I am sure you must have seen the famous example of how Rs 10,000 invested in WIPRO turned out to be Rs 500 crore in 2019. That’s a massive wealth. But today I want to decode this story and let’s see what are some of the issues and problems. I have created a video on this topic, Do watch below

First of all, note that it’s not just WIPRO that has created massive wealth for its investors. There are many other examples as well, like

- CIPLA: Investments of Rs 10,000 in 1979 will fetch 95 crore

- INFOSYS: Investments of Rs 10,000 in 1992 will fetch Rs 1.5 crore

- RANBAXY: Investment of Rs 10,000 in 1980 will fetch Rs 19 crore

- HDFC BANK: Investment of Rs 1 lac in 1995 will fetch Rs 8 crore

While there are some examples of people who were able to hold the stock for 35-40 yrs and created massive wealth for themselves the one question which we shall ask ourselves is – Is it remotely possible for a common man to do it?

2 problem will WIPRO example

Problem #1: Survivorship bias

The Wipro example is a classic example of survivorship bias, where we pick the example which has worked already and survived for 40 yrs. It’s damn simple to look back and say easily that 10,000 become 500 cr if you waited for 40 yrs?

It’s nothing more than a data point. You are just looking at the statistics.

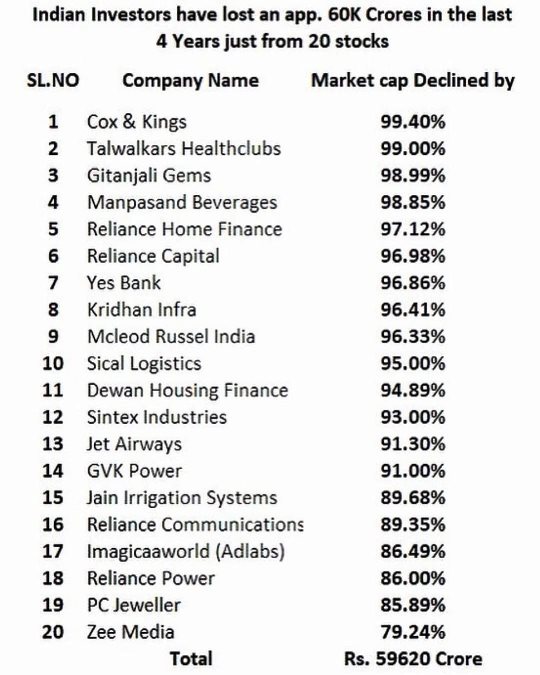

For every Wipro, Infosys, and Reliance example – there is a Reliance Capital, Unitech, and Cox&Kings example that has destroyed all the wealth in so many years.

How will you pick WIPRO in 1980 with so much confidence for the next 40 yrs? It is almost impossible.

Problem #2: How will you handle your emotions all these years?

“If you invest for 40 yrs” is the point.

- Who invests for 40 yrs?

- Who buys and holds for 40 yrs?

I will tell you, it’s mostly people who are dead or someone who really forgot about the investment made.

And then there are promotors of the company who hold for so long. And finally, there is a tiny minority of few people who might have done it successfully whose example we see on the net. But it’s never going to happen with most people because it’s almost impossible to control your emotions when you see the stock going up or down so much.

- When you invest Rs 10,000 and it becomes Rs 1 lac in 1 yr – Will you, not sell-off?

- If not, then what if that Rs 1 lac becomes Rs 5 lacs in the next 2 yrs? – Now will you not sell-off?

- If not, what if that 5 lacs now becomes 1 lacs and drops in value by 80%? – Will you still have “conviction”?

- What if that Rs 1 lacs comes back to 5 lacs? Now?

I think you got my point!

Only robots and machines can stay calm and not react. We are humans and we do.

Here people sell when prices go up by 10% and we are talking of keeping stocks for 40 yrs?

Note that I am not saying that there are people who don’t keep the stocks for 20-30 yrs, but it’s not as easy a game to play as it’s made to look.

If you had bought Wipro in 2000, you would get back your capital now (adjusted for dividends). 20 years of 0 return. Meanwhile the Revenue of the company increased by 26x and PAT by 40x. This is what happens when you buy growth at any price. pic.twitter.com/AByCccmd9V

— Equity Markets (@EquityMarkets_) December 30, 2020

Enjoy the journey of equity bull runs and keep using the money

Note that buy and hold for 40 yrs is not always practical. Even if you have a good stock and patience, it only makes sense to take out profits from time to time and use it for your life goals. Go on vacations, buy a house, travel, and use it to buy stuff. There is no point in dying with Rs 500 crore unless you want to exactly do that.

Another point is to have a well-diversified managed portfolio where you are betting on multiple stocks and not concentrated on few ones. So have realistic expectations from stock investing and take these examples with a pinch of salt.

Only use these examples to reassure yourself that equities have huge wealth creation potential and its an important part of your portfolio.

Do share your comments below