Jagoinvestor recently conducted a online Financial Planning Survey in India and what a common man expects out of the financial plan and a financial planner. I will list down some key observations, some learning based on survey results and finally compilation of the survey in a decent pictorial graph. Note that the survey was also published by Mint Newspaper. Here are the survey results:

Key Observations

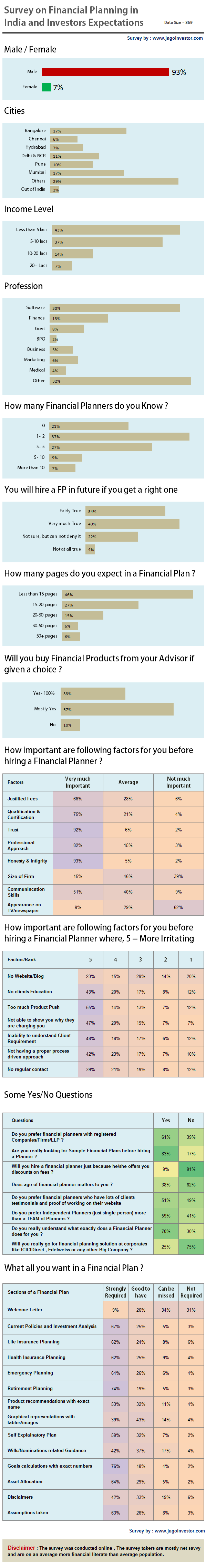

- Total 869 people participated in Survey

- 93% respondents were Male, 7% female

- Trust Factor and Honest/Integrity was highest on rating. 92% said that the trust factor is extremely important, 93% said honesty and Integrity is extremely important.

- Mumbai and Bangalore had highest number of respondents with 17% each Chennai and Hyderabad was lowest in Metro category, NRIs were 2% of overall survey

- 21% respondents were having income of more than 10 lacs

- Top 3 professions were Software (30%) and Finance (13%) and Govt (8%) . The smallest was BPO

- Only 15% people said that Size of the Financial Planning firm is “very much important” to them

- Only 9% people said that “appearing on TV/newspaper” matters to them , 62% clearly said that its “Not much Important” .

- 83% people said that they expect or look for Sample Financial Plans before hiring a financial planner.

- 85% people said that they expect clean financial plan with tables/graphs into it.

- 91% people said that Discounts of Fees does not work if they dont see any value in them .

- 75% people said they will not go for any financial planning with corporates like ICICI Direct, Edelweiss or such firms.

- 90% people said that they will buy products from their financial planner only – if its a CHOICE, only 10% said they will not.

- About 58% people know less than 2 planners in India by their name, 21% know no one!

- 68% people feel that Financial Planning would have improved their financial life if they had taken it 5 yrs ago

- 74% people are very clear that they will hire a planner sometime in future if they get a RIGHT one .

- 73% people expect less than 20 pages in their financial plan , Only 12% said they would be happy to see more than 30 pages

- Most of the people do not want the welcome message and those stories in their financial plans

- In More than 10+ lacs income category , 42% people were from Software jobs

- In more than 10+ lacs income category from Bangalore , 74% were from Software and from Mumbai it was just 14% in Software , 48% Others

- 68% of Govt jobs holders were from Non-metro cities and 60% among them had less than 5 lacs income per year

Learnings for Financial Planners/Advisors out of Survey

1. Different Cities have their target markets

Each city is different from other. A Planner in Bangalore should mostly be targeting Software professionals (62%) rather than Doctors (1%), compared to some one in Delhi which had only 20% in software

2. Have a Dummy Sample Financial Plan for prospects , but make it beautiful

There is no doubt that prospects wants to know what they can expect from planners when it comes to that PDF which has things written to it, I know that one PDF is not Financial plan and it does not matter, still thats one tool to impress the prospect and show them what value one will get out of it .

3. Make your plans more attractive , clean and with tables/graphs

Its a clear indication that clients are not looking for 100% pure wordings in the plan, they expect some kind of tables or graphical representation in the plan. But make sure its only at places where it adds value or is required.

4. Don’t worry if you are not on TV or Newspaper

Being on TV/Newspaper is really a great way of increase a financial planner visibility, but only a handful of prospects will prefer a planner coming on TV than some one who is not . Coming on TV is good, but its not the business secret or the top most thing you should be looking for. 56% of survey takers said Appearning on TV/Newspaper is Not much important factor and only 37% said it was complementary , just 9% said that they would like to have some one who appears on TV shows or writes in Newspapers . However its very much clear that these factors increase visibility and helps a planner to increase trust .

5. Trim your Financial Plans to the point and short

A very big number said that they would like it to be less than 20 pages . Hardly few clients will read each and every page in great detail , for most of them what matters is the “solution” and how things look like . The maximum a plan should be of 25-30 page . More than 30 pages is some not expected from most of the clients.

6. Investors are afraid of Big Corporates companies For Financial Planning

Thanks to all the bad treatment all these years , big corporates firms (banking etc) , people are really not very much keen to go to them for financial planning . People seem to be more interested in pure financial planning firms or individuals .

7. Dont push for products – Clients will anyways buy it from you

I know most of the planners have experienced it already. 90% of the survey takers said that they are almost sure that they will buy the financial products from the planner/advisor only and will not go anywhere else . However a planner has to keep 2 things in mind. a) This point is true only if a client is satisfied with your work and is a happy client . b) At no point you should be pushing products to them or give them any feel that you are there just to sell them products (Too much product push is one of the biggest turn off) , hence just do what you should be doing and almost all the clients will buy the products from you, unless there is some other strong reason not to buy

What do investors think about this Financial Planning Survey in India ?

As a reader of this blog and someone who might be one of the investor, what do you think about this survey and the results ! . Do you agree with it . Do you want to point out something and talk about it ? Jagoinvestor also provides financial planning , you can look at our services page here