If you are going to open a new PPF account then following documents are required:

- PPF account opening form (Form A)

- ID proof - PAN card, voter ID, Aadhaar card etc.

- 2 Passport sized photos

- Pay slip (Salary slip)

- Residential proof

Public Provident Fund (PPF) scheme is a popular long term investment option backed by Government of India which offers safety with attractive interest rate and returns that are fully exempted from Tax

PPF i.e. Public provident fund is a small savings and investment schemes which was started from 1968 by ministry of finance in India. The motive behind starting this scheme was to mobilize small investments by providing interest on it along with tax benefit.

To open PPF account one should satisfy the below given criteria -

Any person who is a Indian Citizen can invest in PPF account. However NRI's can only continue to hold their account.

A person should be more than 18 yr old to open a PPF account. There is no higher age limit.

To open PPF account one should satisfy the below given criteria -

One can open a PPF account in any authorized bank by visiting any of it's branch. Or you can also open online PPF account by visiting the banks website.

Below given is the list of authorized banks where you can open your PPF account.

A PPF account can be opened at Post office also by submitting required forms along with the documents required.

Opening a PPF account is a very simple process which can be completed in 2 steps only.

Visit the nearest branch of an authorized bank or a post office.

Submit the form for opening PPF account along with the documents.

The required documents are as give below:

PPF is a long term investment. The rate of interest on PPF is decided by government which changes every year.

The interest rate on PPF is computed on the minimum balance in an individuals account from the 5th day to the last day of the month.

So if you are planning to deposit lumsum in your PPF, make sure you deposit the money before 5th day of the month to get the interest for that complete month.

Earlier the interest rate on PPF was fixed for a year. But since last few years it is observed that it is fluctuating every quarter.

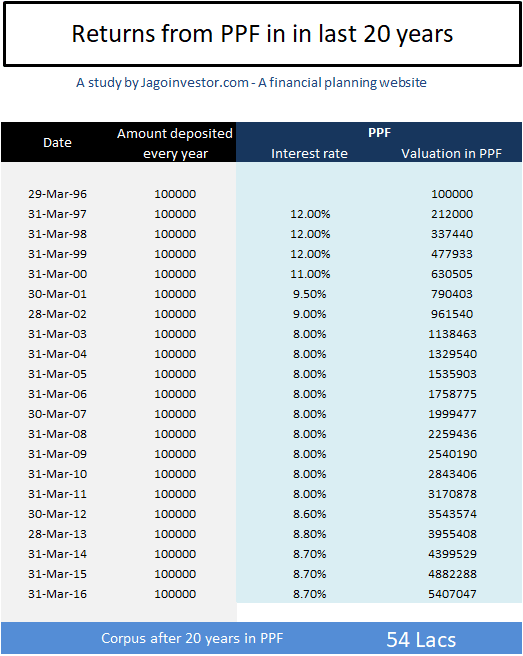

See the image given here. In this image you can see the changing interest rate of PPF since 20 years. You can also see the returns generated through PPF in last 20 year

Lock-in period is the period for which your investment is locked. If you want to withdraw the invested money before completing the lock-in period then you have to pay some penalty on it.

In case of PPF, the lock-in period is of 15 years. You can not withdraw your PPF money before completing this lock-in period. Although there are some exemptions where you can withdraw some part of your PPF but not the entire amount.

Once you complete the 15 years of lock-in period, you can withdraw you PPF money anytime you want.

If you don't want to withdraw the money and want to extend the lock-in period then you can extend it for a block of next 5 years, with or without contribution in it. You can extend it for as many times as you want because there is no limit for extending the lock-in period of your PPF.

But then again your money will be locked for 5 years and you can not withdraw it before completing the extended lock-in period.

PPF is a tax saving investment tool which falls under EEE (exempt-exempt-exempt) tax category. Which makes this investment tool more attractive specially if it is invested for retirement purpose. The amount in PPF account is categorized into 2 parts. One is the capital component or principle components which is your contribution, and another part is the returns or interest earned on that principle amount through our the years or maturity.

Lets see the tax exemption on both of these components:

You contribution to PPF upto Rs.1.5 lacs is exempted from tax under section 80C. So if you invest in PPF upto Rs.1.5 lacs you can claim tax benefit while filing income tax return. If the investment exceeds the limit then tax will applicable on the remaining amount as per the income tax slab.

This part is completely tax free. Which means you don't have to pay any tax on the returns generated though the PPF.

Your contribution to the PPF accounts of spouse or child is also eligible for tax deduction.

EPF or Employee Provident Fund is an investment scheme administered by EPFO (Employee's Provident Fund Organization).

EPF is for employed people only

In EPF, employer and employee both are the contributors

Interest rate on EPF is 8.5% for year 2017-18

There is no particular lock-in period for EPF, You can take the money at the time of retirement of in case of resignation. But to avail the benefit of tax exemption you should keep your money in EPF for at least years.

