Most of the people are worried about their Mutual funds, ULIPs and direct stocks returns. In the last 5 yrs, Stock Markets have been so bad that literally no mutual fund has given a good return in last 3-5 yrs , except few. I recently saw a reader asking this question

I have been going through SIP returns for last 5 years of some best recommended mutual funds and found that the returns were less than the Bank FD rates or at par… What is the use of investing in risky mutual funds if they cannot deliver returns better than Bank FDs in long run… I suppose they are high risk low return investments… please enlighten..

Your investment return is function of underlying Asset Class

A very simple, but not an easy thing is to digest that it’s not the investment product, which is doing bad, but the underlying asset class. Take the same example of mutual funds, ULIP or Index Funds. Its not the “fund”, but the stocks which they are invested in, that are doing badly. Stock markets in India have seen one of their worst 5 year periods (2007 – 2012). In my book “Jagoinvestor”, there’s one chapter on equity and debt, where I take last 30 yrs of history and show how in the long term, equity has given good returns and as the tenure increases, the returns get stabler and better .

So because stock markets have given bad results in the near term, its natural that the investment product which uses those stocks will also give similarly bad returns. So your fund might have just done its job of picking stocks as per their mandate, but the underlying stocks have done so badly that the mutual funds really can’t do anything here. What really you need to look at, is if the mutual funds have beaten its benchmark or not . If not, that’s when the issue is with the fund.

When did you exactly buy matters?

Yes, the last 5 years returns have been really bad!. No investor would be happy with these returns. However, did you notice that your opinion will be strongly biased, based on the tenure you have been holding the stocks or mutual funds? Some one who had bought near the peak of 2007, will surely say – “Stock market is the worst investments, never believe someone who says they are good.” A person who had bought stocks in 2002 and had sold in 2007 , would say – “Stock markets are great” and someone who bought in 2002 and is still holding would also say – “Overall they are good. Ups and downs are always there.”

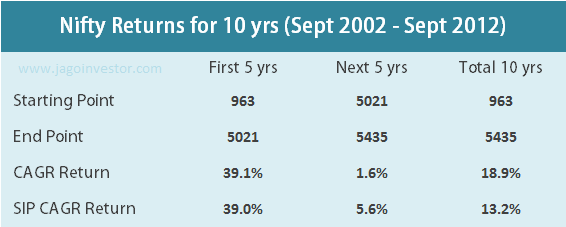

Let me show you some numbers. I took past 10 years of monthly NIFTY data starting from Sept 2002 to Sept 2012. Then I divided it into two halves, so there is the first 5 years (Sept 2002 – Sept 2007) and the next 5 years (Sept 2007 – Sept 2012) . Here are the results of the returns based on the Index values.

First 5 yrs

You will see that the first 5 yrs were a really golden period, which gave close to 35-40% for lump sum as well as SIP investments. Someone who had been invested in this period would know how amazing the returns were.

Next 5 yrs

If you have been lying in this group, you must be complaining and surely your investments have not done well. You are disappointed and you have lost your wealth. But sadly it’s only because you are in this group.

Total 10 yrs

If you see the returns in this period ,you will see that the lump sum returns are 19% and even SIP return have been around 13% , which is a respectable rate of return. Most of the returns were eaten up due to the last 5 years, but even with those 5 years counted, the returns are good enough. At least better than PPF or FD returns and that too tax free .

Stock Markets vs your Investments Return

“Equity gives good returns in long term” is a statement which is nothing but a probability linked statement , It means “most likely, equity will give good returns in long term” It’s purely a function of time and your consistency in investing. While 5 years can be seen as a long term tenure, there can still be 5 years tenures where the returns are not that good and you might get bad or negative returns. Also note that it’s not your investment product, but the underlying asset is behaving wrong. So rather than complain about the fund, better complain about the stock markets .

What was your biggest take away from this article ?