We have worked with more than 500 investors till date one on one and we have decent understanding of how financial lives take shape over the years.

Today I am going to share few observations out of working with clients for so many years and will share some mistakes which you should avoid in your financial life. I really wish if each parent could pass it on to their kids or their siblings when they start earning money.

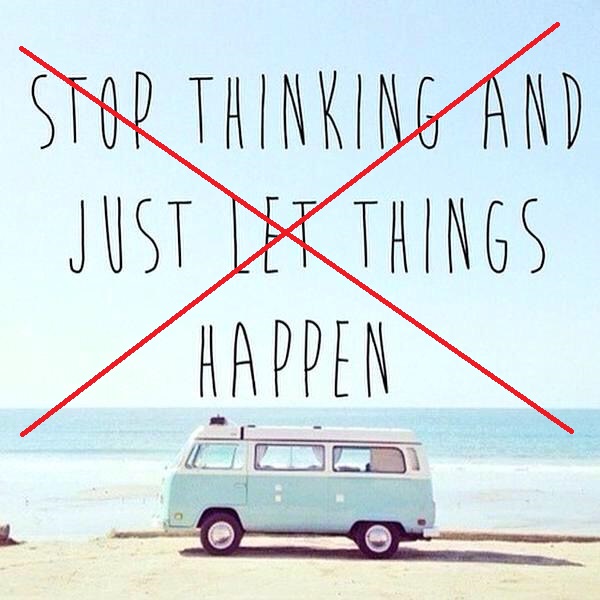

Mistake #1 – Don’t go with the flow

It’s often said that in life – “Go with the flow and don’t worry”. While that’s a good advice for your life in general, but I think it’s not a good advice for your financial life.

Most of the times, if you just go with the flow, you might not get desired results. It’s a shortcut which you are always tempted to take in your financial life, but often that leads to a clumsy and bad financial life.

There is another saying that – “Only dead fish goes with the flow”.

I am sure you don’t want to be a dead fish 🙂

I have observed that most of the people, who today are having a very bad financial life, have just gone with the flow and never planning out things. Nothing in their financial life happens due to their careful planning or conscious effort. Whatever comes in front of them, they take it.

- Tax season arrives and they buy the policy because they have to submit the investment proof.

- They take loan because its a “Interest Free loan” and not because they needed it

- They want to buy a house soon, but then the next moment they upgrade their car !!

- They sign the documents where the agent asks them too and complain they were cheated

I just want to make a point. You can either choose to move with the flow and let things happen to your financial life OR take charge and make things happen in your financial life as per your plan. The biggest issue today is not just less income, but how managing the money in proper manner.

Mistake #2 – Don’t get attached with past and harm your future

Almost all the investors face this. One bad experience in some area and they carry it with them all their future.

When recently, I recommended a mutual fund from ICICI Prudential to one of our client. He was taken aback and very strongly told me that he does not want any ICICI prudential mutual fund because he has had a very bad experience with them.

On further enquiry, I realised that he was sold a ULIP by an ICICI Prudential Life Insurance agent, which he was not happy with and from that day he took a vow that never in his life, he will deal with ICICI products.

In the above example, did you see that the person had just labeled ICICI = FRAUD. There are so many good things which ICICI has to offer (and it’s true for every company) and just labeling things will only hurt your own future because you then cut down your own options.

Good and bad experience are part of life

Good and bad experience’s are part of life and it happens with everyone. You need to learn from it and move on. Take some learning’s from the incident and see how you can make your own self more strong to deal with a situation.

Like in the above example, the person could have said that – “I will now onwards read the documents and understand where I am putting my money” or “I will not buy something, which I truly don’t understand”. But instead he chose to take the extreme step.

I will give you another example

I see many people who bought a stock or mutual fund and it didn’t perform well and gave them bad returns. Now they are so scared to try out equity in their portfolio all their life, because they equate EQUITY = MONEY LOST

Note that in today’s times of high inflation and high taxes, having a good portion in equity class is not an option, but a necessity. You can’t build enough wealth without investing in equity based financial products for long term.

So coming to the conclusion, all I want to say is that don’t make mistakes of carrying a bad experience throughout your life and avoid the opportunities which exists, this is not a money lesson, but a good life lesson – which applies in all the areas of life.

If you buy a book on personal finance, and you don’t like it, it does not mean that good books on money does not exist. Or if you had a bad experience with a financial planner, it does not mean that all financial planners are bad.

Mistake #3 – Don’t just focus on earning money, but also your networth

Do you know one big difference between RICH and Middle class ? Here it is …

“Rich talk the language of Networth and middle-class talks the language of pay-package”

What have you heard your parents ask you – “Go get a good paying job?” OR “Go and build a great networth?”

Over the years, the income level has risen many folds and today its not uncommon to see income levels of 10/15/20 lacs per annum and the society label them as “doing well”. But the ground reality is very different many a times. The net worth of these high earners is still not upto the mark.

When we do workshops in various cities, we often see people who are earning 10-20 lacs per year who have spend years in their job, but they don’t have enough to show off as their networth. Many of them are empty pots whose size if big enough.

Its because they have focused and worked on their income’s, but never focused properly on building networth. Just because you earn good, does not mean you will have a lot wealth, because that needs conscious effort and mindset to build wealth. It needs actions, adoption of structures in your life which many don’t act upon.

Good Income is very Important

Don’t get me wrong. I am not saying don’t try for good income. In fact, if you focus on good income, you can build wealth more easily and faster, because more income generally leads to good wealth. But often its not true and it can happen only if you choose to consciously work on it.

It might happen that a person earning less than you build;s higher networth then you because he was fanatically working towards it.

We once came across a couple in Mumbai who was collectively earning around 35-40 lacs each year. I know the moment you read this, you must have thought – “Wow .. that’s a lot of money. I want to get there”

But reality is different

But their lifestyle never allowed them to save enough. Their expenses list was so huge that I was almost numb, when I saw their datasheet.

Here was a couple who was doing extremely well from “society standards”, but still their networth was pathetic compared to their income because they just focused on consumption and only consumption. Their were so many leakages in their financial life, that money never stayed in their financial life.

They could not even arrange for 10 lacs cash in emergency situation. So poor was their allocation and planning, that it was a height of mismanagement. We then worked with them for few months and redesigned their overall financial life which they approved.

We set their financial goals, helped them to define things and systematically save for each of them and suggested them how they can improve. We put right structures in their financial life, which forced then to save first and only then spend. They are doing better now.

I know this is an extreme example, but many people can relate to it at some level.

As an investor your main focus has to be on your networth and a good income is a tool for it. A higher income which does not lead to a good networth is only a short term success story.

What I have seen in last 7 yrs ?

Today’s generation is into a deep financial depression. You meet a guy, he is going to a swanky office, his package is bloody 16 lacs per annum, you envy him and you hear this guy has just bought a house (on loan). You feel you want to be like him, what an awesome feat he has achieved.

But the reality is very different. While this all looks great from a distance, deep down a big number of investors are facing a very tough situation, which is only known to them.

They are hell scared of future. Even though they are doing well today, they are still not sure what future has for them, they are depressed and fearful of expenses lined up for future. It has destroyed their peace of mind. They have good money coming into their bank accounts, but peace of mind is missing.

I am sure many readers who are reading this can relate it to their lives. What kind of suggestion would you like to give to a new investor who has just started their financial life?