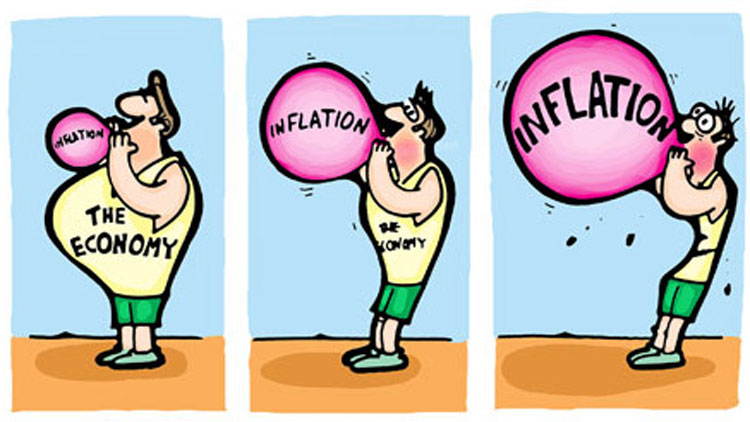

Do you remember the price of a movie ticket or any or your favorite thing few years back? It is the same today also? I don’t think so. It has increased by some numbers. This increase in the price is known as inflation. In this article I’m going to tell you what is inflation and how it can affect your investment.

Inflation :

Inflation is the increase in the rate of prices caused because of devaluation of the currency. Is is also known as the decrease in purchasing power of the currency.

Its a tool to measure the increase in prices. If inflation is 6%, it means on an average the prices have increased by 6%, means anything which had cost of Rs.100 last year will cost 106 this year. (Its a average price and not exclusively for some item)

For example:

Considering inflation at 6%, the value of Rs.100 will go down to Rs.53.86 in 10 yrs and to 29.01 in 20 yrs. In order to keep value of you money same, the absolute return earned must be greater then inflation.

Inflation vs returns on different financial products

Fixed Deposit :

Investing in Fixed Deposits just retains its value, but people feel that they get good returns upto 8.5 or 9.0%.

There is a tax of 3.5% on your FD returns and then if you adjust inflation of 6% after that, you will realize that though your Rs.100 has become 109 in a year, you have to pay 3 or 3.5 tax on that, and then if you have Rs.106 after that, you can purchase the same thing which you could have purchased in Rs.100 a year ago.

Hence, FD don’t give returns in real sense, they just keep your buying power. (considering inflation + tax = return from FD)

Gold investment :

Investing in GOLD is considered the traditional way of investment and also it is consider as the best way to beat inflation. Historically Gold has always outperformed inflation. It has generated 13.66% annualized return since 15 years, which is almost double of the inflation rate.

See the graph given below, in this graph the returns of gold investment since 20 years is given. You can see that how gold prices have moved or increased in last 2o years.

Image source: www.Bemoneyaware.com

Cash in bank :

The worst thing one can do is to keep Cash in Bank account, instead of investing it in any product. The returns generated from this saving can not beat the inflation rate.

For example: Suppose you have some cash in your savings account on which the interest rate applicable is around 4-4.5%, whereas the inflation is around 6%. Here the returns can not even meet inflation rate.

Cash must only be kept to a limit which may fulfill your emergency needs (preferably 3 times of you salary). Any extra amount must be invested.

Mutual fund :

Mutual fund is an investment in stocks so the returns are volatile here but if you consider it as a long term investment product then you will realize that it has given returns way higher and beat the inflation rate by almost double.

So this is the difference between the inflation rate and the returns of different financial or investment products. Now you can compare the returns and choose which product is suitable for you to invest in.

We can help you to improve your portfolio by making a perfect financial planning for you. If you have any doubt or query you can ask us by simply leaving your concern in our comment section.