What is form 26AS and how to view it online?

Form 26AS is a consolidated statement which reflects all the advance tax paid by you personally or through TDS way. The best part about it is that you can view Form 26AS online by just quoting your PAN Number. You can view your Form 26AS online or download it in PDF or Excel format, but for that, you need to register on the income tax website.

Why do we need Form 26AS?

We all check our bank accounts when someone deposits money into it. Once we see that the amount is matching, we feel at peace and confirmed that there is no issue. Now in the same way throughout the year, we might pay the tax in parts. It can be in form of the Advance tax cut by our companies, TDS cut by the bank on your fixed deposits, TDS cut by some third party who is making payment to us. They all pay this tax on our behalf to the tax department and it is linked to our PAN card.

Now at the end of the year before filing for tax returns, we might want to check that how much tax is already paid by us through different ways and then we might want to pay additional remaining tax or ask for a refund in case we see that we paid more tax in a year.

An important point to note is, do not disclose your PAN information to someone else, otherwise, it becomes a security issue. Others can also view your Form 26AS and hence find out how much tax you paid.

How to view Form 26AS online?

Click on this website to login or register. I have attached a screenshot as to how to register in this website so that you can view form 26AS online.

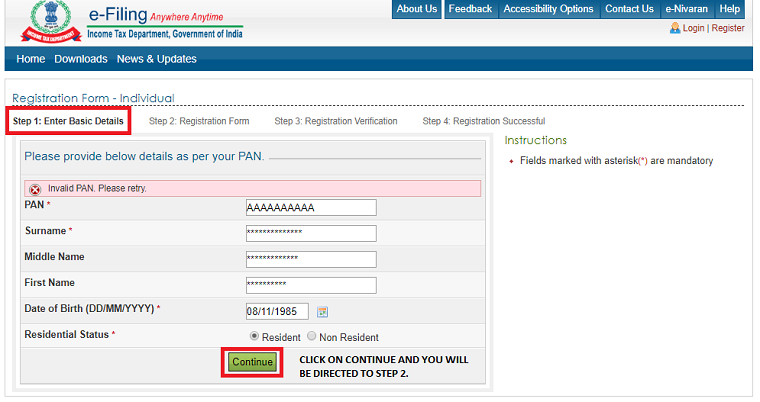

Step #1- To fill in the registration form, Enter Basic Details.

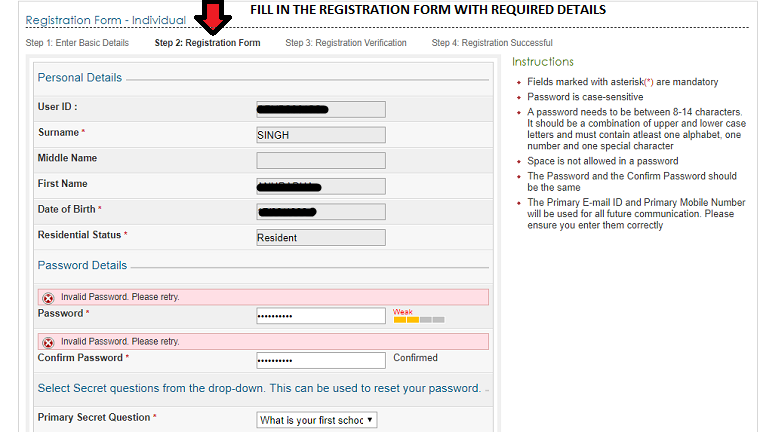

Step #2- Once you enter the basic details, fill in the registration form.

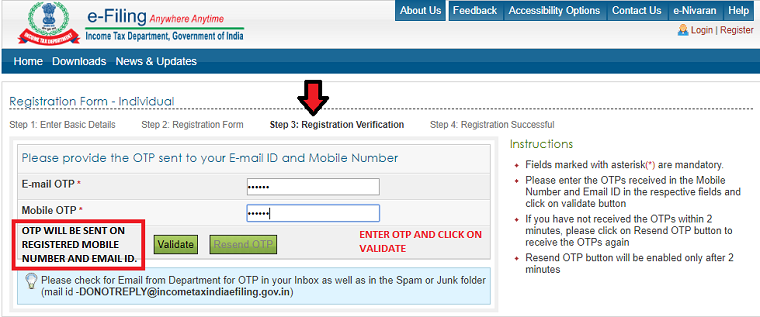

Step #3- Now verify your registration by entering OTP sent on your registered mobile number and email-id. Now click on validate.

