There are many areas which we talk about regarding financial awareness, however there are things which a retail investor is never aware about and that’s “International finance”. It’s equally important to understand what is happening at national and international level which can hugely impact a common man. With financial markets becoming increasingly complacent about the recurrence of a crisis, we believe it is relevant to explain a couple of areas of concern which could trigger the next round of the crisis.

Greece – Europe’s Achilles Heel

What’s Going on in International markets

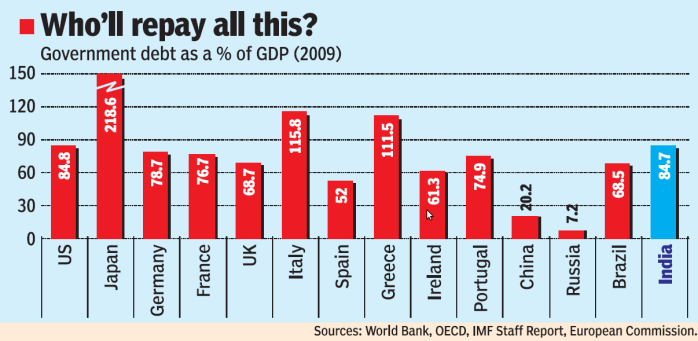

In the last few weeks, Greece has taken the centre stage in the financial markets. Within the next two months, Greece has to pay back the maturing bonds [to investors across the world] and finance its budget deficit. The country needs to borrow around $40 billion from the international market. With 10 year Greek Government bond interest rates of around 7% (more than 3% to 4% higher than 10 year U.S. Treasury or German Government Bonds), this has led to fresh worries over a potential default by the Greek government. What has added to the problem over the last two days is a rapid withdrawal of deposits from Greek banks by individuals in the country. Unless, Greece agrees to the terms set forth in the rescue package put together by European Union and IMF [to reduce government spending and increase taxes], it is difficult to get the support of this consortium to raise the $ 40 billion to stave off the crises. As you can see from the graph, Greece’s debt is over 111% of GDP. We believe the situation in Greece is getting grimmer day by day and could be a trigger for a crisis in other European nations – Portugal, Italy, Spain.

Read more on this through the following links :

- http://ow.ly/1wR0D (Retry opening this several times , if it does not show you article)

- http://ow.ly/1wPhw

The China Bubble

The fiscal stimulus initiated by China last year through bank lending to the tune of $ 1.2 trillion has led to potentially unstable conditions in their economy. According to well-known investor James Chanos with 60 percent of the country’s GDP relying on construction ‘China is on a treadmill to hell’. Marc Faber a long time optimist on China and well-known economist Kenneth Rogoff have also spoken of a China Bubble recently. With the Chinese government trying to enable a slowdown in real estate speculation via a recent tax on sale of homes when they have been owned for less than five years, one cannot rule a rapid decline in prices which would have a negative impact on economic growth.

Read more on this through the following links:

- http://ow.ly/1wPem

- http://ow.ly/1wPcN

Any one or combination of the two global factors identified above could trigger a mild to deep correction in the financial markets and slow down the world economy. Due to the strong financial linkages with the U.S. and the rest of the world, India will not be spared.

This is a Guest Column by Partha Iyengar – Founder and C.E.O and Srinivasa Sharan – Adviser, Investment Management – Accretus Solutions

What do you feel about this Article ?trends

Disclaimer : The article is for information purposes only and should not be construed as any recommendations. Accretus Solutions does not intend to solicit any business. Accretus Solutions do not take any responsibility of the losses that may arise out of actions taken based on the article. This article is not a substitute for developing an investment strategy or plan with a professional adviser. The views expressed in the article are that of the authors only.