8:00 am to 6:30 pm on weekdays (Mon – Fri) and from 8:00 am – 12:30 pm on Saturday.

Any NEFT Transfer done between 8 am – 5 pm generally gets settled on the same day, but if you deposit the money after 5 pm, then that will be settled the next working day. In case of Saturday, any money deposited between 8 am – 12 noon can be expected to reach the beneficiary account the same day.

NEFT Transfer Example

For example lets say Ajay has ICICI Bank account and Robert has a bank account in HDFC bank , Now Ajay deposits Rs 10,000 in Vijay account through NEFT transfer at 10:30 am . The money will be then taken out from Ajay’s ICICI Account and will be sent to Vijay’s HDFC bank the same day, then HDFC bank will credit Vijay’s bank account. In case money can not be transferred to the target account (beneficiary account) , the money will be credited back to the source branch within 2 hours of the batch in which it was processed.

RTGS – Real Time Gross Settlement

RTGS full form is Real Time Gross Settlement and its a system of money transfer between two banks in real time basis, which means the moment one bank account transfer the money to another bank account, its settled at that time itself on real time basis between the banks, but the beneficiary bank has to make the final settlement to the bank account within two hours of getting the money. RTGS is the fastest possible money transfer between two banks in India through a secure channel.

Let me give an example, lets say Ajay has a SBI Bank account and Vijay has an Axis Bank account, Ajay transfers Rs 5 lacs to Vijay’s account through RTGS transfer, SBI bank instantly transfers Rs 5 lac to Axis Bank, now Axis bank has 2 more hours to deposit it in Vijay’s account . Hence in worst case even with RTGS transfer there can be delay of 2 hours.

NEFT and RTGS Charges

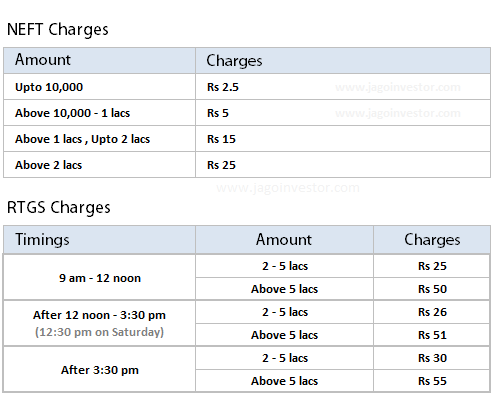

NEFT and RTGS transfer charges depends on the Bank. RBI has guidelines for the maximum fees which can be charged, but it finally depends on the bank in question. Note that NEFT and RTGS charges, varies depending on the amount transferred and the timings when its done. While NEFT charges depends purely on the amount transfered, RTGS charges depends on the amount transferred as well as the timings of the day when its done . A RTGS transfer early will cost a little less charges. Note that, Service tax is also applicable to the charges. Below are the charges shows for NEFT and RTGS for retail banking (not for institutional banking)

Information required to make an RTGS & NEFT payment?

For making a payment through NEFT/RTGS, following information has to be furnished.

- Amount to be remitted

- Remitting customer’s account number which is to be debited.

- Name of the beneficiary bank.

- Name of the beneficiary.

- Account number of the beneficiary.

- IFSC code of the destination bank branch

Points to Note

- Each Bank has their own NEFT and RTGS application form, which you can download from their website

- RBI declared holidays each year when you cant do NEFT and RTGS fund transfer transactions, see 2012 list

- To find out different bank branches which are enabled for NEFT and RTGS transactions, you can see this RBI list

Difference Between NEFT and RTGS

Finally let me list down all the differences between NEFT and RTGS in a table, so its easy for you to understand the conclude finally.

| Criteria | NEFT | RTGS (Retail) |

| Settlement | Done in batches (Slower) | Real time (Faster) |

| Full Form | National Electronic Fund Transfer | Real Time Gross Settlement |

| Timings on Mon – Fri | 8:00 am – 6:30 pm | 9:00 am – 4:30 pm |

| Timings on Saturday | 8:00 am – 12:30 pm | 9:00 am – 1:30 pm |

| Minimum amount of money transfer limit | No Minimum | 2 lacs |

| Maximum amount of money transfer limit | No Limit | No Limit |

| When does the Credit Happen in beneficiary account | Happens in the hourly batch Between Banks | Real time between Banks |

| Maximum Charges as per RBI | Upto 10,000 – Rs 2.5 from 10,001 – 1 lac – Rs 5 from 1 – 2 lacs – Rs 15 Above 2 lacs – Rs 25 |

Rs 25-30 (Upto 2 – 5 lacs) Rs 50-55 (Above 5 lacs) (Lower charges for first half of day) |

| Suitable for | Small Money Transfer | Large Money Transfer |

Are you now clear about the difference between NEFT and RTGS and their transfer charges?

September 3, 2012

September 3, 2012

I have added an account in HDFC Bank. It is showing under RGTS not NEFT, the thing is I wanna tranfer small amount i.e., 15,000Rs but its not accepting small amount. So, what should I do in this case?

Regards

What does it say ? It should allow Rs 15,000 for sure !

It’s saying invalid amount.

I hope you are not keep that , . Put 15000 and not 15,000

Can a NEFT transfer from SBI branch(home branch or any others branchs) to AXIX bank branch

Yes

Hi. My client has given me the UTR no. for the neft done but it does not reflect in my account even after 12 hours. How do I check if the UTR no. is correct? Is there a way to understand details thru a breakup of the no?

Hi Rio

You need to contact your Bank with the UTR no. .

I dont think you can do anything from your end for this

I can do NEFT and RTGS on Government Holidays not in Sunday. . For Ex: August 15 is a government Holiday.

thanks i understand..

The above mentioned charges are applicable for all the bank’s or it will differ defends on the bank

Thanks for your comment Iyyappan

i have account in bank of baroda .i want do rtgs to others account from my Home branch but i don’t have cheque. can i do rtgs from my home branch. please reply me as fast as possible.

You need cheque for NEFT/RTGS .. without that you cant do !

if u using net banking then u can do neft without any cheque.

My money is deducted from my account but did not reached beneficiary account pls reply

Thanks to make me confident about difference between NEFT and RTGS.

Thanks for your comment Arun

I clear understand both transfer easily

ya… i clear thanx useful information

Thanks for this useful information

I have gone through Rtgs and Neft…the way of explaining these is very simple… One can easily understand..

Thanks

Glad to know that Deep ..

NEFT Time Mon To FriDay

if I transfer fund through NEFT in Saturday after 12.30pm. when it will be credit to the beneficier’s account…

Monday !

Can we deposit money directly into the bank under NEFT SCHEME from one bank branch to another branch.

Yes

Is ifsc is matter when transferring money between same bank with different branches?

NO

In my a/c, Ihave added beneficiary name, a/c No.,and IFSC code. funds to be transferred by RTGS system, where one has to transfer min 2 lacs.

Now I have to change this to NEFT transfer pl inform how can be done?

YOu dont need to change anything, Amounts payment below 2 lacs is through NEFT and above 2 lacs is termed as RTGS

it is very useful to bank exam. thank u

It’s very useful on fund transfer

This is very useful to know about the difference of money transfer system in banking..easy to understand everyone with example…thank you for this link and site….

Thanks for your comment sivakumar