A close look at Real Estate Returns in India

Real estate is one of the largest employer after agriculture in India. It is also a globally recognized sector which is witnessing a high growth in recent times because of increasing demands of offices and residential places.

One of my friend has shared his own experience about real estate, let me share it with you.

One of my friends experience about real estate:

“The current market value of my flat in Mumbai is close to 1 crore, I bought it at 28 lacs in year 2000. The returns have been Mind boggling 72 lacs in 9 years, i.e. 8 lacs a year approx. , more than my current salary and now I am planning to invest more in real estate instead of Equity, What do you think”.

A not so close friend was discussing his Real Estate portfolio with me.

He belongs to first category of common sense deprived idiots, who do not understand mathematics well. 28 lacs flat became 1 crore in Value in 9 yrs, the returns are great, but not exceptional enough to make someone eyes pop out.

Simple math’s will tell you that its 15.2% CAGR return over 9 yrs.

Now what’s so great return about this 15.2% Return?

15.2% return over long term is desirable and great and what’s normal return from Real estate in last decade in our Country, The only thing irritating is how people make fuss about it.

Even Gold has outperformed, Gold was $300 per ounce in 2001 and now it’s close to $1100 ounce, that’s 15.5% return, 0.3% more. On the top of that Builders are not keeping their promises of Delivering Projects on Time and with same quality Promised.

Real estate investments have caught everyone’s attention in the past decade and every Tom, Dick and Harry with 5 lacs salary tries to grab a 40 lacs flat. I will try to throw some light on Average Real estate returns in past 8-9 yrs in India.

Coming back to my Friend:

I told him that it’s been a very good return, and I appreciate his timing, good job. But definitely he is bragging more than it deserves. A second person (his friend) suddenly comes to his rescue and challenges me.

“But Manish, I bought a flat in 2003 @20 Lacs with 3 lacs of down payment and rest a home loan. I spent total of 7 lacs till date and the flat is already quoting around 60 lacs, that 40 lacs of profit in just 3 yrs through investment of 7 lacs, that’s 78% return on annual basis”, showing off his fast calculations skills and giving me a “anything-else-you-young-financial-planner” looks his face .

These people are from another category of “common sense deprived and mathematically challenged” people. It is worse than first category. The problem with these people is that they do not understand “leveraging” .

What is mean by Leverage?

A situation of sitting on huge profits by just investing a small amount as down-payment and rest with home loan is pure example of leverage and very common in India, This gives a feel to people that they are very smart.

These people never consider the case when their house value drops by a big margin like say 15 lacs and they have just invested 5 lacs from their pocket, then they are in loss of -300% (absolute). But as you know, investors like to consider a rosy picture; they somehow believe that it can’t be the case with them.

When Real Estate broke in US:

As US citizens who bought Real estate in the middle of the Bubble just because credit was cheap and they could have made a lot of money by taking a Home loan and almost nil Down payment, When Real Estate broke in US, people who has put $10,000 from their pockets for a $4 million house were in losses of $1 million, because they had to pay $4 million as a loan money for something which is now costing $3 million.

That’s an unrealized loss of $1 million in a short time. That’s the problem of Leverage. Investors never think about this, India is a success story and housing is scarce, that’s enough for them to take a chance.

With my amazing quality of self-control, I kept all this in my mind and didn’t argue with him, sometimes your skills of explanation is limited to blogs only.

What is RESIDEX?

Don’t feel amazed if I tell you that there is an Index for tracking Real Estate in India. Its called Residex and maintained by National Housing Bank in India. It’s updated once every 6 months.

It covers all the major cities and the sub-areas in that city. The index Value over time will tell you how real estate prices are doing in some area or city.

Please understand that these prices are average real estate prices and not some general case which would negate what we discuss here today.

I don’t know how that is calculated but a common sense way of calculating it is to take a sample of real estate plots/flats in an area (for example 1000 units) and calculating the appreciation in value from last 6 months .

