How to Check EPF Balance online ?

A lot of us do not have even an idea on how much money we have in our Employee Providend fund account (EPF) and how to check EPF Balance online or offline. So in this post we will see how one can check his EPF balance online and get the details back through sms . Earlier I used to search a lot on checking EPF balance online and I came across some links , but most of them never worked. But few months back I successfully got sms with my EPF balance status. Let me show you that.

How to check your EPF balance online ?

- Go to this EPFO website link

- There will be a link below the page to check your EPF account balance status online , click on that (direct link)

- You will see a drop down there to select the PF Office State ( like Maharashtra, Karnataka , Delhi etc) . Select your PF office .

- Once you select the State , you will see a list of different cities office, like for Karnataka , you can see one of the options as “Bangalore” along with the “data available upto” date , so you can get your PF balance till that date only .

- Choose the city office

- You will be taken to the page where you will have to fill in EPF account number , Your Name and mobile number and Submit.

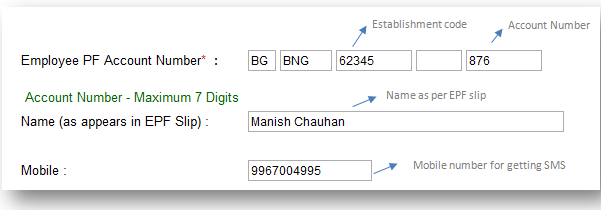

How to enter your EPF account detail ?

For an example lets say Manish Chauhan worked in Bangalore and had a Employee Providend Fund account with number KN/62345/876 . This name “Manish Chauhan” is the name appearing in EPF slip .

In that case 62345 will be the Establishment Code (which will be first blank column) and 876 will be the account number (third column) . The second column will be blank in most of the cases , it’s actually the sub code or extension of the establishment code.

Important Points

- Note that the name should be exactly same as it appears in EPF slip

- The office and state have to be selected properly , In a single start there can be many offices , make sure you choose the right one.

- The SMS can come a little late , so please be patient

- The amount can be only upto a certain date which will be mentioned in the SMS

Can you share if you have are waiting for your EPF money from long time ? Are you facing problem in getting right information on why your EPF money has not reached you ? Were you successful in the enquiry of EPF Balance online ?

February 9, 2012

February 9, 2012

I Umarsherif Ilal former employee of CBOP (now merged with HDFC Bank Ltd.) For which I have worked for 18 months, from March 2007 to Sept. 2008.

I had submittitted my PF withdrawal application, for the service provided in CBOP/HDFC Bank Ltd long back, since my salary account with HDFC has been closed, the PF payment cheque which you had sent got returned.

On 14th Jan 2011 I got Paralysis attack. It was such severe brain attacks that, half the body is still not responsive, unable to talk, read and write properly. We consulted many

Doctors/hospitals and spent enough amount of money. Because of this condition I was not able to follow-up the cheque returned issue.

Thus in this condition I am giving you my another SB account which is in SBI. Kindly, consider the same account for future transactions.

The SBI bank was given a letter that, I can’t sign/write from right hand for bank transactions, and for that they have approved my left hand sign, on

Submitting of Medical Certificate issued by Authorized Medical Practitioner..

By this I request you to kindly look into the matter and please do assist in getting back my PF amount. Please do the needful

SBI Hubli Main Branch

SB Account: 30340400021

PF Account No. MH / 44678 / 25900

Hi Umarsharief ilal

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Hi sir I have tried online online transfer to my new pf account but I did not submitted forms to my company so it is in pending status , now can I claim my pf amount without employer , using form 19c or it only can only transfer to my new account .. But I want to claim directly please suggest me any idea in briefly..