EPF has a tax exemption benefit under 80C if you continue the account for at least 5 years. Tax will applicable if you withdraw from your EPF before completing 5 years.

A person can apply for loan on EPF for the only reasons which are disclosed by EPFO by submitting the required documents.

PPF or Public Provident Fund is a tax saving investment scheme introduced by National Savings Institute of Ministry of Finance.

PPF is for self employed people

In PPF only the account holder can contribute

Interest rate on PPF is 7.6% for year 2017-18

The lock-in period in PPF is 15 years. After that you can withdraw the money or if you want to extend the maturity period then you can increase it in a block of 5 years as many times as you want

PPF also has a tax benefit under 80C if you withdraw it after completing the maturity period. Tax will be applicable if you withdraw before completing the lock-in period.

A person can apply for loan on PPF from the 6th year upto the 50% balance on 4th year.

PPF is a long term savings scheme which has a 15 years lock-in period and you can not withdraw the money from your PPF account before completion of its maturity period. However you can make a partial withdrawal in case of any emergency form the 7th year onwards.

Now the process of withdrawing PPF have became easier. You can withdraw the money from your PPF account after its maturity at any time from anywhere.

Let's see how to withdraw money from your PPF in 4 steps:

Step #1 – Arrange your KYC documents

Step #2 – Visit the bank

Go to the bank where you have your PPF account and submit the documents there. If you are living somewhere else right now then visit the local branch of that particular bank where you have your PPF account and get your documents attested by the authorizes person.

Step #3 – Send documents to Main Branch using Speed/Registered post

Once the bank completes the process of verification and attestation, either the bank will send your documents to the main branch or you will have to do that by yourself.

In case the bank is going to send your documents, take an acknowledgement letter from the local branch with their signature on it.

Step #4 – Get PPF money credited in your account by NEFT/RTGS

Once the original branch gets your documents, they will process them and credit back your PPF maturity amount by NEFT/RTGS.

After completing 7 years you can make a partial withdrawal from your PPF account. You can withdraw 50% of your 4th years balance in case of any emergency. The process for partial withdrawal is similar to the process as I said above.

Note that the years considered here are financial years which means from 1st April to 31st March.

Earlier it was not allowed to close the PPF account before completing it's maturity period of 15 years. But now as per the new rule you can close you premature PPF account, but it can happen only in two cases -

There is also a criteria that you should satisfy for this premature closure of your PPF. The criteria is -

For this early closure of PPF the account holder needs to pay 1% of the interest as a penalty which will be deducted from his PPF amount at the time of withdrawal.

As per the updated rule form April 2016, you can close your PPF account before completing the maturity period, but this happens only in particular case like higher education of children or serious ailment etc. In this case 1% of your PPF will be reused as a penalty charge for premature closure.

Premature closure of PPF is allowed for only those accounts which has completed it 5 years, which means you can close your PPF before maturity after completion of 5 FY.

NRI's can not open new PPF account in India. Although they can contribute and continue their PPF which was opened before changing their status from Indian residential to NRI.

Earlier NRI's were not allowed to have a PPf in India. They need to close their existing PPF accounts once their status changed to NRI. If they still continue their PPF account then they were getting the interest rate similar to the interest rate of post office savings accounts.

But now as per the updated rule from October 2016 NRI's also can continue their pre-existing PPF and the interest they will be getting on it will be similar to the normal PPF's of Indian residential's.

Nominee is the person who has been registered by the account holder as a legal claimant for his PPF after his death. For this the account holder have to fill a separate Form E and register the name of that person to whom hi wants to nominate for his PPF.

In case of death of PPF account holder, the PPF money is transferred to the person who has been nominated by the account holder or to the legal heir of account holder if he/she has not nominated anyone. The claim process in both of these cases are different and it requires to submit some additional documents also.

Lets see the process.

In case nominee is registered:

If the account holder has already registered nominee then the claim process will be easier in case of demise of the account holder. The Nominee in this case have to fill Form G and submit it to the bank where the PPF account has opened along with his ID proof, that's it. After completion of the process money will be transferred to the nominee.

In case nominee is not registered:

If the account holder has not nominated anyone for his PPF then the money will be transferred to his legal heir. In this case the legal heir of the account hold has to submit some more documents also along with Form G. The list of those documents is as given below:

Claimant should submit all these document to the home branch of the bank and after completion of the claim process, bank will handover the money to claimant or the legal heir.

Nominee can be anyone of your family life your parents, spouse, kids or your grandchildren also.

You can nominate two person also for your PPF (For example - your 2 children). In this case, if the nominees want to claim for PPF benefit after the demise of account holder then both the nominees should claim together. A cheque will be issue by the bank or post office where the PPF account is help and the cheque can be deposited only in the joint account of the nominees.

