India has finally witnessed a landmark change in the GST regime.

After years of debate, the complicated structure of multiple GST slabs has been streamlined by govt. The new structure will now have only two main slabs – 5% and 18%. Additionally, a 40% slab exists but is largely meant to discourage luxury/penalty-category consumption and applies to very few items.

The biggest shift is the removal of the 12% and 28% slabs. Almost all items from these slabs have now been moved to the lower slab below them:

This alone impacts a huge chunk of household spending and makes goods more affordable. Lets check its impact on things which we consume

Life & Health Insurance are GST exempt

This was most awaited and demanded from last many years. Finally govt has fully removed GST on life and health insurance policies. With this tax gone, premiums are expected to come down by around 10–15%. It may not be a full 18% cut, because insurance companies will lose the ability to claim input tax credits on their own expenses, however for consumers, it still means insurance will finally become more affordable and accessible.

Note that these changes are applicable only from 22nd sept, so if your premium is due before that, you need to pay the GST on renewal this time, no matter when you pay the premium

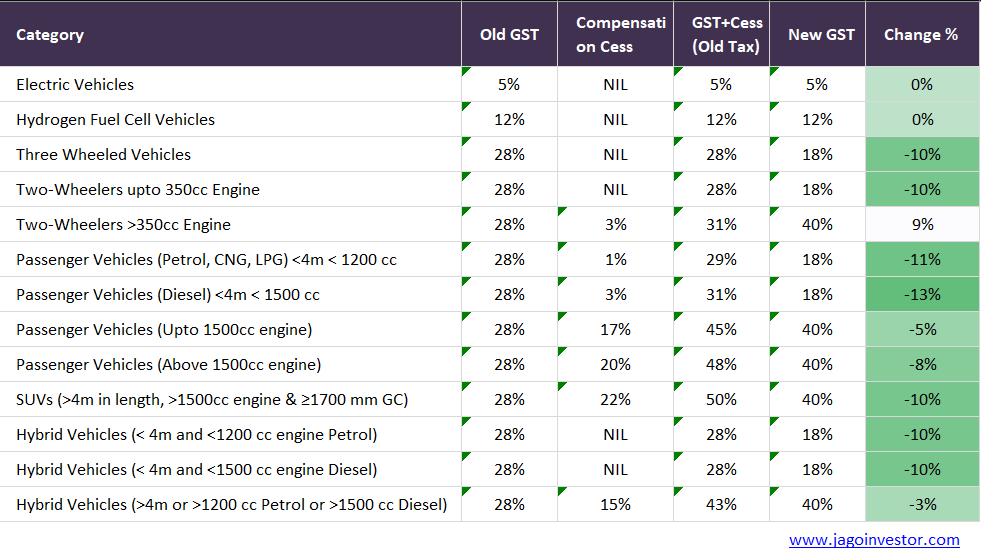

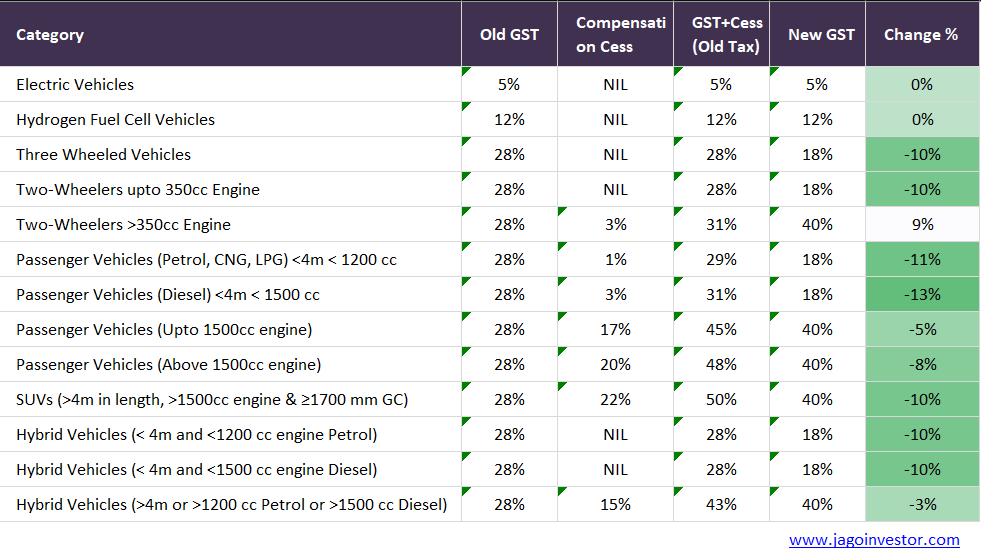

Automobiles – Winners and Losers

The automobile sector has seen a major realignment of taxes:

-

Small Cars: GST has dropped from 28% to 18%, which will lead to a noticeable reduction in prices. For millions of middle-class families, buying a car will now be more affordable.

-

Luxury & Big Cars: Earlier, these attracted 28% GST plus a 22% compensation cess, taking the total to a steep 50%. Now, this has been rationalized to a flat 40%, as compensation cess is NIL now. While still high, it’s a net reduction compared to before, so prices of luxury cars will also see some relief.

-

High-capacity Two-Wheelers (Above 350cc): This is the only category to see a hike. Previously taxed at 28% plus 3% cess (31%), they will now attract 40% GST. Enthusiasts of premium motorcycles will need to shell out more.

Below is a table which shows how prices will change

Medicines & Healthcare

Medicines, especially life-saving ones, are among the biggest beneficiaries:

- Around 33 life saving medicines and drugs are now completely exempt from GST (0%)

- A large number of other medicines have shifted from 12% to 5%, giving additional relief.

Consumer Durables & Household Items

The reform also impacts what households buy every day:

-

Consumer durables like ACs, dishwashers, and TVs were earlier in the 28% slab, making them expensive. They are now taxed at 18%, which will make them more accessible to the middle class.

-

Essential household products like ghee, butter, oil, biscuits, soaps, and several others have been moved down from 12% to 0% or 5%. Essentials that everyone consumes daily will now be cheaper, directly reducing household expenses.

Overall, this GST reform is expected to give a positive push to consumption, as everyday essentials, household items, and even automobiles become more affordable. While the impact on inflation may not be very large, it will still provide some relief to households already coping with rising costs.

At the same time, this move sends a clear signal of stability and growth, which can boost market sentiment. Investors should view this as an opportunity to stay focused on their long-term investment plans. Continuing with systematic investments (SIPs) in mutual funds and even topping up their contributions during this positive phase can help build significant wealth over time.

September 4, 2025

September 4, 2025