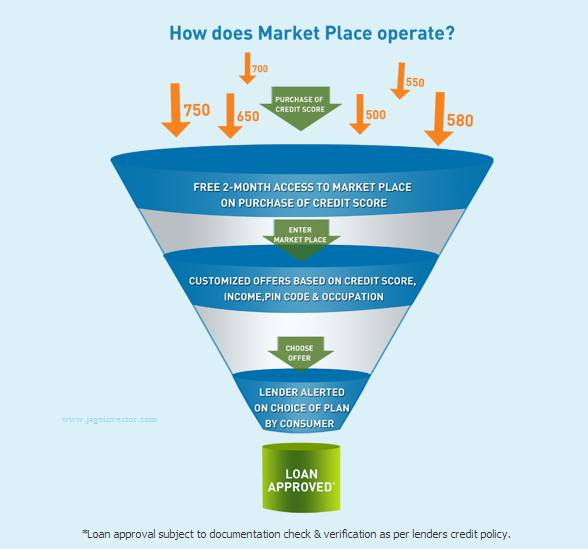

CIBIL has introduced a new facility called “Cibil Marketplace“, which will act like a portal where a person can get customized loan and credit card offers based on his cibil score. Right now, what happens is – when a person applies for some kind of loan or a credit card, the lending institution checks his credit report and credit score and based on their internal criteria and rules, reject or accept the application and move to the next step .

How does CIBIL marketplace work?

With CIBIL marketplace, the whole process is reversed. Here, you can find out which lending institutions are ready to give you different kind of loans, interest rates and other conditions based on your credit score. So a lot of lenders will participate in the cibil marketplace and will give their criteria and checklist, like what kind of customer they would like to offer loans. For example – A lender can say that they are ready to give Car loan @13% interest rate to a person having cibil score between 700-800 and @12% if cibil score is more than 800 . Thats one example .

Another lender can say that he is ready to give home loan to people who have credit score below 700 score, but on a condition that he should be working in a software job, however the interest rate would be as high as 15% – this is just an example of how it might look like. So this is how all the lenders will give their own criteria and when you enter the market place, after the filtering you will be shown only those lenders and loan offers which are exactly for your profile. So if you want to increase the number of loan offers, you need to improve your cibil score for that.

Right now the CIBIL marketplace is started with only Credit Cards. But very soon, you will see Home loans, Auto Loans, Personal Loans and even Business Loans on the portal. Just wait for some time or the next update from CIBIL on this.

How to Apply for Loan with CIBIL marketplace ?

Step 1 : You need to first visit Cibil Marketplace website. When you go there you need to fill in two information.

Step 2 : You need to enter your Control Number (which is 9 digit number that is mentioned at the top right of the CIBIL report) and your latest Credit Score, which should be maximum 2 months old. That means, if you had applied for a credit score long back (more than 2 months back) , you will not be able to use that data to enter CIBIL marketplace. You will first have to apply for a latest cibil score (You can get your cibil score online) and only then you will be able to enter the marketplace. One reason for this is that, cibil score and report keeps getting changed each month when banks update the customers information with CIBIL. So ideally if you know control number and cibil score of some other person, you can enter the cibil marketplace with that information and see all the data . Therefore make sure you dont share this data with anyone whom you dont rely.

Step 3 : The next step is to go inside the marketplace. You can see different kind of loans section and how many lenders are ready to lend you in each section. For example you can see that only 1 lender is interested to lend in this example and that’s “credit card” section . As of now, only credit cards are offered as this is new facility. But in future you can see more lenders in different sections. All you need to do here is click on the kind of loan you want.

Step 4 : After you choose the section, you can see the list of all the lenders individually with some information like Tentative Credit Limit offer, interest rate, fees, charges and other information. You can click on “Apply” button and instantly a small box will appear where you can apply for the loan there itself. Now this will be a kind of pre-approved loan because this is customized to your cibil score, but the next step will be the documentation check, which is part of the check in general . For those who would like to learn more about CIBIL and Credit Score etc, there is a detailed 40 min video course on our Wealth Club.

So these are the 4 steps you need to do to take the benefit of CIBIL marketplace.

Few Important Points related to Cibil MarketPlace

- You can choose only one offer in each category

- While purchasing your CIBIL TransUnion Score (and CIR), please make sure you fill up your income details accurately. As this will ensure the offers that are displayed in your Market Place are the ones you are eligible for. Any incorrect income detail will mean incorrect offer eligibility and can be rejected by the lender at the time of verification.

- It also depends how many lenders choose to participate in CIBIL marketplace. There might be lenders who choose not to.

- Once you have selected an offer then the respective lender will get in touch with you. Please ensure the details entered by you in the CIBIL TransUnion Score (including CIR) purchase form is accurate. This will enable the lender to respond to you at the earliest. You can also provide alternate contact details while selecting and confirming the offer in the CIBIL Market Place.

Who will benefit with Cibil Marketplace ?

CIBIL marketplace is an innovative platform and will also be helpful to those people who have low cibil score and a bad credit report , but still want to go for some kind of loan, even if it means on certain terms and conditions. It may be the case that they might pay a little more interest, but that would be better than not getting loan at all. This platform might also be the first step in providing incentive to those customers who have excellent cibil score. They might get loads of loan offers from lenders with lower interest rates compared to normal customer. Only the time will tell how this platform will evolve.

Let us know what do think about CIBIL marketplace and is it useful for you ?