The government has cut the interest rate on Public Provident Fund from 8.7%to 8.1% effective April.

This was part of the interest rate cuts in the small saving schemes and apart from PPF, other very famous instruments like Kisan Vikas Patra, Senior Citizen Scheme & NSC interest rates have also come down by a good margin.

These new rates will be applicable from Apr 1st. Please note that this is one of the biggest rate cuts in the small saving schemes in a long time.

Here is a summary of all the rate cuts

- Kisan Vikas Patra interest rates down from 8.7% to 7.8%

- NSC interest rates down from 8.5% to 8.1%

- Senior Citizen Saving Scheme interest down from 9.3% to 8.6%

- 5 yr NSC (National Saving Scheme) interest down from 8.5% to 8.1%

- Sukanya Samriddhi Yojana interest down from 9.2% to 8.6%

- 1 yr time post office deposits has been cut from 8.4% to 7.1%

- 2 yr time post office deposits has been cut from 8.4% to 7.2%

- 3 yr time post office deposits has been cut from 8.4% to 7.4%

- 5 yr time post office deposits has been cut from 8.5% to 7.9%

- Postal saving deposits remain unchanged at 4%

Interest rates aligned with market rates

On Feb 16, 2016 (before the budget) itself the govt had announced that they are working towards bring the small saving interest rates closed to the market rates, but that time no changes were done in these schemes.

The government had on February 16 announced moving small saving interest rates closer to market rates. On that day, rates on short-term post office deposits was cut by 0.25 per cent but long-term instruments such as MIS, PPF, senior citizen and girl child schemes were left untouched.

Now the interest on these schemes is closer to the interest rates given by the banks.

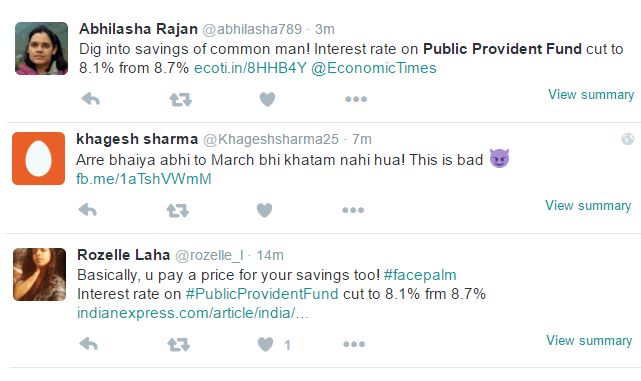

I will leave the decision to conclude if this was a good or bad move by govt on you, however the common man is not very happy with this. Messages against this move are are all over the twitter.

What is your reaction to this?

Majority of investors in India invest in Public Providend Fund (PPF) scheme and it’s very close to their heart. However this move will make many people think if PPF is the best thing they can do with their money or not (learn how PPF interest rate is calculated).

Will they move to equity markets because of this move? Will it make them interested in other kind of financial products?

What do you think? Do you think of this big interest rate cut in PPF and other schemes? Please share your views in comments section.