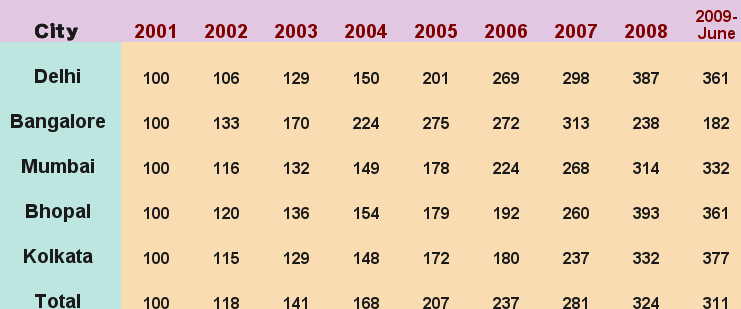

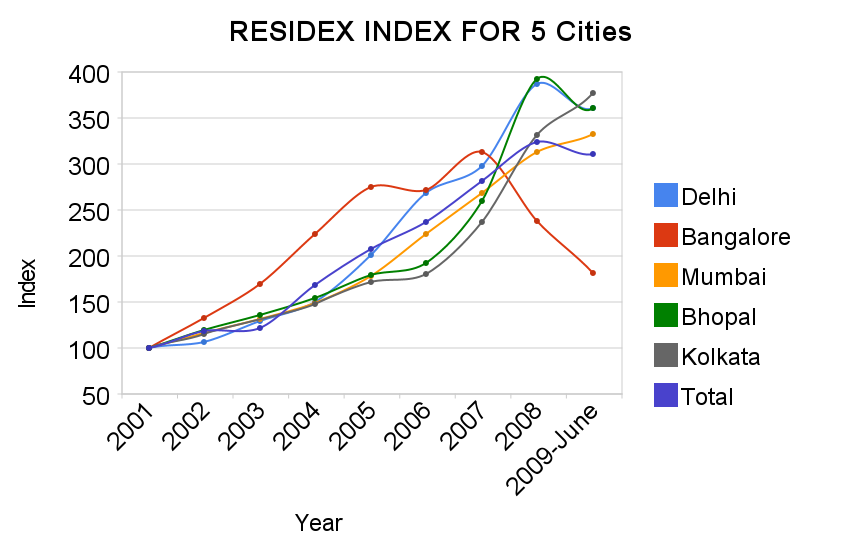

Lets see the RESIDEX values for 5 cities

Here is the chart of the same table

What is the mistake people do when they calculate Returns?

The beautiful mistake which everyone does is that they calculate pure absolute returns from Real estate which is in many lacs of rupees obviously.

So, if a person invested 30 lacs in a flat and it becomes 60 lacs in 5 yrs, they are sitting on a 30 lacs profit.

That’s a lot of money and people are excited to see that much money, but you also have to see that they invested damn 30 lacs !! for that, which is not every one’s cup of tea and the returns are normal 14-15% return/year on investment if you compare it with Gold or Equity.

You could have made more returns if you had invested in Equity (SIP in mutual funds in some top funds) . If you consider the risk taken for the return people have got in Real estate , personally I am not very much excited then, Investors forget the risk taken to get some return and only concentrate on Return part.

See an Article on GFactor , A tool to find out if an investment suits you.

What you have to see is how much return you got from something after adjusting the risk taken for that . So given a time frame of 1 year .

- If you do a FD and make 9%, it’s amazing !!

- If you invest in Real estate and make 10%, its ok

- If you invest in Equity and make 11%, its just fine.. not a big deal

- If you speculate in Options for one year and make your money grow by 500%, I would be personally disappointed a lot .

Some smart (second category people) people think that they can buy Real Estate on loan and make 30-40 lacs in 4-5 yrs from house value appreciation, While that is possible and has happened to a lot of them and definitely the return would be amazing.

But this exposes them to a great amount of risk which they don’t understand, its pure leveraging. There are better ways of leveraging than this. This kind of Leveraging is still nothing in front of Options trading in Nifty or some Stocks.

Not that I discourage people from taking a home loan and invest in real estate , but don’t overdo it , and understand and accept the risk involved, be ready for it.

“Risk happens when you have no idea what you are doing”. If you pre-calculate it and consider it, then it’s called Speculation, which is my favorite 🙂 .

An option trading is something I would recommend who have great risk appetite and dream of millions in short span of time, better than real estate.

