Paytm, India’s largest mobile payment network has partnered with ICICI bank to provide short term small loans to its users. This is India’s first scheduled commercial bank tie-up with a mobile payment platform, and it is named as Paytm-ICICI bank postpaid.

The main motive behind this partnership is to provide 24/7 digital money support to millions of Paytm and ICICI banks common customers across all over India.

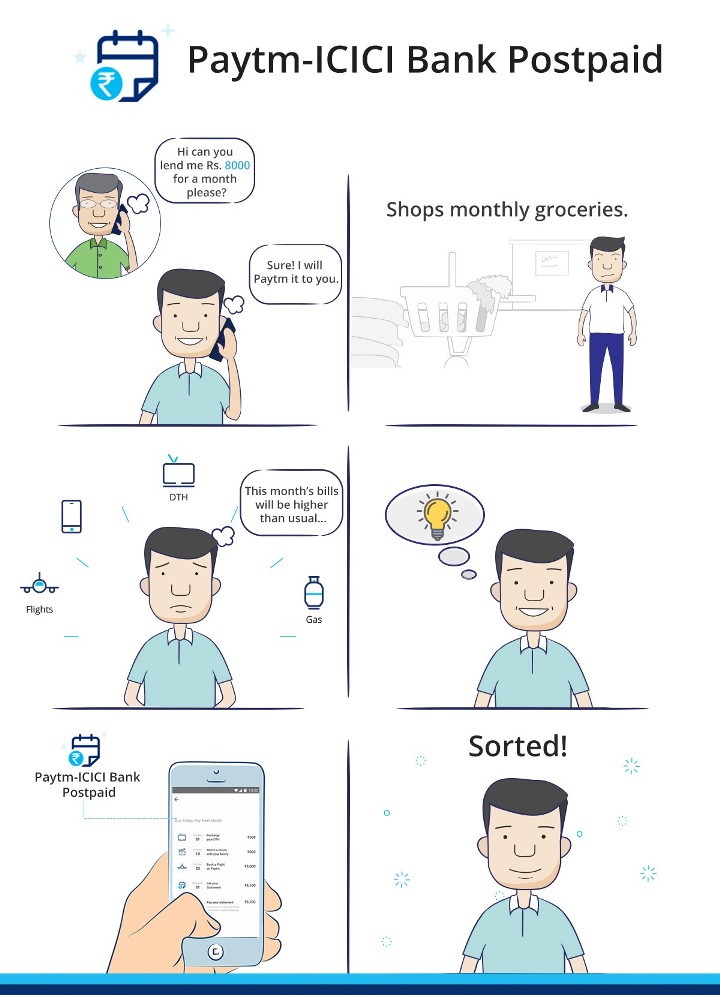

This feature is introduced to ease the daily expenses of all ICICI bank customers who are using Paytm, by providing them Digital credit. The below image shows you how it works

As per this tie-up, you can take digital credit in your Paytm account from ICICI bank, which you can use for your daily expenses like paying bills, booking flight or bus or even buying a movie ticket. You can use this credit anywhere where Paytm payment is accepted.

Please watch below video to know the details.

Type of loan and interest rate

This credit will be interest free for first 45 days. If you repay it within 45 days, then you will have to to pay only the principle amount and no interest will be charged. But if you delay the payment for more than 45 days, then you will have to pay a late fee of Rs.50 and 3% interest.

How much maximum credit can you take?

This credit limit ranges from Rs.3000 to Rs 10000. It means you can take digital credit of minimum Rs.3000 and maximum of Rs.10,000. And if you have a good repayment history which means you payed all your credit loan in time, then the limit can be extended for you upto Rs.20,000.

Which means that this is going to be useful mostly to students and those people who are left with no money by the end of the month or have severe cash crunch.

Right now this facility is available for the customers of ICICI bank who are using Paytm, but soon all the Paytm users also can get benefit of this newly introduced postpaid digital currency.

Who should use this?

If you are using Paytm heavily and if you are the type of person who has severe cash crunch and want to take short term credits, then this facility if for you.

We do not recommend this facility to be used unless you really need the money. Its better to always maintain liquidity in your bank account and not fall for this kind of service.

I hope this information is useful for you. If you have any query, leave your reply in the comment section.