“Discount kitna doge ! Mishra ji mujhe 35% de rahe hain ” , as per Rakesh ,this is exactly how a lot of customers ask their agents commission to be shared with them in Insurance or Mutual funds. Have you ever asked your agent how much discount he can give you on the premium? This happens a lot with LIC agents and other insurance and mutual fund agents. Many times, even agents offer discount or some gift in return, if you buy the policy or mutual funds through them. This practice is illegal and totally against the laws of Insurance Act and SEBI. The agent can even face cancellation of his license if he is found to share his commission. (Read about agents commission in Insurance)

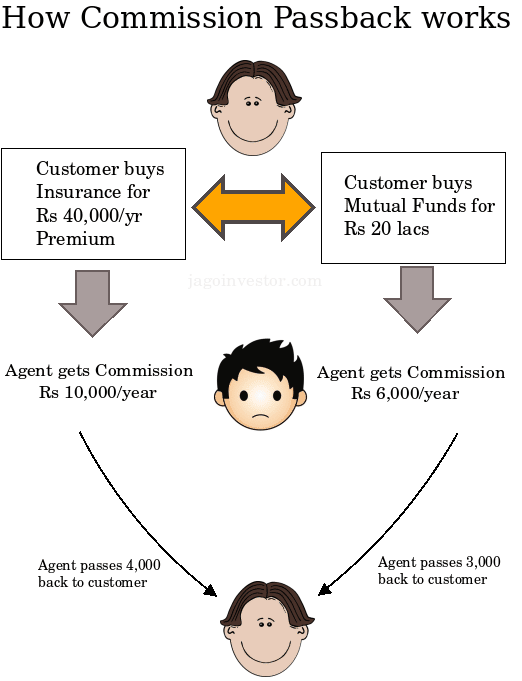

It kinda works like this. Suppose, an Insurance agent sells you a policy with a sum assured of Rs. 10 lacs, with a premium of about Rs. 50,000/- per year. An agent will make around 15,000 in commission for that year, out of which he might offer you a discount of Rs 5,000-10,000 for the first year or he offers you some gift! A lot of insurance agents do this to make sure they do not lose the business or get more and more business . In the same manner, if you have Rs. 30 lacs invested in mutual funds, your agent will get around Rs 10,000/- in trail commissions. It might happen that he can offer you 50% of that commission to make sure you stay with him .

Why you should stop asking share in Agents commission ?

Mutual funds : As per SEBI mandate, sharing the commissions received from AMC is illegal and should be avoided . Pass-backs, the practice of sharing a part of the distributors’ commission with the investor, have been made illegal under the code of conduct issued to distributors. “Intermediaries will not rebate commissions back to investors and avoid attracting clients through temptations of rebate/gifts etc” – As per a SEBI circular.

If a mutual fund agent shares his commission with others, it opens a big hole, not just for mis-selling, but also dilutes the whole industry atmosphere. There have been rampant cases, when an agent asks customers to leave their current agent and transfer their funds with them as a new agent (link) and they are ready to transfer a part of agent commission to them (the customers). For example, if a person has Rs 30 lacs invested in a mutual funds, an agent would get around Rs. 10,000/- as trail commission in a particular year. A lot of agents offer 5,000 (50%) back to the customers to attract them. A lot of agents pass back a part of commission and customers get into wrong & ill-suited mutual funds because of their greed!

Insurance : Other than the fact, that it’s illegal, you should not encourage or engage in sharing the agent commissions because, for one thing, it hampers your relationship with agent. Don’t forget that your agent will be the one to help in claim settlement when you are dead. If you snatch his share of commission today, it might leave him with a bitter taste in the mouth and not result in a healthy relationship. So please live and let live! The other important reason, you should avoid asking for agents commissions, is that it leads to mis-selling. If you ask for a share in commission, it will leave agents with less earnings and that would encourage them to sell more by any means, which in turn fuels mis-selling. So in a way the whole “asking commissions back” will hamper investors in the long run. What you sow is what you reap!

As per section 41 of the Insurance Act, “No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out OR renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance with the published prospectuses or tables of the insurer.”

Real Life experience

As per Dhawal Sharma, a Delhi based agent shares his experience

I face this problem day in and day out and many a times have to miss out on prospective clients because they want “passback of commission“. This practice (Sorry to say, but started by LIC agents) is so much part of the Insurance selling culture that 99.9% of the public thinks that it is obligatory on the part of an agent to part with his commission. But even LIC agents were quite smart at that time as they use to pass back comission mostly on ENDOWMENT or MONEYBACK policies which generate hefty renewal commissions as well (Unlike ULIP) and reversely, would be of little or practically no use to the client in the long term. This practice is actually pound foolish , penny wise approach..

I know at least 100 people, regularly buying insurance for their entire family (father , mother, brother,uncle, aunty) for last so many years from SHARMA JI or OFFICE WALE CLERK who passback 20% commission, and if we make a thorough study of their Insurance portfolio, they are underinsured (No term plan), not properly equipped to handle retirement (their agent never knew that annuity fund is tax exempt only upto 1/3 amount), and no proper child planning (In many cases, child plans where child is life insurand and not father).

Violation of law using Multi-level marketing in Insurance Policies

For some years now, a new way of selling is evolving. It’s called MLM. Here a big agent sells a policy to some one and makes him a customer. Now, this customer also acts like an agent and starts adding new people in the network and sells them policies. This goes on to many levels, a person earns a part of commissions earned from every person under his personal network. This whole idea of multi-chain selling violates Insurance law and is illegal.

As per Section 41 of the Insurance Act, “A licensed agent, whether individual or corporate, can’t appoint a sub-agent and pass on a commission to another person or entity. Any passing of commission by an agent is construed as rebating and is prohibited under the Act.”

There are many companies operating in different part of our country like TLC Insurance (India) in Bangalore, RMP Infotec in Chennai, Golden Trust Financial Services in Kolkata and SecureLIFE out of New Delhi (read more here and here)

Responsible Investor = Health Industry

We as buyers, shape this whole industry based on how we act. Over the years, we expected and asked for share in agents commissions, without realising that it will one day work against us resulting in misselling. So please do not support it! A couple of hundreds or thousands is not going to make you rich or poor, but it sure dilutes the whole environment!

Have you ever experienced a situation where agent has tried to give back his commission? Do you think if everyone stops asking for any agents commission back, it can really have any impact?