Yes you can change the nominee at any time. There are lot of reasons why people want to change their nominee. Some of the reasons are as given below:

The process to change nominee of your PPF is very easy. You just have to take Form F which is for nomination change, fill all the correct details carefully and submit the form to bank or post office where you have your PPF account.

There is a great confusion among investors on how PPF interest is calculated ? Just because a lot of investors don’t know this , they have questions like “what is the best time to invest in PPF to get maximum interest” or “Should they invest in lump sum or monthly?” . Once you know the procedure and exact ppf interest calculation method, life will be easy. Let me explain with examples how its done and also give you a ppf interest calculator in a excel sheet format at the end.

To explain in one line – “PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end”.

Watch the video given below to know how to calculate interest on PPF -

One more benefit of PPF account is that you can take loan against your PPF after completion of 3 financial years. For this you will have to fill form D and submit it along with your PPF passbook

You can take loan of upto 25% of available balance at the end of that particular financial year from 3rd FY to 6th FY. After completion of 7th FY you can anyways make a partial withdrawal from your PPF, so after 6th year you can not take any loan against your PPF.

You have to repay this loan within 36 months. The principle amount will be repaid first and once you pay the complete principle amount you will have to pay the interest part in next 2 month. The interest on this loan will be more that what you are getting on your PPF. You can not take second loan on your PPF until you repay the first one.

Let's see some FAQ's related to loan on PPF -

The interest rate on PPF loan will be 2% higher than what you are getting on your PPF. For example - In this current year interest on PPF is 7.6% so if you take loan against your PPF then you will have to pay the interest 9.6%.

As I said earlier that the interest on loan is depending upon the interest on PPF, this means if the interest on PPF changes then then interest on PPF loan will also change. You will have to pay this interest in 2 months after you repay the principle amount.

If you could not repay the loan within 36 months then the interest you will have to pay on the remaining principle amount will be 6% more than the interest you are getting on your PPF. For example - The current interest rate on PPF is 7.6% then the interest rate you will ave to pay on the loan after 36 months will be 13.6%.

If you still don't relay the loan then the remaining principle and the interest applicable will be deducted from your PPF amount at the time of its maturity.

As a guardian you can avail the loan on minor's PPF but for that you have to mention it clearly in that loan application form that "The account holder is alive and still minor. And the amount for which the loan is applied is for the best use of ...... (minor's name)".

You can take only one loan in one Financial year. Even though you repay the loan amount with all the interest within a year, you can not apply for a fresh loan in the same FY, you will have to wait for next FY.

For example - If you had taken a loan in FY 2015-16 and repaid it within that FY. But still you can not apply for a fresh loan on your PPF in FY 2015-16. You can apply for loan in FY 2016-17.

Nominee or the legal heir will be responsible to repay the loan in case of account holder's demise. The principle amount and the interest part will be deducted before closure of PPF account.

These are the forms that you need to submit to the Bank or Post office at the time of opening new account, taking loan against existing account, making withdrawals or while closing the PPF account.

Lets see which documents are required in these different situations -

If you are going to open a new PPF account then following documents are required:

If you are going to open a new PPF account then following documents are required:

If you are going to open a new PPF account then following documents are required:

Applying for loan against PPF is a very simple way. The documents required for this process are as -

Lot of people wants to know about the forms required for PPF withdrawal. Here is the list -

Documents required for withdrawal in case of death of account holder -

Yes you can transfer your PPF account from authorized bank to post office and vice versa at any time. It's a hassle free process to transfer the PPF. Given below are the steps to complete this transfer process:

Once you go through all this process your account will be transferred to the new bank branch of post office. This transfer is considered as a continuing account and thus will get all the benefits of the old PPF account.

Automated investment is an automatic investment to your PPF account when money is deducted from your account on a regular basis automatically and gets invested into your PPF account. This process of auto deduction has proved helpful for lots of investors as it saves investors efforts of depositing money every time to their PPF.

But his facility is not available at all the institutes. This automated investment facility in PPF is available only in some major and authorized banks. You can not get the benefit of auto investment if you have your PPF account at post office.

Lot of investors close their PPF accounts because of this hassle of depositing the money everytime to their PPF. To such investors i would like to advise that instead of closing your PPF, transfer it to the bank where you can get the benefit of automated investment and also can continue getting the benefit of PPF account.

In case of death of account holder the nominee can withdraw the amount from PPF. If there is no nomination then the legal heir can claim for the PPF benefit. For this the nominee or the legal heir needs to submit form G.

Given below is the process and the documents required to transfer the PPF in case of death of the account holder:

PPF is a savings and investment scheme introduced by government of India. So it is a safe investment tool.

Besides this one more benefit of PPF is that your money in PPF will not be subjected to attachment by court law in case the account holder has any debt or liability which he could not repay. This means your PPF money is secured in each way it provides protection to your money from all the court decree and attachments.

2021 © Jagoinvestor.com All Right Reserved