Make sure you get updated for all the future posts , Subscribe FREE through Email now

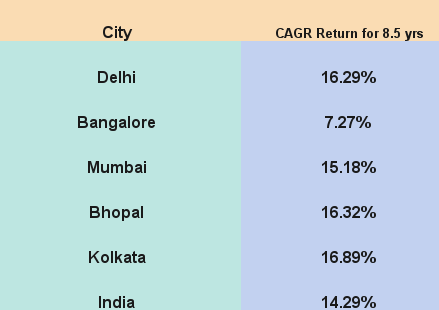

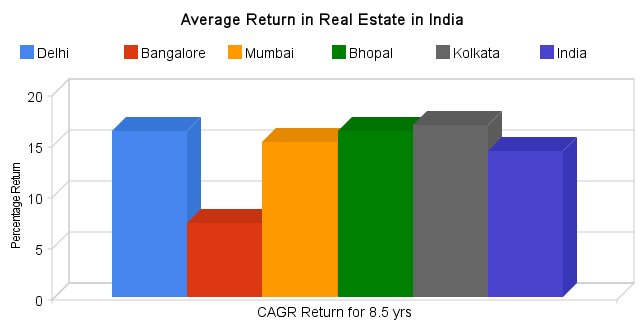

What is Average Real Estate Returns in India

IF we see the above chart of RESIDEX Values (for 8.5 years), you can find out the CAGR return of Real Estate in different cities. Let me show that for 5 cities in India.

Chart f or the same data

Note : I have assigned Index value for “India” by assigning weights of 25% , 25% , 25% , 10% and 15% to all five cities in same order .

Note : I have assigned Index value for “India” by assigning weights of 25% , 25% , 25% , 10% and 15% to all five cities in same order .

What Should you Do ?

First of all, understand that Real Estate is important and you should always invest in it for Diversification of your Portfolio (If you can afford it right now). But that does not mean compromising with your Risk Appetite and investing just for the sake of Investing.

If you want to buy home, make sure you afford it, Buy a 1 BHK which you can afford if you want to live in it. If you want more than 1 BHK, plan for it, take it later. There is no rush. Real Estate is not the last thing in the world.

Don’t feel left out when you see others minting money in Real Estate, believe me they are making similar returns which you can make from Equity, just that the magnitude of profits they are making is high, not the returns on average. So Chill !! .

Note: Understand that whatever we have talked here is based on the RESIDEX index and there will be many specific cases which would make this all talk a nonsense, but we have to look at general case and not a specific case.

Download More data on Residex from HERE (From 2001-2007) and after 2007 at NHB website. Note that you can’t get all data of Residex at one place.

I combined the data from NHB from 2001-2007 and combined it with data on their Website to construct all 8.5 yrs of data. There was a shift in Base year because of which I had to do so.

What do you think about the Real Estate Prices at the moment in India?

I do not feel they are justified and the prices are mainly driven because of unnatural demand created by easy access to Loan. People buy it, but cannot afford it, If things continue for some more years. I would be surprised to see a big bubble burst in India like we saw in 2007.

Leave your Comments and let me know you are reading this blog.

Disclaimer: I have not invested in Real Estate, I am not very much excited about it and I don’t have money for it.

December 6, 2009

December 6, 2009

This graph and info on this will look even more funny now in 2021 as property prices have fallen so much.

Someone needs to do the working again!

Hi Sir, Great analysis as always. However, I thought residex index started only from 2007. Is there any link for the data?

You can get it online .. search for it

May be I am reading this blog very late although it is very good. Giving insight of real state.

Thanks for your comment Anupam

AS of today all the investment are all time high, no body knows what’s going to happen tomorrow with any investment gold, stock, real state , Bonds, ETF, silver Etc., every 6 to 10 year of time there is correction in the prices so fare we don’t see, except 2008 real state price burst OIL from $140 it came down to $30, & stock market nifty/Sensex CRASH was down more than 60% Trillion wiped out of the market, did anyone notice…… I don’t think, very few who is really smart they minted & printed as much as they can. The best think what we can do is to wait until US Election result are declare that is end of NOVEMBER 2016. Does any one know what’s happening, no if we know, then we don’t have to ask anyone. Keeping CASH in hand is the best investment.

2009 was the best year for investment, every thing was selling @ 50% discount.

Thanks for your comment Mansoor

Well said

hi Manish ,

very informative article,thanks for sharing, earlier also you guided me ,this time i have one difficult situation , i am running my hospital since 6 yrs successfuly and since 4- 5 yr i started sip in mutual funds getting good return about 15 -18 % .accumulated about 45 to 50 lakhs for my personal purpose (apart from children education and retirement sip)now i want to own big plot for my big hospital 10000 sq ft for 1.2 cr ,i have to take around 60-70 lakhs loan for it ,current liabilty only home loan 42000 jointly owned by me and wife ,she is a govt servant .

my query is that i should take risk and loan for property for which i have to redeem my mutual fund amount ( which are getting compounding benefit after 4 yrs) or

i should drop my bigger hospital dream and just focus on my existing hospital improvement.