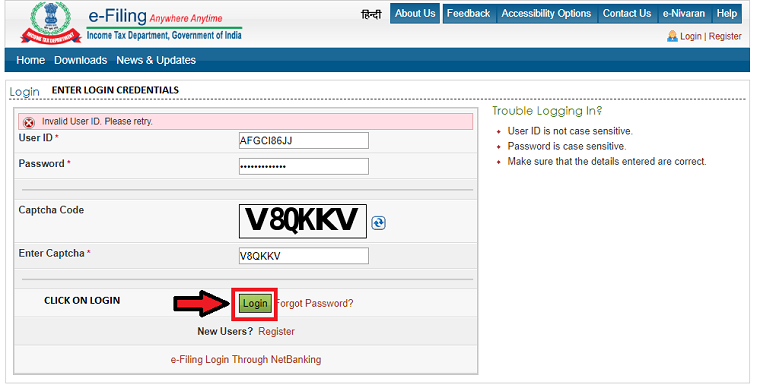

Step #4- Once you validate your registration, now you will have to log in so that you can view form 26AS

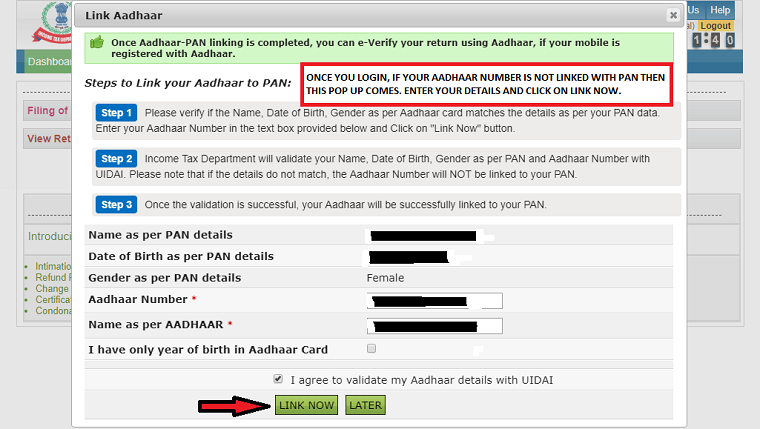

Step #5- After you log in a pop-up window comes if your Aadhaar number is not linked with the PAN number. Enter details and click on Link now.

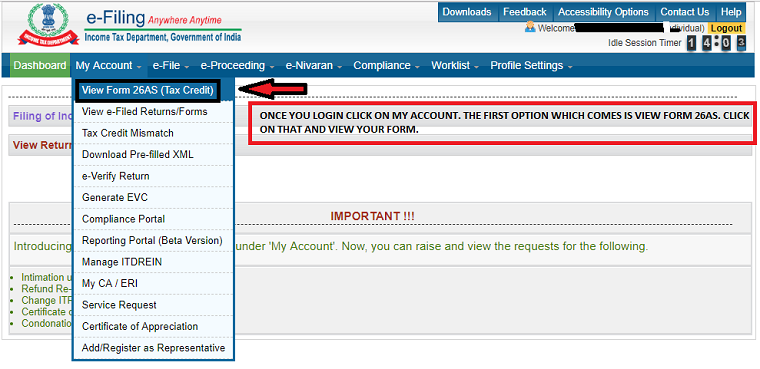

Step #6- Now you are successfully logged in. Click on my account and again click on View Form 26AS (Tax Credit).

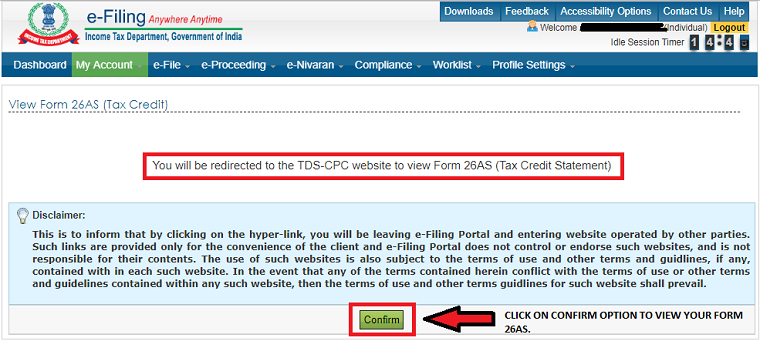

Step #7- To view your form 26AS, read the disclaimer and click on confirm.

