Envelope budgeting system – A simple way to control your expenses

Some months back, when we were working with a Mumbai based client of ours, we noticed that one of his expenses of “Eating Out” was extremely huge. Their explanation was they were never able to control the number of times they went out. So we thought how about limiting the amount spent somehow ?

Envelope budgeting system

Today I am going to share Let me share with you all a simple and effective budgeting system which has been in use for centuries – worldwide! . It’s called the “Envelope Budgeting system”.

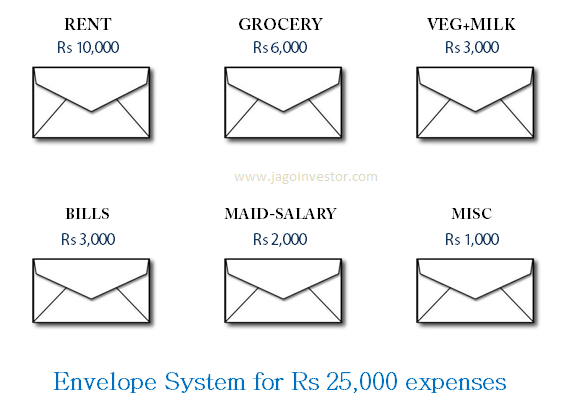

The common problem across families is that they keep spending money on various things from a single card or pool of money. The basic idea here, with this system is to label your different expenses, categorize them if you will, and keep an envelope with money dedicated to that category, in it.

When you need to spend on a category, voilà, you take the CASH for its respective envelope and spend. Let me give an example. Suppose your expenses are as below.

| RENT | Rs 10,000 |

| GROCERY | Rs 6,000 |

| VEG+MILK | Rs 3,000 |

| BILLS | Rs 3,000 |

| MAID-SALARY | Rs 2,000 |

| MISC | Rs 1,000 |

| Total | Rs 25,000 |

[/table]

5 Simple points regarding Envelope Budgeting System

1. Once it’s gone, it’s gone

When you take some money out of an envelope, and spend it, it’s gone! You will be left with some remaining amount for that particular month. Now all you have to spend that month is the leftover. So spend it wisely.

If you still want only spend more than what the envelope contains, you just break the system. Better stop following it then. It’s not for you

2. Don’t transfer between envelopes

Just because you have some money left in some category, does not mean you can spend it on another category. This system is all about controlling your expenses in individual categories. Whatever is left in some envelope should go to your investments. It’s like a bonus leftover.

3. If you fail to follow, invest 10x the amount as penalty

It’s human to fall off the wagon. At times you will deviate from the plan and spend more money other than you allocated. In this case, you should penalize yourself for breaking the rule, by investing 10x the extra amount into some investments. For example, you have Rs 3,000 allocated to “Eating Out” you spend Rs 5,000 in a month. Then you are using an extra Rs 2,000. You should penalize yourself by investing Rs 20,000 (10 times) in some thing to offset this crime. This will be a good spin on just desserts!.

4. Emergency expenses, but settle later

Ideally your expenses should be planned and the money should come from the envelope, but you will have to spend sometimes on your credit/debit card (read various credit card cashback offers), which is fine at times, but make sure you settle things back when you are back at home.

5. Guilt-free shopping

The thing I like about the envelope budgeting system is the “guilt free spending.” Once you have allocated the money to different categories, then you can spend up to the limit, without thinking much. That’s the best part.

TIP : Libin informed me in comments section that there is an Android app called Easy Envelope Budget Aid (EEBA) for this envelope system ! ..

Real life examples of its Effectiveness

I feel so proud to say that I follow this system.

Yes, many times I feel bound but I know what I have got by following this system. Be it getting rid of a loan (worth Rs.2 lacs), renovation of my home (worth Rs.2.5 lacs), be it car (Alto), money for Jewelry (worth Rs.1.5 lakhs), 40 k cash as gift to near & dear ones in a span of 6 years. Right now I am saving for my daughter’s school admission.

I agree that I never spent for grocery, maid salary & rent being in a joint family but still I wonder that I was able to achieve these targets when my present salary is just around 26k and when I started following this system 5 years back, it was much less.

I started this as I had no choice, but believe me I am now addicted to this system.

It’s not for everyone

A lot of people use this envelope system and are pretty successful in following it for months and years. However many people start this, but fail somewhere in middle and are not able to continue. Its all about how serious you are about controlling your expenses and being disciplined. Do you think this Envelope system will work in your case ?

March 7, 2013

March 7, 2013