What is Reverse Mortgage ?

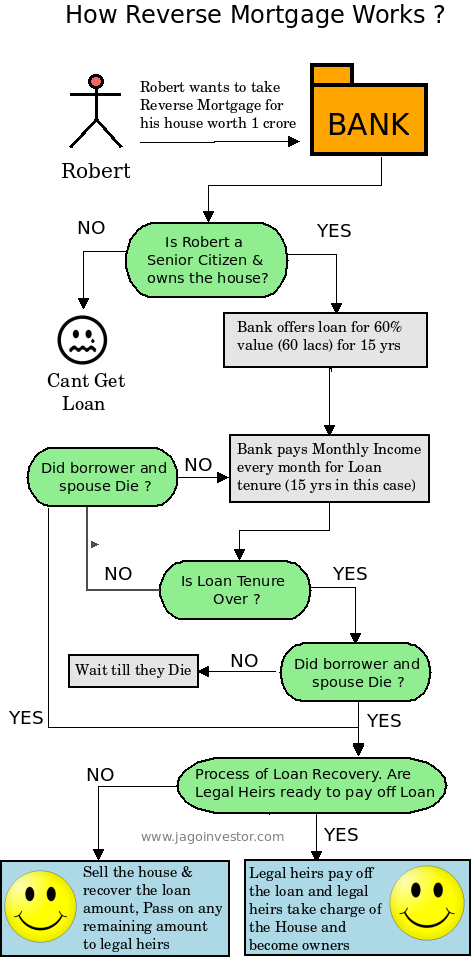

Simple! Reverse Mortgage is the exact opposite of a Home Loan. Anyone, who has a fully owned House can get a loan. The way, this works, is that his loan money will be divided in chunks (EMI’s) over many years and given to him every month. This can easily act as Monthly income. At the end of the loan tenure, the Bank stops paying the monthly income. If one of the spouses dies, the other can still continue living in the house. If both die, the bank gives their heirs two options – settle the overall outstanding loan and retain the house or, the bank will sell the house, use the proceeds to settle the outstanding loan and give the rest to the heirs. For people who don’t know – “Mortgage” means “Loan” 🙂

How is the loan paid ?

With a reverse home mortgage, no payments are made during the life of the borrower(s). Which means the loan has to be paid only after both the borrower and spouse die. Since no payments are made during the term of the reverse home mortgage loan, the loan balance rises over time. In most areas, where the appreciation is good, the value of the home grows at a much faster rate than the loan balance. Therefore, the remaining equity continues to grow.

When both, the borrower and spouse pass away, the ownership of the home is then passed to the estate or directed by a living will or will to the beneficiaries. The beneficiaries now own the home and have to sell the home or pay off the loan. If the home is sold, the reverse home mortgage lender is paid off and the beneficiaries keep the remains. Read about Real Estate returns over last 10 yrs .

Example :

Mr Ajay is around 62 yrs old, and his wife is 60 yrs old, they live and own a house in Karvenagar, Pune which is worth Rs 1 crore now . They have a daughter and son who are their legal heirs (50:50) . The old aged Ajay and his wife do not have a monthly income source, so they decide to go in for a Reverse Mortgage loan. The Bank is ready to loan upto 60 lacs to them, which means they will be paid Rs 35k per month for next 15 yrs (just an example.)

Now, they start getting monthly income of 35k per month for next 15 yrs, & they continue to live in the same home. After this point, their children support them financially and then Ajay dies at age 79. After this, his wife still continues to live in the house. Sadly she too, passes away at age 85. By this time the total loan outstanding becomes Rs 1.1 crores (It was 60 lacs at the end of 15 yrs, but after that, it starts growing.)

Now the loan has to be paid off. The son and daughter does not have money to pay to the bank, so the bank decides to sell off the property. At that time, the price of the house is Rs. 3 crores. The bank sells the house and get total 3 crores, out of which 1.1 crores is taken by the bank and rest is paid to legal heirs, which they split amongst themselves. Look at EMI Calculator

Which Banks Offer Reverse Mortgage ?

- National Housing Bank (NHB)

- Dewan Housing Finance Limited (DHFL)

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Indian Bank

- Central Bank of India

- LlC Housing Finance

- Andhra Bank

- Corporation Bank

- Canara Bank.

Tip from Hemant : “Star Union Dai-ichi offers annuity cover with reverse mortgage . When a person approaches the bank for a reverse mortgage loan on house property, the bank, after assessing the value of the property and sanctioning the loan, will approach the insurer and buy an annuity plan for the borrower. The annuity will be passed on to the borrower’s account on a monthly, quarterly or annual basis. The installments will depend on the purchase price, age and whether the insured person opts for a lower or higher lifetime annuity. “

Important Points in Reverse Mortgage

- Reverse Mortgage is available to Senior Citizens only. Any house owner over 60 years of age is eligible for a reverse mortgage. If wife is a co-applicant, she should be above 58.

- The maximum loan is up to 60 per cent of the value of the residential property subject to maximum of Rs 50 Lacs.

- The maximum period of property mortgage is 15 years with a bank or a HFC (housing finance company.) Minimum tenure will be 10 years. Some banks like Punjab National Bank offer RML for 20 years also.

- The borrower can opt for monthly, quarterly, annual or lump sum payments at any point, as per his discretion.

- The revaluation of the property has to be undertaken by the bank or HFC once every 5 years.

- The amount received through reverse mortgage is considered as loan and not income; hence the same will not attract any tax liability. How to do last moment Tax Planning ?

- Reverse mortgage rates will vary according to market conditions depending on the wheather borrower has choosen Fixed or Floating interest rate.

- Processing fee for the loan would be between 0.15 per cent and 1.50 per cent of the loan amount.

- One can prepay the loan along with the interest any time during the loan tenure. Typically, there is no pre-payment penalty.

How do I apply for Reverse Mortgage?

- Decide to pledge your house for reverse mortgage.

- Go to the branch of the bank, who you have a banking relationship with, and provides Reverse Mortgage

- Fill up the necessary form, the bank offers for reverse mortgage

- You need to furnish your personal and financial details like: the property, your legal heirs, and so on.

- Proof of ownership; you will also need to furnish property papers and a proof that the house that you are pledging is your residence.

When to consider taking Reverse Mortgage ?

Even though Reverse Mortgage seems like a nice idea, it should not be the primary tool to fund one’s retirement expenses. It shouldn’t be used to fund the shortfall in the retirement income if any. A valid reason can be – if one does not have any legal heirs or leaving money to/for them after death, is not high priority. There are many old people who have assets of high worth, but they do not have a proper, steady stream of income. One can use reverse mortgage in that case. In India, Reverse mortgage isn’t very popular yet, because of bad/negligible marketing and our mentality, where we dont take loan on our most valuable and most emotional asset “Home” 🙂 Another reason could also be that there are old / aged people who own 100% of home and are living alone with spouse are few & far between. These products might become very popular in coming decades .

Comments? What do you feel about Reverse Mortgage Products? Do you think it’ll become more popular & successful in the coming decades?