How Career affects our Financial Planning

POSTED BY ON November 23, 2009 COMMENTS (34)

“When you grow up, What do you want to become ?” , and the general answer is Doctor, Engineer or Pilot . That’s the story of 99% people . I just wonder if some kid today says “I want to become a Financial Planner” , how will his/her Parent React ?

They will either think he is an alien or they will find fault in their DNA .

So here is the main question. Where are we in our Life, in our Career? I bring this important question because one of my client 2 days back told me that He is not happy with what he does and he is looking forward to do something which really satisfies him and therefore he cant make long term commitment.s of doing SIP , Paying Regular Premium Payments etc etc, because he is not sure if he can take it anymore.

He is a well earning Software professional , but he actually never enjoys his work and actually wants to be into something like Education or Music which he loved always but had to give up because His parents wanted him to not waste his Life .. LOL . Now I am not a Magician who can fix all the problems like these .

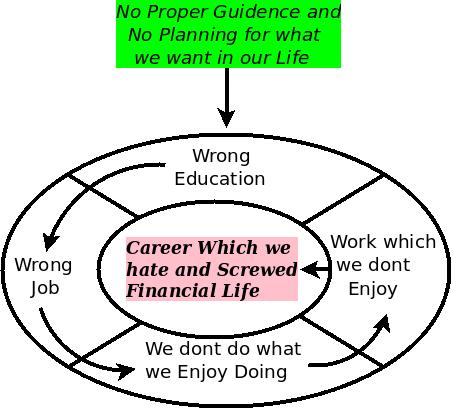

Relation between different aspects

We are today going to talk on how your Career affects your Financial Planning . Lets see how things are related and dependent on each other .Our Goals in Life are important to us, We need money to fulfill them , at least most of them .Money comes from our Jobs and Jobs come to us from our Education (most of the times) .

And Our decision of what we get in Education , from where do that come ?

Here is the root cause . Ask any MBA aspirant why he is preparing for MBA ? What kind of answers do you get ?

- My friend is also doing it

- What else can i do ?

- Good money in MBA

Same problem with Engineering and others Jobs . How many people do you know who say “I love what I do” .. “My day is amazing everyday at work and I am so happy to be at work” . Lets see a typical situation of an average Indian which is happening from Decades and needs to be changed .

“Borrowed dreams don’t make for happy realities”

“Dont let your Schooling come between your Education”

How Career affects our Financial Planning

Finally I come to the point . So for acheiving our goals and satisfying our needs of daily life , we need consistent flow of money from our Jobs , Consistent money can come in two ways

1#. You don’t truly love what you do in your Job , but keep doing it no matter what , and get your Salary every month

I don’t need to explain much here , but you smart to understand and picturize the situation , these people do not like what they do , but are dragging

from years in the same company or same profession.

These are people who make decent money from their jobs , but they are internally never satisfied from their career and somewhere unconsciously are afraid of the fact that If they loose the job or leave it themselves ,from where will cash flow in to meet the expenses .

Life is long, if you are just 25 or 30 in this situation, this situation may not look very bad to you , but wait for some more years , once you have other responsibilities like a Family and Children ,Regular Bills and Education costs , you will so stuck .

One of my friend in Pune says that “It comes to his life daily morning when he has to leave for office, He just dont like the work he does” , This is critical situation .Our lives today is full of stress , Problem at work , Issues with Marriage (Amazing Book I am reading these days) , Unhealthy life style and many more like these and combined all , It has deadly effects.

In coming years you will have to plan for your expenses and money will come from this job which you hate , and then it will be tough situation . These people unconsciously worry a lot for their Financial Goals like Child Education , Marriage , Retirement etc because they somewhere know that there are greater chances of not excelling at what they do because they just cant perform better and what is expected out of them .

These are the people who make Investing mistakes in hope for big returns because they want to fulfill their Financial goals as soon as they can . Most of the people in this category do things like one mentioned in this article

I know people who earn 90,000 per month but they are the most negative people I have seen when it comes to their future , and yes they tell me how idiotic job they do .

2#. You Love what you do in your Job and get your Salary every month

Now this is a very different Situation , here you love to do the job , Your satisfaction part is already fullfilled . If you not paid for what you do , you can still do the job sometimes and wont feel about it . I charge clients for the Financial planning , but I do not charge my close friends when I do it .

I am not paid there .. but Its fun to me , Its something I enjoy . Every new article is a challange for me, Its never a job for me . Every new comment is an appreciation and a message from you that I am being read and I write wonderful 🙂

As per a famous Chinese proverb “Find a job which you truely Enjoy and you will never have to work after that” . People who love their jobs already solve one of the big issues in daily life . When they are at Home , they are more cheerful , more energetic and tend to make a better environment around them .

These poeple Financial life is also better because they dont have a mental pressure of “making themselves fullfilled” at work . These people know that they are going to get much better in what they are doing and someday will reach heights , where they will have much better salary and hence it will help them that time if they are unable to save and invest today .

I am not saying that they dont save or invest, but they are not worried for their future . Read an interesting article on “Can you live with 90% of your Salary ?”

I know a person who is 23 and recently left his Software Job to make a career in full time blogging , He earns more than 1 lac per month now .

What is the Solution ?

Oops .. Its a tough problem to solve . The best thing I can think of is

1. Identify first if you are happy to do what you are doing , make sure you understand that you are going to do it for 20-30 yrs . I am referring to people in Software especially , because most of them just know it sucks .

2. Identify what you like to do and how can you make a career out of it . Career 360 is a good place to look for some career related stuff

3. Gradually start upgrading your skills and get some education in the field and in the meanwhile create a buffer of money which will support you for some 1-2 yrs if things fail and you can get back to what you were doing.

4. Gradually shift to other field once you are ready to make a move .

One thing is sure .. If you do what you love , you worry least about salary hikes , office politics , worry for slowdown and most important “getting Fired”, you have that amazing confidence that you are the powerful person in your job because you will always excel at what you love to do .

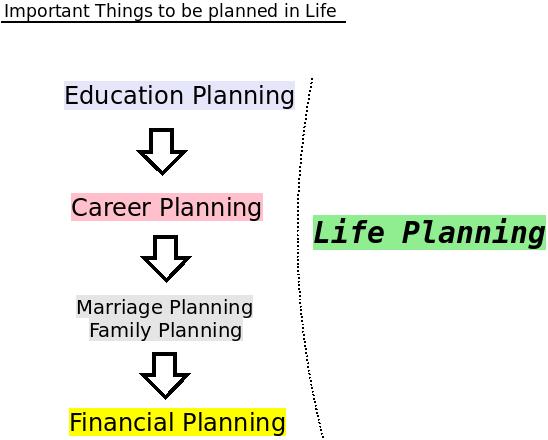

What should be the Ideal Situation

We have to plan for different things in life , some are small things and others are very important in life . Below is the list of things I personally feel are extremely critical for a successful Life .

Each of them is dependents on the things coming next in life . Your Education decides what Job will you get in , Your Job decides how much you are happy and how much you make in money terms .

This combined with how well you choose you Life partner and how great you plan your Family decides your Life ahead, and at the end what we discuss on this blog comes “Financial Planning” . It depends on various small things we generally ignore 🙂 .

So you need to ask following Questions

1. Do I love my job ?

2. Even Though I feel I love this Job , Is there something I can do better and Make a much better career ?

3. If I had to do my current work for next 30 yrs , Am I mentally Ready for that or Will I just Die out screaming !! .

4. What is it that I like to do and what are the career opportunities in that field ?

Answer it yourself 🙂

Conclusion

This is a very Important aspect you need to think about , Financial Planning is totally dependent on how comfortably and happily manage to get the cash flow in your accounts . If its a burden on you rather than a enjoyful event, you are bound to get screwed some time in coming years .

Forget how to choose the best Mutual fund and what is the cheapest Term Plan or What is the best way you can invest your 2 lacs kind of silly questions .. They are idiotic questions which we try to find answers for , answer these real questions in life first .

Comments

I am sure my writing this article at 3:30 am in morning will not go waste and you will provide your valuable comment on this .

Why don’t you let me know about what you feel about this and to what extent you agree on this, Can you suggest some ways out for this problem?

IT will always be a cake for people who are problem solvers and who truly love it. But for others who are just in it for the money, you are doing to have a very hard time in the far future. IT industry is depending on providing low cost services. If there comes a country, in about 5 to 8 years [ probably china ] that bids lower than us, all those that got into IT just for money will be facing a very tough time. China will be taking a big part of the pie from us in a few years.

Yea it can happen . I must say that its true in all the sectors 🙂

your 1st paragraph is almost copied from the book rich dad poor dad, robert kiyosaki. Apart from that u r awsome…..

So if I take a line from someone , for that “part” , I am not awesome 🙂

i didnt mean that. but i think you should add the name of the person who says that. but not a big issue apart from that your article are realy espoused to me.

A very thought provoking article.

fantastic article.

Yet another thought provoking article and it seems you read the mind of our young generation very well and coming up with excellent, informative and helpful articles.

I am sharing this article with my friends as well as book marking 🙂

Thanks Manish , excellent article.

Hi Manish ,

Thanks for nice article.What I think is “We should learn to love our Work”.

There is a good quote-Even a fool can do a work greatly when He likes that , but the real greatness lies in doing what ever work comes to you greatly.

With good attitude we can put our mind even in the tasks that we don’t like much.Changing the career should be the last and worse case as it may not suit for all.

“Changing the career should be the last ”

I dont agree with it , a lot of times we give excuse to ourself that we love our job , we should do best in our job, I agree that there can be a situation where you really cant do anything but live with the situation , but a lot of times one can actually plan for it and get out of the current job and move to a new job . thats tough 🙂

manish

Manish ,

But one problem is there is no grantee that the new job provides all his needs financially.All persons may not give time to prepare for a new career because of their financial status.So I said best way is to change the mindset.

Vidyesh a common friend of Chetan and I referred this article to me. I found it really interesting. I like writing poetry..as my financial planning is screwed up. Your blog has all the answers. Thanks for such a wonderful article. I have got a feeling I should now materialize my likings.

Thanks a lot Manish.

Sagarmani

Nice to hear that. I met both 1-2 days back only 🙂 . Nice to know that you are liking articles on this blog , find all your answers at : http://jagoinvestor.dev.diginnovators.site/archives

Manish

Nice to know that .. great 🙂

manish

Nice coverage of the points manish 🙂 And in your category listing, i fall in the first Category… 😀

I wait for the last day of the month desperately… every month :):)

.-= Amandeep Singh´s last blog ..EquiTipz is still Alive!!! Stay Tuned… =-.

Very good coverage manish, it will give readers atleast some thinking with respect to life planning…how they do it is totally different issue.. but certainly will tickle many readers…. appreciate your efforts.. keep writing….i always forward your blog links in my friend circle..

Nice to hear that .. What are your views about this . Does it look doable whatever i talk about ?

Hi Manish,

I strongly belive that financial planning and career are completely different things.

reasons behind it is –

1. Financial planning is basically money management for now , future and growing that money for future.

2. career definitely gives you initial push for financial planning but for today’s generation where income is high after certain age day to day life doesnt depend on your monthly salary if u plan it correctly.

3. I will definatle prefer to be in cash rich field for 7–8 years and then be finacially free for entire life than be in my preferred field and struggle for entire life for finance. reason being i can change field once i am free in first option.

-Amrut

Your points are well taken .

I mainly point to those people who drag in some thing for whole life . as you pointed out , If you can work for 7-8 yrs and make a lot of money so that you dont have to worry after that , It makes sense to be there 🙂 .

Manish

Very true!!! A good eye opener.

Thanks

Hi,

As usual here is ur another awesome article. it’s root cause which u mentioned here but i have a little doubt here that is if anyone complete his (dream)education at age of 23yrs and got a good earning and dream job in next year and he decided to marry in the age of 28, so should he wait for financial planning up to his marriage or should he start his planning right now?

No , Financial Planning should be started Immediately .. At the time of Planning you will have goals like

1. Marriage Expenses etc

Financial Planning is not something which you do and its intact for all your life , as and when your life changes and big events happen its bound to change at some point , so marriage will result in big change to your Financial Plan.

Manish

I am biased by Rich Dad books (Robert Kiyosaki) and I think what everyone needs to plan for is Passive Income. ie. income without working. Then one is truly free to do or become what one wants.

In one of the Rich Dad books, Rich Dad says regarding what should kids become when they grow up: “I expect my kids to be more honest and truthful when they growup”, with regards to their income, he obviously wants them to be successful in B and I quadrants and not sell their lives in the E (employee) quadrants.

I think creating passive income is a good idea , but not sure how is it related to current topic , can you elaborate .

what are B , I quadrants ?

Manish

U need job for money. So here the need is to have money which is why u need to do the job. The job may or may not give u satisfaction, but it is surely giving you money. Hence if you have a passive source of income, you have more options available to choose regarding job. Once the money thing is taken care of, then we can look to those jobs which gives us satisfaction.

Jigar

you are saying what is happening at the moment, I am saying that people should make sure that they are in right job, something they like , If not ,they should prepare for it , this would be easy in early days , but will get tougher and tougher in years to come .

manish

Good article Manish. Career shifting is not so difficult as it used to be some time. I have seen many engineers ,Commerce grads and even doctors who go for an MBA in B schools like ISB with 7-8 yrs of experience. After that they go into the domain they are intrested in. All it takes is patience, time and determination.

As Mohan rightly said, people in India don’t think about financial planners because more than 90 % don’t have enough money to plan.Lack of vision is also a reason.

Financial planning lessons must come from parents to children as it happens with other learning.

yes, I agree with you .

Financial Planning education should come from Parents and from school level , but it will happen in coming years .

Mohan views are correct . I have clarified my point in above comment .

manish

Manish, there are a number of things to be taken in to consideration here. When you ask a kid on what you want to be, they always talk about something that they can easily relate to. Hence the answers like a doctor, engineer, pilot etc., Finance is not something kids would start growing with.

Similarly, when they grow up, their aim would be to secure some good job which is tested and proven over years. Financial planning is still nascent to Indians. Those who pay tax in india which is as low as ~1%, think of the need of a financial advisor! Now do you get the answer why it is not so known?

Now looking at Financial planning, it is only an after effect of the earnings that too for many as an instrument to save tax! People look for basic needs first. They tend to save money and invest in some means known for all. Most of the time, such people may not even think of financial advisors since they have to be paid for the advise! So my point is, the question of career affecting financial planning is only a by-product. First everyone wants some job to make their living. Then think of either loving it or not so!

Only in an ideal world, things can work out the way you have pointed. When you come to reality, it always goes as life takes turns… never a perfect one!

.-= Mohan´s last blog ..26/11 – Are we solving it right? =-.

“Finance is not something kids would start growing with”

Yup , I agree with your point , The first para was to create humour , I understand that kids will say things like Doctor and Pilot because thats the first thing they can relate to . So “Becoming a Financial Planner” part was just a pun 🙂 . I hope this to happen some time after 30-40 yrs , not before that , However places like US and Australia , there are more chances of kids (not 4-5 yrs , but around 11-12 yrs) , might want to become because its one of the recognised jobs unlike India . But what you say makes sense and I agree to it .

“when they grow up, their aim would be to secure some good job which is tested and proven over years” , I belong to the same category 🙂 , But some part of it is driven by Pressure from Parents , Friends , hesitation etc etc . I am sure you will agree that a large percentage of people take up some education because of Parents pressure and to meet their wish , Also sometimes they lack the risk taking ability , This needs to be changed and this will , but it will take time . My main point here was that “Person should eventually try to do something which he loves ” , “getting into a wrong job is something they should avoid , if they can”

“Only in an ideal world, things can work out the way you have pointed” , you are saying this for majority for people, I understand , But this is true for a small section of people , who have the guts to take the decisions , I hope this will happen in coming decades” .

Thanks for your vauable comments , it has helped us understand more about the topic

Manish

Brilliant points you made there.

.-= Taranfx´s last blog ..BlueHost vs DreamHost vs HostGator =-.

🙂