This is a guest post by our reader Phani Kiran, who has tried to see personal finance from the software industry perspective. It will be more clear to software people but I think the way its written, everyone can understand it. Over to Phani Kiran

—

Hi All

DevOps needs no introduction to people working in the Software industry.

It is a set of best practices where Developers (Dev) and IT Operations (Ops) work together in delivering Software faster, cheaper and with better quality. This article tries to explain how DevOps can be applied to the world of “Personal Finance”.

For those who are hearing the term ‘DevOps’ for the first time, a rough analogy can be made with the FIRE (Financial Independence, Retire Early) movement. Both are best practices where we need to change our thinking, behaviour and tools but at the same time there’s nothing cast in stone and no one size fits all approach.

DevOps is needed as old software methodologies are no more relevant in a world where innovation needs to happen faster. Same with personal finance habits and practices – we need change as we move towards a lower PPF, EPF and Savings rate regime.

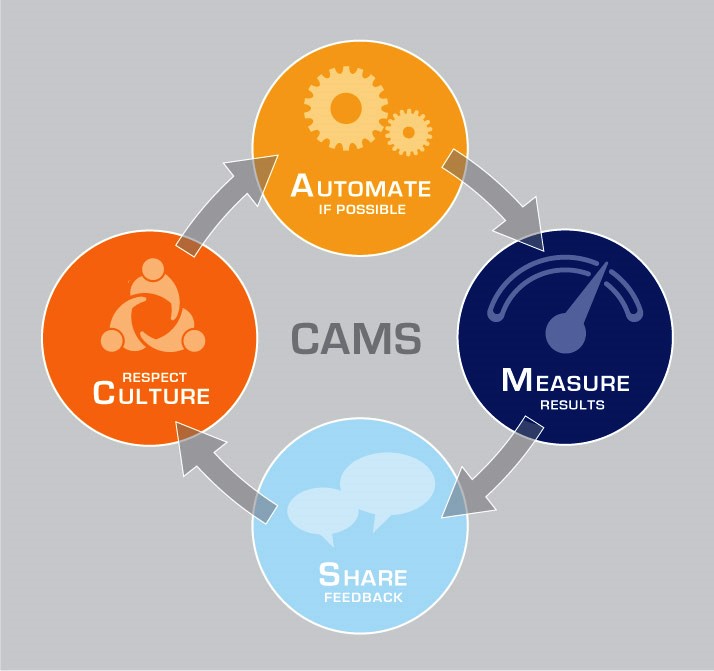

DevOps is frequently explained by CAMS Model (not your CAMSOnline :)). CAMS stands for

- Culture

- Automation

- Measurement

- Sharing.

Let’s see how each of these can be applied to Personal Finance.

C – Culture

- Investors need to start moving away from the culture of only investing in ‘fixed’ income investments. As Warren Buffet, mentioned in his recent annual letter – “fixed-income investors face bleak future”.

- Culture of treating tax saving as a separate and as a year-end only activity needs to be done away with.

- Need to stop combining insurance and investment needs and start saying ‘No’ when resorted to pressure tactics from a so-called relative or a well-wisher selling ULIPs.

- Start focusing on goal setting, risk profiling and asset allocation.

A – Automation

- SIP (Systematic Investment Plan) is the automation you can make to your personal finance. In her book – ‘Let’s Talk Money’, Monika Halan talks about keeping investments on an auto-pilot mode using 3 different bank accounts. (Salary, Investment & Spending accounts)

- Automating SIP or RD instalments inculcate discipline and removes personal biases. This can be your first step towards ‘passive investing’ as you no longer will be focusing on – if Market is High or Low.

- For those who are prone to more discretionary spending, SIPs can be scheduled in the first half of the month so that you will establish a ‘Culture’ of Saving before Spending.

M – Measurement

- The portfolio needs a periodic (quarterly or half-yearly depending on one’s perspective) review of performance. This is possible only when you have a target goal – ie. ‘target corpus’.

- As they say about your year-end KPI (Key Performance Indicator) goals, equally personal goals like retirement, child’s education need to be SMART – Specific, Measurable, Achievable, Realistic and Timely.

- Investment deductions on Auto-Pilot mode need course-correction as and when required. This doesn’t mean too much ‘Action’ (churning) though.

- Measuring and monitoring returns and tracking whether you are on the path to achieving the desired goal or not needs more emphasis as equity returns can be volatile.

- As SIPs automate the corpus-building phase, you can use SWPs (Systematic Withdrawal Plan) to move accrued investments to safer avenues once you are nearing a target goal.

S – Sharing

- Keep your family in the loop about your financial and insurance decisions and documents.

- Be a life-long learner and don’t hesitate to learn and talk in ‘numbers’ (compounding, inflation etc)

- Read good blogs and attend personal finance workshops (Even DIY (Do It Yourself) needs some framework and strategy).

Just like DevOps improved software delivery productivity and reliability, following these principles should lead to a ‘virtuous cycle’ of prosperity. Keep your corpus build-up ‘flow’ by following a CI (Continuous Investment) strategy and let your periodic portfolio reviews provide the required ‘feedback loop’.

Happy Coding. I mean Happy Investing 🙂

–

So share if you liked this article or not in the comments section. And I thank Phani Kiran to give an attempt in writing this article.