Yes, If I were at your place, I would have taken the risk and built it !

if you are confident that you can earn more by taking you do first option for bigger hospital -remember that now with bigger one you have to spend monthly expenses also increase

instead of going big part of loan you improve your old one

Manish, great article as usual. In India, real estate prices went through roof between 2003-2008. This period coincides with the period when even equity markets did equally well if one looks at Sensex.

However one does not realise that fact as generally original capital invested is small here compared to down payment in buying an apartment. If one considers 15 year period, if one invests the same amount through SIP as much as EMI, the equity returns are likely to be similar or a little better in amount terms and they will come in a tax efficient way with a high level of liquidity compared to the real estate.

Having said that, it may be lack of liquidity that forces real estate investors to take a long term view. Also no one sells real estate because prices are down on a day as in case of stock market. 🙂

Thus in stock market a lot of people can’t get even the market returns as they try to time the market and enter and exit at wrong time, rather than staying there for a long time. So it may be a good idea to have a home as a consumption asset where you can stay, but investing in multiple homes may not be an optimum way to grow the Wealth.

I agree with you. Beyond one real estate, I dont think for a common man it makes a lot of sense, unless its a very good deal or great potential investment

Thank you Sir for all this info. Please if you can give your opinion. I have just bought a 2BHK flat on ground floor in Haridwar (Uttarakhand) in Deepganga Apartments ( Delhi Apartments Pvt Ltd). It cost me around 35 lacs. I have bought this on staff housing loan and the installment is coming under Rs 12000 pm. I’m working in a bank. I want to know that how much return should I expect on the property in next 5 or 10 years. Or if I sell that flat within next two years, will I be on safe side? I mean I don’t care if I do not get a fine return but how much can I fetch from that property. As Haridwar is a place where people are still buying plots and making home. Though land rates are now growing much there. My flat is about to be ready for possession. Please let me know if should I worry about selling that property if need arises to sell or should I be assure to at least get back my investment. Deepganga society is in center of the city. People are residing there in good numbers. Please give an idea about future prices of my flat there. Thank you 🙂

Hi Manu

I think we cant predict the home prices like this.

Thank you Sir.

Although I do agree with the idea of not buying a house but not solely on the basis of returns. What hasn’t been considered here is the opportunity cost of buying, that is , renting. That is the major comparison variable which should be used in the decision making along with(in) returns(unfortunately that hasn’t been considered).

Here is the bigger picture: Rental yields in India are very low compared to the other nations.

Example: Consider a 2 BHK in Mumbai which rents out for 40K per month.

The purchase price of the similar flat would be around 2Cr.

With 15% down payment (let’s just say 30 lakhs are lying around with you which can’t be invested anywhere else. Woah!), the EMI comes around to 1.5 lakhs + per month.

Now compare that to 40K you were paying as rent. Even with the generous capital appreciation of 20%, you won’t start saving on this before 15 years. (all approx figures just to give the bigger picture)

Oh wait, I effortlessly assumed that if you can pay 40K per month as rent, you can pay 150K as installment. No biggie! On the basis of HRA of 40 % ( metros), my salary would be 100K per month! (Case closed here!!)

Case reopen: You are not going to buy a similar property as you would rent. You don’t want the same lifestyle when you have your own house.

That makes any study impossible then! But anyway let’s look at it.

So what we are saying is that the comparison should be apple to apple right? Let’s say our apple is the monthly outgo, then we are looking at a property which costs around 50 lakhs on which we can pay the approx 40K EMI for 20 years. Since we are still in Mumbai, we know what we can get in 50 lakhs. If you are happy with that lifestyle downgrade. Good for you! Just remember it won’t end!

Yea Vineet

I agree that this article was written by not many things in mind. I will try to bring more elements in this article. Give me some time .

I think you have given some good analysis with numbers

Very good article. I feel the worst thing that has happened in india in last decade is the exhorbitant rise in real estate prices. because of this common man is badly affected, sometimes without knowing. Due to high real estate prices most of the businesses have become uneconomical to run. Imagine a barber buying a space for his saloon for 50 lacs. after this whats his option – charge very high prices if he can otherwise suffer a big loss. Only a hope of being able to sell his shop keeps him surviving. similar is the case for people owning or renting shops everywhere. This results in higher costs to every consumer.

High re prices are frustrating the young generation who wants to buy a flat for actual use. Black money generation is another evil of RE investment.

