Does False and Misleading Advertisements come under the heading of “Mis-Selling” ? Have you ever saw a financial product advertisement where numbers are tweaked and framed in such a way, that the financial product looks very attractive and not-to-miss deal ?

You see the advertisement and nothing looks wrong to you and you just concentrate on numbers like 15% or 17.45%, as advertised ! . What about mis-selling by big financial institutions who are considered to be too-big-to-fail?

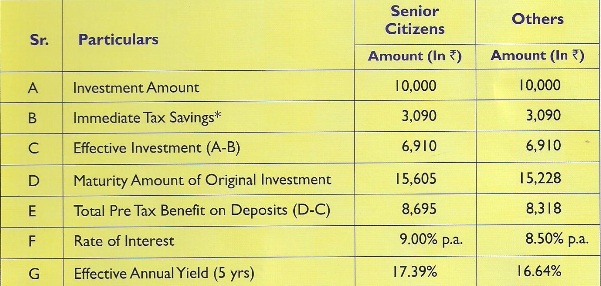

I came across the following advertisement (printed here only partly) in several media including the Company’s website. Even before that, one of our investors, was also flummoxed by the high yield indicated and asked us to explain how it is possible?

Well, a bit of creativity and lot of embellishment seems to have achieved the desired results.

Below is the snap shot of that advertisement which shows the amazing effective yield of the product.

This advertisement in question is about a 5-year deposit from one of the biggest PSU banks in India, which is also eligible for exemption under section 80C of Income tax act. No wonder, tax saving season has just arrived!.

Tax Saving Fixed Deposits, lets you invest a certain amount, on which you will receive tax exemption subject to maximum of Rs.1 Lakh. This would translate to reduction in your tax out go, depending on the tax bracket in which you will fall under – it may be either 10% or 20% or 30% and the cess applicable thereon.

A simple and straightforward situation.

Since it is a bank deposit, it is perceived to be safe. There is an additional layer of safety, because the bank in question may be bracketed under the category of government owned (major share) and it is too-big-to-fail.

What is the problem with this advertisement?

There are so many of these kind of advertisements, enticing you to invest in them because it is the tax planning season. In your interest, if there is little bit of embellishment of the numbers what is wrong with that?

Anyway, you need to be ‘sold’ something, otherwise you will end up paying lot of tax to the same Govt. Instead, just listen to the advertiser and put the moolah where the message belongs to.

At this juncture, let me make it clear the meaning of mis-selling and quote from one of the recent regulations by SEBI Securities Exchange Board of India.

For the purpose of this clause, “mis-selling” means sale of units of a mutual fund scheme by any person, directly or indirectly, by –

a) making a false or misleading statement, or

b) concealing or omitting material facts of the scheme, or

c) concealing the associated risk factors of the scheme, or

d) not taking reasonable care to ensure suitability of the scheme to the buyer.”

If we go by this definition of mis-selling, let us see where does the subject advertisement stands.

1. The advertisement does seem to make a false or misleading statement. While calculating the effective yield at 16.64% or 17.39%, it does not adjust the effective yield for income tax. Even though it says the return is pre-tax, it just stops there.

Why is it important to adjust the return to taxation? Because to arrive at Effective Annual Yield, it has assumed that the investor falls in the category of 30% marginal tax rate and hence he or she is eligible for “B. Immediate Tax Savings” of Rs.3,090/- which is 30% + 3% Cess thereon on Rs.10,000/- deposit.

When such being the case, how the advertisement can conveniently ignore the taxation on the interest income? Interest on bank deposits is taxable as “Income from other sources” either on cash/receipt basis or on accrual basis depending on the method of accounting followed by the investor.

It is a convenient forgetfulness on the part of the advertiser.

2. The advertisement appears to attempt concealing or omitting material fact such as taxability of interest income earned by the investor. It has also not highlighted the tax deduction at source applicability in case the interest income is beyond a certain threshold.

3. The advertisement (in its full form) also has not highlighted the risk factor of possible default or delay in payment of interest in time and the capital. Since bank deposits need no rating, no one bothers about the underlying risks.

4. The advertisement (in its full form) does not highlight the suitability of the scheme to the buyer. It brings in to its fold all investors under the category “Others”.

Therefore, it fails by all the four counts that are applicable for lesser mortals, such as mutual fund manufacturers and advisers. Of course, you can not apply one regulator’s dictum on others in letter; what about the spirit? Just because RBI is the regulators for bank, should bank not follow what is in interest of investors ?

What about Bank Social responsibility ?

What would be the state of mind of the investor, when she sees such a highly enticing advertisement? In the absence of a super-regulator or dialogue between various regulators, different regulators seem to have different yardsticks about mis-selling or mis-representation. But who cares as long as it is a big govt. owned entity?

It used to be the same case when govt was running a mutual fund business from early 1960s till late 1990s. The mutual fund scheme was also guaranteed by the Govt (remember UTI), was eligible for tax exemption and the fund house was considered to be too-big-to-fail in its time, even though such a coinage was not fashionable in that period.

Finally the mutual fund business did collapse under its own weight and thousands of investors lost their hard earned money. Even though the government stepped in to arrest a free fall, the sheen of guarantee was lost. No lesson seems to have been learned from then to now.

What is the actual situation therefore in the present instance?

Below are the various possible scenarios:

As you can see the effective annual yield in all the above scenarios is nowhere near the one mentioned in the advertisement the moment you take in to account the taxability of the interest income.

How many of the investors who are already in the marginal tax bracket of 30% would have the limit left to invest in this fixed deposit scheme and also would be able to receive tax exempt interest income?

They will be definitely in minority or possibly no one would meet both the conditions at the same time. What can one say about the tactics of highlighting a scenario applicable in minority cases to all investors?

Misleading or partially true advertisements

Why should you as an investor and we as financial planners be worried about such misleading advertisements? Are we not immune to such misleading illustrations by many of the financial products manufacturers already?

In fact recently the Finance Minister of the country mildly chided one type of financial product manufacturer not to mis-sell the products. He attributed the consistent fall in the market share of such a product to the past sales practices.

Herein lies the crux of the problem that investors are floating in a sea of distrust and when very big names keep publishing such misleading or partially true advertisements, the distrust would keep growing and that is not good for the saver or investor and in turn to the economy.

Already some of the insurance products and mutual funds have become the victims of mis-selling, perceived or otherwise. I am really surprised that such a big institution is indulging in a highly embellished communication of doubtful veracity when there is no need for such gimmicks. I am also worried because I and my family have our banking relationship with this too-big-to-fail entity.

About the Author – The article is written by Narendra N Kondajji, A bangalore based CERTIFIED FINANCIAL PLANNERCM (CFP) . His website is www.procyonfp.com and this article was originally appeared on his blog here