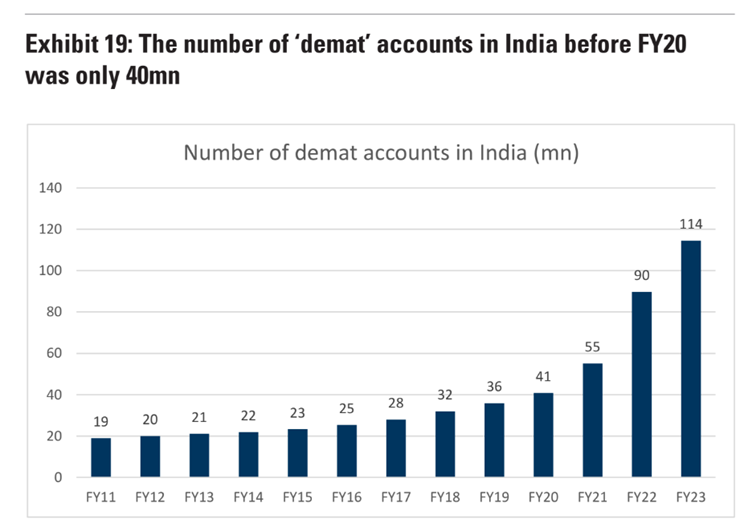

Post Covid-19 hit lockdowns, India has seen a surge in demat accounts being opened.

Around 114 million demat accounts were opened in 2023 alone which is around 2.8 times of 2020 number. Such has been the craze of the bull market we are witnessing.

As a result, there has been an unprecedented increase in the number of traders offering tips for undisclosed fees. Add to that, there are so many YouTube videos where people knowing very little about finance and how stock markets operate have now become overnight financial influencers. Too much irrelevant information is now floating around for no reason at all.

In short, the drama around stock markets is increasing.

Think about it.

Stock prices of several railways and infrastructure companies have multiplied in the last couple of years with absolutely no change in their earnings or their fundamentals. Whereas a high quality bank like HDFC Bank which has been holding the ship steady has lost around 18% in January 2024 alone.

So now you get people on YouTube and television trying to justify everything.

- If the market goes up, there’s enough justification.

- If the market crashes, there’s enough justification.

So what should an investor do in such a scenario?

It’s simple, just keep buying!

In the long run, stock markets are a net positive indicator for wealth creation. They cannot become zero. It’s not in their nature.

Check this chart out

It’s a simple chart of Sensex, Mid cap and Small cap index performance over the last 20 years.

You don’t need to go into tremendous details to understand that in the long term, markets keep going up. We have seen the fall out of the 2008-09 debacle, the 2013 crisis of India being a Fragile 5 nation and the Covid-19 meltdown.

Yet, the prices keep going upwards.

Take HDFC Bank for example.

Over the last couple of weeks, there has been a considerable amount of discussion around this stock. A lot of the youngsters who were born alongside the Bank’s launch date are declaring that this Bank’s future is over.

I believe some of these youngsters mindlessly comment via Telegram and YouTube, their careers are in grave danger.

Because if you take a 3 year horizon, then HDFC Bank’s stock has not gone anywhere.

But if you look at the last 2 decades, then the story is completely different.

It’s been a massive wealth-compounding machine for investors. I’ve written my own story of owning the stock which is up 30x now. (read here)

Now let’s take another example: Bharat Heavy Electricals Ltd. (BHEL)

In the last 3 years, it has become a darling of the stock market. Some people want to own it and some people are wondering what stopped them from owning the stock.

Let’s see the charts.

This chart makes your heart melt by missing out on the stock.

Just look at the chart, if you had owned it for the same period as you would have owned HDFC Bank.

It would have been your worst nightmare of a stock in the portfolio.

Agree to disagree?

So as an investor, you would have made money if you had simply invested with your mutual fund or a portfolio manager whose one of the top holdings has been HDFC Bank and not BHEL.

The shareholding pattern of both companies give a clear insight.

HDFC Bank

BHEL

BHEL has had a very low ownership from institutional investors (FII +DII) with 25% at best vs HDFC Bank with an ownership of 82% as of Dec 2023.

Yet, we often get swayed by making a quick buck. So we tend to make a mistake of timing the market. This never works. As a result, in 2024 itself we are going to see too many people closing their social media shops or being financial influencers.

One fine day they would vanish into thin air leaving your trading capital in the red zone.

So what should you do if you don’t wish to be in red?

So all you need to do is switch off from the markets and keep investing all the way through. If you don’t need your money for the next 15-20 years, then why bother about what’s happening today.

Just leave it to the experts.

Conclusion

With the information flow increasing with each day, it’s hard to understand what is signal and what is noise. It’s even harder when you have a full-time job or a business to run. Such stress tends to take a toll on our family lives too.

Some of us might even be thinking of making a quick buck in this bull run so that we can retire early. That can be a big pitfall too. Because you are trying to make immediate money without understanding the very nature of the beast.

So it’s best to leave it to the experts to navigate the bulls and the bears, while you take a good vacation on the beaches of the Bahamas. At the end of the day, what’s the use of money if we cannot spend it.

This article is written by Jinay Savla, Jagoinvestor