Worst many indians have started thinking of this easy money – invest in RE and do nothing else productive- retarding the progress of society in general.

Case of NOIDA farmers buying mercedes cars after selling their land and then later going back to reclaim the land is a case in point.

I wish the govt takes note of all these disturbing trends and discourage investing in real estate.

No body should be allowed to own more than 1 residential property in a city and maximum 2 all over India.

PSBs must not be allowed to extend the repaymnet schedule of loans given to builders.

Housing construction standards (like BS) must be developed and strictly implemented by govt.

In my view housing is a need and not investment. Hoarding RE is more like hoarding essential commodities – which is a crime in India.

Hi Subhash Chandra

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

In metro cities still there is huge potential atleast in affordable housing because of the initiative taken by the modi goverment housing for all by 2022 so if you invest in this sector it can give you good returns.

Hi Arun

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Dear Manish, thanks for the informative article. I am 28 yrs old, unmarried & I would like to start investing in mutual funds from now itself. I am right now not interested in opting for Real Estate as investment. However, I am facing a lot of opposition from my parents, close relatives and close friends with whom I discussed about the same. They are all of the opinion that I should only invest in FDs and Real Estate (that too, preferably flats).

I tried to convince them about the benefits that mutual funds offer over Real Estate – the generally higher returns over the long term & that since it is liquid, I can quite easily shift my investment from a poorly-performing fund to a well-performing fund – now, if I purchased a flat and it did not appreciate as per my expected goal, will it be easy to sell it immediately and purchase a new one without much effort?

Despite all these facts, my folks are still adamant – they say Real Estate is a time-tested proven approach of wealth appreciation which their fathers followed, their uncles followed and many of their friends are following & that on the other hand mutual funds are a new-fangled notion without proven track-record…some are even going to the extent of comparing mutual funds to gambling dens where I will end up recklessly blowing off my hard-earned money investing in unreliable and sometimes fraudulent schemes!!!

Despite all this, I am sticking to my decision of going for mutual funds right now, but I am just expressing the amount of pressure and opposition I am facing because of it 🙂

Thanks for sharing that amazing experience you are having. I can totally understand your problem and its a issue with how one is experienced with this opposition. I will use your experience in one of my upcoming article

Dear Prashanth

Just a thought. Great economist Keynes once said that it is fine (read acceptable) to fail conventionally than to succeed unconventionally. Our society is crippled with age old idea of buying property. And I don’t blame them. LIC and property was all they knew about. Our time is different and we should adopt it accordingly.

And to be frank, crowds of people submitting themselves to a lifelong of unaffordable debt actually excites me as I am definitely not gonna one of them. Each and everyone of them can’t be right at the same time. They can at most get a mediocre return. With equity I can at least be sure of 12% return. With some knowledge you should be able to enhance it to 15%. An option I would choose any day.

Nikhil

Hi Manish,

Read this article in Economic Times: http://articles.economictimes.indiatimes.com/2014-07-25/news/52026608_1_real-estate-equities-various-asset-classes

which will tell you that Real Estate returns have beaten the equity market over the last 23 year period from 1991 till 2013. Of course, in 2014 equity surged by 30%, but it will still be below the 20% CAGR given by real estate !

Will love to know your comments on the Economic Times article!

Will check that !

Your answer lies in the post. The data is not reliable for drawing a conclusion on the winner. And the most alarming fact is that real estate has grown 670% in 2008-2012. That got to be a big bubble like the 2000 IT bubble in US. People are paying anything for a house without any regard for their future liabilities. Wait some time and the prices shall fall. You at least need to give a window for a big IT recession to arrive where people lose (hopefully not) their jobs and can’t pay their EMIs. You will see a mortgage crisis.

The Post:

It said that the realty sector performance has been measured based on the average of the land rates (1991-2006) and circle rates (2007 onwards) set by the land and urban development authorities for residential property in Delhi.

These have been used as a proxy for real estate prices since reliable data is not available for the period since 1991. Furthermore, the rental yields have been sourced from various new reports for the respective periods, the study said.

Dear Manish

Actually we are living in chawl system which goes under developement 3 years before and we are getting flat of 325sqft. But this flat is of my mom & I also have 1 brother & 1 sister. My brother is living seperately & my sister is married & living in house & giving rent Rs 5000/month. Only I with my wife is living with my mother.If I want to take this flat I will have to pay to my sister & brother as they also have their share in mother property. I have owned one flat in kondwa pune some 2 years back at Rs 1500000. So I am thinking of selling that to pay the share of my brother & sister. But by that I will lose my self owned property. And I am thinking to purchase 1bhk flat in mumbai in suburb by taking loan of Rs 2500000 from bank so in which area should I purchase from where I can get good returns in future if I give it on rental basis.