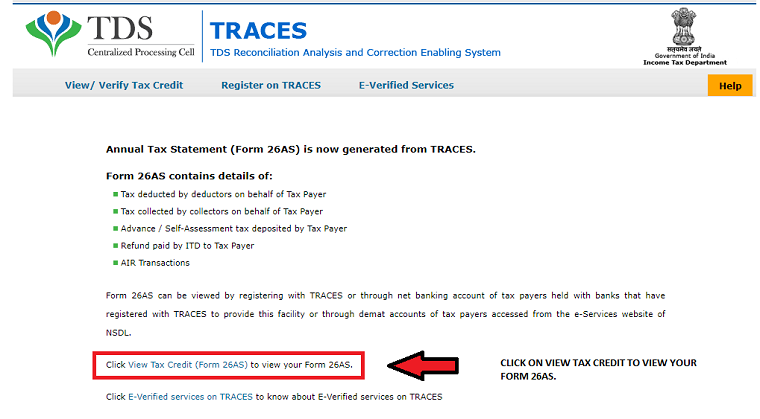

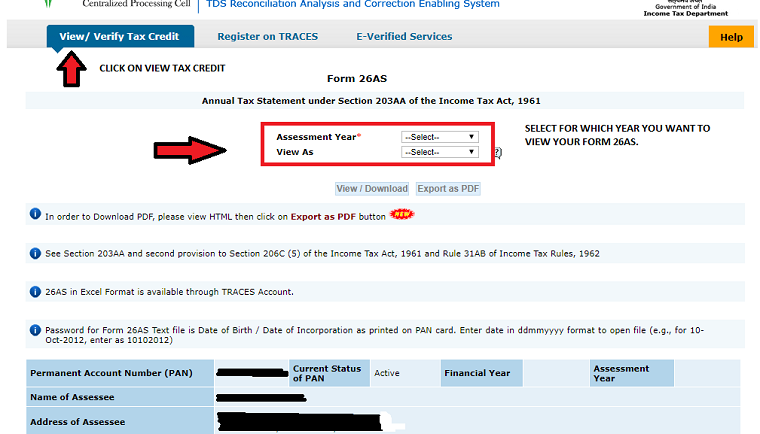

Step #8- Once you click on the disclaimer below window opens and again you have to click on View Tax Credit (Form 26AS).

Step #9- Now select the assessment year ( for which year you want to view your form 26AS) and view as HTML and then click on export as PDF. You can now see your form 26AS.

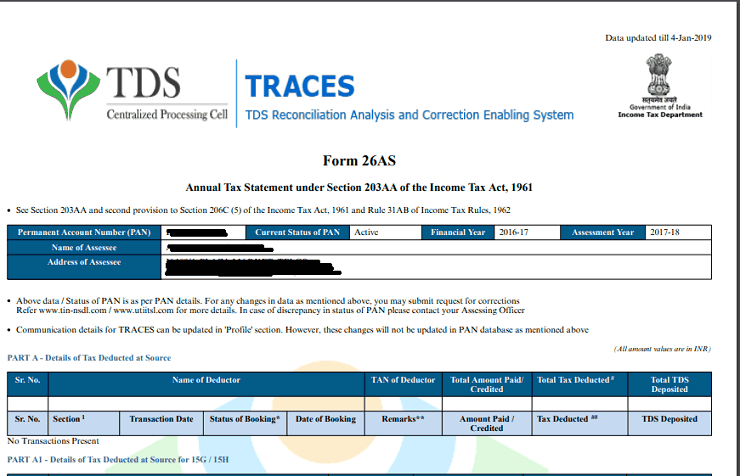

Step #10- This is how form 26AS looks like

Is it possible to link Form 26AS in your net banking?

Yes, A lot of banks like ICICI, SBI etc provide a direct link to your form 26AS through internet banking. On clicking the link, You can directly see 26AS.

Wasn’t this a very simple and easy way to register and view your form 26AS online. Let us know your past experience when you needed form 26AS online and how it was useful to you in the comment section.

June 28, 2012

June 28, 2012

Hi, how to view Form 26As for the assessment year 2008-09

Hi Chella

This query belongs to CA domain, hence we are not the right people to comment on this issue.

I suggest you get in touch with a CA for this in your city.

We also have a CA partner incase you want to explore that, Just fill in your details here and they will give you a complimentary call back

http://jagoinvestor.dev.diginnovators.site/solutions/ca-services

Manish

Hi manesh,

i paid TDS for purchase of immovable property late and now i have been assessed and asked to pay Intrest on TDS , i would like to know how can i pay this intrest online thru Trace, please help me with FORM number etc to be used online.

how to verify/check my contractor small service provider status?