Hi Arun

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hello sir

Guruprasad

Am working in 4;years company bt am left from job because my personal problems

All ready 1.5 year complete still now also Nt take my epf amount please suggest me sir

Hi Guruprasad

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi Sir I obscond from my previous comp for some. Personal reasons .is there possible to with draw my pf amount

Hi kiran

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Hi sir my company to change other company

Hi Naresh

I am not clear on what is your question. Please repeat it with more clarity

Manish

Hello Sir,

I have worked in a company from 12th Dec 2015 – 24 June 2016… but when i check the PF balance, still my balance is showing as updated till Dec 2015… When it will show till June 2016 and will get my full amount?. Please advice

Hi Ramarao

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

Dear sir i dont no my UAN NO i have pan car how to withdra my EPF amount Please tell me

Hi SHASHIKANTH

To know your UAN No. go to – uanmembers.epfoservices.in with following details :-

PF number – You can get it from the salary slip.

Date of birth

Name- as in the PF records.

Mobile number – you should possess the mobile as PIN would be sent on the given number.

Sir. I have left job In 2015. i dont know my UAN NO or i dont have pan no. Only i have given my bank account no. during joining. I dont have payslip. How to withdraw EPF Money.

Hi Bapi

Check with your HR Department.

Sir i have filed the pf form long back n my company gave me stamp also but due to some reasones i was not able to submit it . Can i submit it n can i change the bank account number on it n will i get my pf as i left my company in 2010

Hi Vijay

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

Hi Manish,

I left my last job in may , I have only pay slips, I don’t know that UAN number.can I withdraw my full pf, plz help me how to proceed.

Hi Manish sir, I left my last job in August of 2015, and when I check my pf account balance, in this month August of 2016, I saw that there is a balance of rupee approx 600, but I worked for that company for 8 months, and they use to deduct 1050rupee, for my pf every month, I am having a salary slip, and it’s mentioned in salary slip deducation of rs1050 for pf.So plz kindly help me wath to do .

You need to first check it with your employer if they are DEPOSITING the PF money properly or not . At times the balance you see might be for an old date !

hi manish sir i left my old company 2years ago i din’t apply my pf. presently i am working as a contract employee in other company can i withdraw my old company pf now?

Yes you can do that

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

Sir, I have a old PF account around 9 years old. Now it not updated to my new a/c. The old company is closed now. What is the procedure for withdrawal of my old PF amount or add to my new account.

You need to still fill up the EPF transfer form and EPFO will help you on this.

Hi Manish

Im employed with a company for last 10years in row but now due to soical responsbility I need some partial withdawarls from my pf account is tat possible

No

Hi Manish,

I left my job in 2010 Wat is d easy way to get my full pf amount.

Hi Harshavardhana

To withdraw the EPF, you can always fill up the form 19 and submit it to EPFO office. After few months try to follow up with RTI

Manish

in old records my date of birth is entered by epf office ie 03.03.1987 but actual is 03.03.1981

Hi kvganeswararao

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

I don’t know my uan no but I know the of number, employer also doesn’t my uan no. Could u plze tell me how to generate uan no by using of no.

Your employer will generate it for you. COntact them !

Hey manish,

In the epf balance message, what is the difference between balance as on and account updated up to.

No idea on that

Hi Manish,

I am getting invalid input / member name mismatch against this pf# XXXXXX

Since my PF is being maintained by trust , i believe that’s the reason i am not able to fetch the data from PF site OR my details are wrong there on my PF account. Is there a way i can contact PF department and get this clarified? You have mentioned file RTI , can you point me the right place to file that please.. Thanks for all your help!

Hi Chetan

I suggest that you now take the RTI route. You can file the RTI and ask your queries to them. THey are bound to reply you on your queries.

Its a bit long cut, but works well

Manish

HI Manish,

My Previous account is HIL EPF Trust-HR/5588/183711, I wanted to transfer to new UAN. Can you please let me know how I can do that online From Trust account (HIL EPF Trust-HR/5588/183711) to new UAN.

Hi Hans

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish

Hi Manish,

I tried following the same procedure but i see that i get an error message ” Data not available”

Could you please tell me what could be the problem?

Thanks,

Mukul

I am not sure in that case !

hi,

My pf number will start with KN/25xxx/24xx.

How can i check in portal. I could not found with Starting with KN fallowed by number.

Please advice on this.?

Thanks.

same problem with most of the HCL employee. Data mismatch, name mismatch, date of birth mismatch. I want to know how to login into HIL EPF TRUST. What is this.

Hi sunil

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish