Are you a new investor in mutual funds ? If yes, then you might be having these questions in mind.

- What is KYC ?

- What do I need to do to register my KYC?

- Whom should I approach?

- Do I need to do my KYC every time before investing into mutual funds?

So, in this article you will get the answer of all such queries.

What is KYC ?

KYC i.e. Know Your Client is a process required by RBI norms which needs to be completed before starting any investments. It is used as an eligibility test of an investor to prevent illegal activities like money laundering. So, if you are planning to start investing in mutual funds, you need to register your KYC first.

Do I need to do my KYC every time before investing into mutual funds ?

No, as KYC is one time exercise (central process) needs to be done before investing. Once your KYC is registered you need not to undergo same process again while investing with different mutual fund houses.

How can I register my KYC ?

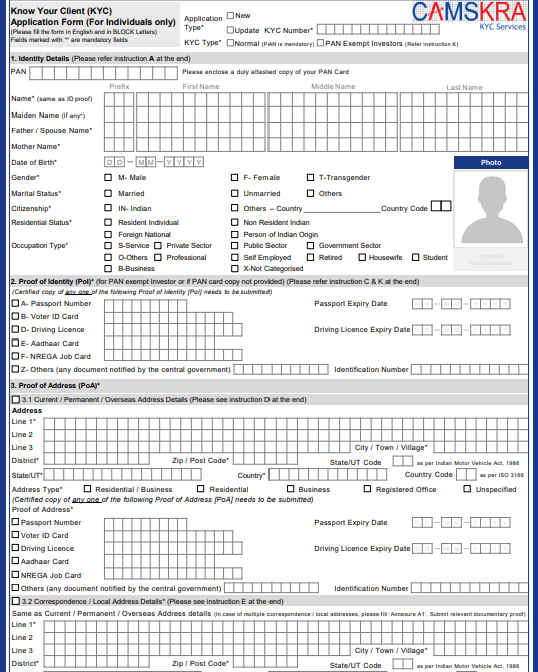

For KYC registration, KYC form has to be filled with all the details and needs to be submitted along with self attested copies of required documents (as discussed below).

Also note, that if you want to invest in mutual funds (Resident or NRI), Click here to know about Jagoinvestor mutual fund services. We also help you in getting your KYC done

From where can I get the KYC form ?

You get get the KYC form via 3 sources:

- For this you need to visit the website of CAMS KRA, Karvy or other registrars.

- Or you can also visit the website of the fund house where you want to start your investments.

- Or you can reach an Independent Financial Advisor.

What documents are required to be attached with KYC form ?

For Resident Indian following documents are required :

|

For Non-Resident Individuals(NRIs) following documents are required :

|

Important Points:

- POI card needed for POI

- In case your overseas address is not in English, you need to get it translated by a translator in your city and get their stamp

- In case you do not want to travel to India just for making investments, you can always give POA to someone trusted who can do the process for you.

- In person verification is mandatory for true identity verification. So, Fund houses or registrars does IPV via video calls.

Where can I check my KYC status?

Once your KYC form along with required documents is submitted to the registrars(CAMS, Karvy, Sundaram etc.) It will take 4 to 5 days in registration. Once it is registered you can start investing into mutual funds. You will get the alert about the registration via mail or SMS. However, if you want you can check status of your KYC by entering your PAN in either of the links below:

https://kra.ndml.in/

https://camskra.com/

https://www.karvykra.com

https://www.cvlkra.com/

https://www.nsekra.com/

You can also refer these links for downloading KYC application form.

Conclusion :

For KYC you need not to go anywhere, it can be done from your home. So, if you are planning to start investing in Mutual Funds, KYC is the first step to it. And if you are having any trouble in KYC or while investing, do let us know in the comment section.