I mean is there any possibility to check his form 26AS to see his turnover last year.

No you cant check it like that

How can i get 26AS form before AY 2009-10. I am looking for 26as form for AY 2008-09. I tried TIN-NSDL website, but it gives error.

Thanks.

Hi Amol

Thanks for asking your question. However we do not have answer to your question.

Manish

I think it is a futile exercise to register on TRACES website for NRIs. I have Form-16A with the tax deducted on interest income. I used Option 1 which asks for TAN of deductor, month and year and the amount deducted. After 30-45 minutes, I got an auto-reply that my registration was failed. I tried using details from previous Form-16A changing the date/year and amount, everytime the result in same. I sent a “contact us” and hopefully someone will respond. But so far there seems to be none to address the issue.

Yes, its not for NRI !

Hi Manish,

This doesn’t work for NRI’s which is very frustrating. Is there anyway I can get a form 26as emailed to me? Banks like Canara Bank just don’t issue a from 16a.

Thanks

Regards

Pradeep

I m not clear on this

Thanks Manish, It got solved.

Hello Pradeep, May i know how it got solved? I’m facing the same problem.

Hi All

I found at last a way to access the Form 26 as after reading a lot and registration failed few times. These are the steps I followed .

1.Click on Know your Jurisdictional A.O. enter the details and verify the accuracy of PAN details

2.Go to “https://nriservices.tdscpc.gov.in/nriapp/login.xhtml” and register your self as a new user even though you are already registered with “https://incometaxindiaefiling.gov”. Enter all the details in the new user registration (Fill all the columns even though only surname/last name is mandatory ,not to leave any columns blank even in the address column ) .Once you are done ….The amazing thing happens you receive a message from Income Tax stating “your registration is successful….”

Hope this helps …..All the best ..

I tried exactly this, but not successful. I only have Form-16A (TDS on interest income deducted by bank) and no other source of income. Can I check if you used “Option 1” (TAN details of deductor) or “Option 2” (Challan number).

Hi Laksh

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi Laksh

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

ManishHi Laksh

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

How long does it take to reflect online tax payment using challan 280 to be shown on form 26 AS ? I made online tax payment through SBI today ( 20-08-2015) but it is not showing on form 26 AS on nsdl. Thanks in advance for any help on this.

I am not sure on this

It is showing now ..took about 10 days.

can a person download 26as form of other person without his consent and circulate among other persons just to defame him.is it a cyber crime

Is it a cyber crime if one person download other person”s 26AS Form without his consent

why should it take more than 5 days for the tax paid into the banks to be reflected in 26AS form. I thought everything is computerized. I am waiting for 8 days to e file it return. 2 days used in filling it return and calculate tax and then tax paid five days ago still it is not reflected in 26AS . my efiling is delayed.

Hi VENKAT

I am not sure why it takes so many days . You should check it with the bank

Hey Manish (or anyone really)

How do you access Form 26as from the United States??

Every time I try to view income tax statement using bank or those websites mentioned, it directs me to a TRACES website….and it IMPOSSIBLE to register there because they ask for either a TAN number of the deductor (unknown) or a challan serial number (unknown).

Anyone else running into this problem?

And I thought we Indians were smart. What knuckleheads do we have running the government?

Gjab, it seem India govt is corrupt as usual. NRI money in india bank can be stolen, not gurantee, no FDIC like US. Bank not pay tax to your pan, then govt will charge YOU and take it all your money in bank as penalty. it willhappen to all NRI. That why no helpfor NRI from any site

Hi Manish – I am unable to get 26AS from the traces website for the AY 08-09. It is available only from the AY 09-10 onwards. How can I get 26AS for AY 08-09, please help

Hi Lloyd

Refer to this https://in.answers.yahoo.com/question/index?qid=20130907035937AADoLl9

26AS FOR AY 2008-2009 IS NOT VISIBLE. refund from AY 2012-2013 IS directed to AY 2008-2009.

Are you check it on TRACES website now ?

I and my wife jointly deposited an amount of Rs 150000/ two 2 years back for our future safety in united bank of india (baruipur municipality br.) . I never earned a taxable income throughout my life and now I am a retired person.

