In a major change in the finance bill 2023, the govt has brought some changes in mutual fund taxation which will now treat pure debt mutual funds on par with Fixed Deposits. Most of the investors were not very happy with this sudden change, how this change is now a reality and we have to accept it.

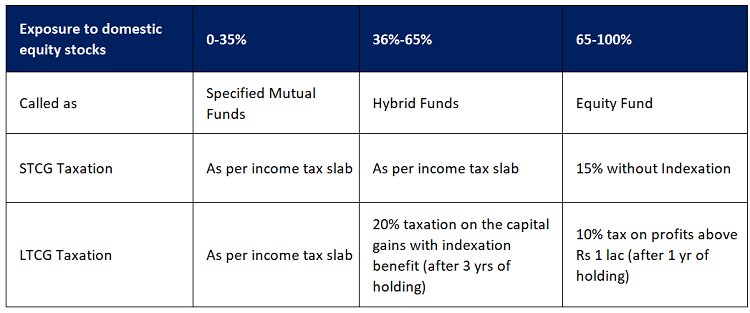

As per the new rule, any mutual fund where not more than 35 per cent of its total proceeds is invested in equity shares of the domestic companies will be termed as “Specified Mutual Fund” and it will be taxed at the marginal rate (as per your slab).

However, the gains from these specified mutual funds will still fall under “short term capital gain” category and not as “interest” income, which still leaves debt funds with some advantages which I will share at the end of this article.

Rule applicable from Apr 1, 2023

This change is applicable only for the new investments which will be made after 1st April, 2023. No impact is there for any old investments.

So if you have any debt fund, you can still hold it for future and you will be eligible to get the indexation benefit. Infact, its suggested that you hold it for long term because the taxation will be only 20% with indexation benefit which makes it a very attractive investments.

Also note that we still have the indexation benefit for those funds where the equity exposure lies between 35% and 65%.

Here is a small chart which will give you a clear understanding of the bifurcation on taxation.

Which category of funds are Impacted?

If you look at the definition, here is the list of categories which will now not be getting the indexation benefit

- Liquid Fund

- Conservative Hybrid Mutual Fund

- International Fund of Funds

- Dynamic Asset Allocation Funds

- GOLD ETF

The fund of funds which invest internationally will also be impacted as they are still treated as debt funds when it comes to taxation because they don’t invest in “domestic equity”. Their portfolio has equity, but its not domestic, and hence they don’t quality as equity funds.

Why Govt made this change?

As per govt, one rational given was that debt funds have a very strong indicative returns and there is almost no credit risk, so they are very much having predictive return and they shall be treated at part with a fixed deposit and not get preferential treatment.

This a bit odd, because debt funds still carry interest rate risk and default risk still exists no matter how small it is. A person investing in debt fund is investing in a market link product and shall get some extra benefit, however govt has other views.

What does this change mean to retail investors?

Truly speaking, this change will mostly impact those investors who are heavily dependent on debt funds for their long term investments and those who were looking for a very safe investment option with low risk and high tax advantage.

Any ways most of the investors were using debt funds for short term and money would get redeemed in 2-3 yrs, for which it was always a marginal rate earliar also.

So right now do not take action in hurry. Anyways the old investments are not impacted due to this rule.

3 advantages of pure debt funds going forward

While the taxation advantages of debt fund has gone, still it has several benefits worth considering as gains from them still is considered as a “Capital Gain” are as follows

- Tax only on Withdrawal, not on accrual – You can postpone taxation in future when you withdraw unlike a FD

- Setoff of gains with losses – You can adjust the capital gains if any with the capital gains which you incur now or later asyou can carry forward the losses for next 8 yrs in your ITR

- Liquidity – You can withdraw anytime from a debt fund without penalty (after the initial 1-3 months) and not pay any penalty like you do in a fixed deposit

We hope it explains what changes have taken place recently. Incase you have any doubts, do write us below, so that we can answer any of your queries.