Please suggest me whether I am going on right path or on wrong path.

With warm regards

Raees Ahmed

Seems a right path to me .. go ahead

Hi Manish,

Good read as always.

I have returned to JI after a long time & am happy to see “happening things” here.

Just a little reminder: Please dont use “second category people” and other such words as theres no need. These people (even if taken as an example) are simply overl-ignorant who didnt get enlightened like you or many others out there (a big part played by, ofcourse JI team effforts!!).

warm regards,

Saurav

Hey Saurav

I didnt mean “second category” in bad sense 🙂 . If you read the article, I was talking about 2 different types of people . I had talked about 1st type earliar and then was talking about “2nd type” . Seems like I didnt give much thought to my wordings 🙂 . Will change that

one more important thing for achieving financial goals it is better if lesser real estate exposer. For middle class or below middle class persons it will be very hard accumelate large sums of money to invest in real estate. we can easily liquidate real estate properties. Even for HNI clients. It is advisable to invest according to their risk appetite. It is also important to re balance assets as per ones risk appetite frequently. Can we sell 1 yard of real estate property for the purpose of re balancing. Any how for achieving goals like child education and retirement real estate investment is not suggestible.

Whats the query here ?

[…] nice article on over leveraging on house and housing loan… Real Estate Return in India in last decade Just go through and put your […]

Hello Manish,

Very good article indeed. Helpful for a guy like me (Software Engineer 🙁 )..

I have a question for you: I have a LIC home loan for 27 lacs for 25 years (EMI-Rs. 25013). At the time of buying the flat, my salary wasn’t supportive to have higher EMIs…so took a decision to increase the tenure to 25 years. It is for 2 years at fixed interest rate of 10.25%. I guess LIC charges 2% fees for prepayment on any amount if paid during first two years. But my question is (I know answer but want to make sure): Whether this prepayment amount would be reduced from principle amount only? Lets say after 6 months of EMIs, remaining principle amount is 25.5 lacs and make a prepayment of 5 lacs. So remaining loan amount would be 25.5 – 5 = 20.5 lacs?

Sorry for a dumb question… new to real estate world…!! Today I paid 5th EMI only.

Also, what would you suggest is the better option –

1. either to make prepayment on regular interval (for eg. quarterly) and keep paying EMIs (Rs. 25013) or

2. reduce the tenure to 10 years (EMI would come down to some 38000, but total interest would substantially come down).

I do not know about future, but for at least next two year I can afford 38000 per month 🙂

Thank you very much in advance !! Have a good day….

Yes it would reduce the PRINCIPAL Amount and the new amount will be 20.5 lacs

1. Keep making prepayments , your tenure will come down drastically

2. Its the same thing , when you bring down the tenure, it means you have the ability to pay more money , which is nothing but prepayment only !

Thanks for the answer, Manish. 🙂

Hi Manish :

This is a real eye opener, which removed my confusion over Real Estate Returns. I read the whole article today and I came across a gentleman saying that he had invested in REIT and then later invested in a flat with the returns from REIT. Can you please suggest what is it and also advise whether it is worth investing now?

REIT are still not functional in India as commercial retail products , it will take lot of time to come

Thank you Manish. Are there any other product similar to REIT in India?

Not right now

if REITS COMES IN INDIA IT WILL BE VERY BENEFICIAL TO SMALL INVESTORS. BUT GOVT SHOULD TAKE STEPS ABOUT THE LIQUIDITY OF REITS.

yea

[…] may also look at this: Investing in 2013 ? Gold or Real Estate or Equities ?? And this one: http://jagoinvestor.dev.diginnovators.site/2009/12/…-in-india.html Video from previous URL (http://www.youtube.com/v/iIaEXxdLpnI…n&fs=1&) I think […]

Hi Manish

Thanks for nice article. My search finally ends here, as i am searching for residex value for a span of 10 years in India but could not get anywhere. My question is whehter we are in the bubble of realty sector or not. I read many magazines but got conclusion that the average middle class people have roughly 10-12% of increment in their annual income (but CAGR of realty is 15% in india) . Adding to above, with increased inflation in present years the percentage gap is further increasing.

Great .. good to hear that 🙂