Form 26AS is a consolidated statement which reflects all the advance tax paid by you personally or through TDS way. The best part about it is that you can view Form 26AS online by just quoting your PAN Number. You can view your Form 26AS online or download it in PDF or Excel format, but for that, you need to register on the income tax website.

Why do we need Form 26AS?

We all check our bank accounts when someone deposits money into it. Once we see that the amount is matching, we feel at peace and confirmed that there is no issue. Now in the same way throughout the year, we might pay the tax in parts. It can be in form of the Advance tax cut by our companies, TDS cut by the bank on your fixed deposits, TDS cut by some third party who is making payment to us. They all pay this tax on our behalf to the tax department and it is linked to our PAN card.

Now at the end of the year before filing for tax returns, we might want to check that how much tax is already paid by us through different ways and then we might want to pay additional remaining tax or ask for a refund in case we see that we paid more tax in a year.

An important point to note is, do not disclose your PAN information to someone else, otherwise, it becomes a security issue. Others can also view your Form 26AS and hence find out how much tax you paid.

How to view Form 26AS online?

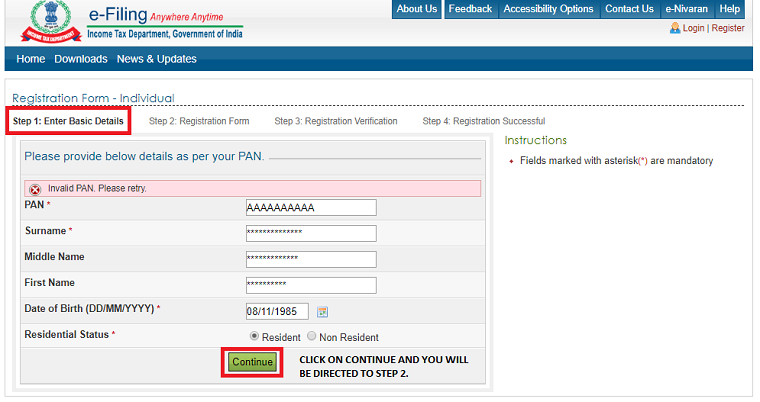

Click on this website to login or register. I have attached a screenshot as to how to register in this website so that you can view form 26AS online.

Step #1- To fill in the registration form, Enter Basic Details.

Step #2- Once you enter the basic details, fill in the registration form.

Step #3- Now verify your registration by entering OTP sent on your registered mobile number and email-id. Now click on validate.

Step #4- Once you validate your registration, now you will have to log in so that you can view form 26AS

Step #5- After you log in a pop-up window comes if your Aadhaar number is not linked with the PAN number. Enter details and click on Link now.

Step #6- Now you are successfully logged in. Click on my account and again click on View Form 26AS (Tax Credit).

Step #7- To view your form 26AS, read the disclaimer and click on confirm.

Step #8- Once you click on the disclaimer below window opens and again you have to click on View Tax Credit (Form 26AS).

Step #9- Now select the assessment year ( for which year you want to view your form 26AS) and view as HTML and then click on export as PDF. You can now see your form 26AS.

Step #10- This is how form 26AS looks like

Is it possible to link Form 26AS in your net banking?

Yes, A lot of banks like ICICI, SBI etc provide a direct link to your form 26AS through internet banking. On clicking the link, You can directly see 26AS.

Wasn’t this a very simple and easy way to register and view your form 26AS online. Let us know your past experience when you needed form 26AS online and how it was useful to you in the comment section.