In last month as I know ,an amount of Rs 3044/ has been deducted from my account as TDS without noticing me. The bank officer gave me a statement of that and with that statement I went to income tax office but they told me that, the amount had not been deposited in my IT account while my PAN no. was not given to the bank. More over the bank officers don’t want to help me any more.

In present situation, you are requested to advice me possible remedy to get back my money.

Thanks,

Samkar kr pal

Just file a RTI and they will be on toes .. File RTI and ask your questions .. Also tell them you are complaining to banking ombudsman !

Manish

Hi

CPC department had raised the demand letter of more than rs. 50k. I have Form16 but I dont’ have Form 26AS. My problem is, IT department want this form to varify and the finance department of company is not ready to give me this form (Trying to avoid me). Also it is not availabl on TRACE website since company had not uploaded the data.

Can anyone tell me, what I should do in this scenerio?

Thanks in advance.

Not sure what you can do here, better use our forum for this – http://www.jagoinvestor.com/forum/

Dear Manish,

Thank you so much for your quick answer. Actually i have been complaining to the bank for last 45 days but they are not giving me any kind of answer. Even i have addressed there ombudsman.But got not reply at all.

Actually i am above 60 and every penny i have earned i have made 3 fds and those are the primary source of my income now a days. That’s why i don’t want to bring any trouble to that bank. Do you think my investment will be safe if i sue the bank in front of RBI.

Regards

Castial

Yes, your deposits are going to be safe . Banks can take revenge or anything like that ! .

you mean Banks can’t take revenge or anything like that . Right?

Regards

Castial

Ahh .. I meant CAN NOT

Hi Manish,

Actually i am a senior citizen. I had 3 FDs with a Bank. The total amount of interest were more than 10000 and they have detucted some TDS from it. But when i see the 26AS of 2013-14 i see that 2 out of 3 charges are missing. Several times i have written emails to banking ombudsman of that bank but i have not received any word from them in this matter. Could you please tell me how serious this matter can go be if i inform RBI about it.

Thanks

Castial

Anyone cutting TDS has to update it to income tax website . If its not done , then you are liable to complain for it . Just that how much time has passed in this ?

Hi Manish,

My 26 AS does not have entry of HSBC in it.

I’m wondering – how can they forget.

Isn’t this their responsibility to do that?

With this – there’s a potential chance of submitting the tax.

if the info is missing in 26 AS, do they charge penalty to the bank consumer or bank?

Thanks,

Sachin

Yes, its there responsibility to make sure they intimate to Govt about it . If they have not, better contact them about it

Dear Manish,

The tax deductions for rent payments received do not show up in 26AS as the co says my pan details were wrongly mentioned ,and they say they have taken up the matter for correcting the details .now if i E file my returns assuming the same ,do i invite trouble as they say the process will hardly take a weeks time to reflect in my tax credits and where as the it takes a months time for the IT dept to discover any mismatch ..

Its not your mistake . pay the tax as per your actual incidents and do all the corrections later .

Dear Manish – I am also facing the same issue. I need to verify the 26AS for 2008-09 and they are not available online. I read on internet that one can send a email to ‘[email protected]’. On sending email on this ID, they replied back to connect with [email protected]. I sent the email to this ID and also tried calling on the helpline. But there has been no response. It would be great if you could help us with the detailed procedure to manage this issue.

=======

We refer to your email. In this regard, you are requested to contact Central Processing Cell (CPC) – TDS Delhi managed by Income Tax Department on below mentioned contact details.

Email ID:- [email protected]

Toll Free Number:- 1800 103 0344.

=======

You need to get it asked on our forum http://www.jagoinvestor.com/forum/

Contact tdscpc? Ha Ha Ha.

It is one of dumbest service and info providers.

U can get nothing from them.

U will not get proper answer even regarding their own site problems.

GOD SAVE THE STAKE HOLDERS.

Hi, I have a demand notice from the income tax department for AY 2008-09.

However, I am not able to check the form 26AS for the Assessment year 2008-09 on the below website as it only shows the form 26AS from AY 2009-10 onwards.

Please let me know how to get the same?

https://services.tdscpc.gov.in/serv/tapn/view26AS.xhtml

Tough thing .. still file a thread on our forum to discuss it – http://www.jagoinvestor.com/forum/

I am also facing the same scenario. I have a demand notice for missing TDS for Assessment year 2008-2009. Since the 26AS forms are no longer available online, how do we show the IT department that the TDS has been deducted ?

Is there any other way to get older 26AS ?

Thanks,

Yamini

I think only a good CA will be able to help you now !